Abstract

This paper presents the application of adaptive simultaneous stochastic optimization with a representative branching framework to generate a strategic mining plan for the Escondida mining complex, the world’s largest copper-production operation. This adaptive stochastic optimization considers geological uncertainty while integrating investment and operational alternatives in the production schedule of a mining complex. Mining complexes are comprised of interconnected components affected by multiple sources of uncertainty. Thus, they must be optimized simultaneously in order to maximize their value, manage environmental impacts, and minimize risk. Additionally, due to the extensive lives of assets and the dynamic and uncertain environment in which mining complexes operate, it is not reasonable to assume that the current strategic plan will remain optimal. Thus, an operationally feasible method to embed alternatives in the mine plan is used. The method utilized provides a strategic plan with representative branches for future possible investment decisions. Adaptive decisions are made sequentially over time, activating costs and effects over the model. The optimization process chooses the optimal strategic production plan accordingly, as well as the investments made and their timing. The Escondida mining complex is a multi-element, multi-pit operation with nine different processing destinations. Investment options considered herein are truck and shovel fleet sizing, adding a secondary crusher in one of the plants, and investing in a main crusher assigned to one of the pits. Additionally, operational alternatives at the mine and plant levels are included. The adaptive solution shows a substantial probability that the mine plan might change its design substantially due to geological uncertainty, presenting an increased expected net present value when compared to the previously developed stochastic mathematical programming formulation that does not consider adaptive decisions, thus generating a single static strategic production plan for the related mining complex. Further studies at the Escondida mining complex can consider adoptive solutions integrating capital investments pertinent to climate change issues.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Escondida is the world’s largest copper-producing mining complex, located at over 3000 m.a.s.l. in the Antofagasta Region in northern Chile. It is operated by Minera Escondida Ltd. and is part of BHP’s operations [1]. A mining complex/mineral value chain consists of a set of connected, interdependent components, including a set of mines, which supply raw materials, stockpiles, different processing streams, products, and a set of final destinations that sell the processed material products for a profit. A diagram of the Escondida mining complex is presented in Fig. 1, which consists of two open-pit mines, Escondida and Escondida Norte, both of which are part of the multi-element Escondida porphyry. There are four material types defined as sulfides, oxides, mixed, and waste. Sulfides can be processed by three different sulfide processing plants, which are fed by four crushers and receive material from both mines; low-grade sulfide material can also be sent directly to a bio-leach pad as run-of-mine. Oxide and mixed material must be processed in a separate leach-pad, which is fed from a fifth crusher, also receiving material from both mines. Additionally, there are two stockpiles available for oxide and sulfide material and a waste dump, which are fed directly from the pits.

Mining complexes are governed by inherent uncertainties both internally (geological, technical) and externally (royalties, markets, etc.) [2,3,4,5,6]. To obtain reliable long-term/strategic mine plans maximizing discounted profits, a mining complex must be optimized simultaneously, to account for and manage: (i) the value created by the synergies that exist between its components generating products [7,8,9,10,11]; (ii) the effects of uncertainty over the strategic plan and related production forecasts [12,13,14,15,16,17,18,19,20,21],and (iii) the dynamic and uncertain environment in which mines operate [22,23,24]. Accounting for uncertainty in point (ii) above is founded upon optimization based on stochastic mathematical programming [25], capitalizing on the required input to the optimization process of geostatistically simulated orebody realizations [26,27,28] for all pertinent, spatially distributed mineral deposit attributes (including mineral grades, material ore types, tonnages, and geometallurgical properties). The latter attributes quantify the spatial uncertainty and variability related to the supply of raw materials from the orebodies mined and are, through the stochastic mathematical programming optimization process, directly linked to the products generated and related risk management in meeting production and product requirements (please refer to overview in Dimitrakopoulos and Lamghari [29]). Montiel and Dimitrakopoulos [30] develop a model to optimize the production schedule of a mining complex that considers supply uncertainty, including operating alternatives at the processing plant and the transportation systems of the related mineral value chain. To account for supply uncertainty, the authors use a set of stochastically simulated realizations of the deposit, representing the local variability of the attributes of interest, such as the grade of metal, material ore types, or deleterious elements [27]. Similarly, Goodfellow and Dimitrakopoulos [13, 31] present a framework for the simultaneous stochastic optimization (SSO) of mining complexes that integrates decisions over material extraction from a set of sources along with their uncertainty, as well as blending, stockpiling, processing, products, and transportation decisions, while managing the related risk to meet production targets and maximize revenue. Goodfellow [32] extends this model to include capital investment alternatives, allowing the stochastic optimizer to define extraction capacities as part of the optimization process. Inclusion of capital investments is important for managing environmental performance for the mining industry (point (iii) above), as supply chain design significantly impacts greenhouse gas (GHG) emissions [22, 24] and direct costs are applied to GHG emissions. Adequately treating GHG emissions and their effect on the viability of mining complexes requires direct modeling of the decisions mining complexes have available when engaging in the regulatory environment [24]. Under an emission trading scheme, a mining complex may elect to buy or sell carbon credits, to either open more production capacity at the cost of credit acquisition or reduce production capacity at the benefit of the carbon credit selling price. Such decisions may be modeled identically to the capital investment decisions described by Goodfellow [32]. Optimizing capital investment decisions for improved mining complex configuration and carbon credits provides guidance for designing mining complexes and engaging in the market considering the cost of producing and its benefit or not. The recent work extends these developments to integrate progressive reclamation and waste management [33] and examine multiple combined sources of uncertainty [14]. However, all of these studies provide static solutions, fixed for the complete life of a mining asset (LOM) or strategic plan based on simultaneous stochastic optimization, and do not propose any feasible alternatives to adapt a strategic plan based on expected future changes, underestimating the asset’s potential [34,35,36]. To deal with this lack of flexibility, Del Castillo and Dimitrakopoulos [37] extend previous SSO methods and propose an adaptive simultaneous stochastic mathematical programming model with representative branching, which unlike the previous SSO approaches allows for the inclusion of investment alternatives into the strategic plan. This model provides a clear image of possible future evolutions of the related mining asset and develops straightforward implementation plans for them. The strategic plan produced is presented as a scenario tree, with branches defined through representative scenario groupings, which show all mine-design investment developments that have a representative probability of occurring given the uncertainty. In order to control the complexity of the model and limit the growth of the solution tree, only investments that have an important effect over the strategic plan are considered for branching. Thus, investment decisions are divided into two sets, branching and nonbranching. The former are major investments with extensive lead times and are taken only once or once every 10 years or more in the LOM, such as the opening of a new processing plant. The latter have a low relative impact over the LOM schedule and/or are multiple small decisions taken repeatedly over the LOM, such as truck purchases, which define the mines’ extraction capacity. The proposed approach provides a probabilistic analysis of whether or not to invest in different large capital expenditures, with their corresponding investment timings, production plans, and extraction capacities.

Due to the long life of assets, environmental considerations, and the uncertainties affecting a mining complex, expecting that their setup will remain unchanged throughout its life is a strong assumption that might hinder the potential to maximize revenue. The Escondida mining complex has a reported life of asset of 58 years, as of January 2018 (“Mining Data Solutions—Escondida Mine,” [38]); thus, it is necessary to develop a strategic plan that not only respects production forecasts but also enables change. Traditionally, mine plans are updated annually according to the previous year’s information on costs, commodity price evolutions, and extracted material. However, this is a suboptimal practice that only allows reactive responses, inhibiting timely and efficient large-scale changes and investments, as these require extensive lead times and coordination between the components involved. Evidently, the simultaneous stochastic optimization (SSO) of a mining complex [17, 31] manages risk and maximizes value given the mining complex’s setup,however, it also produces static plans.

Project value can be maximized by generating strategic plans that react in a timely manner to change [39]. For this, flexibility alternatives must be created and maintained within the model, optimizing the type and timing of new investments that could become valuable given future changes. A “flexible design” is defined as being able to adapt and reconfigure if needed [40, 41]. Accordingly, flexibility in strategic plans is often translated into a set of different possible solutions that are operationally impossible to follow in real life. For strategic plans and financial assessments to be reliable, the strategic plan and mining design must be operationally feasible. In mining terms, this means that they must follow all operational requirements and physical geotechnical restrictions. Including flexibility in mining operations has been a topic of interest in the technical literature, tackling different sources of uncertainty, such as commodity price, geology, or operating costs [42,43,44,45], but they have failed to produce optimized mine plans that allow for feasible, implementable designs.

The model developed by Del Castillo and Dimitrakopoulos [37] extends past approaches on the SSO of mining complexes by including feasible implementations of alternatives in the strategic plan through the dynamic adaptive planning of investments, providing a broader look at possibly profitable evolutions of the plan. Del Castillo [46] extends this work by including decisions over operational alternatives into the model, letting the optimizer define blast-hole patterns to affect rock fragmentation, as well as plants’ throughput and recovery configurations. This work stresses the advantages of integrating the optimization of different investment and operating alternatives into one model, as a part of the strategic planning process, as well as the benefits of allowing a mine design to branch, planning for investment decisions that might be profitable in the future.

This paper outlines the application of the adaptive simultaneous stochastic optimization model [37] to the Escondida mining complex in the presence of supply uncertainty. For comparison, the mining complex is also optimized using the previously developed SSO approach [13, 32] with and without considering investment and operating mode alternatives. The next section briefly outlines the adaptive SSO method. Subsequently, three different case studies at the Escondida mining complex demonstrate results and discuss the related comparisons. Conclusions follow.

2 An Adaptive Simultaneous Stochastic Optimization Method

The adaptive simultaneous stochastic optimization of a mining complex proposed by Del Castillo and Dimitrakopoulos [37] extends the method proposed by Goodfellow and Dimitrakopoulos [13] by including operational and investment alternatives, as well as using dynamic adaptive branching to maximize net present value (NPV) while managing risk due to the presence of uncertainties. Accordingly, uncertainty in supply of materials from orebodies mined is represented through a set of S geostatistical simulations s of the deposit (s = 1, …, S), while the strategic plan is optimized over a period of T production years t (t = 1, …, T), aiming at maximizing the following objective function.

In Eq. (1), Part 1 of the objective function represents all discounted revenues from the final products generated by the mining complex, minus all costs (mining, processing, transportation, and so on). The second term, Part 2, considers directly the purchase cost of the different investments acquired along the life of asset, also discounted to present value. Note that when considering an emissions trading scheme, this term may also include the cost of purchasing and the profit of selling carbon credits and so on. Finally, the third term (Part 3) manages risk associated with supply material uncertainty by minimizing deviations from production targets and including product quality and quantity. These targets can consider for example maximum production and extraction capacities, ore chemistry, and blending targets and constraints in the different processing streams and so on.

To allow the adaptive simultaneous stochastic optimization model to branch (demonstrated in the Appendix), ensuring that decision variables remain constant within a branch and differ only between separate branches, nonanticipativity constraints are included [25]. These nonanticipativity constraints are the only constraints linking the separate scenarios (s) and ensure that decisions are nonanticipative of future outcomes, and in this case, are present for all extraction sequence decisions, destination policy decisions, operating mode decisions, and nonbranching investment decisions. A representation of the set of constraints related to the extraction sequence decisions (\({x}_{b,t,s}\)) is presented in Eq. (2), where \({x}_{b,t,s}\) equals to 1 if mining block b of mine M is extracted in period t, in scenario s, and 0 otherwise.

Given that \({\Omega }_{\rho }\) is the set of scenarios in that branch, \({\Omega }_{\rho 1}\cup {\Omega }_{\rho 2}={\Omega }_{\rho }\) are scenario partitions, where \(\Omega_{\rho1}=\left\{s;\;\omega_{k,t,s}=1,\forall s\in\Omega_\rho\right\},\Omega_{\rho2}=\left\{s;\;\omega_{k,t,s}=0,\forall s\in\Omega_\rho\right\}\), and \({\omega }_{k,t,s}=1\) represents a purchase of investment option k executed in period t under scenario s, while \({\omega }_{k,t,s}=0\) represents no investment. Variable \({A}_{t}\) controls the branching of the algorithm; it is activated (equals to 1) in a given period t if there is a representative probability R* of investing and not investing in a branching capital expenditure (see comments below), eliminating the constraint, and, thus, allowing decisions to vary for the following planning period (branching). However, if \({A}_{t}\) is not activated (equals to 0), then constraint 2 enforces all extraction decision variables to be equal throughout all scenarios. Note that the computation of \({A}_{t}\) is based on an iterative process that uses a look-forward mechanism to quantify the probability of branching decisions and update scenario partitions, ensuring that branching only occurs when it is representative and meaningful (please refer to Del Castillo [46] for details on the calculation of \({A}_{t}\) and for the complete model). The actual decision to branch is taken by calculating the representativity of the probability of purchasing a branching investment. For this, a branching threshold parameter \(R\in [\text{0,0.5}]\) is defined, where branching only occurs when the probability of investing (\({R}^{*}\)) falls within this threshold (\(\in \left[R, 1-R\right]\)). If the probability of investing is lower than the threshold (\({R}^{*}\in [0,R)\)), the solution does not branch, and no investment is made. On the other hand, if the probability is higher than he threshold (\({R}^{*}\in \left(1-R,1\right]\)), there is also no branching, but the full mine plan invests.

The proposed adaptive stochastic mathematical programming model is solved by using a rolling-horizon decision-making mechanism [47,48,49], which iteratively fixes decisions on an increasing time horizon, and allows later periods to differ. This process quantifies investing probabilities and, if these probabilities are representative, branches and rolls back to generate feasible strategic plans for each branch, later fixing the decisions taken until that period. This process is repeated until all periods of the LOM are fixed.

3 Applications and Comparisons at the Escondida Mining Complex

3.1 Overview

As mentioned previously, the Escondida Mining Complex (presented in Fig. 1) consists of two open-pit mines, Escondida and Norte, which contain over 120 and 78 thousand blocks, respectively. Each block measures 25 m × 25 m × 15 m in dimension and contains a variable concentration of copper, gold, silver, and molybdenum as valuable elements, as well as arsenic and iron which must be controlled. The mines are connected to four crushers that feed three sulfide processing plants, OGP1, LC, and LS, which have a processing capacity of 160, 120, and 130 thousand tonnes per day (ktpd), respectively, as well as a crusher that feeds an oxide leach-pad with a capacity of 25 million tonnes per year. Material from both mines can also be sent to a bio-leach pad that has the capacity to treat 135 million tons of run-of-mine material per year and a waste dump with assumed infinite capacity. Additionally, there are two stockpiles available for oxide and sulfide material, which are fed directly from the pits and have a capacity of 75 and 30 million tons per year respectively. Please note that the information provided herein reflects the time this work was conducted.

Exploration drill-holes show that the life of mine is in the order of several decades; however, at the time of the present study, the strategic plan is commonly optimized for a time range of 8 years, and this is the time range to be used herein to demonstrate the aspects of the method applied. The main product sold by the mining complex is copper concentrate produced by the processing plants, which has a premium for gold, silver, and molybdenum content. Copper cathodes are also produced by the oxide and bio-leach pads. Escondida has, at the time of the present study, an initial fleet capacity of 98 trucks and 14 shovels, and Norte has 42 trucks and 6 shovels assigned for the first 2 years of the strategic plan. Extraction capacity after that point will be defined by the optimization process for both mines, by investing in trucks and shovels. Because of geotechnical constraints, Escondida can have a fleet of up to 120 trucks and Norte of up to 70. Due to cycle times and maintenance, for optimal performance, it is considered that a shovel can load up to 7 trucks.

3.2 Alternatives Considered

The alternatives considered for the Escondida Mining Complex are divided into operational and investment alternatives. Operational alternatives correspond to intrinsic flexibilities that allow for adapting the configuration of a process at a given component of the mining complex, and investment alternatives are capital expenditures in equipment or infrastructure that are feasible to consider within the mine plan.

3.2.1 Investment Alternatives

A summary of the investment alternatives considered is presented in Table 1. Here, the two sets of investments defined earlier are presented, which are periodic investments (\({{\varvec{K}}}^{=}\)) and one-time investments (\({{\varvec{K}}}^{<}\)). In this case, the first set includes truck and shovel purchases for the Escondida and Norte pits separately, which jointly define the extraction capacity of the mining complex, and the second considers investments over a secondary crusher at the LS processing plant, and an extra crusher assigned to the Escondida pit, which feeds material to the OGP1 and LS plants.

3.2.2 Operational Alternatives

In this case, as in Del Castillo [46], two sets of operational alternatives are considered. These are (i) adapting the processing modes at each of the three plants, increasing the metallurgical recovery, but at a cost in throughput, and (ii) applying a change in the blasting pattern at each of the mines, in order to help fragmentation, but at a higher mining cost due to extra explosives and blasting perforations.

The interaction between the different investment and operational alternatives within the mining complex’s performance is shown in Fig. 2. The top part of the figure presents the details of plant LS’s flow of material, where the blasting modes and the fleet investment alternatives affect both mines. These sources feed a possible new extra crusher, which in turn feeds the ball mill of LS, which can be aided by the addition of a secondary (2ry) crusher incorporated within the processing plant. This processing plant also has an operating mode that defines whether it will be operating at high throughput/low recovery or low throughput/high recovery. The bottom part of Fig. 2 shows the global view of the adaptive mining complex, along with the set of alternatives mentioned (investment alternatives in red, mining modes in green, and processing modes in blue).

3.3 Results and Comparisons

Three case studies are presented in this section, all considering geological uncertainty within the stochastic optimization approaches employed, in the form of geostatistically simulated equally probable realizations of the two deposits. The first case (Base Case) corresponds to the originally developed and established stochastic mathematical programming approach for the optimization of a mining complex [13, 17], where fixed extraction and processing capacities are defined over the whole mining complex, as well as fixed operating modes. In the second case (Base Case with Alternatives) results obtained for the stochastic simultaneous optimization considering alternatives are presented, following the approach of Goodfellow [32]. In this case, while the dynamic adaptive analysis is not performed, the simultaneous stochastic optimization approach is as used in the Base Case and is allowed to define the optimal investment plan, as well as the operational alternatives, similar to those in Montiel and Dimitrakopoulos [30]. As noted in a previous section, both approaches generate static, single/fixed optimal life of mining asset plans and include no alternative sequences of extraction and production plans to potential future changes. The third case (Adaptive Dynamic Case) presents the adaptive (and in a sense dynamic) case study, which includes the possibility of branching over one-time investments, presenting a probabilistic solution of the life of mining asset design, which allows maintaining flexibilities available until more information is obtained to take the final design decisions. In the following sections, the results from the three case studies are compared and related contributions discussed.

3.3.1 Base Case

The Base Case extraction plan and equipment purchase plan are presented in Fig. 3, where there is a fixed equipment capacity for both Mine 1 (Escondida, in black) and Mine 2 (Norte, in gray), even though the actual extraction (in dashed lines) is considerably reduced in various periods. In Fig. 4, the risk profiles for the first Crusher, as well as for the three different plants, are presented. Please note that in Fig. 4, and other figures, P10, P50, and P90 represent the probabilities of the 10, 50 (median), and 90 percentiles of meeting the related forecast. As demonstrated, Crusher 1 (left of Fig. 4) is working consistently at full capacity; however, there is still some capacity available at the processing plants. This analysis allows for identifying possible investments as interesting alternatives that could improve the performance of the mining complex, such as increasing the crushing capacity in order to increase the plants’ feeds.

3.3.2 Base Case with Optimized Alternatives

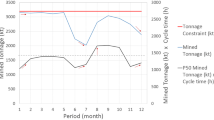

The Base Case with Alternatives presented in this section includes the operating and investment alternatives mentioned in Fig. 2; however, these alternatives are only considered as fixed strategic decisions in the simultaneous stochastic optimization of mining complexes (for investment acquisition plans as in Goodfellow [32] and operating mode alternatives as in Montiel and Dimitrakopoulos [30]). Figure 5 presents the annual mine extraction and equipment acquisition plan for both mines, showing the number of equipment units with respect to the initial quantity available in the left axis, and the percentage of extraction capacity (in full lines) and actually extracted (dashed lines) in the right axis, with respect to the total extraction capacity of the mining complex. In comparison to the Base Case fleet acquisition plan presented in Fig. 3, the Base Case with Alternatives reduces its initial fleet for the first four years, delaying the cost of investing in new trucks and shovels only for when this extra tonnage is required, instead of having idle equipment, as seen in the base case.

The risk analysis of the material fed into the main processing streams is presented in Fig. 6. It can be seen in the leftmost graph that the capacity of Crusher 1 increases in year 5 due to an investment in an extra crusher in period 2, as this investment has a lead time of 3 years (Table 1). The targets of the three graphs on the right side of Fig. 6 are modified by the acting operating modes, which adapt the plants’ throughputs with an effect over their recovery (Table 2). Additionally, the capacity in the LS processing plant is increased in periods 6 through 8 because the plan chooses to invest in a secondary crusher in period 4. Some deviations can be seen from the plant’s maximum capacity, particularly in OGP1 and LC; however, these are mostly during the final periods of the strategic plan.

3.3.3 Proposed Adaptive Dynamic Case

For the Adaptive Dynamic Case, the final solution tree representing the adaptive strategic plan with adaptive decisions is presented in Fig. 7, where the first row illustrates the period (year) of the plan, where T = 8, and the plan of period 1 corresponds to the same as the one presented in the previous section. The figure shows that, in this case, there is a 40% chance of branching over the investment of an extra crusher in period 2. Then, if the investment is made, there is a 30% chance of also investing in a secondary crusher in period 3, and if the extra crusher is not purchased in period 2, there is a 67% chance of investing in it later in period 4. If this is done, there is also a 50% chance of also investing in a secondary crusher in that same period. With these probabilities, it is possible to calculate the probability of each branch, showing that there is only a 20% chance of not investing in any CAPEX alternative (last branch), but there is an 80% chance of investing in the extra crusher between periods 2 and 4, showing that it might be interesting to advance this investment, compared to the fixed case with alternatives presented in the previous section.

Each branch of this solution tree includes a full production schedule, with its corresponding operating modes and minor equipment purchases. For example, the extraction and equipment purchase program for the second branch, which has the highest probability of occurring (28%), is presented in Fig. 8, where it shows that, in this case, the overall fleet size is reduced compared to the original Base Case. However, in the Adaptive Dynamic Case, more trucks are purchased in period 2 (40 instead of 45 as in the previous case for Escondida and 21 instead of 14 for Norte), and there is also an increase in extraction capacity towards the last years, complex configurations, and environmental pressures, while static methods must make the same decision in all potential future scenarios. The material feed for the extra crusher purchased in period 2, as well as for the three investments in trucks and shovels during years 4, 5, and 6 in both mines. The adaptive nature of this method provides better fleet sizing than static methods, as the fleet size is able to adapt to specific mining complex configurations and environmental requirements, while static methods must make the same decision in all scenarios. The material feed for the extra crusher purchased in period 2, as well as for the three different plants is presented in Fig. 9. The figure also shows the effect of the different operating modes over the processing capacities (red line), compared to the initial targets (dotted-line), where it can be seen that the risk profiles are able to closely follow the capacities adapted by the operating modes, with some slight deviations.

3.4 Discussion

The net present value (NPV) distribution for each of the three cases presented is shown in Fig. 10, where the horizontal axis presents the scaled NPV with respect to the initial original base case and the vertical axis presents the probability of obtaining at most that NPV. The values have been scaled to the 50th percentile of the initial base case (i.e., the P50 value) for confidentiality reasons, showing that if investment and operational alternatives are included (“SSO WITHOUT ALTERNATIVES” curve in dashed gray), the NPV of the mining complex can increase between 8 and 12% compared to the original base case (“SSO WITH ALTERNATIVES” curve in light gray). This difference is due to three main reasons: first, the expansion opportunities obtained by allowing the processing streams to expand their crushing capacities; second, because of the flexibilities that the operating modes provide to the configuration of the different component, being able to have a better control over how the material is being processed according to its characteristics; finally, because a lot of this value is obtained by optimizing the timing of purchase of the different equipment, it delays investments that are not immediately required. Figure 10 also shows the NPV distribution for the adaptive case proposed. Results show that the dynamic adaptive analysis provides a more general look at the mining complex’s future performance, maximizing the value of possible opportunities, while hedging from risk.

Net present value (NPV) cumulative probability distribution for the three cases presented in Section 3.3

The strong differences in NPV are directly related to the significant differences present across the physical extraction schedules obtained from each optimization, meaning that these different optimization models produce mine plans that choose to extract different areas and amounts of material in different periods. This can be seen in Fig. 11, which presents a comparison between the schedule of Mine 1 for the SSO with alternatives (Section 3.3.2), and the proposed adoptive approach and analysis (Section 3.3.3). It can be seen that the first two periods are equal between all schedules, and the third one is common between the Base Case and branches 3, 4, and 5, following the branching schedule presented in Fig. 7. It is interesting to notice how the schedule corresponding to branch 5 is clearly smaller than the one obtained by the simultaneous stochastic optimization, showing the extent of the effect that these investments have over the optimal schedule of the deposit. In short, results show substantial benefits in considering adaptive dynamic alternatives within the simultaneous stochastic optimization, both in terms of net present value and in the use of available equipment.

It should be noted that from an environmental perspective, the specialization of the strategic mine plan to specific conditions is of major importance. The approach used in the Escondida mining complex case study is aware of the uncertainty of present and future conditions and the mining complex’s ability to adapt, meaning that the method can position the design to perform well under any conditions it may be subject to, while being able to adapt as required. In future studies, designing a mining complex in such a manner can provide effective guidance for operating under uncertain regulatory conditions, timing investments in renewable energy sources, investing in electric equipment, etc. all while positioning the design to optimally adapt when changing conditions justify.

4 Conclusions and Future Work

The application of the adaptive simultaneous stochastic optimization at the Escondida mining complex has shown that the proposed method is able to capitalize on the full extent of the information provided by the set of simulated geological realizations used to represent the deposit’s uncertainty, as these provide an understanding of the deposit’s areas where the variability and/or the lack of data may cause the strategic plan to change. The method is able to produce feasible strategic plans and take advantage of possible future opportunities, thus allowing the mining complex to be prepared for the possible effects of uncertainty over the strategic plan, being able to react in a timely manner.

The proposed adaptive method provides a significant advantage over the previously developed static SSO method generating single static strategic plans in that it allows for pro-active planning considering the mining complexes ability to adapt in a changing environment. The methods’ ability to provide tailored mine plans for any operating environment the mining complex may be subject to providing significant value compared to alternative static methods. By adapting and specializing mine plans to specific environments, the method is able to ensure environmental considerations are able to be treated in a cost-effective manner and plan and ensure the mining complex is well positioned for successful operation in the future. This is a significant departure from static methods, which make the same decisions in all scenarios, and may be unable to provide specific treatment to environmental and climate change related concerns and thus unable to position the mining complex for adapting in the dynamic environment in which mines operate.

In the case study presented, the algorithm was able to solve the Escondida mining complex comprised of almost 200,000 blocks contained in two mines, with six different processing streams and stockpiles. Results show that the proposed analysis can increase project value between 8 and 20% compared with the plans generated from the previously developed simultaneous stochastic optimization approaches leading to a single static production plans. This value is mostly created due to the optimized investment timings, the possibility of expansions, the better configuration of processing streams obtained through the different operating modes, and the ability to branch the strategic plan, allowing the optimizer to consider and develop alternatives that might be profitable in the future. Future work at the Escondida mining complex can consider studies including specific pertinent climate change related issues.

References

Padilla R, Titley S, Pimentel F (2001) Geology of the Escondida porphyry copper deposit, Antofagasta Region, Chile. Econ Geol 96:307–324. https://doi.org/10.2113/gsecongeo.96.2.307

Barbaro RW, Ramani RV (1986) Generalized multiperiod MIP model for production scheduling and processing facilities selection and location. Min Eng 38(2):107–114

Dowd P (1997) Risk in minerals projects: analysis, perception and management. Trans Inst Min Metall (Sect. A: Min. industry) 106:A9–A18

Dowd P (1994) Risk assessment in reserve estimation and open-pit planning. Trans Inst Min Metall Sect A: Min Technol 103:148–154

Johnson T (1968) Optimum open pit mine production scheduling, in: 8th International Symposium on Computers and Operations Research. Salt Lake City Press

Ravenscroft P (1992) Risk analysis for mine scheduling by conditional simulation. Trans Inst Min Metall (Sect. A :Min. industry) 101:104–108

Bodon P, Fricke C, Sandeman T, Stanford C (2011) Modeling the mining supply chain from mine to port: a combined optimization and simulation approach. J Min Sci 47:202–211. https://doi.org/10.1134/S1062739147020079

Hoerger S, Seymour F, Hoffman L (1999) Mine planning at Newmont’s Nevada operations. Min Eng 51(10):3–7

Pimentel B, Mateus G, Almeida F (2010) Mathematical models for optimizing the global mining supply chain, in: Intelligent systems in operations : methods, models and applications in the supply chain. Business Science Reference, pp. 133–163. https://doi.org/10.4018/978-1-61520-605-6.ch008

Whittle J (2018) The global optimiser works—what next? In: Dimitrakopoulos R, editor. Advances in Applied Strategic Mine Planing: Springer, Cham.; p. 31–37. https://doi.org/10.1007/978-3-319-69320-0_3

Whittle J, Whittle G (2007) Global long-term optimization of very large mining complexes. In: Magri EJ (ed) Application of computers and operations research in the mineral industry. GECAMIN, Santiago, Chile, pp 253–260

Findlay L, Dimitrakopoulos R (2024) Stochastic optimization for long-term planning of a mining complex with in-pit crushing and conveyance systems. Min Metall Explor. https://doi.org/10.1007/s42461-024-01005-2

Goodfellow R, Dimitrakopoulos R (2016) Global optimization of open pit mining complexes with uncertainty. Appl Soft Comput 40:292–304. https://doi.org/10.1016/J.ASOC.2015.11.038

Jiang Y, Dimitrakopoulos R (2024) An application of simultaneous stochastic optimization on an open pit copper mining complex with supply, recovery, and market uncertainties. Int J Mining Reclam Environ. https://doi.org/10.1080/17480930.2024.2381904

Kumar A, Dimitrakopoulos R (2019) Application of simultaneous stochastic optimization with geometallurgical decisions at a copper–gold mining complex. Min Technol 128(2):88–105. https://doi.org/10.1080/25726668.2019.1575053

Lamghari A, Dimitrakopoulos R, Ferland J (2015) A hybrid method based on linear programming and variable neighborhood descent for scheduling production in open-pit mines. J Glob Optim 63:555–582. https://doi.org/10.1007/s10898-014-0185-z

Montiel L, Dimitrakopoulos R (2018) Simultaneous stochastic optimization of production scheduling at Twin Creeks Mining Complex, Nevada. Min Eng 70(12):48–56

Montiel L, Dimitrakopoulos R (2017) A heuristic approach for the stochastic optimization of mine production schedules. J Heuristics 23(5):397–415. https://doi.org/10.1007/s10732-017-9349-6

Montiel L, Dimitrakopoulos R, Kawahata K (2016) Globally optimising open-pit and underground mining operations under geological uncertainty. Min Technol 125:2–14. https://doi.org/10.1179/1743286315Y.0000000027

Paithankar A, Chatterjee S, Goodfellow R, Asad MWA (2020) Simultaneous stochastic optimization of production sequence and dynamic cut-off grades in an open pit mining operation. Resour Policy 66:101634

Saliba Z, Dimitrakopoulos R (2019) Simultaneous stochastic optimization of an open pit gold mining complex with supply and market uncertainty. Min Technol. https://doi.org/10.1080/25726668.2019.1626169

Chaabane A, Ramudhin A, Paquet M (2012) Design of sustainable supply chains under the emission trading scheme. Int J Prod Econ 135(1):37–49. https://doi.org/10.1016/j.ijpe.2010.10.025

Ulrich S, Trench A, Hagemann S (2022) Gold mining greenhouse gas emissions, abatement measures, and the impact of a carbon price. J Clean Prod 340:130851. https://doi.org/10.1016/j.jclepro.2022.130851

Vergara Valderrama C, Santibanez-González E, Pimentel B, Candia-Véjar A, Canales-Bustos L (2020) Designing an environmental supply chain network in the mining industry to reduce carbon emissions. J Clean Prod 254:119688. https://doi.org/10.1016/j.jclepro.2019.119688

Birge J, Louveaux F (2011) Introduction to stochastic programming. Second Edition, Springer-Verlag, New York.https://doi.org/10.1007/978-1-4614-0237-4

Gómez-Hernández JJ, Srivastava RM (2021) One step at a time: the origins of sequential simulation and beyond. Math Geosci 53(2):193–209. https://doi.org/10.1007/s11004-021-09926-0

Goovaerts P (1997) Geostatistics for natural resources evaluation. Oxford University Press

Rossi ME, Deutsch C (2014) Mineral resource estimation. Springer, Dordrecht

Dimitrakopoulos R, Lamghari A (2022) Simultaneous stochastic optimization of mining complexes/mineral value chains: an overview of concepts, examples and comparisons. Int J Mining Reclam Environ 36(6):443–460. https://doi.org/10.1080/17480930.2022.2065730

Montiel L, Dimitrakopoulos R (2015) Optimizing mining complexes with multiple processing and transportation alternatives: an uncertainty-based approach. Eur J Oper Res 247:166–178. https://doi.org/10.1016/J.EJOR.2015.05.002

Goodfellow R, Dimitrakopoulos R (2017) Simultaneous stochastic optimization of mining complexes and mineral value chains. Math Geosci 49:341–360. https://doi.org/10.1007/s11004-017-9680-3

Goodfellow R (2014) Unified modelling and simultaneous optimization of open pit mining complexes with supply uncertainty. PhD Thesis. McGill University, Montreal, QcCanada

Levinson Z, Dimitrakopoulos R (2024) Simultaneous stochastic optimization of mining complexes: integrating progressive reclamation and waste management with contextual bandits. Int J Min Reclam Environ. https://doi.org/10.1080/17480930.2024.2342687

Dowd P, Xu C, Coward SJ (2016) Strategic mine planning and design: some challenges and strategies for addressing them. Min Technol 1–13. https://doi.org/10.1179/1743286315Y.0000000032

Eckart J, Sieker H, Vairavamoorthy K (2010) Flexible urban drainage systems. Water Pract Technol 5:wpt2010072–wpt2010072. https://doi.org/10.2166/wpt.2010.072

Wang T (2005) Real options “in” projects and systems design: identification of options and solutions to path dependency. PhD Thesis. Massachusetts Institute of Technology

Del Castillo MF, Dimitrakopoulos R (2019) Dynamically optimizing the strategic plan of mining complexes under supply uncertainty. Resour Policy 60:83–93. https://doi.org/10.1016/J.RESOURPOL.2018.11.019

Mining Data Solutions - Escondida Mine [WWW Document] (2018) 2019 MDO Data Online Inc

Siegel D, Smith J, Paddock J (1987) Valuing offshore oil properties with option pricing models. Midl Corp Financ J 5:22–30

De Neufville R, De Weck O, Frey D, Hastings D, Larson R, Simchi-Levi D, Oye K, Weigel A, Welsch R (2004) Uncertainty management for engineering systems planning and design, in: Engineering Systems Symposium, MIT. Cambridge, MA

De Neufville R, Scholtes S (2011) Flexibility in engineering design. The MIT Press

Boland N, Dumitrescu I, Froyland G (2008) A multistage stochastic programming approach to open pit mine production scheduling with uncertain geology. Optimization Online 1–33

Groeneveld B, Topal E (2011) Flexible open-pit mine design under uncertainty. J Min Sci 47:212–226. https://doi.org/10.1134/S1062739147020080

Kazakidis V, Scoble M (2003) Planning for flexibility in underground mine production systems. Min Eng 55(8):33–38

Singh A, Skibniewski M (1991) Development of flexible production systems for strip mining. Min Sci Technol 13:75–88. https://doi.org/10.1016/0167-9031(91)90282-H

Del Castillo MF (2018) Dynamic simultaneous optimization of mineral value chains under resource uncertainty. Thesis. McGill University, Canada

Adulyasak Y, Cordeau J-F, Jans R (2015) Benders decomposition for production routing under demand uncertainty. Oper Res 63:851–867. https://doi.org/10.1287/opre.2015.1401

Bertsekas DP, Tsitsiklis JN, Wu C (1997) Rollout algorithms for combinatorial optimization. J Heuristics 3:245–262

Sethi S, Sorger G (1991) A theory of rolling horizon decision making. Ann Oper Res 29:387–415. https://doi.org/10.1007/BF02283607

Stone P, Froyland G, Menabde M, Law B, Pasyar R, Monkhouse PHL (2007) Blasor-blended iron ore mine planning optimisation at Yandi, Western Australia. In: Dimitrakopoulos R editor, Orebody modelling and strategic mine planning: the Australasian Institute of Mining and Metallurgy, Carlton, Vic., Spectrum Series 14, p. 133 – 136

Funding

This work is funded by the National Science and Engineering Research Council of Canada (NSERC) CRD Grant 500414–16, NSERC Discovery Grant 239019, the COSMO mining industry consortium (AngloGold Ashanti, Anglo American/DeBeers, Agnico Eagle, BHP, IAMGOLD, Kinross Gold, Newmont, and Vale), and the Canada Research Chairs Program.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Competing Interests

The authors declare no competing interests.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix. Example of branching in adaptive SSO

Appendix. Example of branching in adaptive SSO

Figure 12 demonstrates the adaptive aspect of the method utilized herein through an example, where the mine planning schedule is optimized over a set of simulated realizations of pertinent orebody attributes, and a unique schedule is produced for the initial years. The adaptive SSO approach considers if a significant proportion of the simulated realizations of the mineral deposit decide to invest in a given option (CAPEX) in year 3, and thus, the stochastic optimization process allows the branching of the solution plan into two feasible mine designs, one for each subset of mineral deposit simulations, thus generating unique strategic schedules for each of the subset cases.

Illustration of extending the SSO mine planning process to consider investment alternatives (from [46])

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Del Castillo, M.F., Dimitrakopoulos, R. & Maulen, M. Adaptive Simultaneous Stochastic Optimization of the Escondida Mining Complex, Chile. Mining, Metallurgy & Exploration (2024). https://doi.org/10.1007/s42461-024-01092-1

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s42461-024-01092-1