Abstract

The need for novel antibiotics to combat emerging multi-drug resistant bacterial strains is widely acknowledged. The development of new therapeutic agents relies on small and medium-sized biotechnology enterprises (SMEs), representing 75% of the late-stage pipeline. However, most SME sponsors of an antibacterial approved by the FDA since 2010 have gone bankrupt, or exited at a loss, below investment cost. Uncovering financial flows related to the development and commercialisation of a single drug is complex and typically untransparent. There is therefore a lack of empirical research on the financial vulnerabilities of these critical SMEs. The development of plazomicin by Achaogen (2004–2019) entailed financial disclosures as a public company enabling application of financial analysis methods to: determine quantum and timing of public and private investments; quantify development costs; and provide a deeper understanding of the role of capital market dependency in exacerbating pipeline fragility. Achaogen’s widely cited bankruptcy, and plazomicin’s commercialisation failure, created a perception that novel antibiotics have zero market value, causing investors to question the SME developer business model. Our analysis of Achaogen’s inability to fund commercialisation suggests three key implications for the antibiotic investment ecosystem: (1) novel antibiotics with narrow approval for small patient populations affected by severe resistant infections cannot be successfully commercialised in the current US antibiotic market; (2) SMEs need incentive payments structured to enable them to survive the commercialisation cashflow drought, and (3) these changes are necessary to restore industry and financial investor confidence in the antibiotic SME development model. Achaogen’s demise demonstrates that proposals to incentivise innovation, e.g. by providing one-off payments at registration, may be insufficient to ensure access to novel antibiotics developed by SMEs. In plazomicin’s case, moreover, US government biosecurity investments have not resulted in access, as the Indian and Chinese companies which bought post-bankruptcy rights have not widely commercialised the drug. This study is timely as new market-based incentives are currently being proposed by the US, EU, Canada and Japan. In order to make further government funding effective, ensuring access, not only innovation, these must support sustainable financial models for the SMEs critical to novel antibiotic development.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Introduction

The rise of antibiotic resistance is a major global health challenge, imperilling biomedical advances in the treatment of infectious diseases and cancer, as well as safe surgery. Experts have identified multiple challenges to research and development of new therapeutic agents to combat multi-drug resistant bacterial strains (Årdal et al. 2020). In 2023, in partnership with the multistakeholder Global AMR R&D Hub, WHO released a progress report for G7 Finance and Health Ministers on the novel antibacterial pipeline. They highlighted insufficient innovation, describing the clinical and pre-clinical pipeline as still inadequate to mitigate the threat of well-established mechanisms of drug resistance (Global AMR R&D Hub and WHO, 2023). Economic hurdles have proven particularly difficult to overcome (Harbarth et al. 2015; Kostyanev et al. 2016). Insufficient profitability led many large pharmaceutical firms to pull out of antibiotic markets (Carlet et al. 2012; Paton and Kresge, 2018; Projan, 2003; WHO, 2017). Therefore antibiotic drug development currently relies on small and medium-sized biotechnology enterprises (SMEs). SMEs dominate early-stage clinical research, and make up 75% of the late-stage pipeline (Access to Medicine Foundation, 2021). Of the 17 US FDA newly approved antibacterials (2010–2020), 11 were developed with SME involvement (Outterson et al. 2021).

However, scarcity of public funding to support commercialisation, and large pharmaceutical firms exiting antibiotic markets altogether, has left these SMEs increasingly financially vulnerable. In other therapeutic areas, large firms often serve as late-stage acquirer or licencing partner. SMEs have therefore become reliant on capital marketsFootnote 1 to raise funds (equity and debt financing), leaving them exposed to investor sentiment. Yet the pipeline of new therapeutic agents has dried up partly because returns demanded by investors are unattainable (Årdal et al. 2018; Harbarth et al. 2015). Indeed, every SME sponsor of an FDA-approved antibacterial since 2010 has gone bankrupt, or had a disappointing exit at a loss, lower than their investment cost (Outterson et al. 2021). Several SMEs have gone bankrupt while seeking to fund commercialisation of their newly approved drug (Chris Dall, 2019; Terry, 2020) rendering many of these new antibiotics inaccessible (Outterson et al. 2021). However, a lack of transparency typically makes it difficult to uncover financial flows related to the development and commercialisation of a single drug (Moon, 2017). There is therefore little existing research on this critical relationship between financial investors and antibiotic SMEs and their impact on pipeline vulnerability.

In order to overcome this knowledge gap, this paper therefore applies financial analysis methods, to a case study of SME bankruptcy: Achaogen’s development and failed commercialisation of plazomicin (2004–2019). Financial analyses use publicly available, independently audited financial disclosures to evaluate the commercial viability of firms. Financial analysis enables evaluation of the firm’s ability to earn a return on invested capital, grow its operations profitably, generate enough cash to meet its obligations, and pursue growth in order to achieve financial sustainability. Achaogen’s funding pathway, as a publicly listed company after 2014, imposed financial disclosure requirements from the US Securities and Exchange Commission (SEC). Applying the tools of financial analysis to Achaogen’s SEC disclosures allows identification of the factors which ultimately led to Achaogen’s bankruptcy, and the demise of plazomicin, a promising new antibiotic.

Plazomicin, was one of the rare drugs in the pipeline to receive FDA approval in June 2018 under a novel regulatory route (ReAct, 2021). Despite targeting serious multidrug-resistant bacterial infections, including WHO priority pathogen carbapenem resistant Enterobacterales (CRE)(SEC, 2014; WHO, 2017), commercialisation failed. Achaogen was forced to file for bankruptcy in April 2019(Dunn, 2019). Analysing Achaogen’s bankruptcy is important because it had ripple effects across the antibiotic development ecosystem. It was seen to imply zero market value for a novel antibiotic (Rex and Outterson, 2020). Without a pathway to financial sustainability, investors lost confidence, putting the funding and business models of such SMEs into question. Other bankruptcies followed, resulting in a lack of access to additional novel antibiotics emerging from the pipeline (Outterson et al. 2021; Taylor, 2020; Terry, 2020). This study is timely as new pull incentives to stimulate the pipeline are currently being designed in the US, Japan, Canada, and the EU (Doyle, 2020; EFPIA, 2022; Mullard, 2020). These incentives have the current blended public-private drug development model as their foundation. They are planned to stimulate innovation, and aim to encourage the financial contribution of the private sector, including both pharmaceutical sector and financial investors. This case study shows additional measures that will need to be taken to support sustainable financial models for the SMEs currently critical to antibiotic development.

Methods

We used financial analysis methods to illucidate the development history of plazomicin. Data was extracted from regulatory documents, audited financial statements (2014–2018), the IPO prospectus (2014), accompanying commentary by management such as investor presentations or investor call transcripts (2018–2019), and bankruptcy documents (2019).

Achaogen’s regulatory and funding pathways (2005–2019) were identified through financial documentary sources including SEC S1 (SEC, 2014) and 10-K reports (SEC, 2017, 2018, 2019a). The clinical trials were confirmed with ClinicalTrials.gov (https://clinicaltrials.gov search term “plazomicin”). From the financial statements we generated a data set allowing us to classify funders (public, private, and philanthropic). Comparing the regulatory and funding pathways allowed us to quantify the contributions of different types of funders as well as the timing of their investments in relation to the clinical trials, approval, and commercialisation process.

The financial statements and bankruptcy reports were further scrutinised to enable analysis of the economics of failed commercialisation. A comparison was made examining the commercial goals for plazomicin outlined at IPO (2014), which formed the basis of investor expectations, versus the actual commercialisation outcome (2018–19). A close reading of the 4Q2018 earnings call transcript (Achaogen, 2019), between Achaogen management, investors, and financial analysts, enabled insight into the operational position of the company as well as capital market sentiment towards Achaogen (this was evidenced in analyst questions). The post-bankruptcy history was traced, from the announcement of purchase of plazomicin rights by Cipla (SEC, 2019b), to the withdrawal of their market authorization request with the EMA (Cipla Europe NV, 2020), and the sale of rights in China (Kurtzman Carson Consultants, 2019).

Semi-structured interviews with experts active in the development and commercialisation of novel antibiotics were used to further inform our findings. These key informants in academic, clinical, biotech, financial, and non-profit drug development circles were identified using a combination of authors’ professional networks and published literature. The key informants identified were all experts with direct knowledge of the case study and US antibiotic markets. They provided expert views on the antibiotic investment ecosystem. Seven interviews were carried out, either remotely or in person, between March and July 2022: two in the UK, two in Europe, two in the US, and one in Asia.

Results

The regulatory pathway

As shown in Fig. 1, Achaogen developed plazomicin from a chemical modification of sisomicin (Aggen et al. 2010) and moved it into Phase 1 trials in 2009. Plazomicin was the first drug to receive a novel FDA fast-track designation, to accelerate regulatory review of drugs to treat serious unmet medical needs, after the Phase 2 study completed in 2012 (Connolly et al. 2018). The FDA granted Achaogen qualified infectious disease product (QIDP) designation for plazomicin under the GAIN ActFootnote 2 in December 2014, which would add five years to the exclusivity period post-approval. Plazomicin received breakthrough therapy designationFootnote 3 in May 2017 (SEC, 2019a) and was approved in 2018 with one Phase 3 trial, the EPIC trial (NCT02486627). The primary efficacy endpoints of the EPIC trial were met. Plazomicin achieved non-inferiority with standard-of-care therapy for complicated urinary tract infection (cUTI), and was approved for use in adults with cUTI including pyelonephritis (US Food and Drug Administration, 2018). A smaller study, the CARE trial (NCT01970371), compared plazomicin and colistin-based combinations for treatment of patients with serious CRE infection. Insufficient enrollment, leading to a small sample size, resulted in an FDA response letter that denied approval for CRE indications (Eljaaly et al. 2019). Achaogen unsuccessfully appealed this decision, hoping to use the limited-population antibacterial drugs (LPAD) pathway. This pathway supports the approval of antifungal and antibacterial drugs to treat serious and life-threatening infections in limited patient populations with unmet needs (SEC, 2019a). Plazomicin became commercially available in the US in July 2018(SEC, 2019a), and was added to the WHO Reserve group of antibiotics in 2019 for the treatment of multidrug-resistant pathogens including CRE (SEC, 2019a; Zanichelli et al. 2023).

Achaogen was thus left with approval only for cUTI in patients for whom there was no existing alternative treatment. The FDA approval came with 10 conditions outlining further costly regulatory requirements (Sagonowsky, 2018; Taylor, 2018) including two paediatric studies: a pharmacokinetic and safety study versus standard of care in hospitalised under 18 s; and a trial specifically for cUTI in under 18 s. Post-marketing requirements included: US surveillance studies for five years to monitor emerging resistance; a clinical study to evaluate the pharmacokinetics of plazomicin in subjects on hemodialysis; and establishment of an FDA-cleared or approved in vitro diagnostic device for therapeutic drug monitoring in cUTI patients prescribed plazomicin (FDA, 2018).

The funding pathway

The company navigated the successive trials prescribed by the regulatory landscape with a combination of public and philanthropic grants, and capital market funding (Fig. 2). In 2004, a $15.7 m Series A capital raise kickstarted the company, with further venture capital rounds (Series B 2006, Series C 2010, Series D 2013) raising $101 m (SEC, 2014, p. 1). Before the 2014 IPO, the company also relied on Non-Dilutive Financing (NDF). Grants from US government agenciesFootnote 4, eager to develop novel antibiotics for biosecurity purposes, contributed $106 million (2006–2013). Such non-dilutive funding is prized in biotechnology circles because, unlike equity capital market funding, it does not require additional share issuance. This allows existing shareholders to retain their share of any potential upside (Hollway, 2010). Indeed, the Wall Street Journal said “Few have raised “non-dilutive” financing better than Achaogen Inc.”(Austin, 2009). Two philanthropic organisations also invested: $13.6 million from the Wellcome (2009–2010), and $10 million from the Bill and Melinda Gates Foundation (BMGF) alongside financial investors in 2017. But in December 2018, Achaogen was forced to repay $5.7 million which had been earmarked for non-plazomicin related R&DFootnote 5 due to a change in the Foundation’s internal priorities. In addition, $7.1 million which had not been drawn down from a $10 million grant agreed with BMGF in 2017 was cancelled (SEC, 2019a). In 2018, Achaogen received an initial $1.3 million from a $2.4 million CARB-X award.

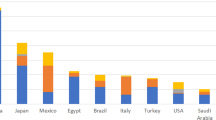

Split of public (26%), private (71%), and philanthropic (3%) funding with the clinical trial phase timeline and amounts per year (on a cashflow basis)Footnote

We analysed funding into Achaogen on a cashflow basis. The funding streams shown in Figure ii, therefore, include cashflows into the company from public grants, which Achaogen reported in their financial statements as ‘contract revenues’, and cashflows into the company from equity investments and debt financing from banks.

.After the Biomedical Advanced Research and Development Authority (BARDA) Phase 3 grant in 2013 (which provided $96 million in cash inflows 2014–2018), the firm became almost exclusively reliant on capital markets for additional fundraising. The IPO in 2014 brought in $74 million from new public market investors, followed by $287 million (2015–2018) in equity capital raises. The IPO and post-IPO equity capital allowed the company to raise debt from 2015 onwards. By 2018 they had a $49.8 million loan agreement with Silicon Valley Bank. Fearing Achaogen’s worsening cashflow situation once the firm began commercialising plazomicin, the bank restructured the loan in December 2018. This restructuring left Achaogen with only $26.4 million available from the bank. In February 2019, the firm sought further funding from capital markets, aptly described in an article entitled: “Last Capital Raise Signals Desperation”(Johnson, 2019). They raised $13.6 million (having targeted $15 million), aiming to cover expenses for one more quarter. As a result, capital markets, primarily equity investors to the tune of $550 million, were critical to the development of plazomicin. Financial investors provided 71% of Achaogen’s funding, dominating later stages from 2016 onwards.

Commercialisation

Commercialisation Costs

Achaogen’s fortunes took a dramatic turn for the worse as their cash needs increased with the costs of commercialisation (Fig. 3). A dedicated US sales force began targeting resistance hotspots and licensing agreements were planned to “maximise the value of plazomicin” in Europe, Asia, and Latin America (SEC, 2014). General and administrative expenses rose by $30 million to $71 million in 2018 as they attempted to build marketing and sales infrastructure (SEC, 2019a, b)(Fig. 4). R&D expenses peaked at $103 million, reflecting the high cost of late-stage clinical trials. These costs included pre-approval manufacturing of plazomicin (to satisfy the regulatory process), medical affairs, and pharmacovigilance. Financial commitments related to the FDA approval involved a milestone payment to Ionis Pharmaceuticals of $7.5 million, a success fee payment to Solar Capital of $1 million, and imminent manufacturing costs with Hovione for future production of plazomicin, which would amount to $43 million during 2020–2024. In a workshop after the bankruptcy, an Achaogen executive presented post-approval costs for one indication as follows: post-approval regulatory commitments ($27 million); surveillance ($3 million); development of automated antimicrobial susceptibility testing ($5 million)(Cirz et al. 2019). The executive called these the “fixed costs of doing business”.

Achaogen suffered a Cashflow Drought in 2018 (SEC, 2019a).

Revenue Constraints

In a 2014 report for investors, a financial analyst forecast US revenues of $63 million and additional EU royalties of $3 million post-approval (Credit Suisse, 2014). In fact, by 2018 Achaogen’s revenues were $8.7 million, lower than any other year. These revenues were primarily from public grants, which Achaogen recorded as ‘contract revenues’. Post-approval plazomicin sales revenues were $0.8 million (Fig. 4). Achaogen could not generate enough revenue in the US to cover their commercialisation costs. Both the price and volume assumptions on which the company and its investors had based their revenue expectations turned out to be unachievable.

Firstly, expectations of plazomicin’s pricing proved overly optimistic. Achaogen estimated that incremental per-patient hospital cost for antibiotic-resistant healthcare-associated infections was over $15,000 (SEC, 2019a). This figure justified a potential price point of $15,000 per treatment course for new antibacterial agents for resistant infections, according to a 2013 Pew Charitable Trusts Forum panel (SEC, 2014). The IPO financial analyst’s “conservative estimate” in 2014 was $1,300 per day (Credit Suisse, 2014). Including the maximum New Technology Add-On Payment (NTAP), which allowed additional payment above the Medicare DRG payment if used in hospital settings, this would have implied a 5-day treatment price of $9,750. In fact, at commercialisaton in 2018, the market entry price was $4955.11 per treatment course (Althobaiti et al. 2023). Plazomicin pricing was set with reference to other recent antibiotics including ceftazidime-avibactam, the first new agent with anti-CRE activity, approved in 2015. Wholesale acquistion costs for plazomicin of $945 per day in 2019, based on dosage for a 75 kg patient, compared with ceftazidime-avibactam ($1076) and meropenem-vaborbactam ($990). Exisiting treatments were much cheaper: colistin ($56 per day) and polymixin B ($21.78-$45)(Clancy et al. 2019).

Secondly, sales volumes were constrained by several local factors. US healthcare system reimbursement rules encouraged the usage of cheaper existing alternatives. This presented a structural barrier to the use of new agents. The FDA approval also restricted volume by specifying that plazomicin was only to be used in cUTI patients with limited or no alternative treatment options (FDA, 2018). Uptake slowed further when Achaogen was forced to restructure to counteract falling revenues and rising costs. The firm began to eliminate field-based sales and medical scientist positions, entailing additional costs of $23 million in the process (SEC, 2019a). In the US pharmaceutical market context, these sales roles were critical to establishing plazomicin in clinical settings, and the medical team to obligatory post-approval clinical trials. The staff cuts meant only 70% of existing plazomicin purchasers were covered. Market creation and revenue generation were made even more difficult.

Bankrupcty

Aiming to support their longer-term cash needs, Achaogen extended their debt maturity by five years taking a $49.8 million loan from now-defunct Silicon Valley Bank (SVB)(SEC, 2019a). However, due to high commercialisation costs and the constrained revenue generation situation, the company’s cash balance fell from $145 million at the end of 2017 to $31 million by the end of 2018 (SEC, 2019a, p. 10). In December 2018, the situation deteriorated further when, fearing the constrained cashflow position, SVB collateralised part of the loan. This left $25 million of Achaogen’s cash blocked. SVB also imposed covenants related to ongoing operations. This meant that if Achaogen failed to achieve certain financial targets, SVB could exercise their right to seize cash, all the company’s physical property, and initiate bankruptcy proceedings. These measures would be triggered in the event of a ‘material adverse change’ in the collateral value, an adverse change in business operations, or a deterioration in the prospects of the company to be able to repay its debt. This conditionality surrounding their debt restructuring in 2018 proved decisive giving the bank the power to force Achaogen into bankruptcy. Management believed they had sufficient cash to survive until June 2019, but would need a further cash injection to survive for longer (Achaogen, 2019).

But the cashflow drought at commercialisation scared investors away (Fig. 4). Without a path to financial sustainability, capital markets became nervous and funding began to dry up. It became impossible for Achaogen to achieve the bank’s financial targets. Bankers pulled the plug, forcing bankruptcy on April 15 2019 (SEC, 2019b). Achaogen’s assets (drug rights and lab equipment) were auctioned for $16 million (Carroll, 2019a). Cipla bought the worldwide rights to plazomicin (excluding China) for an upfront cash payment of $4.65 million with potential additional royalty payments until 2029 in the case of successful commercialisaton (SEC, 2019b). Cipla subsequently withdrew their planned EU market authorization due to a lack of commercial prospects (Cipla Europe NV, 2020). In contrast, Sihuan Pharmaceutical Holdings Group, buyer of the Greater China rights for $4.5 million, shared a prediction of $313 million plazomicin sales for 2022(Sihuan, 2020). In fact they did not proceed to Chinese commercialisation, selling exclusive rights for API and formulation in Greater China to New Asia Pharmaceutical in June 2022(SihuanPharm, 2022).

Post-bankruptcy

To date plazomicin has not been widely commercialised, but several recent initiatives suggest its potential has not been written off. Cipla started a new clinical trial in the US (NCT04699656) in 2021, and attempted to import and market the drug in India, but Indian regulators rejected the request for a local clinical trial waiver (Medical Dialogues, 2021). A Chinese meta-analysis of existing trials was published on efficacy and safety for Enterobacterales(Yan et al. 2022). In 2022, a clinical evaluation of a new gradient diffusion method for antimicrobial susceptiblity testing of Enterobacterales was reported by BioMerieux for plazomicin, which could facilitate future prescribing (Blanchard et al. 2022). At the time of writing (early 2024), plazomicin can only be ordered through specialty distributors from CIPLA USA Inc. who recently launched a Named Patient ProgramFootnote 7 with Tanner Pharma Group to provide access for adult patients in countries where plazomicin is not commercially available(Cipla USA, 2024; Tanner Pharma, 2023).

Discussion

Our study shows that over 15 years Achaogen raised $770 million while developing plazomicin (Fig. 2). Of this 26% came from public grants, 3% from philanthropy (BMGF and Wellcome), and 71% from capital markets (Fig. 5). Public funding, primarily from US biosecurity focussed funding agencies, did the heavy lifting during the earlier clinical trial phases. Capital markets were crucial at the beginning and end of the development trajectory. Financial investors funded the launch of Achaogen, became increasingly important as plazomicin trials progressed, and were the only funding source available for commercialisation. Using financial analysis we have identified reliance on financial actors, and at which stage their support is critical. We thus provide a methodology to quantify the dependency of the novel antibiotic pipeline on capital markets. We discuss our findings and their implications for future pull incentives and the antibiotic investment ecosystem in more detail below.

US Commercialisation Challenges

Firstly, it is important to explore the challenges driven by Achaogen’s choice of the US as its initial location to commercialise plazomicin. The majority of new antibacterial first registrations between 2010 and 2020 came in the US via the FDA, rather than through alternative regulators. However, economic failure has hit most SME developers of newly FDA-approved antibiotics. Despite the well-documented clinical need for novel agents, the FDA route delivered approval, but not access (Outterson et al. 2021). Our analysis has found that regulatory context, clinical practice, reimbursement models, and the epidemiology of resistance all impacted the potential for successful US commercialisation. Was plazomicin the wrong drug, in the wrong place, at the wrong time?

Regulatory context

Our findings suggest the regulatory context contributed to limiting market size. At its initial public offering (IPO) in 2014, Achaogen told investors they hoped to establish a market niche for plazomicin for the treatment of severe CRE infections including hospital-acquired bacterial pneumonia, ventilator-associated pneumonia, catheter-related bloodstream infections, complicated intra-abdominal infections, and complicated urinary tract infections (cUTI) (SEC, 2014). However, it proved difficult to recruit sufficiently to the CARE trial, resulting in the FDA rejecting the CRE indications. Achaogen was left with the narrow cUTI approval based on results of the EPIC trial(Clark and Burgess, 2020). This oucome reflects debate among experts that the clinical trial pathway itself, increasingly focused on being “leaner and meaner”, contributes to very narrow label approval(Bradford, 2020). Some stakeholders, therefore, suggested that plazomicin’s US commercial failure was the market acting appropriately, because sufficient additional clinical merit versus existing alternatives had not been demonstrated(ReAct, 2021). Other newly approved antibiotics, which have similarly failed to establish themselves, have been similarly criticised, but can they really all be ‘bad drugs’? In plazomicin’s defence: it was directed at multi-resistant gram-negative bacteria, a critical novel antibiotic need according to the Pew Pipeline Study(PEW Trusts, 2019; Shaeer et al. 2019), and was included in the WHO Reserve group of antibiotics. Additional studies have noted that in the CARE trial plazomicin demonstrated potential against CRE (Eljaaly et al. 2019), with a lower all-cause mortality or significant disease-related complication rate compared with colistin(Shaeer et al. 2019).

Clinical practice

Potential market size may also have been impacted by US clinical practice. Our informants suggested US prescribers may have been hesitant to prescribe a new aminoglycoside due to the complexity of administration, and risk of adverse events (Chaves and Tadi, 2022). Clinical uptake may have been limited by potential toxicity issues (nephrotoxicity and ototoxicity), a requirement for laboratory capacity for blood level determination, and US clinicians’ unfamiliarity with aminoglycosides as a monotherapy in critically ill patients. Additionally, accurate antimicrobial susceptibility testing, essential for the timely updating of treatment guidelines, may not have been available (Patel et al. 2023). The US National Antimicrobial Susceptibility Testing Committee argued that susceptibility test interpretative criteria (STIC) needed re-evaluation. The absence of automated susceptibility testing was found to hamper the uptake of newer antibiotics including plazomicin (Clancy and Nguyen, 2019). For example, researchers found that three new agents for the treatment of CRE were used in only 35% of cases where they might have been expected instead of existing polymixins. This is despite CRE being defined by US CDC as ‘nightmare bacteria’(CDC, 2013). The application of a more appropriate STIC comparator could demonstrate the clinical superiority of plazomicin, supporting its use by clinicians (Ambrose et al. 2020). In addition, the review of new antibiotics before inclusion on hospital formularies takes many months, slowing sales in the years after launch.

Reimbursement models

Moreover, local reimbursement policies worked against plazomicin. In the US, the Centers for Medicare and Medicaid Services (CMS) provide healthcare insurance coverage for over 100 million Americans(US Government, 2024). CMS rules on the use of diagnosis-related groups (DRGs) drive reimbursement decisions within healthcare facilities. Under the DRG system, a single lump sum payment is made to hospitals for all the care a patient receives, including the cost of any antibiotics administered. Our informants suggested cost allocation within clinical settings, potentially pushing this cost onto the hospital pharmacy’s budget, could incentivise prescribing existing cheaper alternatives. A more expensive novel drug may push the cost of care over the DRG reimbursement limit. As Outterson stated: “Losing $10,000 per DRG because a physician chose to use a newer antibiotic puts the hospital budget at risk” (Outterson, 2019). After Achaogen’s bankruptcy, a CMS spokesperson acknowledged that plazomicin’s commercial failure “occurred in part because Medicare’s volume-based approach to payment was insufficient at capturing the full public health benefit of the antibiotic, causing taxpayer dollars to be used inefficiently”(Verma, 2019).

Epidemiology of resistance

Meanwhile, the epidemiology of resistance means that novel agents are only needed for small populations in the US where, currently, severe antibiotic resistance is relatively rare. Achaogen estimated a cUTI patient population of 1 million, and CRE of under 100,000 (Achaogen, 2018). In terms of revenue, the entire US market for new antibiotics targeting CRE infection was estimated to be $289 million per year(Clancy and Nguyen, 2019). Yet experts estimated that a novel antibiotic developer would need revenues of $350 million over 10 years to break even without covering “repayment of investors, clinical studies, additional indications” (Rex and Outterson, 2020). On this basis, plazomicin would have needed a significant market share within these patient populations to generate sufficient revenues to reach financial sustainability. This begs the question of whether novel agents with narrow approval are viable in countries where severe antibiotic-resistant infections are rare (i.e.typically high-income countries), and whether this new antibiotic was ever going to be commercially viable in the US.

Wrong drug, wrong place, wrong time?

This case study has shown that local factors played an important role in Achaogen’s demise. Potential market size was driven by: the regulatory pathway, which contributed to restricted revenues through limited indications; existing clinical practice; cost-conscious healthcare providers using less expensive and still effective existing antibiotics; and the epidemiology of resistant infections. Such commercialisaton factors differ across geographies. However economic challenges in the US antibiotic market were echoed in Cipla’s withdrawal of their European approval request on commercial grounds, despite a significantly lower initial market entry price of $4.65 million(SEC, 2019b). Cipla’s attempt to get approval in India in 2021, and Sihuan licencing in China in 2022, suggest these firms may see some future for plazomcin in middle-income contexts (MICs) (Medical Dialogues, 2021; SihuanPharm, 2022). Time will tell whether the Chinese or Indian markets for plazomicin prove commercial, or whether different incentive models or state intervention in those countries will support alternative access models.

The plazomicin case study shows the choice many companies make to begin commercialising in HICs can have downstream implications for global access. Plazomicin and several subsequent FDA-approved antibiotics remain inaccessible due to SME bankruptcies following failed US commercialisation(Outterson et al. 2021). In this case, the wrong drug, considering US aminoglycoside prescribing preferences, was commercialised in the wrong place, i.e. the US (for all the reasons previously discussed), at the wrong time, considering the epidemiology of severe resistance. Despite the considerable contribution of US public funders to plazomicin’s development, and the even greater contributions of capital market investors throughout the 15-year development trajectory (Fig. 2), due to the constraints of US antibiotic market conditions, it was impossible for plazomicin to prove commercial viability.

Antibiotic market failure: SMEs cannot fund their cashflow needs

Secondly, financial analysis of the development of plazomicin has evidenced in detail the revenue constraints faced when launching a new antibiotic and the high and immediate cashflow challenges of commercialisation. Use must necessarily be restricted to protect the precious novel agent from emerging resistance (i.e. stewardship practices) but health systems are not structured or incentivised to pay for the societal protection of having a novel agent available only when necessary. Unlike other therapeutic areas where novelty is typically rewarded with pricing power, in antibiotics there is downward pressure on both volume and price. This is widely viewed as market failure(Busfield, 2020; Spellberg et al. 2012). Stewardship limits market size, encourages shorter treatment courses, and cheap generic use pressures profitability across the therapeutic area(Outterson, 2009; Tillotson, 2012). Incentivising sales volume under patent protection in the early years of commercialisation is not acceptable anymore for novel antibiotics(Gagnon, 2013; Harbarth et al. 2015; Outterson, 2014).

SMEs need to have sufficient cashflow to make multi-year manufacturing and distribution agreements, establish themselves in clinical settings, and fund necessary post-authorization trials. The cashflow gap in 2018 was stark with only $0.8 million in revenue generated from plazomicin sales (Fig. 4). Based on our data we estimate by 2019, Achaogen’s annual cash burn was over $60 million just for operational expenses. Additional marketing and regulatory expenses, at and after approval, arrive simultaneously when the revenue stream is too small to sustain SME viability through the years needed to establish the new product. While larger firms can choose to cross-subsidise launch expenses, covering losses with profits from their already established products, SMEs cannot do this and need to continue to raise external funding to support the launch and establishment of the product. For an SME to reach financial sustainability they would need one of two scenarios: either sufficient revenues from prices and/or volume high enough to cover the costs of commercialisation; or, visibility that this will come over time. Expectations that financial sustainability is achievable in future encourage equity investors to continue to speculate on commercial success. Equity investments in turn allow the company to take on bank loans to plug the cashflow holes. This case study shows Achaogen’s cashflow drought became irreversible when investors took fright and funding dried up.

Speculative innovation requires investor confidence

Thirdly, investor fears proved contagious, spreading across the antibiotic investment ecosystem. As one expert put it: “The future development of antibiotics is currently at risk, with investors leery after Achaogen’s bankruptcy filing” (Årdal et al. 2020). During the 2018 Achaogen earnings call, a financial analyst said “large pharma companies are just not seeing the value proposition of the economic returns on developing antibiotics” (Achaogen, 2019). Experts have acknowledged the consequences for antibiotic R&D (ReAct, 2021). For Achaogen this absence had two important additional negative financial effects. Firstly, in other therapeutic areas large pharmaceutical firms typically potentiate SME success, as they often step in at commercialisation and build the new market(Melchner von Dydiowa et al. 2021). When Achaogen needed capital, however, large firms were exiting antibiotic markets(Paton and Kresge, 2018; Plackett, 2020). Secondly, the industry investor exit in 2018 exacerbated capital flight from the antibiotic investment ecosystem(San Franciso Business Times, 2018). “Speculative innovation, capital market liquidity, business model complementary narratives and favourable capital market conditions are required to keep it all going”(Andersson et al. 2010), especially where there are no profits, as is the case for the majority of small antibiotic developers.

A belief in the future value of the business model, validated by an industry partnership or acquisition, is vital to support the route whereby “massive government spending on knowledge-creation combines with stock market speculation to attract finance into biopharmaceutical companies” (Lazonick and Tulum, 2011). Indeed, Achaogen’s bankruptcy itself worsened the environment for attracting capital into the antibiotic pipeline (Chris Dall, 2019; Mullard, 2019). The crisis of investor confidence in the business model generated a 95% fall in equity valuation in the year before bankruptcy (Farrar, 2019) leaving Achaogen unable to continue to tap capital markets. The ensuing cashflow drought and bankruptcy generated negative sentiment in the antibiotic investment ecosystem, with ramifications for other SMEs’ ability to survive (Mullard, 2019). Bankruptcy followed at Aradigm and Melinta, further denting investor confidence (Taylor, 2020; Terry, 2020). Continuing to lose SMEs to bankrupcty would be a poor outcome. In addition to their role in innovation, the DRIVE-AB survey found that European SMEs seek to deliver novel antibiotic development up to phase 2 at lower costs than large pharma (Årdal et al. 2018).

But rebuilding investor confidence requires a track record of positive outcomes, which can take the shape of “exit events”. In financial terms, exit is either by bankruptcy, M&A, or by IPO (Burns et al. 2009). The exit prospects indicate positive or negative outcomes: fewer exits mean firms surviving, more exits suggest acquisitions and room for new entrants unless the exit route is dominated by bankruptcy, which has unfortunately been the case in antibiotic innovation by SMEs (Carroll, 2019a; Mullard, 2019; Taylor, 2020; Terry, 2020). Showcasing the possibility of successful and profitable exit by investors, can spur innovation and the new product pipeline (Burns et al. 2009). The dependency of antibiotic developers on capital markets found in this case study, indicates that industry and financial investor confidence must be robust if we are to continue to rely on SMEs as the engine of the pipeline.

Implications for New Pull Incentives

Industry and financial investors often claim that bringing in more public funding at commercialisation would restore investor confidence. Several governments are exploring new financial models. The UK, Sweden, and more recently Japan and Canada, have either proposed or launched access-driven pull models to build the pipeline while protecting existing medicines (Infectious Diseases Society of America, 2020; Outterson and Rex, 2023). These are subscription models, fixed annual payments or an agreed minimum revenue, in return for guaranteed supply of an antibiotic over a specified time period, while delinking revenue from volumes sold. Such models improve cashflow visibility and seem to be enhancing access to antibiotics included in the pilot schemes such as cefiderocol (Outterson et al. 2021).

Additional market-based solutions are currently under discussion. In the US, the PASTEUR Act, if passed by Congress, would establish a subscription-style model offering successful antibiotic developers an upfront payment for access to novel antibiotics (Doyle, 2020). In the EU, a proposed transferable exclusivity extension (TEE) would grant the successful antibiotic developer a patent extension applicable to an already approved drug, which could either be kept or sold to another firm (EFPIA, 2022). Experts have outlined reasons why they believe these incentives are flawed, forcing society to pay more while reducing access to already commercialised patented drugs, and do not yet go far enough for incentivising antibiotic development (Årdal et al. 2023). Indeed, some experts believe that pull incentives privilege the conventional market driven paradigm despite evidence that the commercial market model has stopped functioning (Glover et al. 2021; Klug et al. 2021). These experts believe public funds are mobilised to sustain a currently unviable ecosystem.

In light of these claims, our financial analysis provides lessons for avoiding further government and philanthropic funding being spent on innovation without ensuring access (Farrar, 2019). In plazomicin’s case, US government biosecurity investments, which supported development up to Phase 3 trials and FDA approval, have not resulted in access. Plazomicin failed the US commercialisation test and remains inaccessible. This case study demonstrates the risk that one-off payments at registration may incentivise innovation, pulling antibiotics through to regulatory approval, but will not necessarily support the longer-term cashflow needs of commercialisation and sustainable access. Knowing that establishing a novel antibiotic market can take up to 10 years post-authorisation, an open question is whether currently proposed pull incentives will provide sufficiently long-term cashflow support. The plazomicin case study suggests that for these incentives to work for SMEs, they will either need to provide sufficient long-term public funding to cover costs for the multi-year commercialisation and market creation period, or be structured to crowd in capital market and/or industry investors, or both.

As reliance on debt funding with strict covenants exacerbated the cashflow crisis for Achaogen, our study also suggests there may be a benefit in creating incentives tailored to supporting bank financing for SMEs. For SMEs to receive sufficiently long-term loans to support commercialisation, banks could for example, be reassured by revenue guarantees from multi-year subscription agreements akin to advance market committments used in other therapeutic areas such as vaccines. Alternatively, incentive structures which guarantee cashflow visibility over the ten-year commercialisation period could also support the development of bond-like structures in the current context of increasing focus by mainstream investors on their social mission and global systemic risks. Investors in ‘antibiotic bonds’ could be repaid through guaranteed purchase contracts backed by public health funders. Such longer-term cashflow support initiatives could contribute to the ability of the ecosystem to leverage grant and equity financing, thereby generating a multiplier effect of any public money forthcoming in new incentive structures.

Structuring new incentives in order to enable antibiotic SME developers to survive and play their role in the pipeline is one piece of the puzzle. Our study highlights that it will also be critical for policy makers to ensure new pull incentives are structured to incentivise context appropriate access, incorporating global stewardship (Outterson and Rex, 2023). Clinical need for new agents has become more acute after the pandemic (CDC, 2022). Therefore launching plazomicin may prove relevant, for example, in countries with well-established aminoglycoside usage as well as high CRE rates. The buyers of plazomicin rights may choose to commercialise, potentially in India and China, the homes of Cipla and Sihuan. Considering the higher AMR burden outside HICs (Wellcome, 2020), to protect plazomicin for future use against emerging antibacterial resistance, deployment of this new agent would need to be done within global stewardship frameworks. Incorporating conditionality into any new incentive structures, such that access and stewardship objectives are included, will be important considerations. Our study suggests that these should continue to apply as a condition of having received public funding, regardless of whether the antibiotic subsequently changes hands in a sale of rights, or is deployed in new geographies.

A Successful Pathway

This case study demonstrates one outcome of the current antibiotic investment ecosystem: SME bankruptcy, which has unfortunately been all too common. Further financial analysis of the trajectories of other recently approved antibacterials within SMEs, which have publically disclosed their financial data, would be helpful to elucidate a contrasting case study of successful commercialisation. Three other SMEs launched new products in 2018/19 after plazomicin and similarly reported revenues dwarfed by the costs of commercialisation: Paratek Pharma’s omadacycline, Tetraphase’s evracycline and Nabriva’s lefamulin(Bhavnani et al. 2020). Tetraphase was sold in 2020 at a valuation close to the company’s cash balance which put no value on evracycline (Bhavnani et al. 2020) while Nabriva declared commercial failure in 2023 (Nabriva Therapeutics PLC, 2023). Omadacycline, also struggled initially, generating $3.1 m in revenue versus $32.6 m in losses in Q3 2019(Bhavnani et al. 2020) before financial sustainability was boosted with a US government BARDA post-approval award in December 2019 under Project BioShield. Both the drug and the firm survived with Novo Holdings and financial investor Gurnet Point Capital announcing their acquisition of Paratek for $462 million in September 2023 (novo holdings, 2023).

Project Bioshield was established in 2004 to accelerate the R&D, purchase and availability of medical countermeasures for national security threats (Larsen and Disbrow, 2017). Paratek’s award, valued at $304 million by 2023, supported US onshoring of manufacturing, all FDA post-marketing requirements related to the initial approval, and the procurement of up to 10,000 treatement courses for anthrax (Contract Pharma, 2022). In contrast to Achaogen, the large post-approval fixed cost base for commercialisation would be covered by a government grant. Revenue and cashflow certainty came from a purchase agreement for a specific volume of omadacycline. Indeed, in Novo Holdings’ announcement of their acquisition they heralded: “Paratek’s successful commercialisation platform”, proven last mile distribution, and sustainability in the US market (novo holdings, 2023). Omadacycline is also used in both hospital and community settings, but in contrast to plazomicin received approval for a wider range of indications, and is reportedly benefitting from off-label use for the treatment of Mycobacterim abscessus infections(Duah and Beshay, 2022; Mingora et al. 2023). Future research using financial analysis methodologies to understand the critical inflexion points which allowed Paratek with omadacycline to achieve financial sustainability would generate additional lessons which could inform future policy action on support for the SME led antbiotic pipeline.

Implications for the antibiotic investment ecosystem

In April 2019 a financial commentator starkly stated: “The larger story of the Achaogen bankruptcy is that the financial structures that sustained antibiotic development for decades are broken” (McKenna, 2019). Indeed in the past, as our case study highlights, public funding has been more focussed on pre-authorisation ‘push’ stages, while the poor profitability of antibiotic markets means the commercialisation “exit” route for an SME to ‘Big Pharma’, as licensing partner or acquirer, has diminished as several large firms exited antibiotics altogether. In turn, the absent financial pull factor of potential industry investment has a detrimental effect on finanical investor sentiment, while simultaneously leaving the SME driven antibiotic pipeline dependent on capital market financing. Yet investors demand iron-clad financial incentives to continue to speculate on commercial success. Without sufficiently long-term cashflow visibility, and a route to SME financial sustainability, speculative capital markets cannot be relied upon to invest in commercialisation. A vicious cycle putting the blended public private funding model for SME antibiotic developers at risk. Three key implications for the antibiotic investment ecosystem are: (1) novel antibiotics with narrow approval for small patient populations affected by severe resistant infections cannot be successfully commercialised in the current US antibiotic market; (2) SMEs need incentive payments structured to enable them to survive the commercialisation cashflow drought; and (3) these changes are necessary to restore industry and financial investor confidence in the antibiotic SME development model.

Conclusion

Following Achaogen’s bankruptcy, the Wellcome Trust called for governments to “send an immediate signal to companies and investors that the future is not as bleak as the present” (Farrar, 2019). Plazomicin proved to be the wrong drug, in the wrong place, at the wrong time. In this case commercialisation “location”, i.e. the US, proved fatal. Post-bankruptcy, rights were bought out by companies from India and China, whose recent actions suggest they may attempt to commercialise first at home rather than in the US/EU. While the clinical need and potential for commercial success may indeed prove greater in China and India, this would nevertheless be paradoxical for a drug developed with considerable US government biosecurity funding. For other global health needs, such as recent COVID vaccine development, partnering between the public and private sector has not only focussed on funding R&D, but also on market shaping, and is increasingly incorporating global access conditionality. For antibiotics, such focus has so far been insufficient and is critical considering the need for global stewardship to protect precious new drugs from over use. This case study therefore has important implications for currently proposed pull incentives, which will need to support commercialisation of context appropriate drugs beyond approval, providing SME developers sufficient visibility on cash flow to survive commercialisation. The critical global health need for novel antibiotics relies on an SME dominated pipeline, action to support SME financing is urgent to enable them to deliver sustainable access, not only innovation.

Data availability

The data analysed in this study are available in supplementary materials.

Notes

In this paper we use the term capital markets to mean financial markets where SMEs have raised funds from financial investors, selling equity (shares in the company), and/or taking on bank loans to finance the immediate cashflow needed to fund later stages of drug development and commercialisation.

H.R. 2182 Generating Antibiotic Incentives Now Act of 2011 “to extend the exclusivity period for a new prescription drug by five years for a drug that the Secretary of Health and Human Services (HHS) determines to be a qualified infectious disease product. Defines “qualified infectious disease product” to mean an antibiotic drug for treating, detecting, preventing, or identifying a qualifying pathogen (certain pathogens that are resistant to antibiotics).” https://www.congress.gov/bill/112th-congress/house-bill/2182

Breakthrough Therapy Designation from the FDA: a process designed to expedite the development and review of drugs that are intended to treat a serious condition and preliminary clinical evidence indicates that the drug may demonstrate substantial improvement over available therapy on a clinically significant endpoint(s). https://www.fda.gov/patients/fast-track-breakthrough-therapy-accelerated-approval-priority-review/breakthrough-therapy

Biomedical Advanced Research and Development Authority (BARDA), National Institute of Allergy and Infectious Diseases (NIAID), Defense Threat Reduction Agency (DTRA) and US Army Medical Research Acquisition Activity (USAMRAA)

Achaogen was a clinical-stage biopharmaceutical company “committed to the discovery, development, and commercialization of novel antibacterials to treat multi-drug resistant, or MDR Enterobacteriaceae, including carbapanem-resistant Enterobacteriaceae, or CRE”(SEC, 2014). Plazomicin ws their most advanced product candidate. They were also working on LpxC Inhibitors, and Antibacterial Antibody candidates. By 2018 their second antibacterial candidate, C-Scape, was at Phase 1 clinical trial stage. It was designed for infections due to ESBL-producing Enterobacteriaceae(SEC, 2019a).

We analysed funding into Achaogen on a cashflow basis. The funding streams shown in Figure ii, therefore, include cashflows into the company from public grants, which Achaogen reported in their financial statements as ‘contract revenues’, and cashflows into the company from equity investments and debt financing from banks.

A Post-Approval Named Patient Program allows a drug sponsor to provide access to their approved medicines in countries where they are not yet approved or commercially available upon direct request from a prescribing physician to the manufacturer, under the direct responsibility of the doctor. The doctor can make such a request in a life-threatening or debilitating situation, where there are no other currently authorised alternatives for satisfactory treatment and the patient cannot enroll in a clinical trial. For example, in the EU this is covered under Article 5(1), (2) of Directive 2001/83/EC https://learning.eupati.eu/mod/book/view.php?id=912&chapterid=891#:~:text=Named%2Dpatient%20basis%20access%20is,named%20patient%20or%20patients%20only. Accessed on Feburary 15th 2024.

References

Access to Medicine Foundation. (2021). Biotech’s antibiotic warriors need new reward system in superbug fight. Access to Medicine Foundation. https://accesstomedicinefoundation.org/news/biotechs-antibiotic-warriors-need-new-reward-system-in-superbug-fight

Achaogen. (2018). Achaogen (AKAO). https://seekingalpha.com/article/4219955-achaogen-akao-ceo-blake-wise-on-q3-2018-results-earnings-call-transcript

Achaogen (2019) Achaogen, Inc. (AKAO) [Internet]. 2019 [cited 2022 Nov 9]. Available from: https://seekingalpha.com/article/4251674-achaogen-inc-akao-ceo-blake-wise-on-q4-2018-results-earnings-call-transcript

Aggen JB, Armstrong ES, Goldblum AA, Dozzo P, Linsell MS, Gliedt MJ, Hildebrandt DJ, Feeney LA, Kubo A, Matias RD, Lopez S, Gomez M, Wlasichuk KB, Diokno R, Miller GH, Moser HE (2010) Synthesis and spectrum of the Neoglycoside ACHN-490. Antimicrob Agents Chemother 54(11):4636–4642. https://doi.org/10.1128/AAC.00572-10

Althobaiti H, Seoane-Vazquez E, Brown LM, Fleming ML, Rodriguez-Monguio R (2023) Disentangling the cost of orphan drugs marketed in the United States. Healthcare 11(4):558. https://doi.org/10.3390/healthcare11040558

Ambrose PG, Bhavnani SM, Andes DR, Bradley JS, Flamm RK, Pogue JM, Jones RN (2020) Old in vitro antimicrobial breakpoints are misleading stewardship efforts, delaying adoption of innovative therapies, and harming patients. Open Forum Infect Dis 7(7):ofaa084. https://doi.org/10.1093/ofid/ofaa084

Andersson T, Gleadle P, Haslam C, Tsitsianis N (2010) Bio-pharma: A financialized business model. Crit Perspect Account 21(7):631–641. https://doi.org/10.1016/j.cpa.2010.06.006

Årdal C, Balasegaram M, Laxminarayan R, McAdams D, Outterson K, Rex JH, Sumpradit N (2020) Antibiotic development—Economic, regulatory and societal challenges. Nat Rev Microbiol 18(5):267–274. https://doi.org/10.1038/s41579-019-0293-3

Årdal, C, Baraldi, E, Busse, R, Castro, R, Ciabuschi, F, Cisneros, JM, Gyssens, IC, Harbarth, S, Kostyanev, T, Lacotte, Y, Magrini, N, McDonnell, A, Monnier, AA, Moon, S, Mossialos, E, Peñalva, G, Ploy, M-C, Radulović, M, Ruiz, AA, … O’Neill, J (2023). Transferable exclusivity voucher: A flawed incentive to stimulate antibiotic innovation. The Lancet, S0140673623002829. https://doi.org/10.1016/S0140-6736(23)00282-9

Årdal C, Baraldi E, Theuretzbacher U, Outterson K, Plahte J, Ciabuschi F, Røttingen J-A (2018) Insights into early stage of antibiotic development in small- and medium-sized enterprises: A survey of targets, costs, and durations. J Pharm Policy Pract 11(1):8. https://doi.org/10.1186/s40545-018-0135-0

Årdal CO, Findlay D, Savic M, Carmeli Y, Gyssens I, Laxminarayan R, Outterson K, and Rex JH (2018) Revitalizing the antibiotic pipeline: Stimulating innovation while driving sustainable use and global access. https://drive-ab.eu/wp-content/uploads/2018/01/CHHJ5467-Drive-AB-Main-Report-180319-WEB.pdf

Austin, S (2009). Biotechs befriend non-dilutive funds. The Wall Street Journal. https://www.wsj.com/articles/BL-VCDB-295

Bhavnani SM, Krause KM, Ambrose PG (2020) A broken antibiotic market: review of strategies to incentivize drug development. Open Forum Infect Dis 7(7):ofaa083. https://doi.org/10.1093/ofid/ofaa083

Blanchard LS, Van Belkum A, Dechaume D, Armstrong TP, Emery CL, Ying YX, Kresken M, Pompilio M, Halimi D, Zambardi G (2022) Multicenter clinical evaluation of ETEST Plazomicin (PLZ) for susceptibility testing of Enterobacterales. J Clin Microbiol 60(1):e01831–21. https://doi.org/10.1128/JCM.01831-21

Bradford, P (2020). Why are new antibacterials failing as commercial products? REVIVE GARDP. https://revive.gardp.org/why-are-new-antibacterials-failing-as-commercial-products/

Burns LR, Housman MG, Robinson CA (2009) Market entry and exit by biotech and device companies funded by venture capital. Health Aff 28(1):w76–w86. https://doi.org/10.1377/hlthaff.28.1.w76

Busfield J (2020) Documenting the financialisation of the pharmaceutical industry. Soc Sci Med 258:113096. https://doi.org/10.1016/j.socscimed.2020.113096

Carlet J, Jarlier V, Harbarth S, Voss A, Goossens H, Pittet D, the Participants of the 3rd World Healthcare-Associated Infections Forum (2012) Ready for a world without antibiotics? The Pensières Antibiotic Resistance Call to Action. Antimicrob Resist Infect Control 1(1):11. https://doi.org/10.1186/2047-2994-1-11

Carroll J (2019a) Once picked as a $500M winner, bankrupt Achaogen auctions off its antibiotic for a fraction of that. Endpoints News. https://endpts.com/once-picked-as-a-500m-winner-bankrupt-achaogen-auctions-off-its-antibiotic-for-a-fraction-of-that/

CDC (2013) Making health care safer stop infections from lethal CRE germs now. Vital signs. https://www.cdc.gov/vitalsigns/HAI/CRE/

CDC (2022) COVID-19: U.S. Impact on antimicrobial resistance, Special Report 2022. National Center for Emerging and Zoonotic Infectious Diseases. https://doi.org/10.15620/cdc:117915

Chaves BJ, Tadi P (2022) Gentamicin. In StatPearls. StatPearls Publishing. http://www.ncbi.nlm.nih.gov/books/NBK557550/

Chris Dall. (2019) Achaogen bankruptcy raises worry over antibiotic pipeline. CIDRAP. http://www.cidrap.umn.edu/news-perspective/2019/04/achaogen-bankruptcy-raises-worry-over-antibiotic-pipeline

Cipla Europe NV. (2020) Withdrawal of Zemdri (Plazomicin) 500 mg/10 ml injection. https://www.ema.europa.eu/en/documents/withdrawal-letter/withdrawal-letter-zemdri_en.pdf

Cipla USA (2024) Zemdri.com. https://zemdri.com/ordering

Cirz R, Krause K, Lichtenstein C, Wagenaar R (2019). Antibiotic bootcamps for developers: Post-approval economics for new antibiotics. ASM/ESCMID Conference on Drug Development to Meet the Challenge of Antimicrobial Resistance, Boston, MA, September 3-6, 2019. https://carb-x.org/resource/bootcamp-post-approval-economics-for-new-antibiotics-asm-escmid-2019/

Clancy CJ, Nguyen MH (2019) Estimating the size of the U.S. market for new antibiotics with activity against Carbapenem-resistant Enterobacteriaceae. Antimicrob Agents Chemother, 63(12). https://doi.org/10.1128/AAC.01733-19

Clancy CJ, Potoski BA, Buehrle D, Nguyen MH (2019) Estimating the Treatment of Carbapenem-Resistant Enterobacteriaceae Infections in the United States Using Antibiotic Prescription Data. Open Forum Infect Dis 6(8):ofz344. https://doi.org/10.1093/ofid/ofz344

Clark JA, Burgess DS (2020) Plazomicin: A new aminoglycoside in the fight against antimicrobial resistance. Ther Adv Infect Dis 7:204993612095260. https://doi.org/10.1177/2049936120952604

Connolly LE, Riddle V, Cebrik D, Armstrong ES, Miller LG (2018) A multicenter, randomized, double-blind, Phase 2 study of the efficacy and safety of plazomicin compared with Levofloxacin in the treatment of complicated urinary tract infection and acute Pyelonephritis. Antimicrob Agents Chemother, 62(4). https://doi.org/10.1128/AAC.01989-17

Contract Pharma (2022). Paratek Achieves Milestone Creating U.S. Mfg. Supply Chain for NUZYRA. https://www.contractpharma.com/contents/view_breaking-news/2022-10-31/paratek-achieves-milestone-creating-us-mfg-supply-chain-for-nuzyra/

Credit Suisse. (2014). Achaogen, Inc. https://research-doc.credit-suisse.com/docView?language=ENG&source=emfromsendlink&format=PDF&document_id=1031611571&extdocid=1031611571_1_eng_pdf&serialid=somPidgTAwJU6N8UZW4G7Ws5znFBZOoeBrz8p%2fRKOLI%3d

Doyle M (2020) The PASTEUR Act. GovTrack.Us. https://www.govtrack.us/congress/bills/116/hr8920

Duah M, Beshay M (2022) Omadacycline in first-line combination therapy for pulmonary Mycobacterium abscessus infection: A case series. Int J Infect Dis 122:953–956. https://doi.org/10.1016/j.ijid.2022.06.061

Dunn A (2019) Achaogen files for bankruptcy protection, seeks asset sale. BioPharma Dive. https://www.biopharmadive.com/news/achaogen-files-for-bankruptcy-protection-seeks-asset-sale/552737/

EFPIA (2022) A new EU pull incentive to address Anti- microbial Resistance (AMR). https://www.efpia.eu/media/636464/a-new-eu-pull-incentive-to-address-anti-microbial-resistance-amr.pdf

Eljaaly K, Alharbi A, Alshehri S, Ortwine JK, Pogue JM (2019) Plazomicin: A Novel Aminoglycoside for the treatment of resistant gram-negative bacterial infections. Drugs 79(3):243–269. https://doi.org/10.1007/s40265-019-1054-3

Farrar J (2019). We ignore the disaster in the antibiotics market at our peril. Wellcome. https://wellcome.org/news/we-ignore-disaster-antibiotics-market-our-peril

FDA (2018) Approval Package for: APPLICATION NUMBER: 210303Orig1s000. Center for Drug Evaluation and Research

Gagnon M-A (2013) Corruption of pharmaceutical markets: Addressing the misalignment of financial incentives and public health. J Law Med Ethics 41(3):571–580

Global AMR R&D Hub, WHO (2023) Incentivising the development of new antibacterial treatments 2023. https://cdn.who.int/media/docs/default-source/antimicrobial-resistance/amr-gcp-irc/incentivising-development-of-new-antibacterial-treatments-2023---progress-report.pdf?sfvrsn=72e4f738_3

Glover RE, Singer AC, Roberts AP, Kirchhelle C (2021) NIMble innovation—A networked model for public antibiotic trials. Lancet Microbe 2(11):e637–e644. https://doi.org/10.1016/S2666-5247(21)00182-8

Harbarth S, Theuretzbacher,U, Hackett J, on behalf of the DRIVE-AB consortium, on behalf of the DRIVE-AB consortium, Adriaenssens N, Anderson J, Antonisse, A, Ardal C, Baillon-Plot N, Baraldi E, Bhatti T, Bradshaw D, Brown N, Carmeli Y, Cars O, Charbonneau C, Cheng S, Ciabuschi, F, … Zorzet A (2015). Antibiotic research and development: Business as usual? J Antimicrob Chemother, dkv020. https://doi.org/10.1093/jac/dkv020

Hollway J (2010) Beyond venture capital. Bioentrepreneur. https://doi.org/10.1038/bioe.2010.4

Infectious Diseases Society of America. (2020). PASTEUR Act Will Build Antibiotic Arsenal, Protect Existing Medicines. https://www.idsociety.org/news--publications-new/articles/2020/pasteur-act-will-build-antibiotic-arsenal-protect-existing-medicines/

Johnson D (2019) Achaogen’s Last Capital Raise Signals Desperation. Seeking Alpha. https://seekingalpha.com/article/4243461-achaogens-last-capital-raise-signals-desperation

Klug DM, Idiris FIM, Blaskovich MAT, von Delft F, Dowson CG, Kirchhelle C, Roberts AP, Singer AC, Todd MH (2021) There is no market for new antibiotics: This allows an open approach to research and development. Wellcome Open Res 6:146. https://doi.org/10.12688/wellcomeopenres.16847.1

Kostyanev T, Bonten MJM, O’Brien S, Steel H, Ross S, François B, Tacconelli E, Winterhalter M, Stavenger RA, Karlén A, Harbarth S, Hackett J, Jafri HS, Vuong C, MacGowan A, Witschi A, Angyalosi G, Elborn JS, deWinter R, Goossens H (2016) The Innovative Medicines Initiative’s New Drugs for Bad Bugs programme: European public–private partnerships for the development of new strategies to tackle antibiotic resistance. J Antimicrob Chemother 71(2):290–295. https://doi.org/10.1093/jac/dkv339

Kurtzman Carson Consultants (2019) Declaration of Nicholas K. Campbell, chief restructuring officer of the debtor, in support of the sale of theChina purchased assets of the debtor to Xuanzhu biopharmaceutical limited and entry of the sale order. https://www.google.com/url?sa=t&rct=j&q=&esrc=s&source=web&cd=&cad=rja&uact=8&ved=2ahUKEwic7PvYpLfvAhWswAIHHaR5CjAQFjAAegQIBBAD&url=https%3A%2F%2Fwww.kccllc.net%2Fachaogen%2Fdocument%2F1910844191229000000000003&usg=AOvVaw0dTC3YSe3_7DaCfBP2d4Wn

Larsen JC, Disbrow GL (2017) Project bioshield and the biomedical advanced research development authority: a 10-year progress report on meeting US preparedness objectives for threat agents. Clin Infect Dis 64(10):1430–1434. https://doi.org/10.1093/cid/cix097

Lazonick W, Tulum Ö (2011) US biopharmaceutical finance and the sustainability of the biotech business model. Res Policy 40(9):1170–1187. https://doi.org/10.1016/j.respol.2011.05.021

McKenna M (2019) The Antibiotics Business Is Broken—But There’s a Fix. Wired. https://www.wired.com/story/the-antibiotics-business-is-broken-but-theres-a-fix/

Medical Dialogues (2021) Cipla proposal to market Plazomicin with clinical trial waiver rejected by CDSCO Panel. Med Dialogues. https://medicaldialogues.in/news/industry/pharma/cipla-proposal-to-market-plazomicin-with-clinical-trial-waiver-rejected-by-cdsco-panel-85490?infinitescroll=1

Melchner von Dydiowa G, van Deventer S, Couto DS (2021) How large pharma impacts biotechnology startup success. Nat Biotechnol 39(3):266–269. https://doi.org/10.1038/s41587-021-00821-x

Mingora CM, Bullington W, Faasuamalie PE, Levin A, Porter G, Stadnik R, Varley CD, Addrizzo-Harris D, Daley CL, Olivier KN, Winthrop KL, Dorman SE, Flume PA (2023) Long-term safety and tolerability of Omadacycline for the treatment of Mycobacterium abscessus infections. Open Forum Infect Dis 10(7):ofad335. https://doi.org/10.1093/ofid/ofad335

Moon S (2017) Powerful ideas for global access to medicines. N. Engl J Med 376(6):505–507. https://doi.org/10.1056/NEJMp1613861

Mullard A (2019) Achaogen bankruptcy highlights antibacterial development woes. Nat Rev Drug Discov 18(6):411–411. https://doi.org/10.1038/d41573-019-00085-w

Mullard A (2020) UK outlines its antibiotic pull incentive plan. Nat Rev Drug Discov 19(5):298–298. https://doi.org/10.1038/d41573-020-00070-8

Nabriva Therapeutics PLC (2023) Form 8-K. United States Securities and Exchange Commission. https://investors.nabriva.com/node/12081/html

novo holdings (2023) Novo Holdings advances antimicrobial resistance strategy with acquisition of Paratek Pharmaceuticals. https://novoholdings.dk/news/novo-holdings-advances-antimicrobial-resistance-strategy-with-acquisition-of-paratek-pharmaceuticals/

Outterson K (2009) Legal Ecology of Resistance: The Role of Antibiotic Resistance in Pharmaceutical Innovation.Cardozo L Rev 31:613

Outterson K (2014) New Business Models for Sustainable Antibiotics. Working Group on Antimicrobial Resistance: Paper 1. http://petrieflom.law.harvard.edu/assets/publications/Outterson_Health_Law_Workshop_paper.pdf

Outterson K (2019) A shot in the arm for new antibiotics. Nat Biotechnol 37(10):1110–1112. https://doi.org/10.1038/s41587-019-0279-8

Outterson K, Orubu ESF, Rex J, Årdal C, Zaman MH (2021) Patient access in fourteen high-income countries to new antibacterials approved by the FDA, EMA, PMDA, or Health Canada, 2010-2020. Clin Infect Dis, ciab612. https://doi.org/10.1093/cid/ciab612

Outterson K, Rex JH (2023) Global pull incentives for better antibacterials: The UK leads the way. applied health economics and health policy. https://doi.org/10.1007/s40258-023-00793-w

Patel JB, Alby K, Humphries R, Weinstein M, Lutgring JD, Naccache SN, Simner PJ (2023) Updating breakpoints in the United States: A summary from the ASM Clinical Microbiology Open 2022. J Clin Microbiol 61(10):e01154-22. https://doi.org/10.1128/jcm.01154-22

Paton & Kresge (2018) Superbugs win another round as big pharma leaves antibiotics Bloomberg. Bloomberg. https://www.bloomberg.com/news/articles/2018-07-13/superbugs-win-another-round-as-big-pharma-leaves-antibiotics

PEW Trusts (2019) Antibiotics Currently in Global Clinical Development. http://pew.org/1YkUFkT

Plackett B (2020) Why big pharma has abandoned antibiotics. Nature 586(7830):7830. https://doi.org/10.1038/d41586-020-02884-3. Article

Projan SJ (2003) Why is big Pharma getting out of antibacterial drug discovery? Curr Opin Microbiol 6(5):427–430

ReAct. (2021). The world needs new antibiotics – so why aren’t they developed? https://www.reactgroup.org/news-and-views/news-and-opinions/year-2021/the-world-needs-new-antibiotics-so-why-arent-they-developed/

Rex J, Outterson K (2020). Plazomicin EU marketing application is withdrawn: Near zero market value of newly approved antibacterials • AMR.Solutions. AMR.Solutions. https://amr.solutions/2020/07/11/plazomicin-eu-marketing-application-is-withdrawn-near-zero-market-value-of-newly-approved-antibacterials/

Sagonowsky, E (2018). It’s a good news, bad news FDA approval for Achaogen’s powerful antibiotic Zemdri [FiercePharma]. https://www.fiercepharma.com/achaogen-wins-fda-approval-for-new-antibiotic-zemdri-limitations

San Franciso Business Times. (2018). Once with lofty plans, Novartis now closing East Bay unit, cutting 140 jobs. https://www.bizjournals.com/sanfrancisco/news/2018/07/11/novartis-institute-antibacterial-antiviral-nvs.html

SEC. (2014). Form S1 Registration Statement Achaogen. https://www.sec.gov/Archives/edgar/data/1301501/000119312514020548/d623715ds1.htm#rom623715_10

SEC. (2017). Achaogen 10K fiscal year 2016. https://www.sec.gov/Archives/edgar/data/1301501/000156459017004283/akao-10k_20161231.htm

SEC. (2018). Achaogen 10K fiscal year 2017. https://www.sec.gov/Archives/edgar/data/1301501/000156459018003544/akao-10k_20171231.htm

SEC. (2019a). Achaogen 10K fiscal year 2018. https://www.sec.gov/Archives/edgar/data/1301501/000156459019010412/akao-10k_20181231.htm

SEC (2019b) Form 8-K. United States Securities and Exchange Commission. https://www.sec.gov/Archives/edgar/data/1301501/000156459019023628/akao-8k_20190620.htm

Shaeer KM, Zmarlicka MT, Chahine EB, Piccicacco N, Cho JC (2019) Plazomicin: A next-generation Aminoglycoside. Pharmacotherapy: J Hum Pharmacol Drug Ther 39(1):77–93. https://doi.org/10.1002/phar.2203

Sihuan (2020) Sihuan Pharmaceutical announces acquisition of all interests and intellectual property rights of Plazomicin, A new generation of Aminoglycoside antibiotics in the Greater China Region. https://www.sihuanpharm.com/en/news/detail0-203.html

SihuanPharm. (2022) Xanzhu biopharm entered into an exclusive licensing agreement with New Asia Pharmaceutical for the development and commercialization of benapenem and Plazomincin in the greater China territory. https://ir.sihuanpharm.com/en/investor-relations/latest-news/investor-news/xuanzhu-biopharm-entered-into-an-exclusive-licensing-agreement-with-new-asia-pharmaceutical-for-the-development-and-commercialization-of-benapenem-and-plazomincin-in-the-greater-china-territory/

Spellberg B, Sharma P, Rex JH (2012) The critical impact of time discounting on economic incentives to overcome the antibiotic market failure. Nat Rev Drug Discov 11(2):168–168. https://doi.org/10.1038/nrd3560-c1

Tanner Pharma. (2023) Tanner Pharma Group initiates a global innovative named patient program for Zemdri. https://tannerpharma.com/tanner-pharma-group-initiates-a-global-innovative-named-patient-program-for-zemdri/

Taylor (2020) Grifols buys antibiotic assets from bankrupt partner Aradigm. Fierce Biotech. https://www.fiercebiotech.com/biotech/grifols-buys-antibiotic-assets-from-bankrupt-partner-aradigm

Taylor P (2018) Achaogen slides after ‘yes and no’ adcomm verdict on plazomicin. https://www.fiercebiotech.com/biotech/achaogen-slides-after-yes-and-no-adcomm-verdict-plazomicin

Terry M (2020) Melinta’s Bankruptcy Underlines Problems with the Antibiotics Market. BioSpace. https://www.biospace.com/article/deerfield-wins-melinta-assets-after-chapter-11-bankruptcy/

Tillotson GS (2012) GAIN Act legislation: Is it enough? Lancet Infect Dis 1211:823–824

US Food & Drug Administration (2018) Drug Approval Package: ZEMDRI (plazomicin). https://www.accessdata.fda.gov/drugsatfda_docs/nda/2018/210303Orig1s000TOC.cfm

US Government. (2024). Centers for Medicare and Medicaid Services (CMS). https://www.usa.gov/agencies/centers-for-medicare-and-medicaid-services

Verma, S (2019). Securing Access to Life-Saving Antimicrobial Drugs for American Seniors. https://wwsg.com/speaker-news/securing-access-to-life-saving-antimicrobial-drugs-for-american-seniors/

Wellcome. (2020). The Global Response to AMR: Momentum, success, and critical gaps

WHO. (2017). Global Priority Pathogens List. World Health Organization. https://www.who.int/medicines/areas/rational_use/PPLreport_2017_09_19.pdf?ua=1

Yan K, Liang B, Zhang G, Wang J, Zhu M, Cai Y (2022) Efficacy and safety of Plazomicin in the treatment of Enterobacterales infections: a meta-analysis of randomized controlled trials. Open Forum Infect Dis 9(9):ofac429. https://doi.org/10.1093/ofid/ofac429

Zanichelli V, Sharland M, Cappello B, Moja L, Getahun H, Pessoa-Silva C, Sati H, Van Weezenbeek C, Balkhy H, Simão M, Gandra S, Huttner B (2023) The WHO AWaRe (Access, Watch, Reserve) antibiotic book and prevention of antimicrobial resistance. Bull World Health Organ 101(04):290–296. https://doi.org/10.2471/BLT.22.288614

Acknowledgements

The authors would like to thank participants at the ‘Boom, Bust and Antibiotics’ opening conference of the DryAp project in Oslo, June 2022 for their feedback on an early presentation of this case study and Professor Kevin Outterson for his comments on an earlier draft of this manuscript. We would also like to thank researchers Alisa Gessler and Seraina Kull for their early input in development of the case study. This research was funded by the Swiss National Science Foundation, grant number 189186.

Author information

Authors and Affiliations

Contributions

Conceptualization, Nadya Wells, Vinh-Kim Nguyen, and Stephan Harbarth; Formal analysis, Nadya Wells; Funding acquisition, Vinh-Kim Nguyen; Methodology, Nadya Wells, Vinh-Kim Nguyen and Stephan Harbarth; Supervision, Vinh-Kim Nguyen and Stephan Harbarth; Writing – original draft, Nadya Wells; Writing – review & editing, Nadya Wells, Vinh-Kim Nguyen and Stephan Harbarth. All authors have read and agreed to the published version of this manuscript.

Corresponding author

Ethics declarations

Competing interests

The authors declare no conflict of interest. The funders had no role in the design of the study; in the collection, analyses, or interpretation of data; in the writing of the manuscript; or in the decision to publish the results.

Ethics

Ethical approval was not required as this article does not contain any studies with human participants performed by any of the authors.

Informed consent

This article does not contain any studies with human participants performed by any of the authors.

Additional information

Publisher’s note Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary information

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Wells, N., Nguyen, VK. & Harbarth, S. Novel insights from financial analysis of the failure to commercialise plazomicin: Implications for the antibiotic investment ecosystem. Humanit Soc Sci Commun 11, 941 (2024). https://doi.org/10.1057/s41599-024-03452-0

Received:

Accepted:

Published:

DOI: https://doi.org/10.1057/s41599-024-03452-0

- Springer Nature Limited