Abstract

This paper applies fractional integration and cointegration methods to examine respectively the univariate properties of the four main cryptocurrencies in terms of market capitalization (BTC, ETH, USDT, BNB) and of four US stock market indices (S&P500, NASDAQ, Dow Jones and MSCI for emerging markets) as well as the possible existence of long-run linkages between them. Daily data from 9 November 2017 to 28 June 2022 are used for the analysis. The results provide evidence of market efficiency in the case of the cryptocurrencies but not of the stock market indices considered. The results also indicate that in most cases there are no long-run equilibrium relationships linking the assets in question, which implies that cryptocurrencies can be a useful tool for investors to diversify and hedge when required in the case of the US markets.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Since the creation of Bitcoin (Nakamoto, 2008) cryptocurrencies have rapidly become a global phenomenon and generated new investment opportunities with important implications for portfolio diversification and hedging decisions. In the last decade numerous papers have analysed them from various perspectives, both at a theoretical and empirical level. Examples include studies applying the extreme value theory (Gkillas and Katsiampla, 2018), modelling their volatility linkages with other markets (Carrick, 2016), examining their predictive power (Watorek et al., 2020), their degree of persistence (Caporale et al., 2018) and other characteristics such as sustainability (Giudici et al., 2019), and carrying out tests regarding the efficient market hypothesis (Gil-Alana et al., 2020), etc.

Another strand of the literature focuses on whether or not cryptocurrencies are linked to other types of assets, which has implications for whether or not they are suitable for diversification and hedging purposes. For instance, Corbet et al. (2018) followed the connectedness approach of Diebold and Yilmaz (2012) and found only short-run spillovers between cryptocurrencies and more traditional assets. Kurka (2019) used the same framework as well as the Spillover Asymmetry Measure (SAM) of Barunik (2016) and found evidence of asymmetries in the transmission of shocks between Bitcoin and other assets. They also detected spillovers over some of the sub-samples, which implies that diversification/hedging strategies can only work at times. Stensas et al. (2019) estimated GARCH models and concluded that Bitcoin is useful for diversification purposes in the case of developed (but not developing) countries. Further (though weaker) evidence consistent with these findings was provided by Klein et al. (2018). Caferra and Tomas-Vidal (2021) used instead a wavelet coherence approach and also estimated a Markov Switching autoregressive model; their results are more supportive of a possible hedging role for cryptocurrencies.

Some more recent papers have focused specifically on the effects of the Covid-19 pandemic on the relationship between cryptocurrencies and other assets. Their purpose was to establish whether the former could serve as safe havens or hedges during that period. For instance, Kumar et al. (2022) found that dynamic connectedness with stock markets increased during the pandemic, thus cryptocurrencies could not insulate portfolios from the crisis. Shahzad et al. (2021) used a cross-quantilogram approach and concluded that Bitcoin and gold are weak hedges. Gonzales et al. (2020) reported some evidence implying that cryptocurrencies were more effective than gold to control risk during the Covid-19 crisis. Gonzales et al. (2021) found that connectedness between gold price returns and cryptocurrency returns increased sharply during the first wave of the pandemic.

The present study revisits these issues by examining linkages between the four main cryptocurrencies in terms of market capitalisation (Bitcoin, Ethereum, Tether and Binance Coin, for which the corresponding figures as of July 2022 are $439.39bn, $196.77bn, $65.90bn and $46.53bn respectively) and four US stock market indices (S&P500, Nasdaq, Dow Jones and MSCI emerging markets. It makes an important contribution to this area of the literature by using a fractional integration/cointegration approach which provides evidence on the long-run linkages and is more general and flexible than the standard framework based on the I(0) versus I(1) (stationary versus non-stationary) dichotomy used in most previous studies. Specifically, it allows for fractional values of the differencing (cointegration) parameter, thus it encompasses a much wider range of stochastic processes. The data are daily and cover the period from 9 November 2017 to 28 June 2022. The empirical results provide useful information to investors for portfolio choices and diversification/hedging strategies (Urquhart, 2016). The paper is organised as follows: Sect. 2 describes the data; Sect. 3 presents the empirical analysis; Section offers some concluding remarks.

2 Data

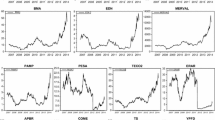

We analyse daily data from Yahoo Finance on four cryptocurrencies (Bitcoin- BTC; Ethereum—ETH; Tether- USDT; and Binance Coin—BNB) and four US stock market indices (S&P500, NASDAQ, Dow Jones and MSCI for emerging markets). The sample goes from 9 November 2017 (since some cryptocurrencies were not being traded before then) to 28 June 2022, therefore the data cover a period of 1165 trading days. Note that data for holidays or weekends are available for cryptocurrencies but not for stock market indices. As a result, when analysing the relationships between the two series weekdays only are considered in order to match them. Figures 1 and 2 display stock market and cryptocurrency prices respectively. Table 1 reports some descriptive statistics for all series, whilst Fig. 3 shows their correlation coefficients. It can be seen that the Dow Jones has the highest value and MSCI the lowest one whilst the Nasdaq has the highest mean and standard deviation in the case of the stock market indices; as for the cryptocurrencies, USDT has the highest mean and standard deviation and BNB the lowest ones. Concerning the correlations, they are generally high between the stock market indices but not between them and the four cryptocurrencies considered; as for the latter, there appear to be strong linkages only BTC, ETH and BNB.

3 Empirical Results

3.1 Univariate Analysis

As a first step, we carry out univariate analysis using fractional integration methods. The estimated model is the following:

where yt stands for the series of interest (the log of stock market indices and cryptocurrencies respectively); α and β are unknown parameters to be estimated, specifically a constant and a (linear) time trend, xt is assumed to be I(d) (where d is a real value estimated from data), B is the backshift operator, i.e., Bxt = xt-1, and ut is I(0) by assumption. Note that the model above can be re-written as:

where

and ut is I(0) by assumption, which implies that standard t-tests remain valid. Following (Robinson, 1994) the estimation is carried out using a Whittle function in the frequency domain as in many other long-memory studies, and the series are logged to smooth them.

Tables 2, 3, 4, 5 display the estimates of d along with the 95% confidence bands for the differencing parameter for three different specifications, namely i) without deterministic terms, i.e. setting α = β = 0 in (1); ii) with a constant only, i.e. setting β = 0 in (1); and iii) with a constant and a linear time trend. The coefficients in bold are those from the model selected in each case on the basis of the statistical significance of the deterministic terms. Table 2 reports the estimates of d when assuming that ut in (1) is a white noise process. Table 4 presents those for the case of autocorrelated disturbances based on the non-parametric approach of Bloomfield (1973) rather than a classical AutoRegressive Moving Average (ARMA) structure. Tables 3 and 5 display instead the estimated coefficients of the selected models.

Under the assumption of white noise residuals (see Tables 2 and 3) both the constant and the time trend are found to be significant in the case of Bitcoin, S&P500 and Nasdaq. In all other cases only the constant is significant. Concerning the estimates of d, in the case of stock market indices they are quite large and close to 1. Note, however, that the confidence intervals are quite wide, such that all values are strictly below 1 and the I(1) hypothesis is rejected in favor of some degree of mean reversion (d < 1). This implies that shocks only have transitory effects. By contrast, the I(1) hypothesis (no mean reversion) cannot be rejected for any of the four cryptocurrencies, the lowest value of d (0.46) being estimated for USDT. This evidence suggests that the Efficient Market Hypothesis (EMH), which in its weak form requires prices to be random, holds for the cryptocurrencies but not for the stock market indices under examination.

When allowing instead for autocorrelated residuals (see Tables 4 and 5) the estimated values of d are slightly higher than in the previous case. Evidence of unit roots (or lack or mean reversion) is found for all four stock market indices and three out of the four cryptocurrencies, USDT being the only exception.

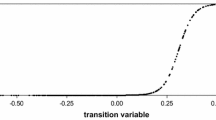

3.2 Bivariate Analysis

Next we test for fractional cointegration between each series and all others on a pairwise basis, thus examining all 16 possible pairings. Specifically, we use the two-step method proposed by Engle and Granger (1987). This involves running regressions between each pair of series in the first step, and then in the second step estimating the value of the differencing parameter d as in Eq. (1) for the residuals from those regressions. Note that the confidence intervals for the purpose of statistical inference are obtained using Monte Carlo simulations. The reason is that the residuals from the regression are estimated and not observed values, which produces a bias (see, e.g., Gil-Alana, 2003). The results are shown in Table 6 for the case of autocorrelated disturbances (similar results, not reported to save space, were obtained under the assumption of white noise errors). As can be seen, in most cases the unit root null hypothesis (d = 1) cannot be rejected, the only exceptions being the pairings of the Nasdaq and the S&P500 respectively with USDT. In other words, in most cases there is no evidence of a long-run equilibrium relationship linking the assets in question. Consequently, it would normally be possible for investors to use cryptocurrencies for diversification or hedging purposes in the case of the US markets.

4 Conclusions

This paper applies fractional integration methods to examine the univariate properties of the four main cryptocurrencies in terms of market capitalization (BTC, ETH, USDT, BNB) and of four US stock market indices (S&P500, NASDAQ, Dow Jones and MSCI for emerging markets). Then the possible existence of long-run linkages between these two sets of series is examined using a fractional cointegration approach. Daily data from 9 November 2017 to 28 June 2022 are used for the analysis. The results provide evidence of market efficiency in the case of the cryptocurrencies but not of the stock market indices examined. They also indicate that in most cases there are no long-run equilibrium relationships linking the assets in question. This implies that cryptocurrencies can be a useful tool for investors to diversify and hedge when required in the case of the US markets. These findings are broadly consistent with previous evidence reported by Gonzales et al. (2020) and Shahzad et al. (2021). As mentioned before, some other studies reach instead the opposite conclusion, namely they find stronger linkages implying that cryptocurrencies were not a useful hedge and/or safe haven during the Covid-19 crisis (see, e.g., Kumar et al., 2022). However, such papers focus on dynamic connectedness, whilst ours sheds light on the long-run properties of the relationships under investigation. Thus our analysis provides more useful information to investors in terms of the appropriate asset choices to insulate their portfolios from falls in stock prices.

Future work could carry out some robustness checks using other (semi-parametric) methods (Geweke & Porter-Hudak, 1984; Shimotsu & Phillips, 2006) for the univariate analysis and the FCVAR approach of Johansen and Nielsen (2010, 2012) for the multivariate one. It could also allow for nonlinearities in the long memory framework (Gil-Alana & Cuestas, 2016; Yaya et al., 2021).

References

Baruník, J. (2016). Asymmetric connectedness on the U.S. stock market: Bad and Good volatility spillovers. Journal of Financial Markets, 27, 55–78.

Caferra, R., & Tomás-Vidal, D. (2021). Who raised from the abyss? A comparisson between cryptocurrency and stock market dynamics during the COVID-19 pandemic. Finance Research Letters, 43, 101954.

Caporale, G. M., Gil-Alana, L., & Plastun, A. (2018). Persistence in the cryptocurrency market. Research in International Business and Finance, 46, 141–148.

Carrick, J. (2016). Bitcoin as a complement to emerging market currencies. Emerging Markets Finance and Trade, 52(10), 2321–2334.

Corbet, S., Meegan, A., Larkin, C., Lucey, B., & Yarovaya, L. (2018). Exploring the dynamic relationships between cryptocurrencies and other financial assets. Economics Letters, 165, 28–34.

Diebold, F. X., & Yilmaz, K. (2012). Better to give than to receive: Predictive directional measurement of volatility spillovers. International Journal of Forecasting, 28(1), 57–66.

Engle, R., & Granger, C. W. J. (1987). Cointegration and error correction: Representation, estimation and testing. Econometrica, 55(2), 251–276.

Geweke, J., & Porter-Hudak, S. (1984). The estimation and application of long memory time series models. Journal of Time Series Analysis, 4(4), 221–237.

Gil-Alana, L. A. (2003). Testing fractional cointegration in macroeconomic time series. Oxford Bulletin of Economics and Statistics, 65(4), 517–524.

Gil-Alana, L. A., Abakah, E. J., Madigu, G., & Romero-Rojo, F. (2020). Volatility persistence in cryptocurrency markets under structural breaks. International Review of Economics & Finance, 69, 680–691.

Gil-Alana, L. A., & Cuestas, J. (2016). A nonlinear approach with long range sependence based on Chebyshev polynomials. Studies in Nonlinear Dynamics and Econometrics, 16(5), 445–468.

Giudici, G., Milne, A., & Vinogradov, D. (2019). Cryptocurrencies: Market analysis and perspectives. Journal of Industrial and Business Economics, 47, 1–18.

Gkillas, K., & Katsiampa, P. (2018). An application of extreme value theory to cryptocurrencies. Economics Letters, 164, 109–111.

González, M. O., Jareño F. & Skinner, F. S. (2020). Portfolio effects of cryptocurrencies during the Covid 19 Crisis’ in: Billio, M. & Varotto S. (eds.). A new world post COVID-19. Venice, Italy: Edizioni Ca’ Foscari - Digital Publishing, 2020. pp. 149 - 154.

González, M. O., Jareño, F., & Skinner, F. S. (2021). Asymmetric interdependencies between large capital cryptocurrency and Gold returns during the COVID-19 pandemic crisis. International Review of Financial Analysis. https://doi.org/10.1016/j.irfa.2021.101773

Johansen, S., & Nielsen, M. (2010). Likelihood inference for a nonstationary fractional autoregressive model. Journal of Econometrics, 158, 51–66.

Johansen, S., & Nielsen, M. (2012). Likelihood inference for a fractionally cointegrated vector autoregressive model. Econometrica, 80, 2667–2732.

Klein, T., Thu, H. P., & Walther, T. (2018). Bitcoin is not the New Gold–A comparison of volatility, correlation, and portfolio performance. International Review of Financial Analysis, 59, 105–116.

Kumar, A., Iqbal, N., Mitra, S. K., Kristoufek, L., & Bouri, E. (2022). Connectedness among major cryptocurrencies in standard times and during the COVID-19 outbreak. Journal of International Financial Markets, Institutions & Money, 77, 101523.

Kurka, J. (2019). Do cryptocurrencies ai traditional asset classes influence each other? Finance Research Letters, 31, 38–46.

Nakamoto, S. (2008). Bitcoin: A peer-to-peer Electronic cash system. Retrieved from Klausnorby: https://klausnordby.com/bitcoin/Bitcoin_Whitepaper_Document_HD.pdf

Robinson, P. (1994). Efficient tests of nonstationary hypotheses. Jounral of the American Statistical Association, 89, 1420–1437.

Shahzad, S. J. H., Bouri, E., Rehman, M. U., & Roubaud, D. (2021). The hedge asset for BRICS stock markets: Bitcoin, gold, or VIX. World Economy, 45(1), 292–316.

Shimotsu, K., & Phillips, P. (2006). Local whittle estimation of fractional integration and some of its variants. Journal of Econometrics, 130(2), 209–233.

Simotsu, K., & Peter, P. C. (2005). Exact local whittle estimation of fractional integration. Annals of Statistics, 33(4), 1890–1933.

Stensås, A., Nygaard, M. F., Kyaw, K., & Treepongkaruna, S. (2019). Can bitcoin be a diversifier, hedge or safe haven tool? Cogent Economics and Finance, 7, 1.

Urquhart, A. (2016). The inefficiency of bitcoin. Economics Letters, 148, 80–82.

Watorek, M., et al. (2020). Multiscale characteristics of the emerging global cryptocurrency market. Physics Reports, 901(17), 1–82.

Yaya, O., Ogbonna, A., Furuoka, F., & Gil-Alana, L. (2021). A new unit root test for unemployment hysteresis based on the autoregressive neural network. Oxford Bulletin of Economics and Statistics, 83(4), 960–981.

Acknowledgements

Comments from the Editor and a reviewer are also gratefully acknowledged.

Funding

Luis A. Gil-Alana gratefully acknowledges financial support from the Grant PID2020-113691RB-I00 funded by MCIN/AEI/10. 13039/ 501100011033.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

There is no conflict of interest with the publication of the present manuscript.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Caporale, G.M., de Dios Mazariegos, J.J. & Gil-Alana, L.A. Long-Run Linkages Between us Stock Prices and Cryptocurrencies: A Fractional Cointegration Analysis. Comput Econ (2024). https://doi.org/10.1007/s10614-023-10510-3

Accepted:

Published:

DOI: https://doi.org/10.1007/s10614-023-10510-3