Abstract

Both policymakers and academics offer various strategies concerning institutions on how to stimulate entrepreneurial activity in Europe. However, historical evidence shows that the cross-national differences in these institutions are the result of long-term historical processes. A successful entrepreneurial strategy would therefore benefit from looking at the past to build and improve current institutions in the future. To provide such a historical insight, this chapter aims to answer the question: How and to what extent have the institutional factors relevant to entrepreneurial activity evolved over time? It discusses the changes in the financial, knowledge, and labor institutions over the twentieth century across European countries to be able to distinguish between institutions that are dynamic and those that are slowly changing. Using the Varieties of Capitalism (VoC) framework, it provides insight into the different patterns of institutional change and the implications of this change for the different forms of entrepreneurial activity across European countries. The historical approach presented in this chapter thus contributes to the development of more diversified and better-informed policy tools to stimulate entrepreneurship.

The author gratefully acknowledges funding from the European Union’s Horizon 2020 research and innovation program under grant agreement No 649378. Thanks to Axel Marx, Mark Sanders, and Mikael Stenkula for comments on earlier drafts of this chapter.

You have full access to this open access chapter, Download chapter PDF

Similar content being viewed by others

Keywords

JEL classifications

1 Introduction

A widely acknowledged explanation for the difference in terms of entrepreneurship outcomes between the USA and Europe, as well as across countries around the world, is institutions (Bruton et al. 2010). Institutions are defined as the formal and informal sets of rules which shape individuals’ preferences and behavior (North 1990), which promote or hamper entrepreneurial activity via the reduction or increase of uncertainty and costs (Baumol 1990). The starting point in the FIRES project is that the institutions in finance, knowledge, and labor markets are key institutions in shaping entrepreneurial activity. This chapter aims to provide a historical perspective on the evolution of these institutions to be able to identify those that are more rapidly changing versus ones that persist over time. This is important information for policymakers aiming to build up institutions for a more entrepreneurial society.

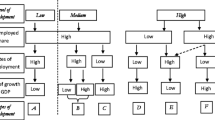

In our earlier works, using the Varieties of Capitalism (henceforth VoC) framework (Dilli et al. 2018; Dilli and Westerhuis 2018a; Dilli and Westerhuis 2018b; Dilli 2019), we showed that the variations in the finance, labor, and knowledge institutions and their complementarities explain the differences both in terms of the level and type of entrepreneurial activity across European countries today. The VoC literature proposes a more holistic approach to institutions. Rather than focusing on single institutions, this holistic approach to finance, labor, and knowledge institutions identifies four institutional constellations characterizing Europe (Amable 2003; Hall and Soskice 2001; Dilli et al. 2018). The first one is the liberal market economies (LMEs), exemplified with the USA and UK, where institutions support market-based solutions. On the other side of the spectrum are coordinated market economies (CMEs), such as Germany, where institutions provide social security and stimulate coordination among firms, governments, and other agents in the market economy such as the labor unions. A third cluster, the Mediterranean Market Economies (MMEs), composed of Italy, Spain, Greece, and Portugal, are characterized by a larger state and governmental regulation. A last cluster is the Eastern Market Economies (EMEs) that have an institutional setup to attract multinational companies.

In Dilli et al. (2018), we established that these four institutional constellations are also relevant to explain the diversity of entrepreneurship in Europe. For instance, in the Eastern European countries there is little protection of minority investors, high minimum capital requirements, little facilitation of venture capital, and a recovery rate favoring creditors over shareholders. In the UK, there are low minimum capital requirements, institutions that facilitate the availability of venture capital, and institutions that privilege shareholders in case of corporate failure by limiting the chances of creditors to recover their investments. In terms of labor market regulations, the Eastern countries and the UK have weak employment protection contrary to the Mediterranean countries where there are strong regulations against firing employees. The governmental transfers to research and development are much higher in the Northwestern European countries compared to the South and Eastern European countries. These cross-national differences in the combination with these institutional factors explain why fewer people are willing to start a new business in the Northwestern European countries compared to the South and East but those who do tend to engage in high-growth innovative sectors. Herrmann (2020) provides a more in-depth discussion of the relevance of the VoC framework for the entrepreneurship literature and our previous findings on this topic.

To stimulate entrepreneurial activity, the European Commission (2013) has identified more flexible labor market institutions, investment in higher education, and better access to finance via regulatory burden reductions as strategies in the Entrepreneurship 2020 Action Plan. Yet, such one-size-fit-all policy tools are unlikely to be successful in Europe. With the establishment of the European Union, there was an expectation of convergence among the Member States. However, comparative studies on the effect of Europeanization have not found strong empirical evidence for such convergence (See Bürzel 1999 for a review). The VoC literature argues against convergence toward a single institutional model in Europe. According to this school of thought, this is because the institutional arrangements of European countries have evolved differently into complex systems of interdependent and complementary institutions over time, which are difficult to change (Hall and Thelen 2009). Another argument against convergence is rooted in history. The literature on path dependency suggests that the institutional legacies of the past limit the range of current possibilities and/or options in institutional innovation (Nielson et al. 1995, p. 6). Historical conditions are thus important in determining the current-day institutional setup as well as socioeconomic outcomes. In this chapter, the focus will be on the latter: the influence of the past in understanding the current institutional diversity and outcomes for entrepreneurship in the dimensions of finance, knowledge, and labor across Europe.

Newly emerging social science literature demonstrates that the historical setting has set in motion divergent evolutionary paths, leading to the deeply entrenched differences in economic, institutional, social, and political outcomes today (see Nunn, 2009, for a review). For instance, Duranton et al. (2009) show that European regions with historically weak family ties perform better in terms of economic growth, adopt better to sectoral shifts, and have a higher educational attainment today. Alesina et al. (2010) find that stringent labor market regulations persist over time despite being economically inefficient due to their deep roots in the historical family structure. Galor and Ozak (2016) find that pre-industrial agro-climatic characteristics have a culturally embodied impact on the economic behavior of countries such as technology adoption, education, and saving today. In the entrepreneurship literature, the deep historical roots as an explanation for the regional and cross-country differences have started to receive attention too. In the case of Germany, for example, Fritsch and Wyrwich (2017) demonstrate that regions with higher levels of self-employment in the 1920s also have higher levels of new business formation today. Nevertheless, the evidence in this strand of literature is largely based on cross-national comparisons, regressing one point in time in the past on a current outcome.

Historians have criticized such cross-country comparisons as it assumes limited change over time and treats countries as being less advantaged in the institutional and development conditions since they first appeared in history (Frankema and Weijenburg 2012). This is a strong assumption to make, as the evidence from historical studies on the persistence and change in historical conditions is rather mixed. On the one hand, historical studies that focus on informal institutions (i.e., norms and values), such as the family systems, the co-residence patterns, and inheritance practices, argue that these institutions experienced limited change since the Middle Ages (Todd 1985; Reher 1998). On the other hand, there are historical studies showing that formal institutions including democratic rule, tax regulation, and social security spending as well as economic conditions such as globalization and distribution of the economic sectors have changed dramatically over time (Lindert 2004; Broadberry 2010). Considering the VoC framework, the debate on whether countries experience a shift between institutional constellations continues to this date (see Hall and Thelen 2009). For instance, according to Sluyterman (2015), the Netherlands has shown liberal market economy characteristics at the beginning and the end of the twentieth century, whereas from the Second World War up to the eighties, it had characteristics of a coordinated market economy and arguably returned to the liberal market since. According to De Goey and Van Gerwen (2008), this shift can also explain why there were more entrepreneurs in the beginning and at the end of the twentieth century in the Netherlands than in the 1950s.

To be able to distinguish between persistent and more dynamic institutions and to evaluate whether and how the institutional constellations described in the VoC literature have evolved over time, this chapter focuses on the historical trends in financial, knowledge, and labor market institutions. Thus, it aims to provide insight into which institutions are more challenging to alter via policy tools. The starting point of this chapter is to include a historical discussion on those institutions, which we found to be crucial for entrepreneurship in Dilli et al. (2018) and Dilli (2019). In order to provide a discussion at the European level in all three institutional aspects in the given scope of this chapter, the discussion of indicators in each dimension has been limited. Here, the availability of time-series data and historical sources mainly determine the choice of indicators and the time coverage presented.

This means that the indicators of finance, knowledge, and labor presented here do not always directly capture the institutional setup in terms of the rules and regulations but are outcomes that are result of the institutional setup and play a central role in entrepreneurial activity. For instance, in the case of finance, the focus is on banks and family, which remain the largest formal and informal sources of financial resources for entrepreneurs in Europe, respectively (OECD 2013).

For knowledge, I present the historical patterns in tertiary education, and research and development, both of which are contributors to higher entrepreneurial activity, business survival, firm growth, or the firm’s return on investment (see Van Der Sluis et al. 2008 for a review). Sanders et al. (2020a, b, c) provide a more qualitative analysis of underlying knowledge institutions (e.g., universities, patent systems, etc.) for these two outcomes for Italy, Germany, and the UK, respectively.

On labor institutions, the discussion will be on three dimensions: the regulation of labor markets, wage-setting institutions, and social security systems that are crucial for entrepreneurial activity (Henrekson 2014; Dilli 2019). In terms of time coverage, the focus is mainly on the twentieth century when it is possible to demonstrate the evolution based on quantitative information. However, when possible, a historical discussion going back to the late Middle Ages is included based on secondary literature; thus, the time coverage varies within each subsection. In the country choice, both historical data availability and the four VoC typologies play a role.

This chapter is structured as follows: first finance, second knowledge, and third labor institutions are discussed in subsections in the following order: first I describe the diversity in current institutions and their relevance for entrepreneurship today, and then I discuss the historical trends in the underlying institutions. The last section concludes with the relevance of the historical analysis of institutions and its implications for the entrepreneurship literature.

2 Finance

This section is taken from the working paper version of Dilli and Westerhuis (2018a). The section on banks (Section 2.2.1) mainly relies on the input by Gerarda Westerhuis in Dilli and Westerhuis (2018a). For an extended version of the finance section please see: https://projectfires.eu/wp-content/uploads/2018/02/D2.4-REVISED.pdf.

The availability of financing options is crucial in all stages and for all types of entrepreneurial activity: in seeing an opportunity to start a firm, growing a business, and engaging in innovation (Dilli et al. 2018). Among the various sources of financing, banks remain the largest financial intermediaries in all European countries, although their importance varies significantly across countries (OECD 2013; 2015). The share of the nonbank instruments, such as factoring, crowdfunding, private equity, and venture capital, remains relatively small in Europe in comparison to the USA with the notable exception of the UK. For instance, between 1995 and 2010, total European venture capital investment has been, on average, approximately only one-third of the volume in the USA (OECD 2013). Informal financing tools are an important source of capital for entrepreneurs too (OECD 2013). These informal financing options via investors, such as private individuals/business angels and a network of friends, family, and foolhardy investors, provide financing directly to unquoted companies to which they may or may not have a family connection (Szerb et al. 2007). Again, across Europe, differences are present in relative importance of these informal sources to fund entrepreneurs. For instance, in Dilli and Westerhuis (2018a), using the Global Entrepreneurship Monitor (2011), we show that today business angels invest more in close family and relatives in the Eastern and Mediterranean countries (with the exception of Portugal) than in the Northwestern countries. Nevertheless, such trends provide only a snapshot of the current situation. To a historian, they raise the question when banks started to play such a central role for entrepreneurs in Europe and whether their role has changed over time. Another question is whether, given the large historical differences in the family systems (Todd 1985), family can indeed be an alternative financing tool in all the European countries. Below I discuss the historical evolution of the banking system and family systems to address these questions.

2.1 Evolution of the Formal Financial Tools for Entrepreneurs: Banks

The historical roots of the banking system can be traced back to the fourteenth century. Although private banks had long provided a mix of commercial and investment services to their customers, the term “universal bank” is usually reserved for the large incorporated financial institutions that emerged in Europe during the second half of the nineteenth century (Cull et al. 2006). Therefore, I will focus here on the period from the late nineteenth century onwards as this covers the period of the emergence of the diverse modern banking system that characterizes most European countries today.

The size of the banks has been linked with the availability of bank credit for entrepreneurship. Small banks have traditionally been important lenders to small firms because small banks have a comparative advantage in relationship lending. Accordingly, the importance of and access to bank credit fell as banks became larger and banking got more concentrated over time (World Bank 2013). According to this view, small banks are better than large banks at relationship lending that depends on “soft” information. Large banks, in contrast, specialize in transaction lending to more mature firms where less discretion is involved (Black and Strahan 2002, p. 2808). In many European countries, large financial conglomerates have emerged over time that are perceived as less willing to finance SMEs in general and entrepreneurship in particular.

In many European countries, the banking landscape had been much more diverse than it is currently. Small, locally embedded credit institutions played an important role in introducing innovations and providing financing to firms and sectors that were overlooked by the larger financial institutions (Wadhwani 2016, p. 192). In some countries (e.g., the Netherlands, UK), this diversity has almost vanished, whereas in others (e.g., Germany), it continues to play an important role in the financial system. At the end of the nineteenth century, these differences between banking systems across European countries started to emerge. In particular, with the Second Industrial Revolution and the emergence of large-scale firms, the increased demand for capital led to the emergence of large commercial banks (Westerhuis 2016). In many countries, these big banks replaced relationship banking that was present prior to the nineteenth century with impersonal transaction banking. In the UK, many local banks that were typically small, private institutions, and limited by law to no more than six partners, played a crucial role in funding local industries during the first industrial revolution (Cull et al. 2006). During the interwar period, UK banking became more concentrated and less competitive. Provincial banks were taken over by large London-based banks, which preferred higher liquidity ratios. This reduced the supply of funds for the industrial clients, in particular the smaller and younger ones. A similar pattern is also visible in the Netherlands. While prior to the twentieth century, regional banks played an important role in financing (new) businesses, around 1910 a process of concentration set in the Netherlands, which created five big banks that would dominate the scene by 1925 (Jonker 1997). An alternative for their clients was offered via market solutions such as stockbrokers and private investors (Cull et al. 2006). This pattern corresponds well with the LME’s institutional structure, which stimulates market-oriented solutions (Hall and Soskice 2001).

In contrast, in Germany, a typical CME, and in Italy and France, classified as MMEs, the banking system remained relatively more fragmented and the state intervened by creating public and semipublic (i.e., cooperatives) lending institutions. These public, semipublic, and regional banks specialized in segments of the market reducing information asymmetries (Carnavali 2005). This type of banking structure lowered assessment and monitoring costs due to long-term relations between lenders and borrowers. The governmental intervention corresponds with the type of institutional structure of the CMEs identified in the VoC literature that stimulates coordination between different agents of the economy. The disadvantage was that these banks were less able to diversify and spread risks (Carnavali 2005).

In Germany, for instance, cooperatives emerged in the nineteenth century in response to the failure of existing lenders to give credit to small retailers and rural populations. The cooperatives were owned and controlled by their members and granted loans to members who might lack access to credit at the large financial institutions (Wadhwani 2016). Around the First World War credit cooperatives together with commercial banks and savings banks formed the core of the German banking system (Deeg 1999). The cooperative model spread across Europe since the second half of the nineteenth century. In Italy, it became a very important part of the financial system as well (Carnevali 2005). In contrast, in the UK and USA, typical LME economies, the credit cooperatives were established relatively late. In these contexts, commercial banks were already providing financial services to the working and rural people, whereas large corporates acquired capital through well-developed capital markets.

In Germany, cooperatives and savings banksFootnote 1 developed close links with local business. Although in the literature the focus is often on the big banks from Berlin, in Germany many small business owners, artisans, and shopkeepers banked in local and regional banks (Carnevali 2005, p. 46). These small regional banks met fierce opposition from the commercial banks, and it was this conflict that “shaped the state’s response toward competition between different types of banks, ensuring the permanence of segmentation” (Carnevali 2005, p. 196). In Germany, the state played an important role in mediating between different types of banks. It was an active political choice to protect the SMEs and their local economies. In contrast, savings banks in the UK, created in the 1810s, for example, were not allowed to lend for commercial purposes by law.

In the 1950s and 1960s, the long-term finance of small businesses in Germany was made available via savings and cooperative banks, ensured by strong competition and state regulation. Regulation provided incentives for the saving and cooperative banks to grant SMEs long-term credits, where these banks operated in a limited market and their success depended on the economic welfare of their region. In their charters, it was stated that pursuing profits was important but only as a means to other goals. Savings banks were mandated with the promotion of the local economy, and cooperative banks had to serve the interests of their members (Carnevali 2005).

In Italy, the banking system was decentralized to strengthen local banks after the Second World War. The government wanted to create local financial channels (decentralized capitalism) to act as a counterbalance to the power of the large private business groups. Decentralization and a segmented banking system were seen as elements that would increase stability, whereas a concentrated banking system was perceived as a factor that would hinder economic growth (Carnevali 2005, p. 177). The diverse financial landscape of the 1930s with various types and sizes of financial intermediaries was defended as a guarantee for the diffusion of credit. As a result, regulations were reshaped in order to reduce banking competition and protect the small- and medium-sized banks from the larger national ones (Carnevali 2005, p. 178). The awareness of policymakers, that SMEs had disadvantages in access to market finance, contributed to the introduction of financial subsidies as part of national industrial policy (Spadavecchia 2005). Of the various countries discussed here, the Italian banking system has been the most regulated and subsidized with the aim to promote the development of small firms. From the mid-1970s, however, the decentralized banking system was increasingly being questioned. As a result, many territorial restrictions were abolished as well as controls over interest rates, leading to the mergers of banks in the 1990s.

In contrast to Germany, industrialization in France occurred in a political context of a unified nation-state, with strong central government. Although large French firms established themselves between 1918 and 1930, SMEs remained a very important part of the economy (Lescure 1999). Due to agreements to fix prices and quotas, there were hardly incentives for firms to merge into bigger conglomerates in this period (Carnevali 2005). Due to active government interference, the banking structure remained more diverse in France than in the UK in the nineteenth century. During the Great Depression of the 1930s, many local and regional banks had to close, and after the Second World War, a process of concentration dominated the banking sector in which the regional and local banks merged into national ones. Four large deposit banks were nationalized after 1945. In 1957, 22 regional banks and 158 local banks were left. The local banks had a strong hold over the local market. The greater role of the state in France was also reflected in the role of public and semipublic banks in stimulating investments after the Second World War (Carnevali 2005).

The process of liberalization and harmonization in Europe that eventually led to the monetary union caused concentration to rise in banking across the Eurozone. This is visible in Fig. 2.1. The (three) firm concentration ratio is the percentage of all banking system assets accounted for by the biggest three banks in a country.

Source World Bank (2013)

Percentage of all banking system assets by the biggest three banks in a country.

For the majority of CME countries, the combination of a few large commercial banks and a broad base of small, local banks resulted in a C-3 ratio of well above 50% (e.g., Switzerland, Austria, Germany, Netherlands). This also applies to the Nordic CME countries Denmark, Finland, and Sweden. An interesting case is the UK banking system, which was rather less concentrated in 1993 with C-3 ratio of 29% increasing to 56% in 2003. Overall, in the clear majority of the 19 EU countries, the largest banks dominated the banking industry 20 years ago and continue to do so today.

While historical studies show that prior to the twentieth century, the regional small-sized banks seemed to play a role in funding the small-sized businesses across Europe, and there is still no consensus on the extent to which this diverse banking structure in the cases of France, Italy, or Germany provided advantages in solving finance problems for small businesses. On the one hand, Carnevali (2005) stresses comparative advantages of these regional banks in Italy, France, and Germany after the Second World War compared to the much more consolidated banking system in the UK. On the other hand, the limited historical evidence shows that the number of firms that could take advantage of the banks’ combination of investment commercial banking services in Germany was quite small (Cull et al. 2006). According to Cull et al. (2006), instead SMEs mostly relied on local intermediaries and private initiatives, which ranged from notaries to family borrowing in France to the cooperatives in Germany (Cull et al. 2006, p. 3028). In the next section, I evaluate the role private initiatives, in particular family lending, as an alternative source of financing for entrepreneurs and link the current differences in family lending to historical family systems.

2.2 Alternative Source of Finance: The Family

Historical studies show that entrepreneurs had alternatives to banks as sources of funding (van Zanden et al. 2012; Gelderblom 2011). These historical alternatives were available in the form of retained earnings, family capital, investment from wealthy entrepreneurs, and short-term loans (Westerhuis 2016). However, the availability and type of financial sources differed substantially across Europe. For instance, Cull et al. (2006) show that in the case of UK and the Netherlands domestic capital markets and governmental bonds provided an important source of exchange and finance for businesses, whereas this option was much more limited in the case of the Southern European countries such as Spain and Portugal. Historically, family has also been a crucial source of finance for businesses, though its relevance differed substantially across Europe (Cull et al. 2006). In this section, I argue that the differences in the historical family systems have likely influenced the variation in the family borrowing across Europe and continue to do so today.

Family members are assumed to be important providers of financial resources (Bygrave et al. 2003). This is because financial capital from family members has important advantages such as lower transaction costs (Au and Kwan 2009), favorable interest and payback requirements, and availability when other sources are not available (Steier 2003). Especially when the firm requires more time to provide returns, family may provide a better lending possibility to the entrepreneur than formal financing options (Arregle et al. 2015). Bygrave and Reynolds (2005) argue that the level of social obligations individuals feel toward their family members shape the willingness of the lender to lend money to the family member (supply side) and the willingness of the borrower to borrow from a family member (demand side). One can expect that in contexts where family ties are stronger (family has priority over the individual), both the willingness to lend and borrow from a family member would be higher, and as a result, the level of family lending would be higher.

Demographer Reher (1998), using census data, showed that strong family ties characterize the Mediterranean countries, whereas weaker family ties (the individual has priority over family) characterize the Northwestern European countries. This pattern seems to correspond with the cross-national differences in the European context in terms of lending behavior to family members by business angels today. In the Eastern European and the Mediterranean countries, business angels seem to invest more often in family members than in other European countries despite the unfavorable financial institutional environment. In the Northern European countries, on the other hand, the investment of business angels and borrowing behavior from the family remain limited. Sweden and Belgium, depicted as having weaker family ties, are the exceptions, which outperform the rest of the European countries in terms of their share of business angel investment in family businesses (see Dilli and Westerhuis 2018a for an illustration of these trends). An explanation for these contradictory cases could be attributed to the overall supply of business angels due to the favorable institutional context such as tax cuts for family lending (Au and Ding 2011; OECD 2015).

One of the core explanations as to why Northwestern European countries have much weaker family ties compared to the Eastern and Southern European countries has been linked with the historical differences in the living arrangements of family members, having long-term effects on the norms and values regarding the importance of the family due to the generational transfer of these norms (Reher 1998). According to demographic historians, Hajnal’s St. Petersburg–Trieste line separates the Central and Northwestern European territories (Scandinavia, the UK, the Low Countries, much of Germany and Austria) from the Eastern and the Mediterranean in terms of co-residence practices and has been present for centuries (Reher 1998; Todd 1985). For instance, the study of Reher (1998) shows that from at least the late Middle Ages until the second half of the nineteenth century, it was common in rural England and in the Low Countries for young adults to leave their parental households at a young age to work as agricultural servants in other households. On the other hand, in the Southern European societies even though there were servants in both rural and urban settings, it affected only a small part of the young population in rural areas (Reher 1998). These differences in the family systems have arguably been the result of the differences in the agricultural practices, the timing of the Neolithic revolution and geographical factors (Todd 2011).

These historical family arrangements are possibly linked with the long-term development of different forms of (private) financing options for entrepreneurs across European regions. The scarce historical evidence from the late Middle Ages and Early Modern Europe shows that in this period, private lending, even that via the family members, was already formalized in the Low Countries. Van Zanden et al. (2012) demonstrate that in the fifteenth and sixteenth centuries, properties were used as collateral on a large scale, and that interest rates on both small and large loans were relatively low (about 6%). As a result, many households owned financial assets and/or debts, and the degree of financial sophistication was relatively high.

Similarly, Gelderblom and Jonker (2004) show that deposits and bonds were common among businessmen and entrepreneurs as a tool to borrow already in sixteenth century Netherlands. Thus, formal institutions as well as the availability of investors due to deep domestic markets as a result of the international trade at the time stimulated lending both from family and non-family members in this period. This resulted in access to credit for a larger share of the population compared to the Southern European countries. The presence of weak family ties might have created the necessity to regulate the lending behavior more formally in the North. On the other hand, while financial historians show that Italian city-states were crucial financial centers in the fifteenth and sixteenth centuries, wealth was mainly concentrated in the hands of a small group of merchants and family businesses and lending again played a central role. The lack of historical data, however, does not allow us to provide insight into how family lending has changed over time across different European countries.

Nevertheless, past and present cross-country differences in family lending behavior and family funding can provide a feasible alternative to formal financing options especially in the Mediterranean and the Eastern European countries given their strong family ties. This can be done by following the Belgian example. In Belgium, anyone who grants a loan to an entrepreneur as a friend, acquaintance, or family member receives an annual tax discount of 2.5% of the value of the loan. If the enterprise is unable to repay the loan, the lender gets 30% of the amount owed back via a one-off tax credit in the context of the “win-win lending” scheme (OECD 2015). This change in the policy seems to have helped with increasing the availability of finance to entrepreneurs in Belgium, and its implementation might be less costly in the Southern European countries where family members are more willingly to invest in family members. An important implication of weak family systems in the Northwestern European countries is that policies should prioritize targeting improvement of the formal financial institutions rather than family lending. However, as both the case of Belgium and the historical evidence highlight, family lending can still provide an alternative in these countries, even if there might be need for more formal regulation and incentives introduced by the government to support family lending.

A more general conclusion on the financial institutions is that while the banking system has experienced rapid change since the late nineteenth century, family systems as an informal institution persisted over time. Supporting small-scale banks and more formalized private lending options such as equity finance therefore might be a better option to pursue in the CME economies, whereas in the MMEs and EMEs, stimulating informal lending options via friends and family would be easier to implement. Of course, the analysis in this chapter is descriptive in nature and serves only as a first attempt to argue how a historical perspective can potentially help in formulating reform strategies to stimulate entrepreneurship. More in-depth historical analysis is advised when formulating strategies for a specific region or country and general conclusions based on the analysis presented here should be approached with caution.

3 Knowledge

The country case studies in Sanders et al. (2020a, b, c) discuss universities and the patent system as the underlying institutions for knowledge creation. In this chapter, I focus instead on outcome variables of these more fundamental institutions of (1) educational attainment in tertiary level and the gender differences therein and (2) research and development, which explain the different levels and types of entrepreneurial activity across Europe (Dilli and Westerhuis 2018b; Dilli et al. 2018). These two indicators can be seen as more direct measures of the knowledge outcomes. I focus on these two measures as they have been commonly used in the VoC literature to capture the knowledge dimension, and there is historical and comparable quantitative data that allows me to evaluate how these two dimensions evolved over time across European countries.

Formal education at the university level is important for entrepreneurial activity. For instance, both the individual entrepreneur’s education and the regional and national educational attainment have been shown to be strong drivers of entrepreneurs’ decision to start a business and grow their business and the economic sector in which they engage (see Dilli and Westerhuis 2018b for a review of the literature). At the societal level, while the educational level of consumers may shape the demand function for an entrepreneur’s venture output, the educational level of employees may affect the entrepreneur’s venture productivity and thereby shape his or her supply function (Millán et al. 2014).

Next to formal education, knowledge-driven innovation is frequently considered as the outcome of research and development (R&D) activities and the general concern that firms may underinvest in R&D has resulted in government policies and programs such as favorable fiscal treatment and R&D subsidies (Coad and Rao 2010). In addition to the scientific knowledge generated by the private sector, entrepreneurial ventures may therefore also acquire the necessary scientific knowledge by participating in, or benefitting from, public R&D programs that lead to new commercial opportunities (Dilli et al. 2018, p. 7).

3.1 Educational Attainment

The VoC literature highlights differences across industrialized economies in terms of how they organize their educational system. For instance, LMEs stimulate general education, as the flexibility in the labor market and transition between jobs require general skills (as discussed in Herrmann 2020). Figure 2.2 shows the trends in years of education at the tertiary level across a selected number of countries over the twentieth century. The USA, a typical LME, already starts outperforming the rest of the European countries in the beginning of the twentieth century and tertiary education takes off in the second half of the twentieth century.

Notes The figure is based on the Lee and Lee (2016) dataset. The Europe + USA average includes the 19 European countries included in the database

Educational attainment in tertiary level (age group 25–64).

The next best performers are the UK (another typical LME) and the Netherlands, which show characteristics of an LME in the beginning and the end of twentieth century (Sluyterman 2015). Germany, a coordinated market economy (CME), performs moderately compared to the LMEs, and progress is visible especially from the 1960s onwards. Poland, an Eastern Market Economy, and Italy, a Mediterranean Market Economy, have the lowest attainment in tertiary education among the European countries. Despite the fact that these two countries also witnessed increases in tertiary education since the 1960s, especially in Italy, this progress has been slower compared to the other European countries. The fact that the LME economies perform highest in the tertiary educational attainment compared to the others thus supports the line of reasoning in the VoC framework that the LMEs have a comparative advantage in general education, whereas CMEs focus more on vocational training.Footnote 2

Dilli and Westerhuis (2018b) also looked at the role of gender differences in educational attainment to explain the gender differences in entrepreneurial activity. We showed that women are less likely to engage in all three stages of entrepreneurial activity across Europe (perceived opportunities to start a business, the knowledge intensiveness of the sector in which they start their business, and their growth aspirations), and that education is one of the explanations for this gap. Figure 2.3 displays the ratio of women to men in tertiary education. While a score below 1 indicates women are underrepresented, 1 would indicate gender equality and a value above 1 means women are overrepresented in education. Figure 2.3 shows a slightly different picture than Fig. 2.2 in terms of gender differences in tertiary education.

Source Lee and Lee (2016)

Gender gap in educational attainment in tertiary level (age group 25–64).

The USA, an LME economy, is the pioneer in closing the gender gap in tertiary education where equality between men and women is achieved as far back as in the 1940s. However, a reversal is visible between 1940s and 1980s, and in the post-1980 period, the gender gap closes again. The USA context highlights that the progress toward gender equality is not linear (Goldin 1995). The UK, also an LME, witnesses progress toward gender equality by the beginning of the twentieth century. From the 1960 onwards, the gap between men and women at tertiary education really starts to close, and in 1985, equality is reached. In Poland, an EME, the gender gap in tertiary education narrowed in the 1990s and women are even outperforming men since the mid-1990s. A similar trend is visible in Italy. While many of the other European countries also achieved equality in tertiary education during the 1990s, Germany stands out as an exception where the size of the gender gap is largest and only a slow convergence to gender equality is visible from the 1970s onwards.

When the gender differences in field of subjects at the university level are considered, a different picture emerges. This has implications for entrepreneurial activity. In recent years, cross-national differences in entrepreneurship have been attributed to the differences in education, more particularly gender differences in science, technology, engineering, and mathematics (STEM) fields (OECD 2016a). To the extent that entrepreneurial ventures come up with radically new innovations, they are typically based on technological inventions developed by scientifically oriented workforces (Dilli et al. 2018). In Dilli and Westerhuis (2018b), we provided empirical evidence on the evolution of the gender differences in STEM subjects at the tertiary level since 1970s, which showed that the gender gap in science education is negatively correlated with entrepreneurial activity.

In Dilli and Westerhuis (2018b), we demonstrate that there is a clear increase in educational attainment in science subjects in all the four VoC clusters since the 1990s with LME countries having the highest level followed by MMEs, CMEs, and EMEs, respectively. However, despite the increase in the share of the population in science subjects, this did not translate into higher gender equality. Instead, all VoC categories show a decrease in the share of women in science subjects since the mid-1990s. The only exception being the 1970s when women in LMEs became relatively more inclined toward science subjects at the tertiary level. Interestingly, while in the period before the 1990s, the size of the gender gap is largest in CMEs, followed by LMEs and MMEs, and EMEs, a convergence toward gender inequality in science subjects is visible. A sharp decline is particularly visible in EMEs after the collapse of the Soviet Union. An explanation for this increasing gap can be partly due to the change in women’s choices to follow careers in other fields such as health and engineering. Thus, we suggest that closing the gender gap in science can be beneficial for knowledge intensive sectors and high-growth aspirational entrepreneurship especially in the institutional environments that are also favorable for women such as in the Nordic CME countries.

3.2 Research and Development

The differences across the institutional constellations described in the VoC are also visible in terms of R&D expenditures. Figure 2.4 highlights that the differences among European countries have been present at least since the 1980s. Considering the share of government expenditure in research and development, both Germany and the USA have the largest public investment compared to the other European countries for almost the entire period of 1980 and 2010, followed by France. While the Netherlands and UK show moderate levels of investment in research and development, Italy and Poland have the lowest. In addition, the share of governmental expenditure in research and development remained rather constant over time. A similar trend in terms of cross-country differences is visible when a second indicator of research and development, researchers per capita is considered. While in the UK, the government plays a limited role in supporting research and innovation (in line with the LME typology), it is among the top performers in terms of the number of researchers. This could be attributed to the academic system of the UK that does not only offer sophisticated scientific training, but also attracts high numbers of immigrant scientists (Dilli et al. 2018).

Source OECD (2019)

Research and development, 1980–2010.

Over time, as the number of researchers has increased substantially across European countries, this progress has been especially limited in the case of Italy and Poland. Overall, the increase in the share of population following science subjects at the tertiary level might be one of the drivers of this general increase over time. Thus, for Poland and Italy, stimulating research and development activity via governmental expenditure and stimulating at the tertiary level to follow science subjects might be tools to support entrepreneurship. Another alternative could also be attracting highly skilled migrants with a science background to increase the number of researchers.

This section illustrated that there have been rapid improvements both in educational attainment and in number of researchers over the second half of the twentieth century. This implies that reforms addressed toward implementation in the field of education, and research might have impact in the short run. However, in pursuing such reforms, it is also important to recognize the differences between CMEs and LMEs in terms of vocational versus general training, as vocational training in the CMEs has also been successful in supporting innovative entrepreneurial activity (Dilli et al. 2018), although arguably, in a more incremental nature (see, e.g., Herrmann 2020).

4 Labor Market Institutions

As mentioned in the introduction, the relevant labor market institutions for entrepreneurship are: (1) regulation of labor markets, (2) wage setting institutions, and (3) social security systems (Henrekson 2014; Elert et al. 2019). These institutions were also in focus in the FIRES project (see Dilli 2019, for an empirical test of this link). The flexibility in hiring and firing employees, as well as the extent of the availability of social security, would shape the decision making of entrepreneurs to start and grow their businesses. Centralized wage setting institutions and strong labor unions can discourage entrepreneurship by introducing standard compensation policies for wage labor that closely tie wages to observed characteristics such as seniority and education. Such institutions would discourage innovative entrepreneurship. In terms of social security arrangements, generous unemployment benefit schemes and other social benefits may decrease incentives and increase perceptions of the risk involved in establishing a business (Henrekson 2014; Dilli 2019). But many of these institutions have deep historical roots. The discussion below therefore focuses on the historically evolved differences between the USA and European countries in these three pillars as well as how they have changed over the twentieth century to develop a historical understanding of the cross-national differences in labor market institutions characterizing Europe today.

4.1 Labor Market Regulations

Labor market institutions in Europe are less flexible compared to those in the USA (Siebert 1997). For example, the USA stands out as the least regulated country based on indicators for dismissals of individual workers on permanent contracts. The success of the USA in terms of entrepreneurial activity has been attributed to less regulated labor market institutions. Among the European countries, however, there is a large variation in the extent to which labor market regulations are stringent. Similar to the USA context, the UK have fairly unrestrictive individual dismissal regulations. By contrast, regulations in France and Germany are far stricter than the OECD average (Scarpetta 2014: 3). These differences were also highlighted in the VoC literature. Labor markets have been deregulated with relatively unrestrictive individual dismissal regulations in LME economies such as UK and the USA. Since 1990, EMEs also tend to have more flexible labor market regulations compared to the Nordic countries and the continental European countries, such as the Netherlands, Germany, and Belgium, characterized by a moderate employment protection. In the MMEs, notably France, Italy, and Spain, it is far more difficult to dismiss employees, especially from public service, compared to the other contexts (Dilli 2019). Some of these cross-national differences characterizing Europe today can be traced back in the past of these economies.

The twentieth century witnessed an important move towards flexibility in labor market institutions across Europe. But the extent of this change differs across European countries. This is visible in the study of Aleksynska and Schmidt (2014), which sheds light on the current-day differences in labor market institutions by looking at the origin and evolution of these labor market regulations for a selected number of European countries. Some of the rules on employment protection, such as prohibited grounds for dismissals, have roots going back as far as the late nineteenth century (Aleksynska and Schmidt 2014). Such labor protection laws often emerged to address the social consequences of early industrialization. The issues of equity and equality, dignity and decent incomes, set the scene for emerging national frameworks of regulating work and work relationships. France was the first country to regulate unemployment insurance, fixed-term contracts, and compensation for unfair dismissal in 1890. Greece and Italy pioneered generous notice periods and severance pay. Spain was the first country to explicitly regulate the use and the termination of fixed-term contracts with respective provisions put in place in 1926. These three Mediterranean economies also introduced regulations similar to France on the notice period and regulations on fixed contracts during the 1920s. These economies are known to have more stringent labor market regulations to this day. In Portugal, in contrast to the other Mediterranean economies, many of the rules on unemployment and employment protection were only introduced in the late 1960s and early 1970s, whereas in the UK, the rules on employment protection legislation developed mainly in the second half of the twentieth century (Aleksynska and Schmidt 2014).

In the second half of the century, there is more systematic evidence available on the differences between countries in terms of the employment protection legislation (EPL). This allows me to trace the change in labor market regulations over time in a comparative way. The OECD has developed the EPL index—a commonly used indicator to capture the regulation of the labor markets—based on 21 items such as laws protecting workers with regular contracts, those affecting workers with fixed−term (temporary) contracts or contracts with temporary work agencies, and regulations applying specifically to collective dismissals.Footnote 3 A higher score on the index indicates stricter labor market regulations. Allard (2005) extends this EPL index back to 1950. Using his information, Fig. 2.5 displays the differences across a selected number of European countries and the USA since 1950.

Source Allard (2005)

Employment protection legislation (EPL), since 1950.

According to Fig. 2.5, in the 1950s, the labor market was relatively unregulated compared to today though the cross-sectional differences between the cluster of countries were already visible in the mid-50s. The typical LME countries, UK and USA, had the lowest employment protection by far throughout this period. Starting from the 1970s onwards, the regulations on employment protection started to become stricter in many countries (e.g., Germany, France). During this period, the EPL increased in the UK as well, though it still remained the least regulated European country. This is because in the 1960s and 1970s, a number of legislations (i.e., the Contracts of Employment Act 1963 and the Industrial Relations Act 1971) were introduced to protect employees against unfair dismissals in the UK. The CMEs Germany and the Netherlands (as well as France, which can either be classified in the Coordinated or in the Mixed Market category) show moderate levels of employment protection. In the early 1970s, however, Germany introduced further legislation to increase employment protection reaching levels similar to Italy.

The late 1970s and beginning of the 1980s witnessed deregulation of the labor market in a number of countries. A deregulation process is visible in the UK, from the late 1970s onwards followed by the Netherlands, and Germany in the late 1980s and early 1990s. In the early 1980s, economic deregulation was the principal labor market policy of the Thatcher government. During the Thatcher government, a significant amount of legislation (i.e., Employment Acts of 1980, 1982, and 1988) was passed, turning back the individual employee rights introduced in the 1960s and 1970s (Capon 2004). In Germany, the major step relaxing the conditions concerning fixed-term employment contracts was the introduction of the Employment Promotion Act (Beschäftigungsförderungsgesetz) in 1985 (Schettkat 2002).Footnote 4 It is also important to note that in all the European countries, the number of temporary contracts noticeably increased in the 1990s (Amable 2003). Labor market liberalization over the 1990s effectively shows that the bulk of the adjustment was borne by temporary contracts. The decline in employment protection for that group is especially remarkable in Italy. While employment protection for regular contracts seems to have been fairly stable over time, the EPL showed clear reductions for temporary workers over the same period. Nevertheless, the extent of this deregulation process differed substantially across the European societies and is reflected in the cross-national differences in the labor market institutions.

4.2 Wage Setting Institutions

In FIRES, in order to capture the wage setting institutions relevant for entrepreneurial activity, we looked at trade union density, the level of wage bargaining (coordination), and governmental intervention in the wage bargaining process (see Dilli 2019 for a discussion on the relevance of these dimensions for different forms of entrepreneurial activity and Sanders et al. 2020a, b, c in this volume for applications). For instance, decentralized and individualized wage setting has been argued to encourage mobility and risk-taking and would therefore support (potential) high-growth firms (Henrekson 2014).

Figure 2.6 shows the cross-national differences in trade union density, defined as the membership as a proportion of all wage and salary earners since 1955 in a selected number of countries (Visser 2013).Footnote 5 Figure 2.6 shows that a large variation exists in terms of trade union density between countries.

Source Visser (2013)

Trade union density, 1970–2010.

The low unionization rate of France is remarkably low (an average of 14% for the entire period), given the capability of trade unions to mobilize their members for mass action (e.g., strikes), and their influence on government policy. For instance, in France the government has withdrawn its plans for a new employment contract for young workers in 2006, while in 2010 there were massive demonstrations between September and October protesting against the government’s pension reform plans (Fulton 2013). Thus, in terms of union density, France shows much lower levels compared to Germany, for example. The trade unionization in the USA, a liberal market economy, is also one of the lowest in Fig. 2.6, whereas the level of union density in the UK is higher than in the CMEs (e.g., Germany) and the MMEs. The CME and the MME countries are close to the average of overall European in terms of trade union density.

Turning to trends in trade union density over time, during the early postwar period, Western trade union movements grew in membership and achieved an institutionalized role in industrial relations and politics, especially in the CMEs. However, in recent decades, trade unions have seen their membership decline in many countries as they came increasingly under pressure due to social, economic, and political changes. The decline in unionization began in the 1960s in the USA, spread to France after the mid-70s, and was then observed in the Netherlands and the UK (corresponding with the Thatcher years as well) in the late 1970s. With the wave of social protest in the late 1960s, unions targeted social groups such as white-collar, female, and often part-time employees. Some unions were more successful in recruiting members than others. The Italian unions, for instance, enjoyed spectacular post-1968 growth after partially successful attempts to reunite the politically fragmented union movements (Ebbinghaus and Visser 1999). The same period witnessed an increase in unionism in Sweden (see also Visser 2013), but the downward trend continued in other countries. Especially from the mid-90s onwards, there has been a second round of decline in trade unionization observable in many European countries. Arguably, due to the different degrees to which unions were able to maintain coverage in wage bargaining, these changes in trade union density did not lead to a convergence between the European countries and the cross-sectional differences remain rather stable over time.

Figure 2.7 reveals the large variation in terms of centralization of wage bargaining process both between countries and over time. Hall and Soskice (2001) argue that in CMEs, the wage bargaining would be more centralized (i.e., involving governments, businesses and labor unions together and agreements would be made across industries) compared to the liberal market economies. Figure 2.7 shows support for this view. While there was industry-level bargaining in the UK historically, since 1980, there have been no centralizing forces. A similar decentralized wage bargaining system has been in place in the USA. The EMEs show similar patterns to the UK with firm or local level bargaining. In the Scandinavian countries, there has been a shift from a centralized wage arrangement to a more sectorial bargaining model during the 1980s. In Germany, Austria, and Switzerland, industry-level bargaining has been the dominant form. In the Netherlands, until the 1980s, there was a mix between central level negotiations with industry bargaining in which there were frequent government interventions. After the 1980s, the bargaining mostly took place between employers and trade unions though during the 2009–10 recession, the government committed to support financially to reducing temporary working hours (Visser 2013). Among the MMEs, industry-level bargaining seems to be more commonly practiced. While Spain first had central bargaining during the 1970s, it moved to industrial level bargaining during the 1980s. Overall, there seems to be a convergence toward industrial level wage bargaining in Europe since the 1980s, except in Belgium, which counters the trend by moving to a more centralized wage bargaining system over the same period. So, although wage bargaining institutions change over decades, there is no tendency for convergence and the differences between countries in terms of wage bargaining process persist.

Source Visser (2013)

Level of wage bargaining.

4.3 Social Security

With regard to social security, we studied the relevance of social spending together with illness, unemployment and pension minimum replacement rates for their relevance for entrepreneurial activity (Dilli 2019). These three show some nuanced differences, but here it will suffice to focus on the historical evolution of social spending with pension minimum replacement rates.

While cross-national differences in terms of social security arrangements are clearly visible today, social security was limited prior to the twentieth century everywhere around the world. During the eighteenth century, there were two forms of tax based social spending, namely poor relief and public schools, which made up at most three percent of GDP in social welfare (Lindert 2004). Still, important differences across societies in terms of social security arrangements are already visible in this period. While the Netherlands and the UK historically led in poverty relief, the USA and Germany led in public schooling. With the extension of suffrage in many countries after the First World War, public spending on welfare started to expand in the world and the modern welfare state emerged with extensive coverage including subsidized healthcare, education, housing, childcare, and old-age pensions emerged (Lindert 2004). The Great Depression of 1929 and economic crisis in the late 1970s were particularly important turning points in the European countries. They gave rise to the role of government in providing security such as in terms of unemployment insurance and introduction of minimum wage laws (Blanchard 2002; Visser 2013); though, a large variation is visible in the national strategies of European countries in terms of government’s support in providing security (e.g., Siebert 1997). Despite the general rise in social spending and social security arrangements over the twentieth century, progress toward social welfare regimes has not resulted in a convergence among the European countries.

Figure 2.8 presents the trends in total social spending as the percentage of GDP. While France, Germany, and Italy are characterized with the highest social spending in total, the USA has the lowest followed by the Netherlands and the UK. A significant decline in social spending is visible during the 1980s, followed by an increase during the 1990s almost in most selected European countries. Italy has caught up with the CMEs like Germany, with relatively large social expenditure. Poland, EME, on the other hand shows a moderate level of social spending, which first rose rapidly but declined in the post-Soviet period. Perhaps the most striking decline in total spending is in the case of the Netherlands, where social security reforms in the early 1980s have driven a sustained decline from about 23 to 17% of GDP, eventually even undercutting levels in the USA.

Source OECD (2016b)

Total social spending, 1980–2012.

Figure 2.9 presents the trends in the minimum pension replacement rates from the 1970s onwards, referring to public pension or equivalent benefit for which a person without working or pension contribution history is entitled. While countries like the Netherlands and France show minimum pension replacement rates high above the European average, the minimum replacement rate in the USA is close to the European average. The USA and the UK, typical LMEs, have lower pension replacement rates than France or the Netherlands, but higher than Germany or Poland. Moreover, some change in the minimum replacement ratesFootnote 6 is visible in a number of countries. For instance, from the mid-1980s onwards, minimum replacement rates have declined in the Netherlands. On contrary, the same period has witnessed an increase in Italy where the minimum pension replacement rate starts at the lowest level but catches up with countries such as the USA (see also the discussion in Kuitto et al. 2012).

Source Scruggs et al. (2014)

Minimum pension replacement rates, 1971–2011.

Overall, this section highlights that there have been various changes in the fields of employment protection legislation, centralization of wage bargaining and social security over the twentieth century. Labor market institutions, therefore, do seem rather flexible. Still, despite these changes, the extent to which European countries experienced change has been different from each other and we do not find convergence in labor market institutions. For instance, while an increase in employment protection legislation is visible in many European countries (such as in Germany, Italy, France) up until the 1980s, these regulations became more flexible in the case of Germany and Italy after the 1980s. Overall, a convergence toward more industry-level bargaining process is visible in Central European countries. It is therefore important to study the history of labor market institutions and carefully tailor reform proposals to the local and national context.

5 Conclusion and Discussion

In the FIRES project, using the Varieties of Capitalism framework, we presented how the different institutional constellations with regard to finance, knowledge, and labor market institutions support different forms of entrepreneurial activity (Dilli et al. 2019; also discussed in Elert et al. 2019 and Herrmann 2020). This chapter provides a long-term perspective on the historical evolution of such institutions. By using a historical perspective, the aim of this chapter is to distinguish between those institutions that change over time versus those that are more resistant to change. This enables us to identify which institutions can be more easily altered versus which are hard to change via policy tools. Overall, while change is visible in all three institutions over the twentieth century, the VoC typology is relevant in understanding the extent and the direction of the institutional change European countries have experienced.

A historical perspective on the financial institutions with a focus on the banking structure in Europe indicates that banks were more diversified in the past than today and provided different possibilities for entrepreneurs to have access to finance. Historically, rather than getting finance from large banks, the challenges in accessing finance were solved in many cases through local and private initiatives. Today in Europe, Eastern and Mediterranean economies face the largest constraints in financial institutions (Dilli et al. 2018). Given the historically strong family ties in these contexts, stimulating informal family funding can provide an alternative source of finance. In the Northwestern European countries, the introduction of more small-scale formal funding options, which were historically an important source of finance for entrepreneurs, can be an alternative solution. In Germany, for instance, cooperatives historically were an important source of finance for entrepreneurs. Such organizational forms can provide alternative sources of formal finance especially in continental European countries. Moreover, platform-based financial intermediation such as through crowdfunding and Fintech are modern-day examples of such institutions.

In terms of knowledge institutions, the LME economies have a clear advantage in tertiary level educational attainment, which stimulates general education compared to occupation and firm specific training in the CMEs. In terms of research and development, the continental European economies are performing as well as the LME economies, but potentially with a slightly different focus. This chapter illustrates that the differences in the knowledge outcomes, which have been highlighted in the VoC framework, have been visible already in the beginning of the twentieth century. The twentieth century also witnessed important progress in closing the gender gap in tertiary education, but the gap remains in STEM education today and presents a challenge for women’s involvement in more innovative entrepreneurial activity (Dilli and Westerhuis 2018b). In the case of the UK, the academic environment has managed to attract researchers from abroad. Continental European economies compensate by stimulating research and development via governmental expenditures such as in the case of Germany. This may provide an alternative for contexts where research and development remain limited.

The historical cross-national differences in labor market institutions also change noticeably on the surface, but there is also clear path dependence and deeply rooted elements that clearly persist over time. The LMEs, for instance, always had the least regulated labor market institutions, whereas the tightly regulated labor market institutions have been characteristic for the Mediterranean and the continental economies over the same period. Therefore, from a historical viewpoint, deregulation in labor market institutions to stimulate entrepreneurship would likely face challenges in contexts where labor markets were historically tightly regulated. Overall, the historical analysis shows that elements of the institutional framework in Europe have deep roots that should be carefully considered when contemplating reforms. In line with this conclusion, in Sanders et al. (2020a, b, c), an objective is to let careful historical analysis precede the formulation of reform proposals.

Notes

- 1.

Saving banks emerged in the late eighteenth century in order to provide possibilities for working and poor people to save for periods of need due to illness, unemployment, or retirement.

- 2.

An important note here is that the educational attainment at tertiary level compares only cross-country differences in terms of quantity and does not provide information on the quality of education, which is hard to capture historically and across space.

- 3.

More information on the method of OEC in constructing the EPL index and the latest version of the index can be accessed at https://www.oecd.org/els/emp/oecdindicatorsofemploymentprotection.htm.

- 4.

The law provided unconditional freedom for the conclusion of fixed-term contracts up to 18 months in duration (Schettkat 2002).

- 5.

While union density does not reflect the strength of the labor unions (as visible in the case of France which has a very low union density but very strong labor unions in terms of wage bargaining), union density is the only indicator to my knowledge that is available historically over time and across the contexts and to have been commonly linked with entrepreneurship outcomes (see Dilli 2019).

- 6.

This indicator is calculated for a fictive average production worker in manufacturing sector who is 40 years old and has been working for the 20 years preceding the loss of income or the benefit period.

References

Aleksynska M, Schmidt A (2014) A chronology of employment protection legislation in some selected European countries. Working paper. Accessed on 15 Nov 2015. http://www.ilo.org/travail/whatwedo/publications/WCMS_324647/lang–en/index.htm

Alesina A, Giuliano P (2010) The power of the family. J Econ Growth 15(2):93–125

Allard GJ (2005) Measuring job security over time: in search of a historical indicator for EPL (Employment Protection Legislation). SSRN Scholarly Paper. Social Science Research Network, Rochester, NY. Accessed on 17 Dec 2015. http://papers.ssrn.com/abstract=1016327

Amable B (2003) The diversity of modern capitalism. Oxford University Press, Oxford

Arregle JL, Batjargal B, Hitt MA, Webb JW, Miller T, Tsui AS (2015) Family ties in entrepreneurs’ social networks and new venture growth. Entrep Theory Pract 39(2):313–344

Au K, Ding ZJ (2011) Institutional influence on love money: informal investment to family, friends, strangers across countries. In: Family business association annual conference, Perth. http://www.fambiz.org.au/wp-content/uploads/Institutional-Influence-on-Love-Money-Informal-Investment-to-Family-Friends-and-Strangersacross-Countries-Professor-Kevin-Au-and-Zhujun-Ding.pdf

Au K, Kwan HK (2009) Start-up capital and Chinese entrepreneurs: the role of family. Entrep Theory Pract 33:889–908

Baumol WJ (1990) Entrepreneurship: productive, unproductive, and destructive. J Polit Econ 98(5):893–921

Black SE, Strahan PE (2002) Entrepreneurship and bank credit availability. J Financ 57(6):2807–2833

Blanchard O (2002) Designing labor market institutions, Working Paper. Accessed on 19 Jan 2016. http://economics.mit.edu/files/664

Broadberry S (ed) (2010) The Cambridge economic history of modern Europe, volume 2: 1870 to the present. Cambridge University Press, New York

Bruton GD, Ahlstrom D, Li HL (2010) Institutional theory and entrepreneurship: where are we now and where do we need to move in the future? Entrep Theory Pract 34(3):421–440

Bürzel TA (1999) Towards convergence in Europe? institutional adaptation to Europeanization in Germany and Spain. J Common Mark Stud 37(4):573–596

Bygrave W, Hay M, Ng E, Reynolds P (2003) Executive forum: a study of informal investing in 29 nations composing the global entrepreneurship monitor. Ventur Cap 5(2):101–116

Bygrave WD, Reynolds PD (2005) Who finances start-ups in the USA? a comprehensive study of informal investors, 1999–2003. Frontiers of Entrepreneurship Research

Capon C (2004) Understanding organizational context: inside and outside organizations. Pearson Education

Carnevali F (2005) Europe’s advantage: banks and small firms in Britain, France, Germany, and Italy since 1918. Oxford University Press, Oxford, New York

Coad A, Rao R (2010) R&D and firm growth rate variance. Econ Bull 30(1):702–708

Cull R, Davis LE, Lamoreaux NR, Rosenthal JL (2006) Historical financing of small-and medium-size enterprises. J Bank Finance 30(11):3017–3042

de Goey F, van Gerwen JL (2008) Entrepreneurs in Netherlands (ondernemers in Nederland: varieties in ondernemen. Boom, Amsterdam

Deeg RE (1999) Finance capitalism unveiled: banks and the German political economy. University of Michigan Press, Ann Arbor

Dilli S, Westerhuis G (2018a) A historical perspective on the varieties of institutions, Finance and entrepreneurship. Available at: https://projectfires.eu/wp-content/uploads/2018/05/d2.2-combined-parts-23-n.pdf

Dilli S, Westerhuis G (2018b) How Institutions and gender differences in education shape entrepreneurial activity: a cross-national perspective. Small Bus Econ 51(2): 371–92

Dilli S (2019) The diversity of labor market institutions and entrepreneurship. Socio-Econ Rev. Online first

Dilli S, Elert N, Herrmann AM (2018) Varieties of entrepreneurship: exploring the institutional foundations of different entrepreneurship types through ‘varieties-of-capitalism’ arguments. Small Bus Econ 51(2):1–28

Duranton G, Andres Rodriguez-Pose A, Sandall R (2009) Family types and the persistence of regional disparities in Europe. Econ Geogr 85(1):23–47

Ebbinghaus B, Visser J (1999) When institutions matter: union growth and decline in Western Europe, 1950–1995. Eur Sociol Rev 15(2):135–158

Elert N, Henrekson M, Sanders M (2019) The entrepreneurial society: a reform strategy for the European union. International studies in Entrepreneurship. Springer, Berlin Heidelberg

European Commission (2013) Entrepreneurship 2020 action plan: reigniting the entrepreneurial spirit in Europe, Brussels, Commission of the European Communities

Frankema E, Van Waijenburg M (2012) Structural impediments to African growth? new evidence from real wages in British Africa, 1880–1965. J Econ Hist 72(4):895–926

Fritsch M, Wyrwich M (2017) The effect of entrepreneurship for economic development—an empirical analysis using regional entrepreneurship culture. J Econ Geogr 17:157–189

Fulton L (2013) Worker representation in Europe. Labour Research Department and ETUI. Produced with the assistance of the SEEurope Network. Accessed on 17 June 2019. http://www.workerparticipation.eu/National-Industrial-Relations/Across-Europe/Trade-Unions2

Galor O, Ozak Ö (2016) The agricultural origins of time preference. Am Econ Rev 106(10):3064–3103

Gelderblom OC (2011) Entrepreneurs in the Dutch golden age. In: Baumol W, Landes D, Mokyr J (eds) The invention of enterprise. Entrepreneurship from ancient Mesopotamia to modern times, Princeton UP, Princeton, pp 156–182 (p 27)

Gelderblom O, Jonker J (2004) Completing a financial revolution: the finance of the Dutch East India trade and the rise of the Amsterdam capital market, 1595–1612. J Econ Hist 64(3):641–672

Global Entrepreneurship Monitor (2011) Global Report. Babson College, Babson Park

Goldin C (1995) Investment in women’s human capital and economic development. University of Chicago Press, Chicago

Greif A (2006) Family structure, institutions, and growth: the origins and implications of western corporations. Am Econ Rev 96(2):308–312

Hall PA, Soskice DW (2001) An introduction to varieties of capitalism. In: Hall PA, Soskice DW (eds) Varieties of capitalism—the institutional foundations of comparative advantage. Oxford University Press, Oxford, pp 1–68

Hall PA, Thelen K (2009) Institutional change in varieties of capitalism. Socio-Econ Rev 7(1):7–34

Henrekson M (2014) How labor market institutions affect job creation and productivity growth, IZA World of Labor. http://wol.iza.org/articles/how-labor-market-institutions-affect-job-creation-and-productivity-growth/long

Herrmann A (2020) Chapter 4. On the institutional foundations of the varieties of entrepreneurship in Europe. In: Sanders M, Marx A, Stenkula M (eds) The entrepreneurial society. Springer, Berlin Heidelberg

Jonker J (1997) The alternative road to modernity: banking and currency, 1814–1914. In: Hart MT, Jonker J, Zanden J (eds) A financial history of the Netherlands, Cambridge University Press, Cambridge, pp 94–123