Abstract

Background

Out-of-pocket healthcare expenditure (OOPHE) without adequate social protection often translates to inequitable financial burden and utilization of services. Recent publications highlighted Cambodia’s progress towards Universal Health Coverage (UHC) with reduced incidence of catastrophic health expenditure (CHE) and improvements in its distribution. However, departing from standard CHE measurement methods suggests a different storyline on trends and inequality in the country.

Objective

This study revisits the distribution and impact of OOPHE and its financial burden from 2009–19, employing alternative socio-economic and economic shock metrics. It also identifies determinants of the financial burden and evaluates inequality-contributing and -mitigating factors from 2014–19, including coping mechanisms, free healthcare, and OOPHE financing sources.

Methods

Data from the Cambodian Socio-Economic Surveys of 2009, 2014, and 2019 were utilized. An alternative measure to CHE is proposed: Excessive financial burden (EFB). A household was considered under EFB when its OOPHE surpassed 10% or 25% of total consumption, excluding healthcare costs. A polychoric wealth index was used to rank households and measure EFB inequality using the Erreygers Concentration Index. Inequality shifts from 2014–19 were decomposed using the Recentered Influence Function regression followed by the Oaxaca-Blinder method. Determinants of financial burden levels were assessed through zero-inflated ordered logit regression.

Results

Between 2009–19, EFB incidence increased from 10.95% to 17.92% at the 10% threshold, and from 4.41% to 7.29% at the 25% threshold. EFB was systematically concentrated among the poorest households, with inequality sharply rising over time, and nearly a quarter of the poorest households facing EFB at the 10% threshold. The main determinants of financial burden were geographic location, household size, age and education of household head, social health protection coverage, disease prevalence, hospitalization, and coping strategies. Urbanization, biased disease burdens, and preventive care were key in explaining the evolution of inequality.

Conclusion

More efforts are needed to expand social protection, but monitoring those through standard measures such as CHE has masked inequality and the burden of the poor. The financial burden across the population has risen and become more unequal over the past decade despite expansion and improvements in social health protection schemes. Health Equity funds have, to some extent, mitigated inequality over time. However, their slow expansion and the reduced reliance on coping strategies to finance OOPHE could not outbalance inequality.

• The healthcare financial burden and its inequality have sharply increased between 2009–19; disproportionally impacting socio-economically disadvantaged households even with Health Equity Funds offering some mitigation since their national expansion. Urbanization, demographic shifts, and changing disease patterns are key factors in understanding these trends.

• Standard methods for measuring catastrophic healthcare expenditure underestimate the financing burden on less-wealthy households by inflating their consumption and shifting their socio-economic rank.

• The mitigating effect of out-of-pocket spending exemptions and preventive healthcare on both inequality and the overall financial burden of the population suggests a way forward towards UHC for the Cambodian healthcare system.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Background

Universal health coverage and equity

Universal Health Coverage (UHC) is encapsulated in the Sustainable Development Goals' Target 3.8. UHC stresses equal access to quality healthcare without financial hardship [1,2,3,4]. However, achieving UHC entails budget constraints, forcing governments to prioritize healthcare services, expand coverage, and substitute out-of-pocket spending with prepayment methods [5,6,7]. UHC embodies equity, efficacy, and efficiency in healthcare use and outcomes [8, 9]. It mandates governments to gradually expand coverage and suitable resource distribution to social sectors based on a country's economic and fiscal capacity [10,11,12]. Yet, initially expanding coverage can emphasize inequalities. Further challenges like inconsistent benefit packages, administrative procedures, quality healthcare access, transportation expenses, other indirect costs, or qualifying for assistance schemes often arise [6]. Overcoming these hurdles requires open, accountable priority-setting and consistent inequality assessments [7, 9, 13,14,15].

Measuring equity, or rather equality or inequality, in healthcare financing is a constant endeavor in monitoring UHC. Among the most used indicators of household financial hardship, burden, and economic shocks associated with out-of-pocket healthcare expenditure (OOPHE) are probably impoverishment and catastrophic health expenditure (CHE) [16, 17]. Defining these indicators and their relevance for policymaking has been the source of much argumentation and revision in the last decades’ literature [18,19,20,21,22].

This study contributes to inequality and financial hardship research, deviating from standard approaches to measure financial shocks through CHE and socio-economic ranking. It employs a wealth index ranking and revised consumption aggregate to examine the impact and distribution of OOPHE financial burden across Cambodia’s population, diverging from prior works [23,24,25,26,27]. It integrates new estimates, trend analysis of economic shocks, and OOPHE’s financing sources as coping strategies. A comparison between standard methods and alternative measures of financial burden is also included in this study.

Further, this study includes a determinant analysis of financial burden and its inequality in 2019, investigating factors' contributions to changes in inequality from 2014–19, and evaluating the influence of social health protection coverage. The primary research questions and associated methods are summarized in Appendix Table 1.

The following subsections will introduce the concepts and challenges of financial burden and inequality measurements, outlining the rationale for the authors’ methodological choices. Due to the word count limitations, we only introduce Cambodia's social health protection context. For a review of the Cambodian health system, its challenges, and its evolution, the reader may refer to Kolesar et al. (2022) [28].

Healthcare-related financial burden

Catastrophic healthcare expenditure, a proxy for financial hardship and burden

The World Health Organization (WHO) and World Bank's 2015 UHC Monitoring Report defined impoverishment from healthcare expenditure as households both falling under and already below international poverty lines due to OOPHE [29]. Subsequent iterations of the report adjusted poverty lines for impoverishment [16, 17, 30]. Still, robustly measuring impoverishment is difficult. Fernandes Antunes et al. (2022), for example, found that even a shift of US$0.01 from the international poverty line for Cambodia can lead to a nearly 3% variation in estimates for 2014 [31]. The challenges in defining poverty might explain why healthcare-driven impoverishment was not retained as an SDG indicator. However, CHE was set as an SDG indicator without specific targets [32, 33]. Standard CHE methods facilitate global comparisons, trend monitoring, and gauging public interventions against OOPHE's impact. Still, a consensus on these methods among researchers remains elusive [34, 35].

Measuring catastrophic healthcare expenditure

Since Xu et al. [36] seminal work—often dubbed the "WHO Method"—there has been an ongoing debate on how to define CHE [37]. Most discussions focus on establishing thresholds representing economic shocks at the household level.

Current metrics lean towards ability-to-pay or total household wealth indicators [3, 18, 29, 38]. Recent UHC and SDG metrics use CHE thresholds rooted in household consumption, set at 10% and 25% [16]. Regardless of the approach, CHE might not entirely reflect the financial struggles of low-income households, especially those already strained by minimal healthcare costs or avoiding such expenses due to the unaffordability of services [18]. Defining financial burden solely through CHE overlooks the nuances of household finances and spending behaviors [39]. Moreover, CHE misses out on the broader implications of healthcare distress spending, like asset selling, child labor, and missed school days.

The WHO Method determines ability-to-pay (commonly referred to as capacity-to-pay) by deducting an allowance for ‘essential’ food consumption from total consumption and equivalizing household sizes, i.e., accounting for the household members’ age structure. In its application, many researchers favor the equalization factor used by Xu et al. (2003) [37], even when detailed household structure data is available. Furthermore, the WHO Method sets essential food consumption on national medians, overlooking regional variations [40].

As an alternative to capacity-to-pay, the standard definition of total consumption encompasses OOPHE, which spikes with health shocks, skewing households’ wealth and socio-economic ranking, and leading to potential bias in inequality measurements. This explains why CHE incidence using consumption ranking appears higher among ‘wealthier’ households [34, 41]. Concurrently, Sas Trakinsky et al. (2020), in their assessment of financial protection in Burkina Faso, deduced that while CHE detects households with health shocks, it poorly correlates with truly disadvantaged groups [42].

Given these considerations, our analysis departs from CHE. It looks at "financial burden" (FB) by defining "excessive financial burden" (EFB) as metrics of healthcare-related financial shocks by excluding OOPHE from total consumption.

Measuring inequality

Inequality measures for binary health outcomes, like CHE, fall into two categories: stratified measures and ratios using socio-economic quintiles or geographic markers [43]; and measures of concentration across distribution rankings [44, 45].

Socio-economic ranking

Households' socio-economic ranking typically uses total consumption, including OOPHE [46]. Yet, understanding wealth and poverty necessitates looking beyond mere consumption, as in measures like the Human Development [47] and Multi-Dimensional Poverty indices [48,49,50]. For a comprehensive review of healthcare inequality measures and equity dimensions, see Pulok et al. (2020) [51]. Another weakness of socio-economic ranking through consumption is that this is sensitive to fluctuations in wealth and does not adequately reflect productive assets or resources that could enable households at the lower end of the wealth spectrum to escape poverty traps or keep better-off households out of poverty. To respond to these challenges, Carter and Barrett (2006) proposed a dynamic-asset-based approach to determine the incidence of poverty traps and persistent poverty [52]. However, asserting which assets display such properties or having surveys that capture those is not trivial.

Complex measures of wealth, such as asset-and-housing-characteristics-based wealth indices, are also commonly used for the socio-economic ranking in concentration analysis [53, 54]. Such indices are popular in inequality analysis of demographic health surveys that lack general consumption data [55, 56]. However, wealth indices are far from universal due to their cross-sectional nature and asset weights varying over time and place. This drove Smits and Steendijk (2015) to propose a consistent international wealth index based on their analysis of 165 surveys across 97 countries [57].

The Filmer-Pritchett Principal Component Analysis (PCA) is widely used with binary variables when building wealth indices [58, 59]. However, Howe et al. (2008) and Poirier et al. (2020) criticize this approach because standard PCA was developed for continuous data simplification, and using binary data leads to skewed scores by favoring variables associated with urban wealth. These shortcomings result in ineffective discrimination between wealth assets in rural areas and a limited demarcation between households at the lower end of the socio-economic ranking (also known as ‘clumping’). [60, 61]. Martel et al. (2021) introduced a polychoric dual-component analysis with ordinal variables to address these weaknesses [62]. The inclusion of the second component intends to reflect the wealth structure in rural areas, as suggested by Ward (2014) [63]. In this study, we adopt this approach.

Concentration indices

Interpreting inequality requires mathematical translations reflecting inherently subjective social welfare judgments [45]. It's crucial to grasp these judgments when interpreting inequality measures, especially commonly used ones like concentration indices (CI) and their transformed versions [64,65,66].

CIs reflect normative judgments of inequality in their extreme values: 0 for perfect equality, -1 when the lowest-ranked socio-economic unit entirely captures the variable of interest, and + 1 when this is held by the highest-ranked [67]. This interpretation is straightforward for continuous variables such as income. However, CIs are more challenging to interpret for health-related variables, among others, because of the possible definition of indicators as shortcomings or gains, their scale, their bounded values, and natural means and limits [68, 69]. Transformations of the CI to accommodate such challenges include the General CI, the Wagstaff CI (WCI), and the Erreygers CI (ECI) [70]. The latter two are widely used for binary variables such as CHE [65, 71,72,73].

WCI and ECI are often termed normalized or corrected CIs. Both correct for the variable's mean distribution in the population and consider the limits of variables like life expectancy [74]. Debates on the relative advantages of both indices have been intense [69, 75, 76]. While reviewing these indicators, Kjellsson and Gerdtham (2013) posited that neither is superior, as their distinction arises solely from normative judgments. Both indices can appropriately reflect health gains and shortcomings (ill-health) through transfer, mirror, and cardinal invariance properties. In addition, ECI is characterized by the level independence property. The latter means that the index is insensitive to proportional increases in the variable of interest across the middle of the distribution. Discussing these properties goes beyond the purpose of this paper. For a review of the characteristics of concentration indices, the reader may refer to Kjellsson and Gerdtham (2013). ECI was used in this study.

Decomposing inequality measures

CIs are also valued in statistical analyses for their capability to accommodate regression models, pinpoint determinants of inequality, and facilitate inference and group comparisons [70]. Their decomposition provides insights into factors’ contributions and mitigational effect, revealing both means and coefficients variation distributional impact [43].

The Oaxaca-Blinder decomposition is a prevalent technique, with applications spanning time cohort, socio-economic, and geographic classifications [77,78,79,80,81]. Rahimi and Hashemi Nazari [82] provide a comprehensive and illustrative guide to this method. The combination of the Oaxca-Blinder decomposition and the Recentered Influence Functions (RIF) methodology—primarily designed for outlier impact assessment [83]—allows for detailed group-wise inequality measure breakdowns [84, 85]. Heckley et al. (2016) expanded RIF's use in index decompositions of binary variables [86]. Notably, Asif and Akbar (2021) and Asuman et al. (2020) applied these methods to study child nutrition and stunting, respectively [87, 88]. For a detailed mathematical explanation and example of wages decomposition on gender see Jithitikulchai (2016) [89]. We adopt this combination of methods in this study.

Cambodia’s context

In Cambodia, the Service Coverage Index increased from 19 in 2000 to a ‘high coverage’ score of 61 in 2019, officially steering the nation towards UHC [90, 91]. This achievement may be partly attributed to the expansion of social health assistance through the Health Equity Fund (HEF). HEF offers free public healthcare and hospital transportation to vulnerable populations. Following a decade of segmented operations by various non-profit organizations, a 2015 government initiative sought to nationalize, consolidate, and expand HEF. More recently, a 2017 scheme reform intended to extend its scope to select informal economy workers [92].

HEF beneficiaries are primarily identified by proxy means testing and community consultation through a national program, IDPoor. In addition, ex-post needs assessments at public hospitals can provide access to HEF benefits for households that can no longer afford services. Such households are supplied with ‘Primary Access Cards’ for identification [93]. While at core IDPoor identification process employs multidimensional poverty measures [94, 95], the prevailing approach to assess the HEF targeting efficacy has been the correlation between its coverage and household consumption ranking [25]. Furthermore, the national representative consumption and living standards surveys do not enable differentiation between pre- and post-identified households.

Concurrently, the National Social Security Fund (NSSF), a mandatory contribution-based social insurance for the formal sector, has broadened its initially limited benefit package. By 2020, it provided effective coverage for 3.3 million individuals, or approximately 19% of households, albeit still excluding dependents [96,97,98,99].

Notwithstanding the expansion of HEF and NSSF schemes, high OOPHE and reliance on coping strategies persist, notably among poorer, larger households and rural areas [26, 90]. In 2014, 12% of individuals encountering health issues borrowed money for treatment, escalating to 28% for bills exceeding US$100 [100], and 2.7% of the population resorted to borrowing or selling assets [97].

Methods

Data

We use data from the Cambodian Socio-Economic Surveys (CSES) 2009, 2014, and 2019. These are nationally representative surveys with 10,000–12,500 household interviews. The data is available upon request from the Cambodian National Statistics Institute or the World Bank Data Repository.

Socio-economic status

Consumption aggregates

Two distinct total consumption aggregates (EXP) were constructed:

-

An "old" aggregate, incorporating OOPHE and education spending, as reported in specific CSES modules.

-

A revised aggregate, encompassing durables and rental consumption alongside all items from the "old" aggregate version but excluding OOPHE.

The old aggregate construction is detailed in Fernandes Antunes et al. (2022) [31]. The revised aggregate follows the recommendations of the authors and integrates previously omitted components like rental consumption for dwelling owners and durable goods consumption, but it excludes OOPHE because of EXP’s elasticity to OOPHE. Rental consumption was estimated from reported rental market values for owned residential dwellings or replaced by actual rental expenditure when available. Missing values for rental consumption were estimated from the median in the sampling unit.

CSES records the number and purchase value of 'new' durable goods acquired within 12 months. For items exceeding this age, households estimated the current rental market value for a similar object in their neighborhood. The revised aggregate only includes non-productive durable goods in line with the Cambodian Demographic Health Survey (CDHS) wealth index and the Cambodian Ministry of Planning’s 2019/20 consumption aggregate. Consumption estimates for these items were determined using their quantity, purchase or market value, and adjusted for life expectancy.

Expenditure and consumption variables were converted to monthly Figs. (30.4 days) in current local currency units (Khmer Riel, KHR, or CU) per household or capita. Conversions to current US Dollars (US$) and constant 2011 Purchasing Power Parity units (International Dollar, INT$) employed deflators from the World Development Indicators databaseFootnote 1 (World Bank, 2022).

Wealth index

The wealth index was adapted from the Cambodian National Institute of Statistics approach used in the CDHS analysis [55]. It includes living standard variables and non-productive assets (durable goods). We employed discrete and ordinal variables with polychoric dual-component analysis with the syntax kindly provided and adapted from Martel et al. (2021) [61, 62].

Key living standard elements include lighting, cooking energy, water sources, sanitation facilities used, dwelling characteristics and size, and qualitative items categorized by quality and financial investment [57]. Housing characteristics such as size and number of rooms were adjusted for person equivalents. Water and sanitation source categorization adheres to the Joint Monitoring Program’s Water and Sanitation Ladders [101].

Durable goods were recoded to discrete ordinal variables considering their monthly consumption. Item value was defined at the 25th, 50th, and 75th percentiles as none, low, medium, and high, respectively. Details on the wealth index calculation and composition are provided with the eigenvalues of the component analysis in Appendix Table 2. Spearman ranking tests for the wealth index showed a higher correlation between this and the revised consumption aggregate, rho 0.67, and the old aggregate, rho 0.50.

Household equivalent size

Household equivalent sizes were estimated using Eurostat's OECD Modified [Equivalence] Scale [102, 103]. The calculated average equivalized household sizes were significantly lower than those generated with the WHO Method’s equivalent factor (unreported results).

Main variables of interest

Out-of-pocket healthcare expenditure and funding sources

OOPHE was derived from the CSES's health and expenditure section, capturing illness reports, care-seeking, and related costs per individual in surveyed households, including service types, provider options, transport costs, and funding sources such as income, savings, borrowing, asset sales, and advanced production sales. Transportation costs were excluded to prevent duplication with reported household non-food expenditures. Funding sources were queried in decreasing order, allowing up to three responses, with a presumed proportional reduction in amount per source. Appendix Table 3 presents the allocation method between financing sources.

Financial burden

FB is defined as the share of OOPHE over EXP. A household was categorized as experiencing ‘excessive FB’ (EFB) if its OOPHE exceeds the 10% (EFB10) or 25% (EFB25) threshold of total consumption, excluding OOPHE.

A household was defined as experiencing CHE when its OOPHE exceeded 40% of its capacity-to-pay (CTP) based on the old aggregate and standard persons equivalences following the WHO Method [24, 26].

The dummy variables can be mathematically expressed as:

where:

• \(OOPHE_{i}\) is the out-of-pocket healthcare expenditure of household i excluding transportation costs

• \(EFB_{ji}\) is the dummy variable for the excessive financial burden of household i at threshold j, at j: 10 and 25.

• \(EXP_{i}\) is the total consumption of household i excluding OOPHE.

• \(T_{j}\) is the threshold set for the EFB at j.

with

and

where:

• \(CHE_{i}\) is the dummy variable for catastrophic healthcare expenditure for household i.

• \(CTP_{i}\) is the capacity-to-pay for household i.

• \(SE_{i}\) is the subsistence food consumption of household i adjusted for household equivalent size.

• \(food_{45th-55th}\) is the weighted average food expenditure per capita for households between the 45th and 55th quintiles, ranked by their share of food expenditure over total consumption including OOPHE.

• \(eqsize_{i}\) is the person equivalent size of household i.

• \(hhsize_{i}\) is the unadjusted number of members for household i.

• 0.56 is the WHO standard equivalent size adjustment factor.

Explanatory variables

The analysis incorporates explanatory variables like geographic strata, household structure, head characteristics (age, education, ethnicity, marital status, gender, and disability status), access to water, use of sanitation facilities, social protection coverage, free healthcare utilization, vulnerabilities, healthcare behavior, disease prevalence, OOPHE funding sources, and coping strategies. Appendix Table 4 includes summary statistics for all explanatory variables from 2009–19.

Geographic strata

Before 2019, CSES geographic stratification was confined to three regions: Phnom Penh, other urban, and other rural areas. Since then, the categorization was expanded to five zones: Phnom Penh, Plain, Tonle Sap, Coastal, and Plateau and Mountains. In addition, dwellings are categorized as urban and rural. Data from 2009–14 was recoded to accommodate the revised categorization.

Access to free healthcare and social protection

CSES tracks access to subsidized healthcare, inquiring about households' utilization of free healthcare in the preceding 12 months and the exemption source, like listing on a poor household roster or insurance. An additional dummy variable for free care was constructed, which defined individuals utilizing services in the past 30 days without paying (zero OOPHE excluding transportation costs). Social protection coverage, through mechanisms like HEF (including Priority Access Cards) and NSSF, was determined based on insurance card ownership.

Vulnerabilities, coping strategies, and liabilities

CSES incorporates a section on household vulnerability in the last 30 days and past year. Coping strategies defined by the CSES include changes in food sources, borrowing or asking for help for food, reducing meals, selling household assets, foregoing essential expenditures such as education and health, illegal income activities, economic migration, and begging.

Additional variables were constructed for dropouts within compulsory schooling age, and loans for general and illness-related purposes. These indicators are supplemented by variables on coping strategies, including work cessation due to illness and incapacitation because of hospitalization, and use of non-income funding of OOPHE.

Disease prevalence and healthcare-seeking

Healthcare-related needs and consumption variables were constructed from the health section data of CSES for the 30 days prior to the interview. The section is structured into two distinct subsections on needs and consumption, so it is impossible to assert which healthcare need services were sought for a specific reported need. However, households report on their seeking of care when ill, and the impact of illness on their activities. Healthcare-seeking data includes the number of visits per individual, first and last provider type visited and, since 2011, hospitalization and inpatient days. Non-illness-related care needs, including maternity care and preventive services, are captured.

Illnesses for which symptoms are prevalent or treatment sought for more than 12 months were previously considered chronic [24], but we categorized these generically as ‘long illnesses’. The 2019 CSES captured detailed causes of disease for 74 conditions for over 5787 households and 7882 individuals. This data was categorized into communicable-infectious diseases (respiratory diseases; and, other infections), chronic-degenerative diseases (neoplasms; endocrine, metabolic and digestive diseases; circular system diseases; and respiratory chronic diseases), injuries and trauma, and other chronic conditions.

Processing of outliers and data cleaning

OOPHE outliers were not excluded. Data was curated for inconsistencies in healthcare and durable goods consumption due to data entry issues, such as omitted zeros, values under KHR1000 for durable goods, duplicate entries, and over-reported items.

Statistical analysis

Means, medians, and differences testing

Analyses were processed using Stata 17 with survey settings or sample weights [104]. Variables’ means were tested through pairwise comparison of linear regression estimates without multiple-comparisons adjustment [105, 106]. For zero-inflated variables, medians and their differences were assessed via quantile regression (Cameron and Trivedi, 2022, chapter 15) [105]. Throughout this paper, “significant” only denotes statistical test results surpassing the 95% threshold (p ≤ 0.05). Table 1 includes the means, concentration indices, and results of differences’ testing for key variables of interest.

Determinants of financial burden

EFB determinants were analyzed using zero-inflated logistic (ZIOL) regression [107,108,109]. Ranked ordinal FB levels (OOPHE/EXP) for the regression outcomes are FB = 0%, 0 < FB < 10%, 10% ≤ FB < 25%, and FB ≥ 25%. These outcomes were chosen as reflecting no (FB = 0%), low (0 < FB < 10%), medium (10% ≤ FB < 25%), and high (FB ≥ 25%) financial burden.

The model, estimated with the Stata command ziologit, was considered appropriate to accommodate the inflation of zeros corresponding to the non-users of health services. The zero-inflated and ordered logit components are simultaneously estimated through a single likelihood function. Considering FB levels as ordered categories enables a straightforward interpretation of results. This model is also less sensitive to outliers. An ordered logit regression has the advantage of handling our outcomes as individual equidistant interest as levels with results that can be expressed as odds ratios. The complete model and its results are provided in Table 2. In addition, the model allows for the simultaneous estimation of contrasted predicted probabilities (marginal effects difference) for explanatory variables, results provided in Table four. The mathematical model and its likelihood estimation equation are briefly introduced below.

where:

-

\({Y}_{i}\) is the outcome for the household \(i\).

-

\(\text{Pr}\left({Y}_{i}=0\right)\) is the probability of the outcome for the household \(i\) is zero (FB = 0%).

-

\({\mathbf{Z}}_{\mathbf{i}}\) is a vector of independent variables for the zero-inflated component of the model.

-

\(\gamma\) is a vector of coefficients for the zero-inflated component.

-

\(\text{Pr}\left({Y}_{i} \le j|{Y}_{i} >0\right)\) is the probability that the specific outcome for household \(i\) is less than or equal to \(j\), given that it is greater than zero.

-

j ∈ { 1,2,3} indexes the non-zero ordered outcomes (0 < FB < 10%, 10% ≤ FB < 25%, and FB ≥ 25%).

-

\({\mathbf{X}}_{\mathbf{i}}\) is a vector of independent variables for the ordered logit component.

-

\({\alpha }_{j}\) are the cut points for the ordered logit component.

-

\(\beta\) is a vector of coefficients for the ordered logit component.

-

\(L\) is the overall likelihood function for the ZIOL regression model.

-

\(I\left(\bullet \right)\) is an indicator function, which is 1 if the condition inside is true and 0 otherwise

Measure of inequality

The [standard] Concentration Index (CI) for continuous variables and Erreygers CI (ECI) for binary variables were estimated and tested using an author-modified version of the Stata command conindex to enable the pairwise testing of differences among groups of three [68]. ECI for EFB can be estimated from:

where:

-

\(ECI\) is the Erreygers Concentration Index.

-

\(CI\) is the Concentration Index.

-

\({\text{EFB}}_{i}\) is the dummy variable for the Excessive Financial Burden for household i at a given threshold.

-

\(R\) is the fractional rank of the household in the socio-economic spectrum.

-

\({\text{Cov}}\left({\text{EFB}}_{i},R\right)\) is the covariance of \({\text{EFB}}_{i}\) ranked on \(R\).

-

\(\upmu\) is the mean of EFB at a given threshold among all households.

Inequality determinants and decomposition

RIF regression on EFB10 and EFB25’s ECI was applied to the CSES 2019 dataset, using the Stata commands package rifhdreg developed by Rios-Avila (2020) [85]. The model is estimated through ordinary least squares regression. Post-estimates of individual RIF values once expressed as a vector allow for the decomposing covariances between groups.

Inequality trends in ECI across years, 2014–19, were decomposed using a two-step method by Firpo et al. (2009, 2018), which combines RIF regression and Oaxaca-Blinder decomposition on post-estimates [83, 84]. Appendix Table 8 and Appendix Table 9 provide the full decomposition model with its independent variables and results on the ECI between 2014 and 2019 for EFB10 and EFB25, respectively.

Results

Descriptive statistics

Descriptive statistics of exploratory variables at the household level by year are provided in Appendix Table 4. Subsequent sections only detail statistically significant means and differences, unless noted as stable or constant over time. When unspecified, variations relate to the period 2009–19. Figures are reported as percentages of all households.

Household characteristics

From 2009–19, urban households doubled from 17.97%-37.79%, and Phnom Penh residents grew from 8.90%-14.62%, while Plain zone populations declined from 40.78%-35.26%. Larger households (> 4 members) decreased from 51.94%-42.92%, as did households led by 13–34-year-olds from 24.66%-17.00% and people without formal education from 25.01%-17.92%. Proportions of married/cohabiting and male household heads held steady (~ 79% and ~ 78%). Access to improved water sources and sanitation facilities notably increased from 45.40%-79.73% and 35.86%-80.36%, respectively.

Healthcare needs and disease burden

Households experiencing recent illness/injury rose from 44.74%-55.14%. Long-term illness rates held steady at ~ 11.8% between 2009–14 but reached 19.78% by 2019. From 2014–19, infectious diseases also raised from 32.34%-37.85%, with non-respiratory conditions, especially malaria and dengue, becoming the major health concerns in 2019, impacting 33.79% of households. Chronic and cardiovascular diseases affected 19.61% and 11.04% of households, respectively. Awareness and uptake of preventive health needs almost doubled, from 14.49%-23.84% and 10.87%-21.23% between 2014–19, while maternity care needs were reported by 2.73% of households in 2019.

Social health protection and healthcare-seeking

Households seeking medical care for illnesses jumped from 35.45%-53.36%, and healthcare visits from 45.27%-56.31%, though per capita visits held at ~ 0.31. The seeking of biomedical professionals grew from 35.29%-52.46% of households, and per capita figures from 11.95%-17.65%. HEF coverage expanded from 1.59%-10.32% between 2009–14 and stabilized thereafter. By 2019, 14.92% of households had a member holding an NSSF card.

Reports of annual free healthcare access doubled from 4.97%-9.58%. Access to free healthcare due to HEF markedly rose from 2.03%-5.43% between 2009–14 but later fell to 3.65%. By comparison, 4.20% accessed free services through NSSF in 2019. Monthly free healthcare access rose from 2.31%-3.82%, albeit the increase was only significant between 2014–19. Free visits per capita grew from 0.0064–0.0119, or 3.10%-4.95% of all visits (data not shown), respectively.

Liabilities, vulnerability, and coping strategies

Household indebtedness declined from 37.90%-31.55% between 2009–14, then increased to 34.47%. The average per capita loan soared from INT$352 to INT$4,483. Loans for illness-related reasons decreased from 3.83%-1.66%, but their per capita value among indebted households rose from INT$209 to INT$1,847. School dropouts fell from 12.19%-7.55% (15–17-year-olds) and 3.92%-2.52% (6–14-year-olds).

From 2014–19, reliance on unspecified coping strategies fell from 14.92%-1.98% annually and 3.14%-1.64% monthly. Meanwhile, ~ 15.68% of households consistently used savings for OOPHE, while borrowing for OOPHE reduced from 2.15%-1.62%.

Financial burden

Appendix Table 5 provides incidences of EFB by thresholds across years and strata for all households. Appendix Table 4 also includes estimates of CHE using the WHO as used in previous publications by Jacobs et al. (2016) and Fernandes Antunes et al. (2018) [24, 26].

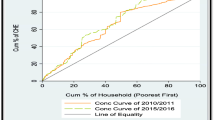

EFB10 and EFB25 incidences at national level and across quintiles for all households are illustrated in Fig. 1. Incidences increased across all categories and years. The uptick was most stark for EFB10, from 10.95%-17.92%, and still rose from 4.41%-7.29% for EFB25. In 2019, EFB10 and EFB25 impacted 24.29% and 10.86% of households in the lowest quintile, respectively. EFB10's rise was not significant for the wealthiest quintile, nor was EFB25's for the wealthiest two quintiles. Appendix Figure 1 illustrates EFB incidences for households reporting healthcare consumption or needs. Among these, the trends were similar to those of the general population. However, national EFB10 and EFB25 in 2019 rose to 31.51% and 12.82%, respectively; for the lowest quintile, these figures peaked at 39.35% and 17.59%.

Figure 2 provides a Venn diagram analysis between the standard WHO Method for CHE at 40% capacity-to-pay, EFB10, and EFB25 in 2019. EFB10 and EFB25 captured over 99% of CHE cases for both years. It is worth noting that this overlap was almost completely captured EFB10 and CHE estimates, suggesting that EFB10 is sufficiently sensitive to capture all economic shocks as defined by the WHO Method. In addition, 0.98% of households were classified as only experiencing EFB25, which would have been missed using CHE.

Healthcare-spending-related economic incidence shock estimates among households in 2019, and their overlap using the “World Health Organization Method” on Catastrophic Healthcare Expenditure at 40% of capacity-to-pay, and the Excessive Financial Burden method at 10% and 25% total consumption threshold excluding out-of-pocket healthcare expenditure. Source: authors’ calculations

The remaining paragraphs present results limited to the incidence of EFB10 in 2019, as EFB25 incidence patterns across strata and years are similar.

From 2009–19, EFB10 rose across all regions, jumping from 4.30%-7.33% in the capital (Phnom Penh), 12.08%-20.92% in other rural areas, and 7.51%-16.53% in other urban areas. In 2019, EFB10 among fully-female households was 23.20% compared to 17.63% for other households. Incidence was also higher for households with married-under-18-years-old members at 23.04% vs 17.88%. Households with 3–4 members had the lowest incidence.

Households headed by people living with some form of disability had a higher EFB10 of 29.42% vs 16.70%. EFB10 was also higher among households with members living with disabilities, at 29.65% vs 15.53%. EFB10 inversely correlated with the household head's educational attainment, from 23.63% for those devoid of formal education, to 3.99% among those surpassing high school education. Households led by widows/ers had a significantly higher EFB10 incidence at 20.14%, whereas differences across other marital, ethnic, and gender categories were not.

EFB10 was higher among HEF-or-PAC-holding households (across years), at 21.27% vs 17.53%. This counterintuitive pattern was also found for households reporting accessing free healthcare through HEF in the last 12 months, at 22.66% vs 17.74%. However, neither held significance once stratified by wealth quintile. Incidence was lower among households that reported seeking healthcare in the last 30 days without paying, at 7.70% vs 18.32%. Differences across NSSF card holding were not significant. Households with current loans had higher EFB10 incidence. So did households with illness-related loans, at 44.64% vs 17.47%.

Evidently, households reporting any healthcare need or consumption had higher EFB10 incidences. The highest incidence was 57.37% among households with people suffering from neoplasms, and 47.47% for injuries and trauma. When members were hospitalized, this rose to 70.31%.

Households that reported relying on coping strategies in the 12 months prior to the interview or that had 15–17-year-old children dropping out of school also had higher EFB10 incidences.

Inequality

Table 1 provides the means, CIs, testing results, and medians for key variables on interest by year and absolute differences among all households. Appendix Table 6 provides the same table but for the sub-group of households reporting healthcare needs or consumption. For most variables, inequalities were more pronounced in the latter sub-group. However, as the patterns are similar, this section only reviews the results from the general population.

Inequality in EFB10 and EFB25 incidences across households deepened and remained concentrated among the poorest households between 2009–19, from -0.027 to -0.113 for EFB10, and from -0.013 to -0.062 for EFB25. Both EFB and CHE concentrated on the poorest households when using the revised consumption aggregate or wealth index ranking. By contrast, using the old aggregate for ranking and asserting CHE showed a concentration of economic shocks among the wealthy. The behavior of these measures is illustrated with Lorentz concentration curves in Fig. 3.

Lorentz concentration curves for Catastrophic Health Expenditure at 40% capacity-to-pay as per the WHO Method at 40% of capacity-to-pay ranked by total consumption, including out-of-pocket healthcare expenditure but excluding rental and durable goods consumptions, and for Excessive Financial Burden at 25% of total consumption ranked by wealth index scores. Source: authors’ calculations

Over time, the average and the median total consumption, measured by the revised consumption aggregate, more than doubled in constant terms. By 2019, total consumption per household reached INT$1,578 and the median INT$1,194. Between 2009–14, it became more equitable, its CI dropping from 0.314–0.275, but it plateaued afterward.

Monthly OOPHE increased from INT$30.49 to INT$91.82 per household. The average FB, measured as the share of OOPE over total consumption, rose from 5.07%-7.67%. Inequality in OOPHE remained unchanged and concentrated among the wealthier households, reaching 0.083 in 2019. The concentrations were more pronounced in financing sources. Income-finance OOPHE’s CI was 0.152, but for borrowing-financed OOPHE, it was concentrated among the poor at -0.0245. No significant difference was found in the distribution of OOPHE financed from savings and selling of assets.

Liabilities sharply rose, particularly between 2014–19, from INT$1286.95 to INT$6,688.91 for all loans, and from INT$55.62 to INT$118.60 for illness-related loans. No significant inequality was found for illness-related liabilities across all years in contrast to overall loans, which were more concentrated among the wealthier households at 0.393 in 2019.

Significant changes appeared in social health protection coverage and benefits distribution, albeit mainly between 2009–14. HEF (pre-identified households) or Priority Access Card (households post-identified at hospitals) holding was concentrated among the poorest households across all years, reaching -0.217 in 2019. Poorest households benefited more from free healthcare in the 12 months prior to the interviews. However, the distribution remained unchanged between 2009–19, despite an improvement from -0.086 to -0.173 between 2009–19. This V-shape trend in inequality was also found for HEF benefits in the last 12 months.

From 2014–19, inequality in the burden of disease, measured by the number of household members reporting an illness or/and an injury, was significant, at approximately -0.04. Contrastingly, over that period, the distribution of long illnesses was equal. Inequality in the need for non-illness-related care only became significant in 2019.

All healthcare-seeking measures concentrated on households in the lowest part of the socio-economic spectrum from 2014 onwards. By 2019, inequality for healthcare visits was small but pro-poor at -0.022, seeking healthcare for reported illness or injury -0.041, medical healthcare seeking -0.026, and hospitalizations -0.097. Disease impairment, measured by days of activity lost because of illness or injury, tended to disproportionally burden the poorest households over time, with inequality deepening from -0.059 to -0.139 between 2009–19.

Determinants of the financial burden

Table 2shows the results of the ZIOL regression on FB expressed in odds ratios for 2019. The table includes two sets of results, one for the zero-inflation and one for the FB levels. The zero-inflated equation results can be interpreted as the likelihood or susceptibility of consuming and spending on healthcare.

Susceptibility to out-of-pocket healthcare expenditure (zero-inflation equation)

A higher susceptibility to healthcare spending was significantly associated with being in the wealthiest quintile versus the poorest (OR 4.189), belonging to a large household of seven or more members compared to 3–4 members (OR 2.564), and residing in a household headed by individuals aged 17–24 years (OR 3.718) or 25–34 years (OR 2.930) versus 35–44 years. Higher susceptibility was also observed in households utilizing NSSF-free healthcare in the past 12 months (OR 2.885) and those reporting a member's illness or injury (OR > 10). Conversely, residing in urban dwellings (OR 0.548), having members aged 60 years or above (OR 0.450), and being led by a divorced or separated head, in contrast to married (OR 0.104), are factors related to a lower susceptibility.

Level of financial burden (ordered logit equation)

Households outside Phnom Penh were likelier to have a higher FB (ORs > 1). However, households living in urban areas were less likely to have higher levels (OR 0.841). Those in the three highest quintiles were less likely to experience a higher FB than the poorest households. Compared to households with 3–4 members, smaller households were more likely (ORs > 1), and households with seven or more members were less likely (OR 0.601).

Holding a HEF or PAC card was associated with a lower likelihood of higher financial burden (OR 0.721). However, having at least one household member holding an NSSF card did not significantly influence the odds. Unsurprisingly, having benefited from free healthcare in the last month for at least one household member was associated with a lower likelihood of high levels of FB.

Having members suffering from prolonged illnesses and needing prevention services was associated with an increased likelihood of higher FB levels (OR 1.235). So were neoplasms prevalence (OR 2.301), endocrine, metabolic and digestive infectious diseases (OR 1.738), and injuries/trauma (OR 1.709). Furthermore, the need for preventive services was positively associated with FB levels (OR 1.355). Activity impairment (OR 1.038), seeking healthcare of any sort (OR 1.064), medical healthcare (OR 1.893), and inpatient days per hospitalization (OR 1.430) were associated with higher FB levels.

The association with the financial source of OOPHE was significant and increased from savings (OR 1.284), to borrowing (OR 4.710), to selling of assets (OR 8.400). Having children out of schooling was not significantly associated with a household FB.

Individual financial burden levels probabilities (overall model)

Table 3 provides the summary statistics for the four outcomes considered in our ZIOL regression analysis for 2019. Households without OOPHE expenditure (FB = 0%) represented 46.47% of the sample. Households with FB under 10% (0 < FB < 10%) accounted for 35.61%. Of the remaining, 10.63% experienced FB between 10% and under 25% (10% ≤ FB < 25%), and 7.29% had to cope with FB over 25% (25% ≤ FB).

To assess the impact of individual variables with significant effects on the level of FB, we estimated the contrasted predicted probabilities (marginal effects differences) on the entire model at each outcome. Table 4 provides the estimations by categorical variables. Results for continuous variables are illustrated with charts. In the table and charts, the sum of the probabilities for the four outcomes is one for predictive margins and zero for contrasted predictive margins.

Households living outside Phnom Penh and in rural areas had significantly higher probabilities of experiencing FB above 10% (10% ≤ FB < 25% and 25% ≤ FB). Living in rural dwellings also significantly reduced the probability of no FB, but it did not affect the probability of FB under 10%.

Compared to the first quintile, households in the three wealthiest quintiles were significantly more likely to experience FB under 10% and less likely to have to cope with FB over 10%. Significant differences in probabilities for no FB were only found with the fourth quintile. No differences in the probability of outcomes were found with the second quintile.

No significant differences were found between the reference households (3–4 members) and those with 5–6 members, or across household sizes on the probability of no FB. However, smaller households (≤ 2 members) were less likely to have FB under 10% and more likely to have FB over 10%. The pattern was inverted for larger households (≥ 7 members).

HEF households were more likely to have no and under 10% FB, and less likely above the 10% threshold. Figure 4 illustrates results for HEF households in different outcomes. As could be expected, households benefiting from free healthcare had significantly higher probabilities of no FB and lower FB across all outcomes.

Probability differences (predictive margins contrast) of financial burden outcomes at 0%, 0% to 10%, 10% to 25%, and over 25% of out-of-pocket healthcare expenditure over household consumption between households with a Health Equity Fund or Priority Access Card vs non-holders, in 2019. Error bars for 95% confidence interval. Source: authors calculations

Prevalence of neoplasms or endocrine, metabolic, and digestive diseases, the need for non-illness-related healthcare significantly lessened the likelihood of no and under 10% FB, and increased the probability of outcomes above 10%. Similar patterns were seen with reported preventive needs and injuries or trauma, though the latter does not significantly impact the probability of FB above 25%.

When relying on OOPHE funding via savings, borrowing, or asset and production sales, households were significantly less likely to have no or under 10% FB, and more likely to exceed the 10% and 25% thresholds.

Figure 5 illustrates the probabilities (predictive margins) for the four outcomes against inpatient days per hospitalization. Under four days, the most likely outcomes were for a household to have no or FB under 10%. Above five days, households were still more likely to experience no FB, but the probability of EFB25 rapidly rose with hospitalization days and was more likely than the two other outcomes (0% < FB < 10% and 10% = < FB < 25%). Above 15 days, the most likely outcome was to experience FB above 25%, i.e. EFB25.

Probability (predictive margins) of financial burden outcomes at 0%, 0% to 10%, 10% to 25%, and over 25% of out-of-pocket healthcare expenditure over household consumption by inpatient days per hospitalization and household, in 2019. Error bars for 95% confidence interval. Source: authors calculations

Figure 6 illustrates how having household members seeking medical healthcare increases the probability of higher FB outcomes. With three members seeking medical healthcare, the most likely outcomes were that a household would experience no or FB under 10%. However, from 4 members seeking care upwards, a household’s most probable outcomes were no or FB above 25%.

Decomposition of inequality variation between 2014–19

In complement to the decomposition analysis results below, the reader will find in the Appendix results from the determinants analysis of EFB inequality for 2019 using RIF regression on ECI of EFB10 and EFB25. These results guided the construction of our Oaxaca-Blinder decomposition model. The results of both analyses are consistent.

Appendix Table 8 and Appendix Table 9 provide the results of the Oaxaca-Blinder decomposition on RIF of the ECI differences between 2014-19 for EFB10 and EFB25, respectively. Results are segmented into endowments for means (‘explained’), and effects and interactions (‘unexplained’). Overall (‘total’) results from combined explained and unexplained contributions.

The tables display the means for independent variables, coefficients (effects), testing results, and the contribution to total ECI variation by factor [% diff]. The latter are provided in brackets in the remaining paragraphs. We deem the overall contributions as significant only if both the explained and unexplained contributions are also significant.

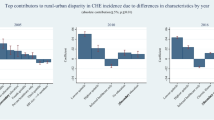

Figures 7 and 8 illustrate the results of the decomposition analysis on inequality for EFB10 and EFB25, respectively. The figures only include data labels for significant results (p-values ≤ 0.05).

Explained (endowments) and unexplained (coefficients and interactions) results from Oaxaca-Blinder decomposition inequality (Erreygers Concentration Index) increase in excessive financial burden at 10% threshold between 2014–19. Data labels are provided only for results with p-values < 0.05 (**p ≤ 0.01, *p ≤ 0.05). Source: authors calculations

Explained (endowments) and unexplained (coefficients and interactions) results from Oaxaca-Blinder decomposition of inequality (Erreygers Concentration Index) increase in excessive financial burden at 25% threshold between 2014–19. Data labels are provided only for results with p-values < 0.05 (**p ≤ 0.01, *p ≤ 0.05). Source: authors calculations

From 2014–19, EFB inequality shifted further in disfavor of households in the lower half of the wealth spectrum. The ECI for EFB10 fell by 41.05%, from -0.0799 to -0.1130, while EFB25’s ECI worsened by 67.03% from -0.0370 to -0.0618. Most of these can be attributed to unexplained variations in effects and interactions from a few factors.

Overall variations (mean and effect variations) in urbanization had a significantly worsening contribution to EFB10 (-70.06%) and EFB25 inequality (-63.35%). Population ageing, or rather the increase in means of the share of older people in households, mitigated EFB10 (-9.21%) and EFB25 inequality (-7.90%). Conversely, the means variations in households with children under five didn’t significantly alter inequality. However, variations in effects significantly exacerbated EF10 (52.44%) and EFB25 inequality (54.84%). Similarly, variations in effects for the share of household members living with disabilities significantly contributed to EFB10 (30.44%) and EFB25 inequality (27.56%).

Despite no variation in HEF coverage, improvements in its effects notably lessened inequality for both EFB10 (-26.31%) and EFB25 (-22.22%). Concurrently, the increase in mean free healthcare explained a smaller but significant mitigation of EFB10 (-7.13%) and EFB25 (-5.36%).

The jump in consumption of durable goods explained part of the increase in EFB10 (39.94%) and EFB25 inequality (23.87%). Higher education expenditure only significantly explained the change in EFB10 inequality (10.52%).

The variations in the prevalence of illness and injuries among household members had the highest overall contribution to EFB25 (134.52%), particularly in their effects (118.15%). However, only variations in means significantly worsened EFB10 inequality (16.31%). The increased share of household members suffering from long illnesses explained a worsening EFB10 inequality (12.13%). However, the changes in effect for the factor mitigated EFB25 inequality (-20.48%).

Of non-illness-related healthcare needs and utilization subcategories, only preventive services contributed overall to mitigating EFB10 inequity (-78.96%) and EFB25 (-55.04%). These were among the largest in the decomposition. In comparison, and despite a substantial rise, maternity care had a small mitigative contribution to EFB25 inequality (-4.64%) only.

In general, healthcare seeking had no significant contributions to changes in EFB inequality, except for medical healthcare seeking explaining a worsening in EFB10 inequality (14.88%). Having household members stopping regular activities also explained the worsening in EFB10 (7.77%) and EFB25 inequality (6.57%). Similarly, having household members hospitalized members contributed to a further deterioration of EFB10 (5.46%) for EFB10 inequality (9.15%).

OOPHE and OOPHE funding sources' contributions to inequality were mixed. Variations in means mitigated inequality, but variations in effects counterbalanced the latter. Overall, the increase and change in effect in OOPHE mitigated EFB10 inequality (-4.94%) and worsened EFB25 inequality (5.04%). For savings-financed OOPHE, this contributed to an overall worsening in EFB10 (41.89%) inequality. In contrast, overall changes in borrowing-financed OOPE mitigated EFB10 inequality (-7.13%). Similarly, overall changes in OOPHE financed through selling assets and production mitigated EFB10 (-1.28%) and EFB35 inequality (-3.47%).

Discussion

This study delves in-depth into the evolution, determinants, and inequality of FB in Cambodia over a decade. It departs from the standard definition of healthcare expenditure financial shocks, CHE, by adopting an ‘excessive financial burden’ measurement that separates OOPHE from the total household consumption, and wealth socio-economic ranking approach to asserting inequalities. Our findings diverge from previous and recent conclusions from publications using the standard CHE and consumption aggregates, which found a financial burden in middle consumption quintiles of the population and somewhat positive time trends [24, 25, 27, 110].

Our results suggest that while more stringent, EFB25 can identify instances of the financial burden that CHE misses (Fig. 2). These also indicate that EFB25 helps identify more severe cases of financial burden that the CHE measure may not detect. The results suggest that the EFB measures are more sensitive in asserting FB than standard CHE. EFB10, in particular, appears to be a comprehensive measure, capturing a wide range of economic shocks, including those identified by CHE and additional cases.

In addition to more effectively capturing economic shocks, the revised methods showed a fairer representation of inequality, as shown by contrasting the Lorentz concentration curves for CHE and EFB25 (Fig. 3). The difference in behavior can mainly be attributed to excluding OOPHE from the denominator in EFB and using our wealth index as an alternative to total consumption for socio-economic ranking.

Evolution of healthcare-related financial burden (2009–19) and distribution

The past decade saw a striking rise in FB nationally, especially amongst the poorest households, accentuating a growing disparity in healthcare affordability. Nearly a quarter of all households in the lowest quintile faced EFB10, and one in 10 experienced EFB25 by 2019. The doubling in incidences among the two lowest quintiles is noteworthy, contrasting with the non-significant rise in EFB10 for the wealthiest quintile.

Geographically, urban areas and regions like Phnom Penh faced lower burdens than rural areas, suggesting that location plays a significant role in determining healthcare expenditures. EFB10 incidence more than doubled in urban areas outside Phnom Penh, and almost tripled for EFB25. More than a fifth of households in rural areas experienced EFB10 in 2019.

By 2019, EFB25 incidence impacted one in ten fully-female households and one in eight households with disabled or handicapped members. Almost a third of households with healthcare needs or consumption experienced EFB10, and one in eight EFB25. Among households with members suffering from long diseases, the figures rose to a staggering two-fifths for EFB10.

The observations align with global patterns, where urban–rural disparities in healthcare access and affordability pervade, often attributed to disparities in infrastructure, income, and health policies [81, 111,112,113,114,115,116]. For example, Jiang et al. (2019) illustrated that despite over 95% of China's population having public medical insurance, significant disparities in healthcare service utilization and OOPHE across varied income groups persist, especially revealing more healthcare needs and CHE risks among rural residents [117].

Inequality over time

Reflecting the trends in FB, inequality in the distribution of EFB worryingly increased over time. Alarming is that this trend is uncoupled from the inequality in household consumption, overall healthcare visits, or hospitalizations, which did not significantly change over the decade. The available data does not enable us to account for the quality of services or the type of provider sought; most likely, the inequalities in these are substantial. Inequalities were markedly higher among households with healthcare consumption or needs, but patterns remained similar to those of the general population.

From 2009–19, despite a tripling of OOPHE, both in constant terms and as a portion of total consumption, OOPHE inequality remained unchanged across the population and those consuming or requiring healthcare. However, from 2014–19, income-financed OOPHE leaned towards wealthier households, whereas borrowing-financed OOPHE prevailed among poorer ones, with borrowing emerging as a predominant EFB coping strategy. Concurrently, average household debt over 2009–19 more than decupled and became pro-wealthy, whereas illness-related debt quadrupled but remained equitable. This may be related to a surge in micro-financing access over the past decade [97, 100, 118].

Over the studied period, healthcare-seeking indicators shifted from pro-wealthy to more nuanced, with illness-related metrics like illness/injury incidence, healthcare provider visits, hospitalizations, and lost productivity days increasingly concentrated among the poor by 2019. Within the subgroup needing or consuming healthcare, inequalities lessened yet shifted towards wealthier households, notably in non-illness-related care needs such as maternity care and preventive services.

The concentration of HEF coverage and free healthcare among less wealthy households is a positive finding, and suggests only a limited misallocation of HEF cards, contrary to previous evidence [25]. However, as HEF coverage reported in the CSES did not significantly change between 2014–19, contrary to what would have been expected from official figures. Thus, it seems critical to look at overall exemptions from OOPHE, allocation of HEF benefits, and their distribution.

Across 2009–19, overall use of free healthcare in the preceding 12 months and 30 days significantly increased, barring exemptions via local poor lists. Although distribution remained pro-poor, especially between 2009–14, inequality in these variables diminished from 2014–19. Nevertheless, the average exemptions per household and the percentage of households spared from OOPHE when seeking care in the preceding 30 days increased.

Despite certain positive trends, concerns arise regarding equity from the distribution of FB, debt, and constrained access to exemptions and social health protection coverage. EFB has increasingly burdened the poorest households over time. Notably, only a small portion of the 40% of the population at the lower end of the socio-economic spectrum benefited from exemptions. This persistent inequity and resultant population segregation potentially threaten the social cohesion essential for fair-sustainable socio-economic development [119].

Determinants of financial burden

The zero-inflated model highlighted several variables significantly associated with households’ likelihood to incur OOPHE and FB levels after adjusting for covariates. Larger, wealthier households, those with heads under 35, and those with children under five using NSSF-paid healthcare in the last year were particularly prone to OOPHE spending. Conversely, households in urban areas, those with members above 60, and those led by divorced or separated individuals exhibited reduced susceptibility.

Although households outside Phnom Penh were less likely to avoid spending or maintain FB under 10%, they were likelier to experience EFB at both thresholds. Urban areas were generally more likely not to spend on OOPHE but less likely to experience FB above 10%. No significant differences were found between the first two quintiles regarding likely FB levels. In comparison, the three wealthiest quintiles tended to maintain FB under 10% and were less likely to exceed this mark, a trend mirrored in rural areas. This, alongside significantly lower illness or injury prevalence in the three wealthiest quintiles, implies potential disparities in accessing expensive healthcare, presumably more qualitative.

Some health conditions significantly drive FB levels. The prevalence of neoplasms, endocrine, metabolic and digestive diseases, and injuries correlate with a higher likelihood of FB above 10%. These outcomes are consistent with existing literature discussing the financial toxicity of cancer [120,121,122]. The unanticipated positive association between high levels of FB and preventive services, which may encompass costly and capital-intensive elective health checks, warrants further research.

As anticipated, the number of household members hospitalized and the duration of hospitalization are significantly associated with FB levels. Households tend to encounter EFB25 beyond five inpatient days per hospitalization and when over three members sought medical healthcare in the past 30 days. Kastor and Mohanty [123] found comparable outcomes in India, where hospitalization for cancer was the most common diagnosis associated with CHE (79%).

Coping and financing strategies

Our findings show a strong association between EFB and income-alternative sources of financing for OOPHE, such as savings, borrowing, and selling assets. While the proportion of households using savings remained stable from 2014–19, the relative share of savings, borrowing, and selling assets in financing OOPHE declined, even as the share of households relying on them persisted. The incidence of loans specifically for illness costs halved from 2009–19. Nevertheless, a significant increase was observed in reliance on borrowing and asset sales for those encountering EFB between 2014–19.

No statistically significant relationship was found between school dropouts (children aged 6–17) and EFB after adjusting for other variables, despite a generally higher prevalence amongst those experiencing EFB. It should, however, be noted that we did not disaggregate between children's gender. Further, research in this area is also granted as gender-based discrimination has been reported in Cambodia [124].

These findings align with research from other low and middle-income countries encountering excessive OOPHE [125,126,127,128]. Furthermore, despite a decline in direct financing of OOPHE through savings, borrowing, and asset sales, the prospective long-term effects on future revenues, due to loan service demands and asset loss, might pave the way for deteriorated physical and mental health, and possibly diminish human capital [97, 129, 130].

Decomposition of inequality over time

The 2014–19 substantial increase in EFB inequality was mainly driven by an inequitable rise in a few factors across both thresholds. Urbanization was the primary mitigating factor across. However, population growth in the capital contributed significantly to rising inequality between rural and urban areas.

The protective effect of urbanization on EFB inequality posits ethical questions. It would be dystopian to promote policies to urbanize the entire country or actively relocate population groups. Leaving rural areas behind will necessarily contribute to a social divide, and rapid urbanization in the absence of social security will erode benefits from urbanization, as suggested by the negative effect of the increase in population in Phnom Penh on inequality.

Demographic changes alone do not explain the observed changes. Still, it is alarming that disability-based discrimination may have worsened, as suggested by changes in effects for the share of children under five, and people living with disabilities. Surprisingly, the increasing share of older people had a mitigating contribution. This finding may be due to wealthier households being more likely to have elderly members; either because they can afford healthcare or because they take on the burden of caring for elderly family members within large family networks. More worryingly, this association might be interpreted to suggest that wealthier households are more apt to provide the necessary healthcare for their members to reach older age.

Furthermore, the rapid rise in inequalities in durable goods consumption contributed to exacerbating EFB inequality across thresholds, and so did, to a smaller extent, education spending (but for EFB10 only). Worth noting was a mitigating but non-significant effect of education spending.

For EFB25 only, the rising discrimination towards the wealthy in unspecific loans contributed to rising inequality. Addressing this discrimination by promoting borrowing for illness costs should be cautiously interpreted. Kolesar et al. (2021) explore non-for-profit-commercial credits for healthcare [97]. The challenges in setting up such policies are substantial and should not be uncoupled from questions on their limited social solidarity.

The average OOPHE increase mitigated inequality, suggesting that the poor absorbed most of the rise. Most households did not have any OOPHE. Thus, a marginal increase in the mean technically decreased inequality as the differential between the high and low spenders was reduced. However, the changes in the OOPHE effect almost compensated for this for EFB10 inequality, and worsened EFB25 inequality.

Reducing the share of non-income-financing OOPHE was associated with mitigation of EFB. But as for OOPHE, discrimination in the availability of these coping strategies actually contributed to a deepening of inequality, particularly savings-financed OOPHE.

Unsurprisingly, the increase in the prevalence of illness or injury worsened inequality. However, its strong exacerbating effect on EFB25 inequality suggests that the adverse impact on the less-wealthy has worsened. On the positive side, despite substantial jumps, variations in prevalence activity days lost to illness, hospitalization, and seeking medical healthcare had comparatively modest contributions to increasing inequality. Also, rises in preventive care mitigated inequality substantially.

Improvements in HEF had a notable mitigating effect on inequality, suggesting gains in the effectiveness and equity of the system. However, no significant contribution could be found for coverage changes as this remained stable between 2014–19, at 10.3% of households. Furthermore, HEF-free healthcare in the 12 months decreased. This low coverage contrasts with the official figures for the latest year that we could find, 2017, of ~ 2.9 million people covered, or 18.3% of the population [92]. Worth noting, our estimates put NSSF coverage at 14.92% of households in 2019, close to the officially reported 2.3 million, or 14.4% of the population, in 2021 [27].

Conclusions

The overall increase in consumption may have contributed to making services more accessible and reducing the FB of the majority of the Cambodian population. However, our findings also show that the increase in material wealth has not benefited every household equitably. The continuous rise in FB, particularly among households in the lowest 40% of the wealth spectrum of the population, shows that the economic gains from peace and political stability of the last decades have yet to be redistributed and translated into the equitable financial burden needed to secure human capital growth. The increasing EFB inequality, the contribution of durable goods, and changes in the effects of the share of people living with disabilities and children under five suggest an urgent need for policy measures to secure social cohesion in Cambodia.

The nationwide extension of the HEF in 2015 marked a significant social policy intervention [92]. Our findings suggest that while HEF has gained in effectiveness and improved access to free healthcare, its impact on reducing FB and inequality is nuanced by its slow expansion. Our findings also illustrate that the concern of misallocation of HEF benefits to the non-poor is, to the most extent, unjustified and that an extension of exemptions and social health assistance through population or condition-specific targeting is a valid policy to reduce financial burden and inequality.

Extending social health protection to the entire population through the NSSF may be part of the solution to tackle inequality. However, the low average income from salaried work, minimum wage (~ US$200), and salary ceilings on contributions make redistributing the last decade’s economic growth unpractical through contributive health insurance only [99].

Following the COVID-19 pandemic, the Cambodian government expanded the IDPoor program in 2020 to include cash transfers to vulnerable families [98, 131]. The expansion of the program, further investments in quality public health services, expansion of the HEF, and removal of non-financial barriers to access healthcare may well contribute in the medium-term to reductions in inequality. Tables 5, 6, 7, 8, 9, 10, 11, 12 and 13

Appendix 1

Determinants of inequality in excessive financial burden

Results

Appendix Table 7 provides the results of RIF regression on the Erreygers Concentration index for EFB10 and EFB25 incidence in 2019. Coefficients were rescaled by a 100 factor.

Inequality in EFB is significantly influenced by where households live. A one percentage point (pp) increase in the share of households living in urban areas would increase the ECI for EFB10, and subsequently decrease inequality by 0.44%, from -11.28 to -11.23. The same variation would reduce inequality in EFB25 by 0.64%. A one pp increase in the share of households in Phnom Penh would increase inequality in EFB10 by 1.23% and 1.31% for EFB25.

Marginal variations in household size would, in general, not significantly influence inequality, except for increases in the number of small households with 1–2 members. A one pp increase in the share of these would reduce inequality by 0.69% inequality in EFB10.

Increasing the share of elderly, people 60 years old and over, among household members by one pp would decrease inequality by 1.21% and 1.34% for EFB10 and EFB25, respectively. It is worth noting that neither the share of children under five years old nor people living with disabilities has significant marginal effects on inequality.

Only marginal variations among household heads with higher levels of education would significantly influence inequality. A one pp increase in this category would increase inequality by 1.29% for EFB10 and 1.44% for EFB25.

Neither social protection marginal changes in coverage through HEF nor NSSF significantly influence inequality. However, an overall increase in OOPHE exemptions of one pp across households would reduce inequality by 1.26% for EFB10 and 1.32% for EFB25.

Not all health conditions had significant marginal effects on inequality. However, an increase of one pp in respiratory infections would increase inequality in EFB10 by 3.21% and in EFB25 by 4.65%. Increases in circular disease prevalence would increase inequality in EFB10 by 2.73% and EFB25 by 1.39%. A similar increase in preventive services awareness or intake would decrease inequality in EFB10 by 2.20% and EFB25 by 2.90%.

Among the variables on health-seeking behavior considered (hospitalization rates, activity days lost, and inpatient days per hospitalization), only hospitalizations significantly influenced inequality. An increase in one pp of hospitalizations increases inequality in EFB10 by 1.52% and 3.27% in EFB25.

Depending on the primary purpose of the loan, this significantly influences inequality in EFB. An increase in the average loan related to illness of 1 INT$ per 100 household members (equivalent to 1 cent INT$ per member per capita) decreases inequality in EFB10 by 2.47%. Unspecified loans significantly influence inequality in EFB25. However, their effect is weaker, with inequality increasing by 0.20%.

Unsurprisingly, marginal variations in total consumption and OOPHE affect inequality distribution most. An increase in EXP one INT$ per 100 household capita would increase inequality in EFB10 by 14.91% and 10.20% in EFB25. However, the same increase in OOPHE would decrease inequality in EFB10 by 63.88% and 63.75% in EFB25.

The source of financing of OOPHE significantly and strongly influences inequality in EFB10 and, in most cases, in EFB25. An increase in one pp in the funding of OOPHE through savings increases inequality in EFB10 by 1.13% and 0.95% in EFB25. The same increase in financing of OOPHE through borrowing increases inequality in EFB10 by 7.84% and in EFB25 by 9.9%. Financing OOPHE through selling assets increases inequality in EFB10 by 10.55% but does not significantly influence EFB25.

Discussion

The RIF regression analysis on EFB’s ECI revealed that the increase in urban-dwelling households, small households (1–2 members), the share of elderly in households, preventive services consumption and needs, OOPHE exemptions, average per capita illness loan, and average per capita OOPHE significantly and positively impacted inequality reduction across EFB thresholds. Conversely, residing in Phnom Penh, higher education level of household heads, prevalence of respiratory infectious and circulatory system diseases, number of hospitalized household members, total per capita consumption, and an elevated share of non-income-financed OOPHE from all sources exerted significant negative effects. However, neither circulatory system disease prevalence nor the proportion of selling-assets-financed OOPHE significantly influenced EFB25 inequality.