Abstract

In the study of molybdenum deposits and most other minerals deposits, including copper, lead and zinc, there is speculation that most undiscovered ore results from an increase (or “growth”) in the estimated size of a known deposit due to factors such as exploitation and advances in mining and exploration technology, rather than in discovering wholly new deposits. The purpose of this study is to construct a nonlinear model to estimate deposit “growth” for known deposits as a function of cutoff grade. The model selected for this data set was a truncated normal cumulative distribution function. Because the cutoff grade is commonly unknown, a model to estimate cutoff grade conditioned upon the deposit grade was constructed using data from 34 deposits with reported data on molybdenum grade, cutoff grade, and tonnage. Finally, an example is presented.

You have full access to this open access chapter, Download chapter PDF

Similar content being viewed by others

Keywords

- Porphyry molybdenum

- Deposit growth

- Cutoff grade

- Truncated cumulative distribution model fitting and estimation

- Confidence and prediction intervals for nonlinear estimation

1 Introduction

Initial estimates of a mineral deposit size based on limited data usually underestimate the ultimate size of a mineral deposit, often by a significant amount. The initial size estimate may be of only marginal interest but the size estimate after some exploration and development can be of significant interest. The steps in this process are the subject of this chapter. “Mineral resources” are defined as concentrations or occurrences of material of economic interest in or on the Earth’s crust in such form, quality, and quantity that there are reasonable prospects for eventual economic extraction (Zientek and Hammarstrom 2014), and the term “mineral reserves” is restricted to the economically mineable part of a mineral resource.

The reported size of known mineral or oil and gas deposit reserves recorded in the mining literature typically increases through time as subsequent development drilling and mining enlarge the deposit’s footprint. This phenomenon is referred to as “deposit growth”. In a sense, a deposit is never finished “growing” until it is completely mined out. Research on the growth of a deposit’s reserves has been a topic of investigation for many years within the United States Geological Survey. Drew (1997) illustrated the growth of oil and gas fields over time in the United States and determined that a large percentage of the ultimate production of a region could come from deposit growth, if the forecast was made early enough in the discovery process. Long (2008) defined reserve growth as the ratio of current reserves plus past production to original reserves. He examined reserve growth in porphyry copper deposits and found that about 20% of porphyry copper mines in the Western Hemisphere had experienced reserve growth of a factor of 10 or better over initial reserves. Reserve growth at these mines added reserves comparable in size to reserves added through discovery of new deposits during the same time period.

Three variables are required to estimate the ultimate size of a deposit: (1) the grade of the deposit, (2) cutoff grade of the deposit, and (3) associated tonnage of ore at successive points in the development of the deposit (Long 2008). The grade of a deposit is defined as the relative quantity of ore mineral within the orebody, typically expressed as a percentage (or g/t). The grade may vary across an orebody, but commonly an average grade may be applied to the orebody as a whole. A cutoff grade is the lowest grade of mineralized material that qualifies as economically mineable and available in a given deposit (Committee for Mineral Reserves International Reporting Standards 2006). Mined material with a grade below the cutoff grade is not processed into metal but is set aside. As deposit development and mining progress, over time the cutoff grade usually declines in an orderly manner. Tonnage is typically reported in metric tons (mt) and includes the mass of total production, reserves and resources of pre-mined material.

The purpose of this study was to construct a nonlinear model to estimate the incremental deposit “growth” for known mineralized areas as a function of cutoff grade, using porphyry molybdenum deposits as an example. Porphyry molybdenum deposits are related to granitic plutons, mostly of Tertiary age, and are formed by hydrothermal fluids associated with the emplacement of granites. They typically occur as large tonnage, low-grade deposits that are commonly mined using open-pit methods.

Two issues must be addressed to predict porphyry molybdenum deposit growth. The first is that, in many instances, the cutoff grade is not available for a given deposit and thus must be estimated. Thus, the first part of this study uses the known molybdenum grade of a deposit to predict probable cutoff grade. The second part of this study in turn uses this predicted cutoff grade to estimate deposit growth as a function of cutoff grade. Two data sets were used in this study. Nearly all porphyry molybdenum deposits used in this study are for unworked deposits; that is, deposits that have been delineated by drilling but are yet unmined. The first data set (Appendix 1) consists of 34 porphyry molybdenum deposits used to model molybdenum cutoff grade in percent (COG) as a function of molybdenum deposit grade, also expressed in percent. The second data set (Appendix 2) is used to model the deposit growth as a function of cutoff grade. The references to Appendices 1 and 2 are Barnes et al. (2009), Baudry (2009), Becker et al. (2009), British Columbia Ministry of Energy and Mines (2012, 2014a, b), Chen and Wang (2011), Ewert et al. (2008), General Moly (2012), Geological Survey of Finland (2011), Geoscience Australia (2012), Kramer (2006), Lowe et al. (2001), Ludington and Plumlee (2009), Mercator Minerals (2011), Mindat.org (1992, 2011), Nanika Resources Inc (2012), Northern Miner (2010), Raw Minerals Group (2011), RX Exploration Inc (2010), Singer et al. (2008), Smith (2009), Taylor et al. (2012), Thompson Creek Metals Company Inc (2011), TTM Resources Inc (2009), US Geological Survey (2011), Wu et al (2011), Yukon Geological Survey (2005). The authors know of no subset of publications that cite the deposits presented in Appendices 1 and 2.

2 Cutoff Grade as a Function of Deposit Grade

The first and most straightforward of the two models to analyze is the relationship between molybdenum cutoff grade (Mo COG, %) as a function of molybdenum deposit grade (Mo Grade, %) for the 34 deposits shown in Appendix 1. A scatter plot between these two variables plus a fitted linear regression line, 95% confidence intervals, and 95% prediction intervals are shown in Fig. 20.1.

The model to fit cutoff grade U as a function of deposit grade D is

where \( \varepsilon \) is the random error, assumed to be normal \( N(0,\sigma^{2} ) \). The constant c is determined from the linear regression fit since the \( {\text{COG}} \ge 0 \).

The fitted model is:

where \( \hat{U} \) is the estimated cutoff grade in percent and D is the deposit grade in percent. The residual standard error is 0.012 on 32 degrees of freedom and the adjusted R2 = 0.61. The model is statistically significant and reasonable for the given data set. The residual plot is shown in Fig. 20.2.

Residuals versus deposit grade for the linear model fit (Fig. 20.1)

There is no evidence to suggest that the residuals are non-normal. Thus, within the domain of the deposit grade, namely from 0.03 to 0.13, the linear model shown above appears to be appropriate. Predictions outside of this interval will depend on the same linear relationship holding.

3 Deposit Growth as a Function of Cutoff Grade

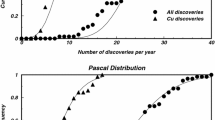

The second model is the fraction of growth as a function of estimated cutoff grade. In this example the growth data (Fig. 20.3) consists of 58 observations from eight deposits (Appendix 2). The inverse S shaped form of the data corresponds to an inverse cumulative distribution function. Therefore, this relationship is modeled as an inverse cumulative distribution function, since the fraction growth is a number between 0 and 1, inclusive. Several models including the gamma, lognormal, normal and their left truncated forms were candidates to fit this data. Of these, the left truncated normal was the best fit by visual inspection and by a nonlinear least squares fit. The form of the left truncated normal probability distribution function is:

where \( \varTheta^{\prime } = (\mu ,\sigma^{2} ) \) and the left truncation point \( \lambda \) is assumed known. The probability density function for the normal distribution with mean \( \mu \) and standard deviation \( \sigma \) is:

The corresponding left truncated cumulative distribution function, cdf, is:

The truncated distributions’ models used for model fitting are from the package truncdist (r-project.org) by Novomestky and Nadarajah (2012) based upon work by Nadarajah and Kotz (2006).

As Fig. 20.1 shows, there is uncertainty in the COG when estimated from the deposit grade. However, when estimating the left truncated normal cumulative distribution function (cdf), the estimates are conditioned upon the COG being known. A possible alternative is an errors-in- variables approach (Schennach 2004) where both the fraction growth and cutoff grade are considered to be random variables.

The chosen optimization criterion to estimate the fraction growth (Fig. 20.3) is

where x i is the ith COG and F is the cumulative distribution function. \( \hat{\varTheta } \) contains the estimated parameters. If F is a normal distribution the parameters would be \( \hat{\mu } \) and \( \hat{\sigma } \). The ith COG is represented by x i and \( \hat{F}(x_{i} ) \). Note that \( \hat{F}(x_{i} ) = 1 - \hat{G}(x_{i} ) \) where \( \hat{G}(x_{i} ) \) is the fraction growth. The nonlinear least squares package used to estimate the left truncated normal model parameters is nls2 (r-project.org). See Grothendieck (2013). The left truncation point is \( \lambda = 0 \).

Deposit growth as a function of cutoff grade was modeled for each of the eight deposits (not shown). These results indicate that the data could have been generated from the same population Thus, the observations were pooled and a single model was fit. The reason to fit a cumulative distribution function was twofold. One was that eight deposits were used so the data was not in the form of a stepwise function. The second was that the data were not randomly or systematically spaced across the domain of the empirical distribution. The data, expressed as an empirical distribution function, together with the cumulative left truncated normal distribution fit and confidence intervals, are shown in Fig. 20.4. The results of the least square fit were \( \hat{\mu } = 0.0609 \) and \( \hat{\sigma } = 0.0282 \). The residual sum of squares, RSS = 0.3631.

The 95% confidence and prediction intervals for nonlinear estimation are approximate. The confidence interval shown in Fig. 20.4 (dashed lines) is from package propagate, r-project library predictNLS programmed by Spiess (2014) based upon work by Bates and Watts (2007), and others. It uses a second-order Taylor series expansion and Monte Carlo simulation. The second order approximation captures the nonlinearities around f(x). A corresponding algorithm for the prediction interval has not been developed. The prediction interval shown in Fig. 20.4 (dotted lines) is based upon a linear model of the form \( H = \alpha_{0} + \alpha_{1} U + \varepsilon \) where U was the COG. H is a linear estimate of growth. The next step was to estimate the upper and lower prediction intervals for the linear model with U = 0, 0.001, 0.002, …, 0.150. These are vectors LPIu and LPIl respectively. The upper and lower 95% nonlinear confidence interval vectors estimated above are CIu and CIl respectively. The differences between the linear prediction intervals and the nonlinear confidence intervals are computed as follows. Let Lud = LPIu − CIu and Lld = CIl − LPIl. The estimated upper and lower predictions intervals, UP and LP, for the nonlinear fit (Fig. 20.4) are UP = CIu + Lud and LP = CIi − Lld. These estimates appear reasonable in the given domain, namely for COG between 0.04 and 0.10.

A histogram of the residuals, which appear normal, is shown in Fig. 20.5. The truncated normal probability density function corresponding to the cumulative distribution function (Fig. 20.4) and COG data are shown in Fig. 20.6.

Figure 20.7 is like Fig. 20.4 except that the variable plotted on the vertical axis is the fraction growth as opposed to the cumulative distribution. There is no suggestion that the model illustrated in Fig. 20.7 is universal, even for molybdenum deposits. Clearly different deposits may require different models.

4 An Example

Suppose the problem is to estimate the fraction growth corresponding to a COG (%) = 0.06 using the model shown in Fig. 20.7. Then, given that the assumed distribution is a truncated normal at zero with estimated model parameters, \( \hat{\mu } = 0.0609 \) and \( \hat{\sigma } = 0.0282 \), the results are shown in Table 20.1. The point estimate of fraction growth, namely 0.479, is straightforward to compute. Namely it is:

The confidence and prediction intervals are more difficult to compute; however, the R code is available on request from John Schuenemeyer.

5 Conclusions

Mineral deposit growth commonly constitutes most unknown resources. The growth considered in this study is due to a progressively lower cutoff grade, which may be unknown. In this study, a statistical model was constructed to model cutoff grade as a function of deposit grade, followed by construction of a model to estimate the fraction growth as a function of cutoff grade. This latter model involves estimation of a truncated normal distribution and second order Taylor series estimates to characterize uncertainty.

References

Barnes A, Thomas D, Bowell RJ et al (2009) The assessment of the ARD potential for a ‘Climax’ type porphyry molybdenum deposit in a high Arctic environment: Skellefteå, Sweden, In: 8th international conference on acid rock drainage securing the future (ICARD), p 10

Baudry P (2009) Zuun Mod porphyry molybdenum-copper project, South-Western Mongolia: China: Minarch-Mineconsult Independent technical report dated June 2009 prepared for Erdene Resource Development Corporation (Project No. 3421 M), p 147

Becker LA, Gustin MM, Drielick PE et al (2009) NI 43-101 Technical Report, Creston Project, Pre-feasibility study, Sonora, Mexico: Tucson, Ariz., M3 Engineering & Technology Corporation and Golder Associates, and Reno, Nev., Mine Development Associates, 23 March 2008, to Creston Moly Corp., Vancouver, British Columbia, p 273

British Columbia Ministry of Energy and Mines (2012) Ajax, Le Roy: British Columbia Ministry of Energy and Mines MINFILE No. 103P 223

British Columbia Ministry of Energy and Mines (2014) Huber, Mineral Hill, Butte, Granby, Lone Pine, Independent: British Columbia Ministry of Energy and Mines MINFILE No. 093L 027

British Columbia Ministry of Energy and Mines (2014) Kitsualt, Clary Creek, B.C. Molybdenum, Alice, Lime Creek Lynx, Cariboo, MINFILE Record No. 103P 120

Bates D, Watts D (2007) Nonlinear regression analysis and its applications. Wiley-Interscience

Chen Y, Wang Y (2011) Fluid inclusion study of the Tangjiaping Mo deposit, Dabie Shan, Henan Province: implications for the nature of the porphyry systems of post-collisional tectonic settings. Int Geol Rev 53(5–6):635–655

Committee for Mineral Reserves International Reporting Standards (2006) International reporting template for the reporting of exploration results, mineral resources, and mineral reserves

Drew LJ (1997) Undiscovered petroleum and mineral resources. Assessment and controversy. Plenum Press, New York, pp xiii + 210

Ewert WD, Puritch EJ, Armstrong TJ et al (2008) Technical report and resource estimate on the Carmi molybdenum deposit kettle river property, Greenwood Mining Division, British Columbia: Brampton, Ontario, P&E Mining Consultants Inc., Effective date: 4 August 2008, Signing data: 25 September, 2008; for Hi Ho Silver Resources Inc., Mississauga, Ontario, p 97

General Moly (2012) Mt. Hope. web pages @ http://www.generalmoly.com/properties_mt_hope.php. Accessed 8 Nov 2010

Geological Survey of Finland (2011) Large unexploited deposits in Fennoscandia. web pages @ http://en.gtk.fi/ExplorationFinland/fodd/largeunexpl_060508.htm. Accessed 15 March 2011

Geoscience Australia (2012) Australian Mines Atlas of minerals resources, mines and processing centres, Geoscience Australia. web pages @ http://www.australianminesatlas.gov.au/?site=atlas&tool=search. Accessed 12 June 2012

Grothendieck G (2013) Non-linear regression with brute force. R package nls2. contact: ggrothendieck@gmail.com

Kramer B (2006) Mountain of controversy, tribe’s history, future clash in face of mine proposal: SpokesmanReview.com, Web pages @ http://www.spokesmanreview.com/tools/story_pf.asp?ID=116309. Accessed 16 Dec 2010

Long K (2008) Economic life-cycle of porphyry copper mining, In: Spencer JE, Titley SR (eds) Ores and orogenesis; Circum-Pacific tectonics, geologic evolution, and ore deposits: Arizona Geological Society Digest 22, pp 101–110. Ores and orogenesis; Circum-Pacific tectonics, geologic evolution, and ore deposits: Arizona Geological Society Digest 22, pp 101–110

Lowe C, Enkin RJ, Struik LC (2001) Tertiary extension in the central British Columbia intermontane belt: magnetic and paleomagnetic evidence from the Endako region. Can J Earth Sci, vol 38, pp 657–678

Ludington S, Plumlee GS (2009) Climax-type porphyry molybdenum deposits. U.S. Geological Survey Open-File Report 2009–1215, p 16

Mercator Minerals (2011) Molybrook: mercator minerals. http://www.mercatorminerals.com/s/OtherProjects.asp. Accessed 8 May 2013

Mindat.org (1992) Buckingham mine (Hardy mine; Bentley mine; O’Leary mine), Battle Mountain District, Lander Co., Nevada, USA: Mindat.org. web page @ http://www.mindat.org/loc-60116.html. Accessed 29 Oct 2010

Mindat.org (2011) Mačkatica ore field, Čemernik Mts., Serbia; Mindat.org. web page @ http://www.mindat.org/loc-40789.html. Accessed 21 Jan 2011

Nadarajah S, Kotz S (2006) R programs for computing truncated distributions. J Stat Softw http://www.jstatsoft.org/v16/c0. Accessed 16 Aug 2006

Nanika Resources Inc (2012) Management discussion and analysis for the six months ended 31 March 2012. Form 51-102F1, Nanika Resources Inc., filed 30 May 2012, p 12

Northern Miner (2010) Canadian & American MINESCAN Folio, 2009–2010, CD ROM

Novomestky F, Nadarajah S (2012) R-project, package truncdist, updated 20 Feb 2015. contact: fnovomes@poly.edu

Raw Materials Group (2011) Sphinx molybdenum deposit, Canada. Raw Materials Group. Web page @ http://www.rmg.se/RMDEntities/S2/Sphinx_Molybdenum_Deposit_SPHIMO.html. Accessed 26 April 2011

RX Exploration Inc (2010) Drumlummon gold mine, Marysville, Montana, USA. RX Exploration Inc. Web pages @ http://www.pdac.ca/pdac/conv/2009/pdf/core-shack/cs-drumlummon-gold.pdf. Accessed 3 March 2010

Schennach SM (2004) Estimation of nonlinear models with measurement error. Econometrica 72(1):33–75

Singer DA, Berger VI, Moring BC (2008) Porphyry copper deposits of the world: database and grade and tonnage models, 2008. U.S. Geological Survey Open-File Report 2008-1155, p 45

Smith JL (2009) A study of the Adanac Porphyry Molybdenum Deposit and surrounding placer gold mineralization in Northwest British Columbia with a comparison to porphyry molybdenum deposits in the North American Cordillera and Igneous geochemistry of the Western United States, University of Nevada, unpublished Master’s Thesis, p 198

Spiess AN (2014) Package propagate. contact: a.spiess@uke.uni-hamburg.de

Taylor RD, Hammarstrom J, Piatak NM, Seal RR II (2012) Arc-related porphyry molybdenum deposit model, chap. D of Mineral deposit models for resource assessment. U.S. Geological Survey Scientific Investigations Report 2010–5070–D, p 64

Thompson Creek Metals Company Inc (2011) Annual report pursuant to section 13 or 15(d) of the Securities Exchange Act of 1934, for the fiscal year ended 31 December 2011: United States Securities and Exchange Commission Form 10-K, p 140. Web Pages @ http://www.thompsoncreekmetals.com/s/Annual_Report.asp?DateRange=2011/01/01…2011/12/31. Accessed 4 June 2012

TTM Resources Inc (2009) TTM Chu Molybdenum Project accepted by BC and Canadian Environmental Assessment Agencies & SGS Lakefield preliminary metallurgical results: TTM Resources Inc. Press Release dated 4 May 2009. Web pages @ http://ttmresources.ca/english/wp-content/documents/09-05-04.pdf. Accessed 26 March 2010

U.S. Geological Survey (2011) Buckingham molybdenum deposit: mineral resource data system (MRDS) deposit ID 10155557. Web pages @ http://tin.er.usgs.gov/mrds/show-mrds.php?dep_id=10310305. Accessed 17 Dec 2010

Wu H, Zhang L, Wan B et al (2011) Re-Os and 40Ar/39Ar ages of the Jiguanshan porphyry Mo deposit Xilamulun metallogenic belt, NE China, and constraints on mineralization events. Miner Deposita 46:171–185

Yukon Geological Survey (2005) Red Mountain: Yukon MINFILE No. 105C 009. Web pages @ http://data.geology.gov.yk.ca/Occurrence/12735. Accessed 1 April 2011

Zientek ML, Hammarstrom JM (2014) Mineral resource assessment methods and procedures used in the global mineral resource assessment. In: Zientek ML, Bliss J, Broughton DW et al (eds) Sediment-hosted stratabound copper assessment of the Neoproterozoic Roan Group, Central African Copperbelt, Katanga Basin, Democratic Republic of the Congo and Zambia: U.S. Geological Survey Scientific Investigations Report 2010–5090–T, Appendix A, pp 54–64

Acknowledgements

Data used in this chapter represent part of an extensive and ongoing data compilation effort on porphyry molybdenum deposit types. This study evolved over several years through discussions with current and former U.S. Geological Survey employees including Arthur A. Bookstrom, Mark D. Cocker, Robert J. Kamilli, Keith R. Long, Steve Ludington, Barry C. Moring, Greta J. Orris, Ryan D. Taylor, Jay A. Sampson, and Gregory T. Spanski. Eric Seedorf, University of Arizona, Tucson provided his bibliography on porphyry molybdenum deposits, which was of considerable use in this study.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Appendices

Appendix 1

Porphyry molybdenum data for 34 selected deposits used to model molybdenum cutoff grade as a function of deposit grade.

[Country and state codes: AUQL = Australia, Queensland; CHHN = China; CHNA = China; CNBC = Canada, British Columbia; CNNF, Canada, Newfoundland and Labrador; CNON = Canada, Ontario; CNYT = Canada, Yukon Territory; GRLD = Greenland; MCDA = Macedonia; MNGA = Mongolia; MXCO = Mexico; RUSA = Russia; USAK = USA, Alaska; USID = USA, Idaho; USMT = USA, Montana; USNV = USA, Nevada; USWA = USA, Washington]

Name | ID | Country-State | Mo grade (%) | Deposit size (Mt) | Mo COG (%) |

|---|---|---|---|---|---|

Ada nac-Ruby Creek | 101 | CNBC | 0.042 | 791 | 0.020 |

Adjax-Le Roy | 102 | CNBC | 0.062 | 552 | 0.040 |

Anduramba | 103 | AUQL | 0.054 | 32 | 0.014 |

Bald Butte | 106 | USMT | 0.059 | 176 | 0.040 |

Big Ben | 108 | USMT | 0.092 | 245 | 0.060 |

Buckingham | 110 | USNV | 0.063 | 1800 | 0.043 |

Cannivan Gulch-White Cloud | 111 | USMT | 0.056 | 327 | 0.040 |

Carmi | 113 | CNBC | 0.057 | 40 | 0.026 |

Cave Creek | 114 | USTX | 0.130 | 28 | 0.060 |

Chu | 115 | CNBC | 0.050 | 673 | 0.017 |

Creston | 118 | MXCO | 0.071 | 215 | 0.059 |

Endako | 124 | CNBC | 0.050 | 1232 | 0.020 |

Jiguanshan (Jiganshuan) | 130 | CHNA | 0.095 | 100 | 0.060 |

Joem-Haskin Mountain | 131 | CNBC | 0.101 | 11 | 0.050 |

Kitsault (Updated 11/2015) | 132 | CNBC | 0.070 | 688 | 0.048 |

Lobash | 140 | RUSA | 0.063 | 365 | 0.030 |

Lone Pine | 143 | CNBC | 0.072 | 179 | 0.020 |

Lucky Ship | 144 | CNBC | 0.064 | 85 | 0.015 |

Mac | 145 | CNBC | 0.048 | 248 | 0.035 |

Malmbjerg | 148 | GRLD | 0.118 | 229 | 0.072 |

Moly Brook | 151 | CNNF | 0.049 | 199 | 0.010 |

Mount Hope | 152 | USNV | 0.039 | 1148 | 0.014 |

Mount Tolman | 156 | USWA | 0.056 | 2200 | 0.029 |

Pidgeon-Lateral Lake | 163 | CNON | 0.083 | 59 | 0.040 |

Pine Nut | 165 | USNV | 0.060 | 181 | 0.028 |

Qua rtz Hill | 167 | USAK | 0.082 | 1310 | 0.030 |

Red Bird-Haven Lake | 169 | CNBC | 0.049 | 201 | 0.010 |

Red Mountain | 170 | CNYT | 0.100 | 187 | 0.067 |

Sphinx | 178 | CNBC | 0.035 | 62 | 0.010 |

Storie Molie | 180 | CNBC | 0.049 | 105 | 0.000 |

Sudulica-Mackatica-Kucisnjak-Groznatova Dolina | 146 | MCDA | 0.030 | 383 | 0.005 |

Tangjiaping | 183 | CHHN | 0.063 | 373 | 0.020 |

Thompson Creek | 184 | USID | 0.086 | 575 | 0.038 |

Zuun Mod | 195 | MNGA | 0.052 | 408 | 0.050 |

Appendix 2

Molybdenum data for estimating fraction deposit from cutoff grade; n = 58

Deposit name | COG (%) | Fraction growth | Deposit name | COG (%) | Fraction growth |

|---|---|---|---|---|---|

Adanac-Ruby Creek | 0.095 | 0.113 | Moly Brook | 0.095 | 0.126 |

Adanac-Ruby Creek | 0.085 | 0.168 | Moly Brook | 0.085 | 0.180 |

Adanac-Ruby Creek | 0.075 | 0.247 | Moly Brook | 0.075 | 0.258 |

Adanac-Ruby Creek | 0.065 | 0.351 | Moly Brook | 0.065 | 0.365 |

Adanac-Ruby Creek | 0.055 | 0.470 | Moly Brook | 0.055 | 0.504 |

Adanac-Ruby Creek | 0.045 | 0.581 | Moly Brook | 0.045 | 0.673 |

Adanac-Ruby Creek | 0.035 | 0.679 | Moly Brook | 0.035 | 0.831 |

Adanac-Ruby Creek | 0.025 | 0.864 | Moly Brook | 0.025 | 0.941 |

Ajax | 0.095 | 0.037 | Moly Brook | 0.015 | 0.991 |

Ajax | 0.085 | 0.087 | Red Bird | 0.105 | 0.107 |

Ajax | 0.075 | 0.202 | Red Bird | 0.095 | 0.160 |

Ajax | 0.065 | 0.450 | Red Bird | 0.085 | 0.226 |

Ajax | 0.055 | 0.765 | Red Bird | 0.075 | 0.305 |

Ajax | 0.045 | 0.956 | Red Bird | 0.065 | 0.409 |

Bald Butte | 0.070 | 0.333 | Red Bird | 0.055 | 0.540 |

Bald Butte | 0.055 | 0.623 | Red Bird | 0.045 | 0.687 |

Bald Butte | 0.045 | 0.875 | Red Bird | 0.035 | 0.833 |

Cannivan | 0.075 | 0.296 | Red Bird | 0.025 | 0.935 |

Cannivan | 0.065 | 0.426 | Red Bird | 0.015 | 0.984 |

Cannivan | 0.055 | 0.593 | Storie | 0.088 | 0.320 |

Cannivan | 0.045 | 0.854 | Storie | 0.063 | 0.518 |

Lucky Ship | 0.095 | 0.260 | Storie | 0.045 | 0.685 |

Lucky Ship | 0.085 | 0.337 | Storie | 0.038 | 0.768 |

Lucky Ship | 0.075 | 0.426 | Storie | 0.033 | 0.827 |

Lucky Ship | 0.065 | 0.523 | Storie | 0.025 | 0.907 |

Lucky Ship | 0.055 | 0.634 | Storie | 0.015 | 0.977 |

Lucky Ship | 0.045 | 0.767 | Storie | 0.005 | 0.998 |

Lucky Ship | 0.035 | 0.891 | |||

Lucky Ship | 0.025 | 0.963 | |||

Lucky Ship | 0.015 | 0.985 | |||

Lucky Ship | 0.005 | 0.993 |

Rights and permissions

<SimplePara><Emphasis Type="Bold">Open Access</Emphasis> This chapter is licensed under the terms of the Creative Commons Attribution 4.0 International License (http://creativecommons.org/licenses/by/4.0/), which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license and indicate if changes were made.</SimplePara> <SimplePara>The images or other third party material in this chapter are included in the chapter's Creative Commons license, unless indicated otherwise in a credit line to the material. If material is not included in the chapter's Creative Commons license and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder.</SimplePara>

Copyright information

© 2018 The Author(s)

About this chapter

Cite this chapter

Schuenemeyer, J.H., Drew, L.J., Bliss, J.D. (2018). Predicting Molybdenum Deposit Growth. In: Daya Sagar, B., Cheng, Q., Agterberg, F. (eds) Handbook of Mathematical Geosciences. Springer, Cham. https://doi.org/10.1007/978-3-319-78999-6_20

Download citation

DOI: https://doi.org/10.1007/978-3-319-78999-6_20

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-319-78998-9

Online ISBN: 978-3-319-78999-6

eBook Packages: Earth and Environmental ScienceEarth and Environmental Science (R0)