Abstract

The emergence of Islamic finance as an alternative financial investment area and the increasing political and economic uncertainty around the world necessitated an examination of the relationship between these two factors. This study examines the impact of four important global uncertainty and risk indicators “Global Economic Policy Uncertainty-GEPU, Geopolitical Risk Index-GPR, World Uncertainty Index-WUI, and CBOE Volatility Index-VIX” on two important Islamic stock market indices (Dow Jones Islamic Market Index and Bist Participation 100) using wavelet coherence (WTC) and asymmetric Fourier TY analyzes Quarterly data for the period March 2011–June 2023 were used in the study. The results of the analysis show that economic instability indicators impact Islamic equity market indices (both in Turkey and the world). This effect is determined as VIX, GEPU, GPR, and WUI. In addition, the fact that the GPR and WUI indices, which have an impact on conventional markets, have truly little and only a partial impact on Islamic equity markets is an important finding. The results of this study make important contributions to the literature and provide important findings for investors and policy makers.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Economic policy uncertainty, geopolitical risk, and fear are both push and pull factors that lead to capital flows in financial markets. For this reason, these factors are considered to be among the most important risk factors affecting investor behavior in global markets (Erdoğan et al., 2022). Global risk factors have significant effects on the real economy (goods and factor markets) and financial markets. For this reason, risk, uncertainty, and fear, which are the main components of global risk factors, have been among the most discussed topics among researchers, policy makers, and financial analysts in recent years. In the early days, the effects of global risk factors on variables such as economic growth and development, unemployment, inflation, exchange rate, foreign trade, and foreign capital investments on the real economy have been the subject of frequent research in the literature. However, in recent years, especially after the emergence of behavioral finance theory, which was developed based on Keynesian arguments with the works of Friedman (1957), Kahneman and Tversky (1974), Langer (1975), Kahneman and Tversky (1979) and Fama (1991), the effects of global risk factors on stock returns and stock market volatility on financial markets have become the focus of research (Bayar & Kılıç, 2012; Emsen, 2022; Ghani & Ghani, 2023).

Volatilities that arise in an economy due to global risk factors have significant effects on both commodity and factor markets and financial markets. In an unstable environment dominated by global risk factors in the economy, economic activities will become difficult, slow down, and even come to a halt. The recession caused by the risk, uncertainty, and fear that emerged with the COVID-19 pandemic in many other sectors, especially in the sub-branches of the services sector (tourism, transportation, accommodation, food and beverage, entertainment, etc.), can be shown as an example. Such an economic environment will limit not only the macroeconomy but also the activities of companies on a microscale and even cause bankruptcies (Emsen, 2022). These and similar effects of global risk factors on the macro and micro economy will have adverse effects on “economic growth and development, employment, general price level, foreign trade, exchange rates, interest rates, balance of payments and foreign capital investments”.

Global risk factors can affect not only commodity and factor markets but also domestic and foreign investors, financial markets and especially equity markets (such as stock returns and stock price volatility). In the literature, the effects of global risk factors on stock markets are negative (Adam & Yacob, 2022; Dakhlaoui & Aloui, 2016; Erdoğan et al., 2022; Hoque & Zaidi, 2020; Jung et al., 2021; Kannadhasan & Das, 2020; Kirikkaleli, 2020; Ko & Lee, 2015). However, some studies also show that global risk factors have a positive effect on stock markets (Amtiran & Indiastuti, 2017; Bossman & Gubareva, 2023; Brogaard et al., 2015; Erdoğan et al., 2022).

In an economy dominated by global risk factors, domestic and foreign investors either abandon their investments or move their investments to safer and more stable environments because they do not feel secure. In this case, underdeveloped and developing economies that do not have sufficient capital experience even more capital shortages, decrease in stock returns, crash their stock markets, and even face economic crises (Erdoğan et al., 2022). From this viewpoint, it is extremely important for underdeveloped and developing countries to manage the risk well or to control global risk factors in terms of “economic growth and development and financial development” processes (Table 1).

In addition to the negative effects of an economic environment dominated by global risk factors, sometimes limited positive effects may occur. While the shocks experienced in an economy due to global risk factors and the resulting economic and political fluctuations may affect the capital costs of the companies, this situation causes the stock price of the companies to increase and improves the stock returns of the companies (Amtiran & Indiastuti, 2017; Erdoğan et al., 2022).

Due to the fundamentals in the structure and systematics of Islam and the fact that Islamic finance has some advantages over conventional finance, it has become a very important issue to address the factors affecting these markets. Due to the emergence of Islamic finance as an alternative financial investment area and its ever-growing structure, Dow Jones Islamic Market World representing the world stock markets and BIST Participation 100 representing the Turkish stock markets are analyzed in this study. In this way, it has become essential for investors to investigate to what extent this investment area is affected by these four instabilities. A review of the literature reveals that very few studies have examined the effects of these indices on Islamic markets. In this study, four instability indicators are evaluated in terms of their impact on world and Turkish stock markets.

The main objective of this study is to analyze the impact of uncertainty called global risk factor (“global economic policy uncertainty index and world uncertainty index”), risk (geopolitical risk index), and volatility or fear (CBOE Volatility Index-VIX) on the Dow Jones Islamic and Borsa Istanbul (BIST) Participation 100 stock markets. This study is expected to make significant contributions to the existing literature in various aspects. The first of these is the subject of this study. Although there are many studies in the literature that deal with the impact of global risk factors on stock markets, there are very few studies that analyze their effects on the Islamic and BIST Participation 100 stock markets. In this context, this study is expected to make a significant contribution to this gap in the literature. Another important contribution of the study is the wavelet analysis method When the studies in the related literature are examined, it is seen that generally time series, ARDL and NARDL approaches, panel data analysis, and Fourier analyzes are preferred. Variables in financial markets have a heterogeneous, non-stationary structure with many structural changes and volatility. For these reasons, time information can be lost in the models preferred in the literature, loss of time information can prevent the opportunity to define structural changes, and it becomes difficult to distinguish temporary relationships between variables from permanent relationships. Wavelet analysis prevents the emergence of these problems and provides a healthier way to determine the relationship between the variables.

The study consists of five (5) chapters. Following the introductory part of the study, in the second part, the literature review dealing with the relationship between global risk factors and stock market, in the third part, the definition of the variables in the analysis, the analysis method to be applied, and the formulations of the tests, and in empirical test results are expressed in figures. Findings, conclusions, and policy recommendations are discussed in the fifth section (Fig. 1).

2 Literature Review

A review of the literature on the relationship between global risk factors and the stock market reveals that there are studies that examine economic uncertainty (Adam & Yacob, 2022; Amtiran & Indiastuti, 2017; Balcilar et al., 2019; Ben Ghozzi & Chaibi, 2022; Dakhlaoui & Aloui, 2016; Emsen, 2022; Erdoğan et al., 2022; Ghani & Ghani, 2023; Hoque & Zaidi, 2020; Kannadhasan & Das, 2020; Kirikkaleli, 2020; Ko & Lee, 2015; Li et al., 2020; Liang et al., 2020), which is one of the sub-branches of global risks, as well as geopolitical risks (Balcilar et al., 2018; Bouras et al., 2019; Hoque & Zaidi, 2020; Kannadhasan & Das, 2020; S. Lee et al., 2021; Sohag et al., 2022; Adam & Yacob, 2022; Bossman & Gubareva, 2023) and systematic risks (such as volatility in oil prices, inflation, interest rates and exchange rates) (Burlacu et al., 2012; Duarte, 2013; Fahmi et al., 2017; Pudji, 2017; Al Shubiri & Jamil, 2018; Demiralay, 2019; Liang & Wei, 2020; Baykut & Diyar, 2021; Mohanty et al., 2021; Gouveia, 2022; Adam & Yacob, 2022; Boons et al., 2020; Ogiemudia et al., 2022; Laopodis, 2022; Cikiryel et al., 2022; Khan, 2023a; Khan, 2023b; Khan & Gunwant, 2024; Akram et al., 2023), climate change risk (Danni & Finance, 2009; Faccini et al., 2021; Giang et al., 2021; Gong et al., 2022; Wu et al., 2022) and epidemic risk (Anh & Gan, 2021; Chatjuthamard et al., 2021; Davis et al., 2020; Duppati et al., 2023; Marobhe & Kansheba, 2022; Moslehpour et al., 2022; Raza Rabbani et al., 2023; Shear et al., 2020; Tan, 2021; Yilanci & Pata, 2022). The literature review part of the study has been designed to discuss the relationship between “each global risk factor and the stock market”.

From studies dealing with the relationship between economic policy uncertainty and the stock market, Ko and Lee (2015) analyzed the relationship between “the economic policy uncertainty index and stock prices” in 11 countries using data for the period 1998–2014. The findings of the study revealed that an increase in the economic policy uncertainty index would decrease stock prices. Dakhlaoui and Aloui (2016) examine the volatility spillovers between BRIC stock prices and US economic policy uncertainty using the cross-correlation function rounding technique described by Cheung and Ng (1996). This study covers data from 1997 to 2011. The research results reveal that the average return spread between BRIC stock indices and US uncertainty is negative, whereas the volatility spread varies between negative and positive values. Amtiran and Indiastuti (2017) investigated the relationship between “political risk and stock returns” in Indonesia during the 2007–2015 period using weighted least squares regression. When the findings were examined, it was determined that there was a positive relationship between political risks and stock returns. Balcilar et al. (2019) investigated the forecast of stock returns in Hong Kong, Malaysia, and South Korea over the 1997/01–2012/03 month period considering policy uncertainties in Japan, China, the European region, and the United States. The findings of the study revealed that Linear Granger causality tests did not provide evidence of predictability, other than the fact that economic policy uncertainties in South Korea predicted stock returns. On the other hand, when causality testing is applied to nonparametric quantities, strong causality evidence is found for economic policy uncertainties in stock returns. Hoque and Zaidi (2020) investigated the relationship between the Malaysian stock market and global economic policy uncertainty using the GARCH model with data from 2003 to 2017. The findings revealed a negative relationship between global policy uncertainty and the Malaysian stock market. Li et al. (2020) examined the relationship between “stock market volatility and global economic policy uncertainty” in China during 2005–2017 using the GARCH-MIDAS method. The findings of this study revealed that global economic policy uncertainty will increase stock market volatility in China. Liang et al. (2020) analyzed the impact of uncertainties on stocks in 11 Asian stock markets using the nonlinear autoregressive distributed lag (NARDL) model with the help of data from 2000 to 2017. The findings revealed that uncertainties reduce stock prices. Kannadhasan and Das (2020) investigated the economic policy uncertainty of developing Asian countries and the effects of geopolitical risk on the stock market using a quantitative regression approach. When the results were examined, it was found that economic policy uncertainty had a negative relationship at all percentiles, GPR had a negative relationship at the lower percentiles, and a positive relationship at the middle and upper percentiles. On the other hand, the negative effect of EPU was found to be stronger than that of GPR. In addition, the dependance of stock returns on EPU and GPR is asymmetrical. Kirikkaleli (2020) investigated the effect of local factors (economic, financial and political risk) and external factors (global economic policy uncertainty) on the stock market index in Taiwan using quarterly data for the 1997Q1–2015Q2 period. According to the findings of the ARDL, DOLS, and Markov Switching tests, a negative relationship was found between economic, political, and financial risks and the stock market index. Adam and Yacob (2022) analyze the relationship between the stock market index in ASEAN countries and geopolitical risk, oil price, and global economic policy uncertainty using a two-stage Markov transition model with data covering the period 1997–2020. Empirical results have revealed that global policy uncertainty has a negative impact on stock returns during periods of high volatility. Ben Ghozzi and Chaibi (2022) analyze forty-six (46) developed and emerging markets over the 1995–2019 period. Using the ARCH model, this study analyzes the impact of political risk on stock returns and volatility. The findings reveal that political risks are positive for excess returns but negative for volatility. Erdoğan et al. (2022) examined the relationship between “real oil prices, country-specific geopolitical risk and global economic policy uncertainty” and “real stock returns” in Turkey over the period 1997:01–2020:12 using the NARDL (nonlinear autoregressive distributed lag) method. When the results were examined, it was determined that there was a negative relationship between global economic policy uncertainty and stock returns. Emsen (2022) investigated the effects of geopolitical risks and political uncertainties on stocks in 10 emerging Asian countries using data from 2001 to 2020. In this study, the stationarity of the series is analyzed by Hadri and Kurozumi (2012) test, and horizontal cross-section dependance is analyzed by the LM, LMS, CD, and LMBC LMBC tests. Co-integration relationships between variables are examined by Westerlund (2006) co-integration method with multiple structural breaks, while regression analyzes are evaluated by Eberhardt and Bond (2009) method. In the study, it was determined that high geopolitical risks decreased stock market returns in “Turkey, Korea, Russia, Indonesia and Malaysia”, while they increased them in India, Thailand, and the Philippines. The study also finds that high global economic and political uncertainty increases the stock market index for “Turkey, India and Malaysia” and decreases it for “Korea, China, Indonesia and Thailand”. Ghani and Ghani (2023) analyzed the relationship between “economic policy uncertainty and stock market” volatility in Pakistan and bilateral global trade partner countries, the United States, China, and the United Kingdom, using the GARCH-MIDAS model and combination forecasting approach. The findings revealed that the U.S. economic policy uncertainty index is the strongest predictor of stock market volatility. On the other hand, the Pakistan and China EPU indices do not have meaningful predictive information for volatility prediction.

One of the studies examining the relationship between geopolitical risk and the stock market, Balcilar et al. (2018), analyzed the relationship between geopolitical uncertainty and stock markets in BRICS countries using non-parametric quantitative causality tests through data for the period 1985–2016. The findings revealed that geopolitical uncertainty causes low volatility. Among the BRICS countries, Russia is the country most exposed to geopolitical risks, while India is the country with the lowest risk. Bouras et al. (2019) analyzed the impact of local and global geopolitical risks on stocks for 18 developing countries using the panel Generalized Autoregressive Conditional Variance (GARCH) approach with the help of data for the period 1998–2017. The results show that the positive impact of local geopolitical risks on stock market volatility is weak. The general findings of the study reveal that global geopolitical risks are stronger than local geopolitical risks. Hoque and Zaidi (2020) investigated the relationship between local and global geopolitical risk uncertainty and stock returns in “Brazil, India, Indonesia, South Africa, and Turkey” using a three-regime Markov shift approach from 2003 to 2017. The findings revealed that country-specific geopolitical risks negatively affect stock market performance, except in India. On the other hand, global geopolitical risks can have both positive and negative effects on equity market performance. Kannadhasan and Das (2020) use a quantile regression technique to examine the impact of economic policy uncertainty and geopolitical risk on the stock market in a sample of Asian countries. When the results were examined, it was determined that economic policy uncertainty had a negative relationship in all percentiles, and GPR had a negative relationship in the lower percentiles and a positive relationship in the middle and upper percentiles. On the other hand, the negative effect of EPU was found to be stronger than that of GPR. In addition, the dependance of stock returns on EPU and GPR has been found to be asymmetrical. S. Lee et al. (2021) investigated the relationship between geopolitical risk and stock returns in South Korea due to North Korea in the period 1996–2019 using the newly created geopolitical risk index. The findings revealed a negative relationship between geopolitical risk and stock returns”. Sohag et al. (2022) analyzed the relationship between geopolitical risk and stock market synchronization in the United States, China, and Russia using data for the period 1998–2021. Results obtained using the quantile-on-quantile framework showed that an increase in geopolitical risk reduces the total connectivity index. On the other hand, it has been determined that the response of bilateral commitment to the geopolitical risk related to the US-China and US-Russia bilaterals is negative. Adam and Yacob (2022) analyzed the relationship between the stock market index in ASEAN countries and geopolitical risk, oil prices, and global economic policy uncertainty using a two-stage Markov transition model with data for the period 1997–2020. Empirical results have revealed that global policy uncertainty has a negative impact on stock returns during periods of high volatility. On the other hand, geopolitical risks do not have a noticeable effect on ASEAN stock indices. Bossman and Gubareva (2023) investigated the relationship between the geopolitical risk caused by the Russia-Ukraine conflict and the stock market in 7 developing (E7) and developed (G7) countries using a non-parametric approach. The findings reveal that all E7 and G7 stocks respond positively to geopolitical risk, except for Russia and China.

From studies on the relationship between “systematic risks and the stock market”, Burlacu et al. (2012) discussed the relationship between “expected returns and risk” in the existing multi-asset rational expectations equilibrium (REE) model between 1965 and 2005. The findings reveal that a change in our variable from 1 to + 1 s will result in a 0.31% difference in average returns the following month. Duarte (2013) investigated the relationship between inflation risk and stock returns using the two-step Fama–MacBeth procedure. The findings reveal that inflation risk is priced in the cross-section of stock returns. Fahmi et al. (2017) analyzed the relationship between “systematic risk and stock return” in Malaysia using the arbitrage pricing theory (APT) framework. The results revealed that the relationship between the variables varies depending on the economic situation of the country, the time period, the variables used as independent variables, and the type of stock used to measure returns. Using panel data analysis, Pudji (2017) examined the relationship between systematic risk and stock prices in the LQ45 index over the period 2011–2015. When the results of the study were examined, it was found that the determinant of systematic risk had a negative effect on stock prices. Al Shubiri and Jamil (2018) investigated the unique risk of the banking sector in the Sultanate of Oman on stock market indicators, financial indicators, and oil using OLS regression with the help of data for the period 2009–2015. The findings revealed a statistically significant effect on all stock market indicators in the Securities Market 30 share price. Additionally, the direction of oil exports and total expenditures are also important. Demiralay (2019) examined the dependance of emerging European stock markets (“Bulgaria, Croatia, Czech Republic, Hungary, Poland, Romania, Russia, Turkey and Ukraine”) on global risk factors using a quantitative regression model with data from 2004 to 2013. The results show that larger stock markets such as Turkey, Poland, and Russia are sensitive to global factors, whereas Bulgaria is least sensitive. S. X. Liang and Wei (2020) evaluated the pricing of market volatility risk in 21 developed markets as a level risk. The pricing of the local market volatility risk factor was found to be a negative and systematic pricing factor in 21 market portfolios. The pricing of the global market volatility factor, on the other hand, was found to be a pricing factor in 21 established market portfolios. Baykut and Diyar (2021) applied the ARDL bound test approach using data from 2008 to 2020 to analyze the effect on stock market returns in BRICS-T countries. According to this analysis, a long-term relationship was found between the variables in all remaining countries except China. Mohanty et al. (2021) analyzed the relationship between “macroeconomic risk factors” and “shipping stock returns” using the quantile regression (QR) model with the help of data from 2001 to 2016. Examining the study results, asymmetric and heterogeneous dependence between certain “macroeconomic risk variables” and “stock returns” was detected. Gouveia (2022) aimed to compare risk-adjusted returns in emerging stock markets with those in developed stock markets, with the help of data for the period 2004–2021, and to identify the factors affecting the markets. In this regard, multiple linear regression analysis was performed. The results revealed that the S&P 500’s risk-adjusted returns over the period were higher than those of the SSE Composite. On the other hand, the US market index has higher returns and lower volatilities than the Chinese index. Adam and Yacob (2022), analyzed the relationship between the stock market index in ASEAN countries and geopolitical risk, oil prices, and global economic policy uncertainty using a two-stage Markov transition model with data from 1997 to 2020. Empirical results have revealed that global policy uncertainty has a negative impact on stock returns during periods of high volatility. On the other hand, geopolitical risks do not have a noticeable effect on ASEAN stock indices. Boons et al. (2020) empirically analyzed the relationship between “inflation risk and stock returns” during the period 1962–2014. These findings reveal that inflation risk is priced in stock returns. Ogiemudia et al. (2022) analyzed the relationship between “market risk and stock return” in Nigeria using a vector error correction model (VECM) with the help of data for the period 1980–2019. The findings of the study showed a significant causal relationship between stock returns and market risk factors in Nigeria. On the other hand, while interest and inflation rate risks and political instability risks have a non-significant effect on stock returns, exchange rate risks and oil price risks have a significant effect on stock returns. It has been determined that exchange rate, interest rate, inflation rate, and political instability risks adversely affect stock returns in the long term, whereas oil price risk positively affects stock returns. Laopodis (2022) examined the impact of risk factors on the stock returns of transportation companies listed on the New York Stock Exchange and the National Association of Securities Dealers Automated Listing (NASDAQ) between 2001 and 2019 using panel regression. The findings showed that some US-specific and global macro risks were statistically significant and impacted shipping stocks. On the other hand, Libor and G20 inflation rates also impact stock returns in companies listed on the NASDAQ. Cikiryel et al., (2022) examined the co-movement dynamics of Islamic stock returns with the help of data from the 2013–2019 period using the multivariate generalized autoregressive conditional heteroskedastic-dynamic conditional correlations, continuous wavelet transforms and maximum overlap discrete wavelet transform methods. The findings reveal a high correlation between the UK's Islamic stock market returns and those of Malaysia, India, Canada and the US. On the other hand, post-Brexit, a decreasing correlation has been found between UK Islamic stock markets and other selected markets. Khan (2023a) analyzed whether stock market investors in India can diversify their stock market portfolios compared to other Brazil, Russia, China and Southern African countries during the period 2013–2021. When the results of the DCC-MGARCH technique are examined, it is revealed that stock market volatility spreads from the Indian stock market to the stock markets of other BRICS countries in the short and long term. Khan (2023b) investigated the relationship between remittance inflows and sustainable economic growth in Brazil, Russia, China and India between 1976 and 2021. According to the a nonlinear autoregressive distributed lag model technique (NARDL) results used in the study, it has been determined that remittance inflows and economic growth in India have a positive relationship in the short and long term. Khan and Gunwant (2024) used data from the period 2000–2019 to estimate remittance inflows for the period 2020–2026. The results of the study applying the Box-Jenkins ARIMA technique suggest that the expected increase in remittance inflows in the next 6 years will correspond to 36.83% of the country's gross domestic product. Akram et al. (2023) analyzed the situation of return volatility between the financial markets of Pakistan and its important trading partners using the diffusion index approach model with the help of data for the period 1995–2019. The findings reveal that stock markets are effective for return and volatility spillovers.

From studies investigating the relationship between climate change risks and the stock market, Danni and Finance (2009) investigated the climate risk exposure and stock performance of some carbon-intensive sectors in Europe using data from the 2006–2008 period. The findings of this research revealed some price fluctuations that may indicate a correlation between the two elements. In addition, a positive relationship was found between the company’s carbon management performance and share performance. Giang et al. (2021) investigated the relationship between climate change risks and financial performance of manufacturing enterprises in Vietnam using data from 144 companies between 2015 and 2019. The findings revealed a negative relationship between climate change and financial performance. To assess the link between “climate change and the stock market” in the United States, Faccini et al. (2021) conducted a textual study of climate change-related stories in the press between 2000 and 2018. According to the data, only the climate policy element is valued in the US stock market. Moreover, the reported premium is consistent with investors' goals of hedging short-term transition risks. Wu et al. (2022) investigated the response of stock prices to climate risk information of companies in China between 2009 and 2021. In this research, transcripts containing companies’ performance briefings were used. The results suggest that a higher level of climate risk for companies leads to negative market reactions in the short term. Gong et al. (2022) empirically investigated how political uncertainty affects the stock market with the climate risk of an international firm, using firms from 34 countries with data for the period 2002–2019. The findings revealed significant changes in stock returns for firms with different climate risk levels during periods of political uncertainty. In addition, companies with high climate risk are exposed to high return volatility and return correlation in an environment of uncertainty caused by the US presidential elections.

From studies on the relationship between COVID-19 and the stock market, Davis et al. (2020) investigated this relationship. Empirical findings reveal that the COVID-19 epidemic has a negative impact on the returns of companies such as travel, traditional retail, aircraft production, and energy, while it has a positive impact on the returns of companies that are largely exposed to web services, health policy, e-commerce, telecommunications, and drug trials. Shear et al. (2020) examined the relationship between COVID-19 and stock market returns by taking data from 34 countries from January 23 to June 12, 2020. The findings revealed that the COVID-19 pandemic had a negative impact on stock market returns. In addition, the negative impact of investors on stock market returns is dominant in countries with a culture of uncertainty avoidance. Tan (2021) examined the impact of COVID-19 news on stock market returns using 2996 observations from 80 countries from January 22, 2020—April 17, 2020. The analysis determined that the possible impact of COVID-19 news on stock market returns differs across stock market segments. The study also found that the negative impact on the market decreases from lower brackets to upper brackets as the news about the pandemic increases. Anh and Gan (2021) investigated the relationship between the COVID-19 epidemic and stock returns in Vietnam from January 30 to May 30, 2020, using panel data regression analysis. When the findings were examined, it was determined that increases in COVID-19 cases negatively affected stock returns. On the other hand, it has been observed that the epidemic had a positive effect on stock returns during the quarantine period. Chatjuthamard et al. (2021) investigated the relationship between COVID-19 and the global stock market for 43 stock indices around the world using data between October 30, 2019—May 13, 2020. The findings revealed that increasing the number of cases reduces returns by increasing volatility and jumps. Moslehpour et al. (2022) examined global and Vietnamese stock markets affected by the COVID-19 epidemic. In the research, 1,170 observations were made between January 7, 2016–July 1, 2020. Examining the findings, it becomes clear that if COVID-19 becomes more widespread, systemic risks will change the volatility of the global stock market and multiple exchanges and become more relevant over time. The link between Vietnam and the global stock market index highlights the negative risk integration of major monetary systems during the COVID-19 period. Marobhe and Kansheba (2022) examined the relationship between “the COVID-19 pandemic and stock markets” using the panel vector autoregression method. The findings of the study revealed that COVID-19 containment measures had a positive impact on the stock market. Yilanci and Pata (2022) examined the relationship between the COVID-19 pandemic and exchange rates, stock prices, and government bond yields in Brazil and India from March 17, 2020 to May 8, 2021, using wavelet transform coherence (WTC) and continuous “wavelet transform (CWT)” techniques. When the findings were examined, it was found that while COVID-19 did not impact exchange rates, it increased government bond yields starting in 2021. On the other hand, it has been determined that the increase in COVID-19 cases also increases stock prices. Duppati et al. (2023) analyzed the impact of fuel price movements on stock market returns during the COVID-19 pandemic in 2020, using monthly data of seven selected stock market indices representing developed and developing economies. The results of the entropy transfer model and time-varying parameter VAR approach applied in the study show the existence of a high information flow from fuel prices to FTSE-100, Pacific and European stock indices. On the other hand, it has been determined that there is a two-way information flow relationship between stocks and natural gas for the European region and FTSE-100. Raza Rabbani et al (2023) investigated the impact of geopolitical risk on Islamic and composite stocks, sukuk, oil and gold markets during the COVID-19 pandemic and the Russia-Ukraine conflict in the period 2012–2022. The findings suggest that BRENT is leading the geopolitical risk during COVID-19 and the Russia-Ukraine conflict, where it confirms the remaining relationship. Additionally, during the COVID-19 pandemic, GPR was found to be a laggard while Dow Jones Sukuk index, Dow Jones Islamic index, Dow Jones composite index were leaders.

3 Data and Methodology

3.1 Data

In this study, the effect of various financial and economic instability indicators (“Global Economic Policy Uncertainty-GEPU, Geopolitical risk index-GPR, World Uncertainty Index-WUI and CBOE Volatility Index-VIX”) on two indices representing the Islamic equity markets of the world and Turkey [Dow Jones Islamic Market World (DJIM) and BIST Participation 100 Index (XK100)] is analyzed In this study, two separate data series were created for two independent variables (XK100 and DJIM). Accordingly, the data cover the period of 2016/11 and 2023/06 for DJIM. The reason for taking 2016/11 as the starting period is that some instability indicator indices have just begun to be constructed. This starting date was chosen to include all indicators in the study. For the XK100 variable, the data covers the period between 03/11/2011 and 06/2023/2006. The reason for this is that the start date of the XK100 data is newer than DJIM.

In this study, separate models were constructed for DJIM and XK100 dependent variables. The reason for this is that the XK100 variable has been created more recently and the data is less. Because the number of observations of the dependent and independent variables are different in the models, descriptive statistics are given in two different tables (Tables 2 and 3).

The model using the dependent variable XK100 has 148 observations. Table 2 displays descriptive statistics for the dependent and independent variables. When the table is evaluated, the highest and lowest values belong to the WUI variable (5.575–3.641). When the Jargue-Bera test statistic is evaluated, the H0 normality assumption is strongly rejected at the 1% significance level of the Jargue–Bera (JB) statistic for all four variables whose natural logarithms are used, except for the WUI variable. Accordingly, the series is not normally distributed (H1). The WUI variable is normally distributed (H0).

The number of observations in the model where DJIM dependent variable is used is 200. Table 3 displays descriptive statistics for the dependent and independent variables. When the table is evaluated, the highest and lowest values belong to the WUI variable (5.575–3.641). When the Jargue-Bera test statistic is evaluated, the H0 normality assumption is strongly rejected at the 1% significance level of the Jargue–Bera (JB) statistic for all four variables whose natural logarithms are used, except for the WUI variable. Accordingly, the series is not normally distributed (H1). The WUI variable is normally distributed (H0).

3.2 Methodology

The Fourier-ADF unit root test proposed by Enders and Lee (2012) was used in this study. Both models established in the study were evaluated using the FFFADF Unit Root test statistic. Because the FFFADF unit root test statistic is widely applied in the literature, it is not necessary to provide detailed information here. Following the unit root tests, the wavelet approach was applied to determine the causality relationship between the variables and the Asymmetric Fourier TY test was applied to determine the direction of the relationships.

Although the Fourier approach is a critical step compared with traditional causality tests, the Fourier transform has some limitations. Wavelet approximation is proposed as an important method for overcoming the limitations of Fourier transform. Because in studies using the Fourier transform, more accurately localized temporal and frequency information can be obtained using wavelet analysis (D. T. Gallegati & Semmler, 2014; Gençay et al., 2001; Lee & Yamamoto, 1994). In light of these explanations, the wavelet approach is particularly preferred in this study because it is a powerful tool for time–frequency analysis.

Continuous wavelet transform (CWT) is a mathematical technique that was introduced in the early 1980s for analyzing inputs with characteristics that vary at different scales, such as signals or images (Goupillaud et al., 1984; Grossmann & Morlet, 1984). CWT decomposes a signal or a continuous function on a time–frequency basis through a special class of functions called wavelets (Larnier et al., 2016). Wavelet transform signals, called mother wavelets [ϣ (τ)], are decomposed on the basis of two functions: time position (τ) and frequency (\({{\raisebox{10pt}{\rotatebox{180}{$\curvearrowleft$} }\!\!\!\!\!\!\!\!\!\!\int}}\)). These wavelets are defined as follows (Cazelles et al., 2008):

In Eq. 1, ⨑ and \({\uptau }\) denote dilation (frequency-scale factor) and translation (time shift), respectively. According to the selected mother wavelet, the wavelet transform of the time series x(t) is performed as follows:

The complex conjugate form is denoted by “*” in Eq. 2. The wavelet coefficients, \(W_{x} \left( {w,{\uptau }} \right)\) describe the signal's contribution of scales (⨑ values) at various time locations (τ values). “The wavelet transform can be considered as the cross-correlation of the signal x(t) with a sequence of wavelets of various ‘width’ or ‘scale’ ⨑ at different time positions τ” (Cazelles et al., 2008). The factor \(\frac{1}{\sqrt{{\raisebox{7pt}{\rotatebox{180}{$\curvearrowleft$} }\!\!\!\!\!\!\!\!\int}} }\) normalizes the wavelets such that they have a unit assumption and all time positions can be compared (Tiwari & Albulescu, 2016).

“An essential characteristic of the continuous wavelet transform is the capability to decompose and, consequently, seamlessly recreate a time series \({\text{x}}\left( {\text{t}} \right)\)“ (Afshan et al., 2018).

In this study, wavelet coherence (CWT) analysis was used to analyze the relationship between variables over time. CWT is very useful only for bivariate cases. The study becomes more meaningful with the Asymmetric Fourier TY Test to be conducted after the study, in which we determine the direction of causality. To analyze the relationship between two-time series, a bivariate structure called wavelet coherence needs to be established. Torrence and Webster (1999) “defined the equation of the corrected wavelet coherence coefficient as follows” (Eq. 4):

In Eq. 4, S is represented as a smoothing operator. The range of the square wavelet coherence coefficient is \(0 \le R_{n}^{2} \left( s \right) \le 1\). A value close to zero reflects a weak correlation, whereas a value close to one reflects a strong correlation.

The Morlet wavelet (MW)can be represented as time (\({\uptau }\)) and frequency (⨑), respectively, as in Equation S (Yilanci & Pata, 2022) (Eq. 5):

Here (Eq. 5) \(\lambda_{1}\) and \(\lambda_{2}\) are the normalization constants and \(\Pi\) is the rectangle function. The coefficient 0.6 in the equation is the scale average factor empirically determined by Torrence and Compo (1998). “The significance of the estimated wavelet coherence was determined using Monte Carlo simulations” (Yilanci & Pata, 2022).

In the last stage, the asymmetric Fourier TY test was performed to determine the direction of the relationship between the variables. Based on the study of Granger and Yoon (2002), which found that the relationship between positive and negative shocks may be different from the relationship between normal variables, Hacker and Hatemi-J (2006) and Hatemi-j (2012) addressed the causality between positive and negative shocks. Accordingly, the asymmetric Fourier TY causality test can be defined as follows (Eq. 6).

In Eq. 6, the values represent the decomposition of the effects of both shocks.

In Eq. 6, n and m denote the number of negative and positive shocks, respectively. Causality is analyzed by splitting the series into negative and positive shocks.

4 Empirical results

The results of the fractional frequency Fourier augmented Dickey–Fuller unit root test for the variables considered in this study are as follows (Tables 4 and 5). When the FADF test statistics and critical values given in Tables 4 and 5 are compared, all variables are stationary at first order. In both models established in this study, both dependent and independent variables are stationary at their level values.

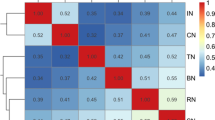

At this stage, wavelet coherence (WTC) analysis and the asymmetric Fourier TY test were performed to determine the direction of the relationships between the variables. The results of the wavelet coherence (WTC) analysis of the models established with these variables are explained in the figures. In the figures, red represents high coherence, while yellow, green, and blue represent lower coherence The shapes formed by the black lines show the impact areas, and the arrows inside them give information about the direction of the impact. Arrows pointing upward and to the right are interpreted as positive relationships, whereas arrows pointing to the left and downward are interpreted as negative relationships. While the x column gives date information, the y column gives frequency density information.

First, the relationship between the DJIM and GEPU variables is evaluated.

There is a high frequency and high consistency level relationship between the DJIM and GEPU variables in the first years of the analysis. In the first years of the analysis, while there is generally a negative relationship at short time frequency, it is observed that the relationship becomes positive as the frequency increases. Toward the end of the analysis period, the relationship returns to a negative relationship with high consistency and long frequency. During this period, a short-frequency negative relationship is also observed during 2014–2021.

The results of the Asymmetric Fourier TY test analysis, which was conducted to determine the direction of the relationship between the variables (DJIM and GEPU)—considering positive and negative shocks at the same time—are as follows (Table 6).

When the Asymmetric Fourier TY test results given in Table 6 are evaluated, there is a causality relationship from GEPU (+) to DJIM (+) and DJIM (−), from GEPU (−) to DJIM (−) and DJIM (+), and finally from DJIM (−) to GEPU (+). When all these results are evaluated, it is seen that the GEPU variable has a significant effect on the DJIM variable, especially in recent years, in the form of a negative relationship. Although a high-frequency short-term positive relationship was observed in the first years of the analysis, a clearly negative relationship was observed in the last decade. Accordingly, a rise in “the Global Economic Policy Uncertainty (GEPU) index” has a positive effect on DJIM, whereas a fall in the GEPU index has a negative effect with these results, the study supports studies in the literature (Dai et al., 2021; Maquieira et al., 2023; Yu et al., 2018).

In the next stage, the relationship between the DJIM and GPR variables was evaluated.

Looking at the relationship between the DJIM and GPR variables in Fig. 2, it is generally seen that there is a low consistency between them. However, toward the end of the analysis period, i.e., after 2019, it is possible to talk about a partially high-frequency high-consistency positive relationship.

The results of the Asymmetric Fourier TY test analysis to determine the direction of the relationship between the variables (DJIM and GPR) are shown in Table 7).

When the results of the Asymmetric Fourier TY test given in Table 7 were evaluated, no causality was found between the variables (DJIM and GPR). Except for the short-term temporary effects seen in the wavelet power spectra in the wavelet analysis table, the (GPR) index, which represents geopolitical risk, does not have much effect on DJIM.

In the next stage, the relationship between the DJIM and VIX variables was evaluated.

As shown in Fig. 3, the relationship between DJIM and VIX variables is the most intense and consistent relationship in the study. There is a highly consistent relationship throughout the entire analyzed period. For the two variables in question, there is a highly consistent negative relationship, especially in the short frequency.

The results of the Asymmetric Fourier TY test analysis to determine the direction of the relationship between the variables (VIX and DJIM) are shown in Table 8.

Table 8 shows that there is a causality relationship from VIX (+) to DJIM (+) and finally from VIX (−) to DJIM (+) and DJIM (−). The intense, consistent, and weighted negative relationship observed in the wavelet power spectra is toward causality from VIX to DJIM. A rise in the VIX index, which is caused by investors’ concerns about the market, has a positive effect on DJIM, whereas a fall in the VIX index has a negative effect it is observed that this relationship is intensive in almost all periods. The results of the analysis support studies based on Islamic markets (Gökgöz & Kayahan, 2023; Hammoudeh et al., 2014; Kazak, 2023; Naifar, 2016; Ozcelebi & Pérez-Montiel, 2023).

In the next stage, the relationship between the DJIM and WUI variables was evaluated.

As shown in Fig. 4, the relationship between DJIM and WUI variables is similar to that between DJIM and GPR. When the relationship between DJIM and WUI variables is analyzed, it is generally observed that there is low consistency between them. However, toward the end of the analysis period, i.e., after 2016, it is possible to talk about a partially high frequency and high consistency-negative relationship.

The results of the Asymmetric Fourier TY test analysis to determine the direction of the relationship between the variables (DJIM and WUI) are shown in Table 9).

When the results of the Asymmetric Fourier TY test given in Table 9 were evaluated, no causality was found between the variables (DJIM and WUI). Although very little relationship was observed in the wavelet power spectra, the same result was not found in the asymmetric Fourier TY test. Therefore, it can be said that the relationship between WUI and DJIM is very limited but negative. These results do not support studies in the literature (Saâdaoui et al., 2023; Yang & Yang, 2021; Zhang et al., 2023) that state that WUI and GPR have a significant and intense effect on the stock market. Yes, a partial and limited relationship was found in the continuous wavelet power spectra, but this relationship was not seen in the Asymmetric Fourier TY Test. When the graph and causality results are evaluated together, it is observed that there is only a partial and limited effect.

Until this stage, the relationship between the DJIM variable representing the world Islamic equity markets and various financial instability indicators (economic policy uncertainty, geopolitical risk, uncertainty and fear) has been analyzed. After this stage, the relationship between the same financial instability indicators and the XK100 variable representing the Turkish Islamic equity markets will be evaluated. At this stage the relationship between XK100 and the GEPU variable will be discussed.

In the analysis of the models where the dependent variable is XK100, there is generally a lower consistency and frequency of relationship compared with the dependent variable DJIM. There was a negative relationship between XK100 and GEPU at medium frequency in 2011 and 2012. Toward the end of the analysis period, especially in 2019 and 2020, it is possible to talk about a negative relationship with high consistency at lower frequencies (Fig. 5).

The results of the Asymmetric Fourier TY test analysis to determine the direction of the relationship between the variables (XK100 and GEPU) are shown in Table 10).

As can be seen in Table 10, there is a causality from XK100 (+) to GEPU (−), from GEPU (+) to XK100 (+), and finally from XK100 (−) to GEPU (−). Considering the very little relationship seen in the wavelet coherence (WTC) power spectra, it is observed that GEPU has a partial and short-term effect on XK100 in some periods. The fact that the GEPU-DJIM relationship observed in the world Islamic equity markets is not observed between GEPU-XK100 may be because the Turkish Islamic equity index is relatively new and/or the Turkish Islamic equity markets are less sensitive to the uncertainties represented by the GEPU index. The GEPU index represents the GDP-weighted average of national EMU indices for 21 countries that Turkey is excluded from. Turkey's economic conditions are of course influenced by countries around the world. But on a GEPU basis, the impact is quite limited.

In the next stage, the relationship between the XK100 and GPR variables is evaluated.

Looking at the relationship between XK100 and GPR variables in Fig. 6, while it is possible to talk about a positive relationship at medium frequency in 2011, toward the end of the analysis period, after 2017, a relationship was detected in such a way that the direction of the relationship was negative at high consistency at long frequency.

The results of the Asymmetric Fourier TY test analysis to determine the direction of the relationship between the variables (XK100 and GPR) are shown in Table 11).

When the results of the Asymmetric Fourier TY test given in Table 11 were evaluated, no causality was found between the variables (XK100 and GPR). Previously, no causality was found between DJIM and GPR. Accordingly, except for the short-term temporary effects observed in the wavelet coherence (WTC) power spectra, the (GPR) index representing geopolitical risk does not have much effect on Islamic equity markets. In particular, the impact seen in the 2019–2022 period is probably due to the earthquakes in Elâzığ (Magnitude: 6.8) and İzmir (Magnitude: 7.0) in Turkey in 2020. These earthquakes were reported in newspapers monitored by the GPR index. Considering the peaks of the Turkish GPR index in 2010/01 (0.74), 2015/11 (1.05) and 2019/10 (1.18) (Caldara & Iacoviello, 2023), it can be said that geopolitical risks have a short and temporary effect on equity markets.

In the next stage, the relationship between the XK100 and VIX variables is evaluated.

In Fig. 7, the relationship between the XK100 and VIX variables between 2011 and 2013 is determined as a high consistency and negative relationship with a medium frequency. Between 2018 and 2020, the frequency of this relationship is relatively low.

The results of the Asymmetric Fourier TY test analysis to determine the direction of the relationship between the variables (XK100 and VIX) are shown in Table 12).

As can be seen in Table 12, there is a causality from VIX (+) to XK100 (+) and from VIX (−) to XK100 (+). The negative relationship observed in the wavelet coherence (WTC) power spectra at medium and sometimes high frequencies is a causality from VIX to XK100. Accordingly, as seen in the VIX-DJIM analysis, an increase in the VIX index, which is caused by investors’ concerns about the market, has a positive effect on the XK100, whereas a decrease has a negative effect on the XK100. The fact that this relationship is observed in both Islamic equity indices reveals that the VIX is very effective and important in Islamic equity markets. The results of the study support studies based on conventional markets (Basher & Sadorsky, 2016; Kazak, 2023; Urom et al., 2022) and studies based on Islamic markets (Hammoudeh et al., 2014; Kazak, 2023; Naifar, 2016). It differs in some respects from studies that find the aforementioned relationship absent (Arfaoui & Raggad, 2023) or weak (Haddad et al., 2020).

In the next stage, the relationship between the XK100 and WUI variables was evaluated.

Finally, when we look at the relationship between the XK100 and WUI variables shown in Fig. 8, it is possible to say that there is very little relationship. There is a high frequency negative relationship with high consistency at the beginning and end of the analysis period.

The results of the Asymmetric Fourier TY test analysis to determine the direction of the relationship between the variables (XK100 and WUI) are shown in Table 13).

When the results of the Asymmetric Fourier TY test given in Table 13 were evaluated, no causality was found between the variables (XK100 and WUI). Although the wavelet coherence (WTC) power spectra showed little correlation at the beginning and end of the analysis period, the same result was not found in the Asymmetric Fourier TY test. Therefore, the relationship between WUI and XK100 is very limited but negative. A similar result is also found for the relationship between DJIM and WUI. Accordingly, the effect of the WUI variable on the Islamic stock indices (world and Turkey) is limited.

5 Conclusion and Policy Recommendations

In this paper, we examine the impact of various financial and economic instability indicators (Global economic policy uncertainty, geopolitical risk, World uncertainty and CBOE Volatility-fear) on these indices by considering two indicators representing Islamic equity markets (Dow Jones Islamic Market World representing world equity markets and BIST PARTICIPATION 100 representing Turkish equity markets). The study covers the period between 2016/11 and 2023/06 for the DJIM variable and the period between 2011/03 and 2023/06 for the XK100 variable. Because Islamic finance has emerged as an alternative financial investment area and exhibits a continuously growing structure, it is essential to focus on this field. Many studies in the literature argue that Islamic finance has some advantages over conventional finance because of the fundamentals in the structure and systematics of Islam. For all these reasons, it is essential for the literature and investors to reveal the findings on Islamic finance. In view of the importance of Islamic finance, it is necessary to address the factors affecting these markets. Undoubtedly, one of these is the various indices that measure financial and economic instability. The effects of these indices on conventional financial markets have been extensively analyzed in the literature. However, their effects on Islamic markets have been addressed in very few studies. In this study, four instability indicators are evaluated in terms of their effects on the world and Turkish equity markets. In this respect, it makes an important contribution to the literature.

In this study, two different analyses were used to investigate the relationship between dependent and independent variables. The first of these analyses is the asymmetric Fourier TY test to determine the causal relationship between the variables. The correlation relationship was investigated with WTC analysis. According to the results of the Asymmetric Fourier TY Test and WTC analysis; The results of this study reveal that the VIX fear index has the highest impact on equity markets both in the world and in Turkey. There is an intense and consistent relationship between DJIM and VIX and between XK100 and VIX variables. The fact that the direction of causality is from the VIX to Islamic equity indices clearly demonstrates the importance of the VIX fear index. A rise in the VIX index, which is caused by investors’ concerns about the market, has a positive effect on DJIM, whereas a fall in the VIX index has a negative effect on DJIM. It is observed that this relationship is intense and almost throughout all periods. The results of the study support studies based on conventional markets (Basher & Sadorsky, 2016; Kazak, 2023; Perote et al., 2023; Urom et al., 2022) and studies based on Islamic markets (Gökgöz & Kayahan, 2023; Hammoudeh et al., 2014; Kazak, 2023; Naifar, 2016; Ozcelebi & Pérez-Montiel, 2023). It differs in some respects from studies that find the aforementioned relationship absent (Arfaoui & Raggad, 2023) or weak (Haddad et al., 2020). Another variable analyzed in the study was GEPU, and the highest correlation was found in this variable after the VIX variable. In the relationship between GEPU and variables representing Islamic equity indices, the relationship between DJIM and GEPU is high level of significance, whereas the relationship between XK100 and GEPU is low level of significance. There is a causality relationship between GEPU and DJIM and XK100 for both markets. A rise in “the Global Economic Policy Uncertainty (GEPU) index” has a positive effect on DJIM, whereas a fall in the GEPU index has a negative effect on DJIM. With these results, the study supports the studies by Yu et al. (2018), Li et al. (2020), Dai et al. (2021), and Maquieira et al. (2023). The other two instability indicators evaluated in the study are GPR and WUI, and it is observed that these variables have low impact on Islamic indices. Wavelet coherence (WTC) analysis shows this slight relationship, whereas causality analysis does not show this relationship. This study does not support studies in the literature that suggest that there are significant causal relationships and interactions. Examples of these studies are Kannadhasan and Das (2020), Yang and Yang (2021), Chowdhury et al. (2021), Zhang et al. (2023), Saâdaoui et al. (2023).

When all these results are evaluated, economic instability indicators (economic policy uncertainty, geopolitical risk, uncertainty, and fear) have an impact on Islamic equity market indices (both in the world and Turkey). This effect is determined as VIX, GEPU, GPR, and WUI. In addition, it is an important finding that the GPR and WUI indices, which have an impact on conventional markets, are not felt much in Islamic equity markets. Considering studies showing that the development of Islamic financial markets is effective on economic development (Boukhatem & Moussa, 2018; Kassim, 2016; Kazak & Okka, 2022; Kazak et al., 2023), it is imperative for policymakers to remove the obstacles to the development of these markets. Therefore, it is important for policymakers to closely monitor these instability indicators and take necessary measures. It is also important for investors to consider financial uncertainty indicators while shaping their investment decisions. This study is believed to be a guiding contribution to the literature, investors, and policy makers through its original contributions.

In this study, the relationship between the Dow Jones Islamic Market Index and Bist Participation 100 and VIX, GPR, GEPU, and VUI variables was investigated. However, the Dow Jones Islamic Market Index and Bist Participation 100 variables are found to have a close relationship, especially with VIX and GEPU. Investors in the Dow Jones Islamic Market Index and Bist Participation 100 should pay attention to events and developments that are likely to affect GEPU and VIX variables before making their investment decisions and make their investment decisions accordingly.

This study investigates the relationship between Islamic participation indices and global variables with the most recent data set in the literature. In addition, there is no other study analyzing the relationship between dependent and independent variables with the asymmetric Fourier TY test and wavelet transform coherence (WTC). Therefore, the econometric method and data set used in this study are considered to contribute to the literature in terms of timeliness.

This study investigates the relationship between global variables and the Dow Jones Islamic Market Index and BIST Participation 100. However, one of the dependent variables used in the study is closely related to the US and the other to Turkey. However, the participation index can be found not only in these two countries but also in other countries. The study has limitations in this respect. Expanding the study to include other countries with updated literature and new econometric methods is important for future studies and literature.

References

Adam, N., & Yacob, N. (2022). the impact of global economic policy uncertainty, geopolitical risk and oil price on stock market: Evidence from Asean countries. International Journal of Academic Research in Accounting Finance and Management Sciences, 12(1), 28–46. https://doi.org/10.6007/IJARAFMS/v12-i1/11674

Afshan, S., Sharif, A., Loganathan, N., & Jammazi, R. (2018). Time–frequency causality between stock prices and exchange rates: Further evidences from cointegration and wavelet analysis. Physica a: Statistical Mechanics and Its Applications, 495, 225–244. https://doi.org/10.1016/j.physa.2017.12.033

Akram, M., Hunjra, A. I., Malik, I. R., & Al-Faryan, M. A. S. (2023). Dynamic connectedness among Pakistani stock markets and its major trading partners. International Journal of Emerging Markets. https://doi.org/10.1108/IJOEM-04-2022-0629

Al Shubiri, F. N., & Jamil, S. A. (2018). The impact of idiosyncratic risk of banking sector on oil, stock market, and fiscal indicators of Sultanate of Oman. International Journal of Engineering Business Management, 10, 43. https://doi.org/10.1177/1847979017749043

Amtiran, P. Y., & Indiastuti, R. (2017). Political risk and stock returns in Indonesia. J. Bank. Fin. Review, 2(3), 8–13.

Anh, D. L. T., & Gan, C. (2021). The impact of the COVID-19 lockdown on stock market performance: Evidence from Vietnam. Journal of Economic Studies, 48(4), 836–851. https://doi.org/10.1108/JES-06-2020-0312

Arfaoui, M., & Raggad, B. (2023). Do Dow Jones Islamic equity indices undergo speculative pressure? New insights from a nonlinear and asymmetric analysis. International Journal of Finance & Economics, 28(2), 1582–1601. https://doi.org/10.1002/ijfe.2495

Balcilar, M., Bonato, M., Demirer, R., & Gupta, R. (2018). Geopolitical risks and stock market dynamics of the BRICS. Economic Systems, 42(2), 295–306. https://doi.org/10.1016/j.ecosys.2017.05.008

Balcilar, M., Gupta, R., Kim, W. J., & Kyei, C. (2019). The role of economic policy uncertainties in predicting stock returns and their volatility for Hong Kong, Malaysia and South Korea. International Review of Economics & Finance, 59, 150–163. https://doi.org/10.1016/j.iref.2018.08.016

Basher, S. A., & Sadorsky, P. (2016). Hedging emerging market stock prices with oil, gold, VIX, and bonds: A comparison between DCC, ADCC and GO-GARCH. Energy Economics, 54, 235–247. https://doi.org/10.1016/j.eneco.2015.11.022

Bayar, Y., & Kılıç, C. (2012). Küresel finansal krizin davranişsal finans perspektifinden değerlendirilmesi. İstanbul Üniversitesi İktisat Fakültesi Mecmuası, 62(2), 177–195.

Baykut, E., & Diyar, S. (2021). The effect of global risk indicators on developing country stock exchanges: The case of BRICS-T. Journal of Corporate Governance, Insurance, and Risk Management, 8(1), 101–117. https://doi.org/10.51410/jcgirm.8.1.7

Ben Ghozzi, B., & Chaibi, H. (2022). Political risks and financial markets: Emerging vs developed economies. EuroMed Journal of Business, 17(4), 677–697. https://doi.org/10.1108/EMJB-11-2020-0123

Boons, M., Duarte, F., Roon, F., & Szymanowska, M. (2020). Time-varying inflation risk and stock returns. Journal of Financial Economics, 136(2), 444–470. https://doi.org/10.1016/j.jfineco.2019.09.012

Bossman, A., & Gubareva, M. (2023). Asymmetric impacts of geopolitical risk on stock markets: A comparative analysis of the E7 and G7 equities during the Russian-Ukrainian conflict. Heliyon, 9, 13626. https://doi.org/10.1016/j.heliyon.2023.e13626

Boukhatem, J., & Moussa, F. B. (2018). The effect of Islamic banks on GDP growth: Some evidence from selected MENA countries. Borsa Istanbul Review, 18(3), 231–247. https://doi.org/10.1016/j.bir.2017.11.004

Bouras, C., Christou, C., Gupta, R., & Suleman, T. (2019). Geopolitical risks, returns, and volatility in emerging stock markets: Evidence from a panel GARCH model. Emerging Markets Finance and Trade, 55(8), 1841–1856. https://doi.org/10.1080/1540496X

Brogaard, J., Detzel, A. L., & Ngo, P. T. H. (2015). Inequality and risk premia. SSRN Electronic Journal. https://doi.org/10.2139/ssrn.2649558

Burlacu, R., Fontaine, P., Jimenez-Garces, S., & Seasholes, M. S. (2012). Risk and the cross section of stock returns. Journal of Financial Economics, 105(3), 511–522. https://doi.org/10.1016/j.jfineco.2012.03.008

Caldara, D., & Iacoviello, M. (2023). The geopolitical risk (GPR) index. https://www.matteoiacoviello.com/gpr.htm

Caldara, D., & Iacoviello, M. (2022). Measuring geopolitical risk. American Economic Review, 112(4), 1194–1225. https://doi.org/10.1257/aer.20191823

Cazelles, B., Chavez, M., Berteaux, D., Ménard, F., Vik, J. O., Jenouvrier, S., & Stenseth, N. C. (2008). Wavelet analysis of ecological time series. Oecologia, 156(2), 287–304. https://doi.org/10.1007/s00442-008-0993-2

Chatjuthamard, P., Jindahra, P., Sarajoti, P., & Treepongkaruna, S. (2021). The effect of COVID-19 on the global stock market. Accounting & Finance, 61(3), 4923–4953. https://doi.org/10.1111/acfi.12838

Cheung, Y.-W., & Ng, L. K. (1996). A causality-in-variance test and its application to financial market prices. Journal of Econometrics, 72(1), 33–48. https://doi.org/10.1016/0304-4076(94)01714-X

Chowdhury, M. A. F., Meo, M. S., & Aloui, C. (2021). How world uncertainties and global pandemics destabilized food, energy and stock markets? Fresh evidence from quantile on quantile regressions. International Review of Financial Analysis, 76, 101759. https://doi.org/10.1016/j.irfa.2021.101759

Çıkıryel, B., Aslan, H., & Özdemir, M. (2022). Impact of Brexit on Islamic stock markets: Employing MGARCH-DCC and wavelet correlation analysis. International Journal of Islamic and Middle Eastern Finance and Management, 15(1), 179–202.

Dai, P.-F., Xiong, X., & Zhou, W.-X. (2021). A global economic policy uncertainty index from principal component analysis. Finance Research Letters, 40, 101686. https://doi.org/10.1016/j.frl.2020.101686

Dakhlaoui, I., & Aloui, C. (2016). The interactive relationship between the US economic policy uncertainty and BRIC stock markets. International Economics, 146, 141–157. https://doi.org/10.1016/j.inteco.2015.12.002

Danni, T. U., & Finance, M. (2009). Do the stock markets price climate change risks? (Vol. 25, Issue 01). End-of-study Research Paper.

Davis, S. J., Hansen, S., & Seminario-Amez, C. (2020). Firm-level risk exposures and stock returns in the wake of COVID-19 (Issue w27867)). National Bureau of Economic Research.

Demiralay, S. (2019). Global risk factors and stock returns during bull and bear market conditions: Evidence from emerging economies in Europe. Prague Economic Papers, 28(4), 402–415. https://doi.org/10.18267/j.pep.680

Duarte, Fernando. (2013). Inflation risk and the cross section of stock returns. SSRN Electronic Journal. https://doi.org/10.2139/ssrn.2351521

Duppati, G., Younes, B. Z., Tiwari, A. K., & Hunjra, A. I. (2023). Time-varying effects of fuel prices on stock market returns during COVID-19 outbreak. Resources Policy, 81, 103317.

Eberhardt, M., & Bond, S. (2009). Cross-section dependence in nonstationary panel models: A novel estimator (MPRA Paper 17870). https://mpra.ub.uni-muenchen.de/17870/

Emsen, H. S. (2022). Effects of geopolitical risks and political uncertainties on stock markets: Country specific new generation panel data analysis for developing Asian countries. Journal of Process Management and New Technologies, 10(1–2), 82–101. https://doi.org/10.5937/jpmnt10-38252

Enders, W., & Lee, J. (2012). The flexible Fourier form and Dickey-Fuller type unit root tests. Economics Letters, 117(1), 196–199. https://doi.org/10.1016/j.econlet.2012.04.081

Erdoğan, L., Ceylan, R., & Abdul-Rahman, M. (2022). The impact of domestic and global risk factors on Turkish stock market: Evidence from the NARDL approach. Emerging Markets Finance and Trade, 58(7), 1961–1974. https://doi.org/10.1080/1540496X.2021.1949282

Faccini, R., Matin, R., & Skiadopoulos, G. (2021). Are climate change risks priced in the US stock market? (Working Paper 169). Danmark Nationalbank.

Fahmi, S., Geetha, C., & Mohidin, R. (2017). The effect of systematic risk factors on the performance of the Malaysia stock market. Proceedings of International Conference on Economics, 17, 57–68.

Fama, E. (1991). Efficient capital markets: II. The Journal of Finance, 46(5), 1575–1617. https://doi.org/10.1111/j.1540-6261.1991.tb04636.x

Friedman, M. (1957). A theory of the consumption function. Princeton University Press.

Gallegati, M., & Semmler, W. (2014). Wavelet applications in economics and finance. Springer.

Gençay, R., Selçuk, F., & Whitcher, B. J. (2001). An introduction to wavelets and other filtering methods in finance and economics. Elsevier.

Ghani, M., & Ghani, U. (2023). Economic policy uncertainty and emerging stock market volatility. Asia-Pacific Financial Markets, 31(1), 165. https://doi.org/10.1007/s10690-023-09410-1

Giang, N. T. H., Hanh, T. M., Hien, P. T., Trinh, N. T., Huyen, N. T. K., & Trang, V. H. (2021). The impacts of climate change risks on financial performance: Evidence from listed manufacturing firms in vietnam. International Conference on Emerging Challenges: Business Transformation and Circular Economy, 2021, 581–595.

Gökgöz, H., & Kayahan, C. (2023). Analysis of the interaction of participation 30 index with dow jones islamic markets index and CBOE volatility index. Afyon Kocatepe Üniversitesi İktisadi ve İdari Bilimler Fakültesi Dergisi, 25(2), 2. https://doi.org/10.33707/akuiibfd.1257942

Gong, X., Fu, C., Huang, Q., & Lin, M. (2022). International political uncertainty and climate risk in the stock market. Journal of International Financial Markets, Institutions and Money, 81, 101683. https://doi.org/10.1016/j.intfin.2022.101683

Goupillaud, P., Grossmann, A., & Morlet, J. (1984). Cycle-octave and related transforms in seismic signal analysis. Geoexploration, 23(1), 85–102. https://doi.org/10.1016/0016-7142(84)90025-5

Gouveia, J. F. (2022). Risk vs return: A comparative analysis between a developed and an emerging stock market [Master’s dissertation]. Iscte - University Institute of Lisbon.

Granger, C. W., & Yoon, G. (2002). Hidden cointegration (Working Paper 2002–02). University of California; https://papers.ssrn.com/. https://papers.ssrn.com/sol3/Delivery.cfm/SSRN_ID313831_code020605640.pdf?abstractid=313831&mirid=1

Grossmann, A., & Morlet, J. (1984). Decomposition of hardy functions into square integrable wavelets of constant shape. SIAM Journal on Mathematical Analysis, 15(4), 723–736. https://doi.org/10.1137/0515056

Hacker, R. S., & Hatemi-J, A. (2006). Tests for causality between integrated variables using asymptotic and bootstrap distributions: Theory and application. Applied Economics, 38(13), 1489–1500. https://doi.org/10.1080/00036840500405763

Haddad, H. B., Mezghani, I., & Al Dohaiman, M. (2020). Common shocks, common transmission mechanisms and time-varying connectedness among Dow jones Islamic stock market indices and global risk factors. Economic Systems, 44(2), 100760. https://doi.org/10.1016/j.ecosys.2020.100760

Hadri, K., & Kurozumi, E. (2012). A simple panel stationarity test in the presence of serial correlation and a common factor. Economics Letters, 115(1), 31–34. https://doi.org/10.1016/j.econlet.2011.11.036

Hammoudeh, S., Mensi, W., Reboredo, J. C., & Nguyen, D. K. (2014). Dynamic dependence of the global Islamic equity index with global conventional equity market indices and risk factors. Pacific-Basin Finance Journal, 30, 189–206. https://doi.org/10.1016/j.pacfin.2014.10.001

Hatemi-j, A. (2012). Asymmetric causality tests with an application. Empirical Economics, 43, 447–456. https://doi.org/10.1007/s00181-011-0484-x

Hoque, M. E., & Zaidi, M. A. S. (2020). Impacts of global economic policy uncertainty on emerging stock markets: Evidence from linear and non-linear models. Prague Economic Papers, 29(1), 53–66. https://doi.org/10.18267/j.pep.725

Jung, S., Lee, J., & Lee, S. (2021). The impact of geopolitical risk on stock returns: Evidence from inter Korea geopolitics. International Monetary, 21(251), a001.

Kahneman, D., & Tversky, A. (1974). Judgment under uncertainty: Heuristics and biases. Science, 4157, 1124–1131.

Kahneman, D., & Tversky, A. (1979). Prospect theory: An analysis of decision under risk. Econometrica, XLVI, I(2), 263–291.

Kannadhasan, M., & Das, D. (2020). Do Asian emerging stock markets react to international economic policy uncertainty and geopolitical risk alike? A quantile regression approach. Finance Research Letters, 34, 101276. https://doi.org/10.1016/j.frl.2019.08.024

Kassim, S. (2016). Islamic finance and economic growth: The Malaysian experience. Global Finance Journal, 30, 66–76. https://doi.org/10.1016/j.gfj.2015.11.007

Kazak, H., & Okka, O. (2022). İslami Finans Ekonomik Kalkınma ve Sosyal Barış (1st ed.). Nobel Akademik Yayıncılık

Kazak, H. (2023). Korku endeksi etkisinde islami ve konvansiyonel pay piyasa endeksleri arasindaki ilişki: Türkiye Örneği. Journal of Emerging Economies and Policy, 8(2), 94–107.

Kazak, H., Uluyol, B., Akcan, A. T., & İyibildiren, M. (2023). The impacts of conventional and islamic banking sectors on real sector growth: Evidence from time-varying causality analysis for Turkey. Borsa Istanbul Review, 23, s15. https://doi.org/10.1016/j.bir.2023.09.004

Khan, I. (2023). Analyzing the impact of positive and negative remittance inflow shocks on economic growth of India. Journal of Economic Studies, 51(2), 338.

Khan, I. (2023). An analysis of stock markets integration and dynamics of volatility Spillover in emerging nations. Journal of Economic and Administrative Sciences. https://doi.org/10.1108/JEAS-10-2022-0236

Khan, I., & Gunwant, D. F. (2024). Application of ARIMA model in forecasting remittance inflows: Evidence from Yemen. International Journal of Economic Policy Studies, 18(1), 283–303.

Kirikkaleli, D. (2020). The effect of domestic and foreign risks on an emerging stock market: A time series analysis. North American Journal of Economics and Finance, 51, 100876. https://doi.org/10.1016/j.najef.2018.11.005

Ko, J.-H., & Lee, C.-M. (2015). International economic policy uncertainty and stock prices: Wavelet approach. Economics Letters, 134, 118–122. https://doi.org/10.1016/j.econlet

Langer, E. (1975). The Illusion of Control. Journal of Personality and Social Psychology, 32(2), 311–328. https://doi.org/10.1037/0022-3514.32.2.311

Laopodis, N. T. (2022). Global risk factors of NYSE-and NASDAQ-listed shipping companies’ stock returns. Maritime Business Review, 7(2), 90–108. https://doi.org/10.1108/MABR-09-2020-0059

Larnier, H., Sailhac, P., & Chambodut, A. (2016). New application of wavelets in magnetotelluric data processing: Reducing impedance bias. Earth, Planets and Space, 68(1), 70. https://doi.org/10.1186/s40623-016-0446-9

Lee, D. T., & Yamamoto, A. (1994). Wavelet analysis: Theory and applications. Hewlett Packard Journal, 45, 44–44.

Lee, J., & Lee, S. (2021). the impact of geopolitical risk on stock returns: Evidence from inter-Korea geopolitics. SSRN Electronic Journal. https://doi.org/10.2139/ssrn.3904489

Li, T., Ma, F., Zhang, X., & Zhang, Y. (2020). Economic policy uncertainty and the Chinese stock market volatility: Novel evidence. Economic Modelling, 87, 24–33. https://doi.org/10.1016/j.econmod.2019.07.002

Liang, C. C., Troy, C., & Rouyer, E. (2020). US uncertainty and Asian stock prices: Evidence from the asymmetric NARDL model. North American Journal of Economics and Finance, 51, 101046. https://doi.org/10.1016/j.najef.2019.101046

Liang, S. X., & John Wei, K. C. (2020). Market volatility risk and stock returns around the world: Implication for multinational corporations. International Review of Finance, 20(4), 923–959. https://doi.org/10.1111/irfi.12252

Maquieira, C. P., Espinosa-Méndez, C., & Gahona-Flores, O. (2023). How does economic policy uncertainty (EPU) impact copper-firms stock returns? International Evidence. Resources Policy, 81, 103372. https://doi.org/10.1016/j.resourpol.2023.103372

Marobhe, M. I., & Kansheba, J. M. P. (2022). Stock market reactions to COVID-19 shocks: Do financial market interventions walk the talk? China Finance Review International, 12(4), 623–645. https://doi.org/10.1108/CFRI-01-2022-0011

Mohanty, S. K., Aadland, R., Westgaard, S., Frydenberg, S., Lillienskiold, H., & Kristensen, C. (2021). Modelling stock returns and risk management in the shipping industry. Journal of Risk and Financial Management, 14(4), 171. https://doi.org/10.3390/jrfm14040171

Moslehpour, M., Al-Fadly, A., Ehsanullah, S., Chong, K. W., Xuyen, N. T. M., & Tan, L. P. (2022). Assessing financial risk spillover and panic impact of Covid-19 on European and vietnam stock market. Environmental Science and Pollution Research, 29(19), 28226–28240. https://doi.org/10.1007/s11356-021-18170-2