Abstract

The Russian invasion of Ukraine in 2022 triggered a global wheat price spike and food insecurities in import-dependent countries. We combine an analysis of the global wheat supply network with an agricultural commodity price model to investigate national impaired supplies and the global annual wheat price hike, respectively, for the trade year 2022. Using a scenario analysis, we show that international cooperation manifested in the Black Sea Grain and Solidarity Lanes initiatives and the removal of export restrictions may have mitigated the 2022 price hike by 13 percentage points. In a worst case scenario – characterized by multi-breadbasket harvest failures, escalating export restrictions, and blocked Ukrainian exports – wheat price increases by 90% compared to the 2000–2020 average. Coping strategies – such as food-secure countries dispersing stocks, reducing wheat as feed, or boosting wheat production – are effective at mitigating the price spike in simplified scenarios. Our findings underscore the imperative of coordinated policy responses to avoid global food supply disruptions.

Similar content being viewed by others

Introduction

The concentration of production in a few main breadbasket regions and resulting import dependencies of many developing countries renders the global trade network for main food crops like wheat susceptible to system shocks disrupting global supply chains1,2. Within the last 20 years, two major world food price crises in 2007/08 and 2010/11 put tens of millions of additional people at risk of food insecurity triggering civil unrest around the globe3. Both crises were preceded by simultaneous harvest failures in several main breadbasket regions and aggravated by unilateral export restrictions by many countries, causing disproportionate spikes in food prices4. A decade later, the COVID-19 pandemic posed a serious threat to regional5,6 and global food security7,8. In doing so, it disproportionately impacted low- and middle-income populations9 and societies already grappling with environmental fragility and economic insecurity, such as those in the Sahel region10. Further, regional food security was jeopardized in recent years by pests and plagues, including the locust infestation in the Horn of Africa in 2019 and 202011, and extreme weather events like the devastating floods and droughts experienced in Nigeria12. Compounding extreme weather events in different main production regions can lead to multi-breadbasket failures and thus jeopardize food security also at the global level1,13. In the past many countries have responded to global supply failures by unilateral, uncoordinated policy interventions: exporters raised export restrictions and importers winded down restrictions14. These interventions and the resulting market uncertainties further amplified agricultural price spikes15,16. The intensification of extreme weather events under global warming may exacerbate the risk of multi-breadbasket failures17, in the absence of adequate adaptation measures18. Studies have highlighted that disrupted supply chains19, financial crisis20,21, and changes in population and land use22,23 can put food security at risk in crisis situations.

In early 2022 food price levels were already high due to high fertilizer prices and pandemic-induced supply chain disturbances. The market uncertainties triggered by the Russian invasion of Ukraine then caused monthly prices for agricultural commodities, which Ukraine exports globally such as wheat, corn and sunflower oil, to exceed the peak levels of the two preceding crises24. For global food security, the impact on international wheat markets was arguably more critical than other food commodities, because Ukraine and Russia contribute about one-third of the world’s wheat exports25.

Many developing countries, especially in the Middle East, North and Sub-Saharan Africa, and Southeast Asia, heavily rely on wheat imports from either Ukraine or Russia26. Moreover, prior to the war, the World Food Program sourced nearly half of its global wheat supplies from Ukraine to support its food assistance27. Given these dependencies, the international community feared a major food security crisis when Ukrainian exports through the Black Sea were blocked, wheat transport infrastructure was destroyed, and harvesting of wheat became difficult28,29,30,31.

Various short-term coping and long-term adaptation strategies were discussed at national and international levels such as incentivizing countries to refrain from hoarding and panic buyings32, the reduction of livestock33, and a rapid expansion of wheat production in major producing countries not directly affected by the war28,31,34. Further, different long-term adaptation strategies to make the food system more resilient to conflict- and weather-induced supply failures were proposed including a reduction of feed-demand for main food crops by the adoption of a more plant-based diet by European consumers35, an increase of the production of 2nd to 4th generation biofuels that do not compete with food crops for arable land36, and improving farming practices in Sub-Saharan Africa37.

Most of these strategies were not enacted as prices began normalizing in June 2022, coinciding with the wheat harvest season in the Northern Hemisphere. Better-than-usual wheat harvests of several main producers25 helped take pressure off international markets and two multinational agreements dampened the decline in Ukrainian exports38. The Black Sea Grain Initiative, brokered by the United Nations (UN), enabled Ukraine to resume shipments of staples from the three Black Sea ports still under their control in July 202239. Additionally, the European Union’s (EU’s) Solidarity Lanes Initiative facilitated increased Ukrainian exports via rail, road, and river routes (e.g., the Danube River) through its western borders40. Until Russia’s withdrawal from the Black Sea Grain Initiative in July 2023, it enabled Ukraine to export 33 million metric tons of grains and other agricultural products in one year41. Further, between May 2022 and January 2024, the Solidarity Lanes Initiative allowed Ukraine to export at least 2 million metric tons of grain, oilseeds, and other related products each month, adding up to nearly 64 metric tons for this period42. These exports have substantially mitigated the world market price hikes for wheat (and other grains) and averted severe food insecurities, particularly for countries in the Middle East and sub-Saharan Africa38.

While initial research has started assessing the role of these multilateral agreements in mitigating current food crises and short-term coping strategies43, further analysis is still needed. Specifically, there is a need to thoroughly examine systemic risks capable of intensifying crises, including risks of simultaneous breadbasket failures or uncoordinated export restrictions. Here, we consider systemic risks that are specifically relevant to the global wheat supply network, which includes the potential for localized supply or demand shocks within a major exporting or importing country to propagate through the complex trade system. This could potentially generate cascading effects leading to global wheat shortages, price volatility, and downstream food insecurity across multiple world regions44,45.

Building on this definition of systemic risk, we analyze the impacts of the Russian invasion of Ukraine on the global wheat market. Specifically, we use two modeling approaches to assess the resulting risks across the wheat supply network and implications for global food security46: the static Food Stock Cascades (FSC) network model47 and the Trade With Storage (TWIST) model48. The FSC model calculates each country’s annual wheat supply by summing up national wheat production, imports, and initial reserves, and then subtracting wheat exports. It offers a detailed assessment of country-level supply imbalances resulting from disruptions, enhancing our understanding of localized impacts from supply shocks. By contrast, TWIST is a global supply-demand model that, driven by annual production and demand, calculates year-to-year variations in the equilibrium world market price and associated storage movements. By computing the endogenous responses of international prices to supply and demand shifts, TWIST offers insights into the wider implications of such disruptions on global food security and market stability. In our scenario analyses, we use both models in parallel, but do not couple them. This allows leveraging their unique strength but avoids the additional complexity and associated uncertainties of an integrated modeling approach. However, it comes with the drawback that the changes in national supply computed with FSC do not feed back into the price dynamics calculated by TWIST. Detailed model descriptions can be found in the Methods and in the model description papers47,48.

We capture two key food security metrics. First, world market price hikes impact consumers, especially in low-income countries that have little means to insulate their domestic market. Second, there is the concept of ‘impaired supply’. This term indicates supply challenges from production anomalies or export restrictions that countries have to cope with by either tapping into their reserves, filing additional demand requests to non-failing suppliers or, as a last resort, reducing their consumption.

Using a storyline approach49,50, we compare the actual price hike and impaired supply from the 2022 trade year (factual scenario) to counterfactual scenarios in which we vary key drivers. In this study, we analyze counterfactuals based on historical events instead of speculative scenarios, under the premise that historical experiences provide more tangible insights for individuals51. Our approach is best suited to assess first-order effects of weather- and policy-induced supply disruptions on the world market price and national supply levels. Accordingly, our scenario analysis examines the impact of export restrictions, international agreements, and major crop failures. We deliberately exclude higher-order effects, such as spillovers from energy prices or other agricultural commodity prices14,52,53, from our study of the wheat market.

We employ this modeling setup to address the question of how international cooperation may have helped mitigate the crisis by: i) reducing the actual wheat market price hike in the 2022 trade year and ii) preventing impaired supplies. Furthermore, we aim to assess the potential for an even more severe crisis to emerge under similar conditions. We achieve this by examining the impact that historical stressors – such as the weather-induced multi-breadbasket failures and escalating export restrictions of the 2007/08 World Food Price Crisis14 – might have had if they occurred in the trade year of 2022. Specifically, we investigate their potential effect on the factual price spike and impaired supplies in 2022. Finally, we evaluate various short-term measures, both on the supply and demand sides, that could have helped mitigate the severity of the crisis. (Here, we define short-term measures as measures that impact annual wheat prices.)

Results

In our analysis, we consider international trade years for wheat spanning from July 1st of one calendar year through June 30th of the following year (e.g., 2022 refers to the international trade year July 2022–June 2023). Our model operates on an annual timescale, which inherently smooths over daily or weekly fluctuations.

Factual scenario: reproduction of historical annual wheat prices

For the factual scenario, we drive the TWIST model with annual production and domestic consumption data for the period 1980–2022 from the Production Supply and Distribution (PSD) database of the United State Department of Agriculture (USDA)25. We further use the Food Export Restrictions Tracker from the International Food Policy Research Institute (IFPRI)54 to estimate relative reductions in world market supply and demand resulting from national export restrictions during the last two world food price crises (2006–2011) and in the current crises (2021–2022), and account for major changes in stockholding policies (Methods and Supplementary Table 1). We rely solely on input data from the USDA-PSD and IFPRI, as FAO data is not available for the selected study period. Comparing simulated prices with the reported real world market prices for wheat shows that the model is able to reproduce price levels and year-to-year price changes reasonably well (coefficient of determination of \({R}^{2}=0.82\)) (Fig. 1a). In subsequent sections, we examine 2022 price shifts compared to the simulated 2000–2020 average (indicated by the dotted line in Fig. 1a).

a Comparison of observed real (solid orange line) annual world market prices for wheat to simulated prices (dashed black line) for the international trade year for wheat (July–June) over the period 1980–2022. The horizontal dotted black line indicated the simulated average price for the period 2000–2020. The vertical black arrow indicates the price hike in 2022 (relative to the reference period). b, c National impaired supplies in percent of the 2018–2021 average annual supply (b) and in multiples of 2018–2021 average domestic reserves (c).

In our factual scenario, the simulated wheat price for trade year 2022 is 37.0% higher than the long-term 2000–2020 average of simulated prices, while this historical reported price increase was 31.8% higher (not directly shown in Fig. 1a) than the average of reported prices over the same period. Notably, this discrepancy partly arises from the fact that the reported 2000–2020 (in trade year 2022) average price was higher than the simulated price. Despite this variation in the reference period, the simulated and reported prices for 2022 are nearly identical (Fig. 1a).

We drive the FSC model with country-to-country trade data from the Food and Agricultural Organization of the United Nations (FAOSTAT) [24] and with country-level productions, domestic consumptions, and ending stocks from the USDA-PSD database25. By accounting for export restrictions as reported by IFPRI (Supplementary Table 1) and production anomalies in 2022 (Supplementary Table 2) from the USDA-PSD database25, we estimate the country-level impaired supplies in 2022 compared to a 2018–2021 baseline period. In a year when no major wheat-exporting nations imposed export restrictions and global wheat production reached an all-time high25, the countries most substantially impacted were those relying on Ukraine for their wheat supply. Moldova and Tunisia were the hardest hit, with declines of 55.7% and 13.2% in their supplies, respectively (Fig. 1b). Egypt’s wheat export restrictions helped avert higher domestic supply shortages, but impaired supplies to Eritrea. Similarly, export restrictions from Kazakhstan impaired supplies to downstream import-reliant countries like Turkmenistan and Tajikistan (Fig. 1b and Supplementary Fig. 2). Large domestic production losses relative to the 2018–2021 average (Supplementary Table 2) also drove large impaired supplies relative to reserves in Argentina and Spain (Fig. 1). Overall, most countries are able to buffer the impaired supply of wheat by their domestic reserves (Fig. 1).

How international cooperation likely averted a larger crisis

We next explore a series of counterfactual scenarios to assess to what extent international cooperation helped mitigate the 2022 price hike (Table 1). The first counterfactual scenario ‘No Black Sea Grain Initiative’ considers a situation where the Black Sea Grain Initiative failed and Ukrainian exports through the Black Sea remain blocked throughout 2022 reducing Ukrainian exports by 60% compared to the pre-invasion 1918–2021 average55. This situation increases the 2022 wheat price hike by +3.0 percentage points (pp) compared to the factual scenario (Fig. 2a). While there is a surplus of supply to the domestic market in Ukraine because less grain can be exported (Supplementary Fig. 3), countries depending on Ukrainian wheat exports suffer larger impaired supplies than in the factual scenario (Fig. 2b depicts the regions with the largest impaired supplies in the Blocked Ukraine scenario due to Ukrainian supply failures; see Supplementary Tables 5 and 6 for the impaired supplies for all countries). Tunisia is most affected (−31.7% vs. factual −13.2%) followed by Libya (−23.1% vs. factual −0.5%) and Lebanon (−23.1% vs. factual −0.3%).

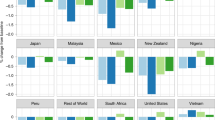

a Changes of the modeled world market price for wheat in the international trade year 2022 (July 2022–June 2023) compared to the 2000–2020 average for the factual scenario (blue bar) and different counterfactual scenarios that were averted by international cooperation (orange bars). The white number indicates the factual price increase relative to the 2000–2022 average. Black numbers indicate the relative price increase in percentage points (pp) of the counterfactual 2022 prices compared to the factual price. b National impaired supplies of selected countries for the factual (blue dot) and the counterfactual scenarios relative to the 2018–2021 average.

In the second counterfactual scenario, ‘Blocked Ukraine’, the international community fails to enact both major multilateral agreements, the Black Sea Grain and the EU Solidarity Lanes initiatives, which results in a complete blockage of Ukrainian exports. Compared to the factual price hike, this scenario results in an additional price increase of +8.3 pp (Fig. 2a). Widespread supply failures strip many countries in West Asia, North Africa, and Southeast Asia of more than one fifth of their usual annual supplies. Especially large impaired supplies arise for Tunisia (−44.0% vs. factual −13.2%), Lebanon (−38.3% vs. factual −0.3%), Libya (−38.3% vs. factual −0.5%), Djibouti (−36.1% vs. factual −0.7%), Mauritania (−32.9% vs. factual 0%), and Indonesia (−27.0% vs. factual 0%) (Fig. 2b).

In the third counterfactual scenario, ‘Ongoing export restriction’, we assume that countries not directly involved in the conflict will maintain the export restrictions they initially imposed during trade year 2021 throughout the entire 2022 trade year. Since no major net exporting countries (besides Ukraine and Russia) imposed restrictions at the start of the crisis, the 2022 price increases by +4.7 pp compared to the factual scenario. However, several strongly import-dependent countries in the Horn of Africa such as Eritrea (−49.1% vs. factual −13.8%) and Somalia (−12.7% vs. factual −3.6%) suffer from supply failures mainly due to missing supplies from Egypt (Supplementary Fig. 2).

In the fourth counterfactual scenario, which we term ‘Lacking international cooperation,’ elements from the previous three scenarios are combined. As a result, the price hike for 2022 exceeds that of the factual scenario by +13.3 pp, leading to widespread supply failures (Fig. 2). Many countries in Northern Africa, the Horn of Africa, and East Africa, as well as in South-East Asia with import dependencies on Ukraine experienced larger supply impairments than in the factual scenario. For instance, the impaired supplies of Eritrea, Tunisia, Libya, Lebanon, Djibouti, Mauritania, and Indonesia, increase by more than 27 pp compared to the factual scenario (Fig. 2b). For Lebanon, Mauritania, Libya, Indonesia, and Tunisia, they exceed the countries’ domestic reserves by more than 170% (Fig. 3b and Supplementary Table 7) revealing the high vulnerability of these countries to Ukrainian supply failures. By contrast, the comparably large supply failures of Argentina (−89%), Paraguay (−39.5%) or Spain (−28.7%) are the result of poor domestic harvests (Fig. 3a, Supplementary Tables 2 and 5). Additionally, Central Asian nations such as Turkmenistan (−23.9% vs. factual −17.9%) and Uzbekistan (−20.6% vs factual −3.3%) suffer impaired supplies that are large compared to the factual scenario due to their import dependencies on Kazakhstan (Supplementary Fig. 2), which imposes export restrictions in this counterfactual scenario (Supplementary Table 1). Notably, when the full scale Russian invasion started in February 2022, winter wheat (the dominant wheat species) had already been sown in fall 2021 in the Northern Hemisphere, where most of the wheat is grown. Therefore, we do not consider the effects of cropland expansion in the counterfactual scenarios of this section and keep the global wheat production fixed at its historical value.

Counterfactuals based on historical stressors

In the following analysis, we explore how various scenarios could have exacerbated the food security crisis in 2022: i) ‘Multi-breadbasket failures’ representing the failures that preceded the 2007/08 crisis, ii) ‘Escalating export restrictions’ which substantially aggravated the 2007/08 crisis, iii) ‘Historical stressors’ a combination of these two key drivers, and, iv) a worst-case scenario combining ‘Blocked Ukraine’ with ‘Historical stressors’ (Table 1). In the ‘Multi-breadbasket failure’ scenario, global production failures amount to a decrease of 4.4% (Supplementary Table 3). These failures result in a 2022 price hike that is +22.1 pp higher than in the factual scenario (Fig. 4a). This increase not only exceeds the relative price hikes in all counterfactuals from the previous section but also surpasses the price spike of the 2007/08 crisis by 6.5% (Fig. 4a and Supplementary Fig. 1a). In the ‘Escalating export restrictions’ counterfactual, the 2022 price hike increases by +17.3 pp. Additionally, export restrictions imposed by Argentina result in widespread supply failures in Southeast Asian countries. For example, Thailand experiences an 11.8% decrease in supply compared to a factual change of 0%, as shown in Fig. 4b. Similarly, Uganda and Kenya experience decreases of 26.5% and 17.4% respectively, compared to factual changes of −0.2% and −2.8% (Supplementary Table 6).

Same as Fig. 2 but for counterfactual scenarios based on historical stressors. The vertical gray dashed line in (a) indicates the simulated price hike in the international wheat trade year 2007 (July 2007–June 2008) relative to the 2000—2020 reference period.

When the ‘Historical Stressors’ scenario combines both counterfactuals, the resultant price hike is twice as large as the actual increase observed, leading to widespread and severe supply failures. According to Supplementary Table 6, Romania is most severely affected, with a projected decrease of 80.4% compared to the actual increase of 0.3%. This is followed by Tajikistan and Brazil, which see decreases of 48.4% (vs. a 10.3% factual decrease) and 46.4% (vs. a 37.2% factual increase), respectively.

Finally, in the ‘Worst Case’ scenario, the supply available to international markets is drastically reduced by 4% (Supplementary Table 6). This results in a strong price increase of +52.5 pp compared to the factual price spike, exceeding the factual 2007/08 price by approximately 25% or +$35 per metric ton (Supplementary Fig. 1). Over 28% of the countries face supply shortages that exceed their domestic reserves and more than 50% of the countries have supply losses higher than 40% of their reserves (if they have any at all, Fig. 5b and Supplementary Table 8). The countries most reliant on Ukrainian wheat and experiencing substantial impaired supply include Tunisia in Northern Africa, with a −44.1% drop compared to a factual change of −13.2%. In the Greater Horn of Africa, Djibouti shows an impaired supply of −40.3% versus a factual reduction of −0.7%. Indonesia, in South-East Asia, suffers from an impaired supply of −39% against a factual change of 0%. In the Middle East, Lebanon’s impaired supply is −38.8% compared to a factual change of −0.3%. In South Asia, Bangladesh faces an impaired supply of −30.3% relative to a factual change of −0.5% (Fig. 4b). The impaired supplies of Lebanon, Mauritania, Libya, and Indonesia exceed twice their 2018—2021 average annual reserve (Fig. 5b and Supplementary Table 8). Notably, the impaired supplies of many import-dependent countries in the Sahel region and Central Africa which do not report reserves could also exceed their domestic reserves (Fig. 5b). Further, several countries not dependent on Ukrainian wheat exports also experience substantially impaired supplies due to poor domestic harvests. This includes Canada, with an impaired supply of −80.8% vs. a factual increase of +43.0%, Romania at −80.6% compared to a factual +0.3%, and Bulgaria, which shows an impaired supply of −62.3% against a factual increase of +27.6%. Similarly, Brazil and Chile report impaired supplies of −46.4% and −23.9% respectively, compared to factual increases of +37.2% and +2.0% (Fig. 5a and Supplementary Fig. 2). The impaired supplies in Brazil and Chile are partially due to export restrictions imposed by Argentina.

The factual 2022 crisis triggered by the Russian Invasion of Ukraine was mitigated by a better-than-usual global harvest and the absence of the cascading export restrictions of the previous crises. Notably, already in the counterfactuals where only one of the main stressors of the 2007/08 crisis (multi-breadbasket failures, escalating export restrictions) compounds with the 2022 factual situations, the 2022 price hikes exceed the factual price hikes. Suggesting that the global wheat market situation in 2022 was more critical than in the years preceding the 2007/08 crisis.

Mitigation potential of short-term coping measures

Next, we explore counterfactual scenarios to assess the potential for mitigation through two demand-side and one supply-side coping measures, all of which have been actively discussed but not yet implemented in the current crisis (Fig. 6). We deliberately study only the price impacts of the coping measures because the FSC model does not allow for the endogenous calculation of trade responses resulting from changes in regional supply or demand due to these measures, and we want to avoid introducing ad-hoc rules for demand and supply redistributions (cf. Methods).

Relative changes in the world market price for wheat in the international trade year 2022 (July 2022–June 2023) compared to the 2000—2020 average for the factual scenario (blue bar) and under different counterfactual short-term coping strategies (orange bars). The white number indicates the factual price increase relative to the 2000–2022 average. Black numbers indicate the relative price reduction in percentage points (pp) of the counterfactual 2022 prices compared to the factual price. The counterfactual scenarios include one or several of the following measures: reduction in feed consumption by −30% in the EU and globally, reduction in wheat stockpiles in G7 countries and China corresponding to −1% and −5% reductions in global stocks, and increasing wheat production by the major producers China, India, USA, France, Canada, Australia, Germany, and Argentina by 3% and 3% globally compared to the 2018–2021 average. The moderate (rigorous) coping strategy counterfactual combines the strategies ‘−30% feed consumption in EU’ (‘−30% feed consumption globally’), ‘−1% global stocks’ (‘−5% global stocks’), and ‘+3% production of major producers’ (‘+3% global production’).

As the first demand-side measure, we analyze a reduction in livestock in order to reduce the feed use of wheat (constituting about 20% of global demand). In this counterfactual, we consider a reduction in wheat demand for animal feed by 30% for one year in the EU as suggested by experts in early calendar year 2022 when wheat prices started to hike due to the Russian invasion of Ukraine33. This would imply a reduction in animal breeding up to 30%, if there are no shifts in agricultural practices. Since the period between breeding and birth of farm animals is less than a year56,57, this demand-reducing measure would be biophysically feasible. Feed use constitutes 40% of the total EU wheat consumption25. Accounting for a feed-to-food conversion ratio of 24% (conservative estimate)58, global demand for wheat reduces by −1.3%, resulting in only a limited decrease of the 2022 price hike by −5.8 pp compared to the factual scenario (Fig. 6). Applying this measure worldwide decreases global wheat demand by −4.5%, and the factual 2022 price hike is more than halved (−19.3 pp). The latter scenario, which requires high levels of global coordination, serves as an aspirational test of the extent to which such a demand-side strategy could be effective.

As a second demand-side strategy, we discuss a reduction of (strategic) stocks in times of crises to reduce the demand through restocking attempts in crisis situations. This strategy is motivated by the observations that the economically powerful G7 countries and China maintain stocks that are much higher, relative to their consumption, than most other countries; the G7 countries and China have a stock-to-consumption ratio of 61%, compared to 21% for the rest of the world (global average 37%)25. It appears unlikely that a moderate reduction in the stocks of these countries would measurably reduce their national food security. In the third counterfactual, we study a moderate reduction of the stocks in the G7 and China by 1.5% corresponding to a 1% reduction in global stocks for one year. This measure mitigates the price hike by −6.5 pp compared to the factual scenario. It thus has a similar price effect as the 30% reduction of feed demand in the EU. A stronger reduction of stocks in G7 countries and China by 7.6% (corresponding to a reduction of global stocks by 5%), would reduce the 2022 price spike drastically by −31.5 pp. Notably, the G7 countries and China would still maintain a greater average stock-to-consumption ratio than the rest of the world.

In the ongoing crisis, the idea of boosting global production has gained wider discussion than demand-side strategies28,31,43, likely because it is more readily accepted by stakeholders and the general public. Following a recent proposal by Lin et al.28, we consider a 3% increase in wheat production for major producers – China, India, USA, France, Canada, Australia, Germany, and Argentina – which together account for 55.6% of world wheat production. This corresponds to a 1.67% increase in global production compared to the period 2018–2021 (Supplementary Table 2). The 3% production increase from major producers reduces the 2022 wheat price hike by −7.6 pp compared to the factual scenario. This reduction is comparable to what is achieved under the scenarios involving moderate feed use and stock reduction. A 3% increase in global wheat production, attainable either through a larger production boost from these major producers or through an increase across all wheat-producing countries, leads to a −13.4 pp reduction in the 2022 price spike.

Examined individually, the moderate versions of each coping strategy discussed yield only modest price mitigation. The more rigorous variants are more effective, but likely far more challenging to implement. We then explore a blended approach using moderate measures and find that this would more than halve the 2022 price spike, reducing it by −19.4 pp compared to the factual scenario. To fully map out the risk reducing potential of the discussed coping strategies, we also consider a counterfactual combining the most rigor versions of each strategy. This leads to a price drop in 2022 by −59.1 pp or -$56 per metric ton – pushing the price to roughly 22% below the 2000–2020 average level (Fig. 6 and Supplementary Fig. 1).

Discussion

Our analysis emphasizes the vital importance of international collaboration and multilateral agreements – such as the UN-brokered Black Sea Grain Initiative and the EU Solidarity Lanes Initiative – in enhancing global food security, particularly given the impact of the Russian invasion in Ukraine. This is well in line with the literature59 showing that international agreements that lower agricultural trade barriers can increase the resilience of the global food system to climate and trade shocks. Further, our findings indicate that maintaining Ukrainian wheat exports has not only stabilized global wheat prices but also likely averted severe supply interruptions for import-dependent developing countries in the Middle East, North Africa, and Southeast Asia. Many of these countries would not have been able to buffer such interruptions with their reserves. Our results align well with empirical work by Bertassello et al.60, who found a similar set of countries (e.g., Oman, Libya and Mauritania) to be most vulnerable to Ukrainian supply failures due to the Russian invasion. They explained the high vulnerability of these counties by their strong import dependencies on Ukraine, domestic wheat reserves that are too small to buffer the resulting supply shocks, and low per-capita income rendering it difficult for those countries to buy additional grain at world markets. Further, in line with our findings, a recent study of Zhang et al.61 found Lebanon, Libya, Tunisia, and Bangladesh to be especially vulnerable to food supply disruptions caused by the Russo-Ukrainian war.

Our findings underscore the pivotal role of both supply and demand strategies in mitigating risks to food security, especially when factors like adverse weather and escalating export restrictions can exacerbate crises. An analysis of the key short-term factors driving the 2007/08 crisis reveals that multi-breadbasket failures, combined with uncoordinated beggar-thy-neighbor policies from national governments aimed at insulating domestic markets from global price volatility, could have substantially aggravated the crisis. This finding is especially concerning in the light of ongoing climate change, which is projected to render multi-breadbasket failures more likely17. In this regard, our counterfactual analysis expands on previous empirical and review studies on food security risks from the Russian invasion of Ukraine. We offer additional insights by assessing the impact of international cooperation and weather-induced crop failures.

Both modeling techniques used in this study, the dynamic modeling of price hikes at individual agricultural markets for main food staples48,62,63 and network analysis to assess the vulnerability of countries to supply failures13,47,60,61,64,65 have been used extensively in the literature to assess food security risks in crisis situations. Here, we combine both methods in a harmonized scenario setup that was previously employed by Falkendal et al.46. Thereby, we intentionally avoid the direct coupling of the global market model TWIST with the static network FSC due to the inherent risks and complexities associated with such integration. Instead, we use these models as complementary analytical tools within our scenario analyses: TWIST simulates the broader global market dynamics, focusing on the endogenous responses of international prices to supply and demand shifts. By contrast, the FSC model allows assessing country-level supply and demand imbalances. This analysis pinpoints the extent of impaired supply and the necessity for compensatory supply following disruptions. Its country-specific focus is essential for understanding the localized impacts of supply shocks.

Our approach has the advantage of being comparably simple and transparent, but also introduces limitations (cf. Methods). Importantly, the analysis omits the higher-order effects through which the multi-crisis of 2022 impacted prices and impaired supplies. This omission may lead to either an overestimation or an underestimation of the associated risks to food security.

First, by modeling solely the wheat market, we do not account for spillover effects of price levels and price volatility from other commodity markets, e.g., the energy sector. There is an important body of empirical studies52,53,66,67 showing that spillover effects between energy and agricultural markets (as well as other commodity markets) can drive price levels and volatility in crisis situations, especially on daily to monthly timescales68. By neglecting spillover effects, we may underestimate the impact of the crises on prices. Since spillover effects are larger in times of crises69,70, the underestimation of the price hike may be strongest in those counterfactual scenarios, where the crisis is assumed to be worse than in the factual scenario.

Second, our single market approach does not allow accounting for cross-commodity substitution, which may lead to an overestimation of the price hike. However, we would expect this overestimation to be moderate because during the 2022 crises also the prices for other staple crops hiked simultaneously with the wheat price71. This may have limited the potential to reduce costs through cross-commodity substitution, which may have therefore played only a minor role in wheat price formation.

Third, we cannot model the endogenous demand-side responses of countries to impaired supplies, such as redistributing demand to unaffected suppliers, broadening the supplier base72,73,74, or behaviors like panic buying and restocking attempts48. Whereas the former two responses would likely temper the price hike, panic buying and restocking attempts have shown to be price drivers14. Thus, the neglect of these demand side responses may lead to an over- or also underestimation of the price hike, depending upon which of these mechanisms is dominant. In addition to these limitations, our modeling approach has several more technical limitations (Methods).

To accommodate these limitations, we kept our counterfactual scenarios deliberately simple, focussing on potential main price amplifying and mitigation factors. We thereby focus on historical stressors, such as the production failures of the 2007/08 crisis, to avoid speculative scenarios beyond the capability of our models. We assess the impacts of multinational trade agreements and multilateral coping strategies on global food security. However, this does not mean that local measures are less effective in protecting consumers75. It has been shown that social networks and regional actors can enhance the resilience of local food systems76,77. Further, it has been shown that policies fostering national self-sufficiency can enhance food security domestically78, but not all countries have the necessary environmental capacity to achieve self-sufficiency79,80. However, if many countries strive for self-sufficiency this could undermine international trade and thereby the ability of the world food system to buffer local production failures, which may become more frequent under global warming81.

In our analysis, we focus on the international wheat trade year 2022 that concluded in June 2023. Since June 2023, there have been two concerning developments related to major international initiatives. First, Russia has terminated the implementation of the Black Sea Grain Initiative82 and attacked alternative Ukrainian export terminals, such as the Danube port Izmail83. Second, multiple Eastern European countries have restricted imports of Ukrainian wheat to shield local farmers, and the resolution of this conflict at the EU level remains uncertain84. These recent developments put short-term coping strategies as those discussed in this paper back in the spotlight of political debate. Our analysis indicates that when implemented by a coalition of wealthy exporting countries, a coordinated approach to these short-term strategies could considerably mitigate, or even entirely prevent, damaging price spikes. While it is unlikely that the measures could jeopardize food security in the implementing countries, each measure does come with its own set of challenges. These include additional costs and potential resistance from both producers and consumers, factors that could complicate implementation.

Planting more wheat seems to be one of the most intuitive solutions in the face of a wheat crisis. However, rapidly scaling up production can be challenging — a cropping response may be delayed until the next growing season if a crisis emerges post-sowing. For instance, when the full-scale Russian invasion of Ukraine started in February 2022, winter wheat had already been sown in the Northern Hemisphere where most major wheat producers are located. This complicates our counterfactual scenario, in which the eight most important producers increase their production by 3% in the trade year 2022. Except for Argentina, these are all Northern Hemisphere countries. They would have to plant spring wheat in addition to the already planted (and more common) winter wheat. Further, while expanding wheat cropping area can aid food security in the short term, it could also substantially increase agriculture’s carbon footprint43 and potentially heighten disease risks85,86,87 if not managed carefully. Countries must weigh these environmental concerns against food availability. Additionally, quick intensification of production may conflict with longer-term environmental and biodiversity protection plans88, degrade soil health88,89,90 and strain water resources in some regions91,92 if sustainable practices are not prioritized. However, targeted and strategic expansion of wheat planting informed by ecological constraints could aid food security during crises in many contexts.

Wheat demand can be temporarily reduced by lowering stockpiles in affluent countries. However, while such a move may not directly threaten food security, clear and transparent communication is essential with utmost care when decreasing strategic reserves during a crisis. Failing to do so might not garner the support of decision-makers and the general public, which could lead to panic buying or even public unrest, both of which are common during food crises93.

The reduction of livestock to curtail the feed use of wheat would necessitate public subsidies for animal farmers and related industries (e.g., abattoirs) to shield them from financial insolvency. The absence of such compensatory measures could lead i) unemployment, ii) economic downturns in regions heavily reliant on livestock farming, and iii) the relocation of livestock production to nations that do not implement measures to reduce wheat demand for animal feed. Furthermore, livestock reduction policies can typically only be implemented for short periods of 1 or 2 years before risking the relocation of livestock production abroad. Avoiding this outcome would require rapid changes in consumer behavior to accept less animal-sourced heavy diets or implementing protective import taxes, both of which seem unlikely. Consequently, consumer prices for dairy products and meat are likely to surge in both the implementing and import-dependent countries. This price hike, especially in times of high food price inflation, may severely limit the social acceptance of this measure, even in wealthier nations. Despite a reduction of EU livestock, which could potentially decrease EU’s animal protein supply, each EU citizen’s protein intake would still surpass the global average, with the option to substitute animal protein with plant-based sources94,95,96. Additionally, priority in EU meat exports should be given to low-income, meat import-dependent countries like Cape Verde to safeguard their nutritional needs94,95. Finally, even if the short-term reduction of livestock would be possible due to sub-annual breeding cycling, it would have required coordinated and decisive action by many political and societal actors.

By evaluating the effectiveness of the international agreements as well as potential demand- and supply-side measures, our study contributes to the ongoing discourse on collaborative policy responses to crisis situations97. Our analysis further reveals the need to develop more elaborate rapid assessment tools for assessing the short-term risks to food security resulting from weather- and conflict-induced supply failures. These tools should fully account for the complexity of food trade networks (e.g., regional food budgets) and be able to resolve short-term (e.g., weekly to monthly), out-of-equilibrium market dynamics. Such a tool would allow for rapid and systematic assessments of i) short-term systemic risks and ii) the effectiveness but also the limitations and adverse side effects of a broad range of coping strategies. They could thus complement established agricultural integrated assessment models like GTAP-AGR98, GLOBIOM99, and MAgPIE100 primarily designed to assess long-term risks to global food security from climate change and socioeconomic factors. Combining short- and long-term risk assessment tools would allow providing critical information and decision support for decision-makers in politics and international organizations during developing food security crises.

Methods

Agricultural commodity price model – TWIST

We use the global Trade WIth STorage (TWIST) model, which is a dynamic supply-demand model including producer and consumer storage. The model calculates year-to-year variations in prices and stocks at individual global grain markets, driven by annual changes in supply and demand. We assume that all produced grains are traded at a single common global market, and we model the annual world market price of wheat. Here, we concentrate on the main modeling principles, while a detailed model description was published by Schewe et al.48.

The supply curve (\({Q}_{{\mathsf{s}}}\)) is a function of the equilibrium world market price (\(P\))

where \({I}_{{\mathsf{p}}}\) is the producer storage, \({\delta }_{{\mathsf{trade}}}\) is the share of the world market supply unavailable for trade due to export restrictions, \({P}_{{{{\rm{max }}}}, {\mathsf{p}}}\) is the maximum producer price, and \({e}_{{\mathsf{s}}}\) is the price elasticities of supply. Contrary to the standard supply-demand model, TWIST account in its supply curve not only for the current production but also for the carry-over of grain in the producer storage

where \({Q}_{x}\) is the quantity sold to the consumer and \(H\) is the global production (harvest).

Similar to the supply side, the demand curve (\({Q}_{{\mathsf{d}}}\))

is a function of the equilibrium world market price \(P\) and the consumer storage \({I}_{{\mathsf{c}}}\). Further, \({\delta }_{{\mathsf{demand}}}\) is the change in consumer stock-to-use (as a proxy for changes in consumer demand, e.g. stock-up-attempts in order to build up grain reserves), \({I}_{{{{\rm{max }}}} , {\mathsf{c}}}\) is the maximum size of consumer storage, \({P}_{{{{\rm{max }}}} , {\mathsf{c}}}\) is the maximum consumer price, and \({e}_{{\mathsf{d}}}\) denote the price elasticities of demand. Accounting for the carry-over of consumer side stocks to the next time step, the update equation for the consumer storage reads

where \({Q}_{{\mathsf{out}}}\) denotes the final consumption. The maximum storage level \({I}_{{{{\rm{max }}}} , {\mathsf{c}}}\) controls the upper end of the short-term demand curve such that at a price of zero the consumer refills its storage completely. Thus, \({I}_{{{{\rm{max }}}} , {\mathsf{c}}}\) controls the storage level which the consumer considers to be the optimal tradeoff between food security in times of crisis and storage costs in normal times.

As a model for global market dynamics, TWIST focuses on analyzing the annual price fluctuations and stock movements of a single commodity. The model uses the historical consumption pattern to drive the demand for wheat. TWIST assumes that changes in the world market price and stock levels reflect a simplified interaction of supply, demand, and stocks, disregarding country-level markets dynamics (e.g., domestic wheat subsidies), sub-annual price driver (e.g., speculation on future market), cross-commodity substitutions (e.g., endogenous dietary shifts), and spill-over effects from other sectors (e.g., high crude oil price affects wheat price). This approach is designed for the evaluation of broad market trends without considering the nuanced effects of short-term market forces or regional market peculiarities.

In the factual scenario, the free parameters of the model are calibrated to reproduce the observed world market price for wheat for the years 1980–2022 (Fig. 1a). The model parameters are listed in the appendix under Supplementary Table 4. They partially differ from the parameter choice in the original publication48 because the model’s calibration was amended. We augmented the consumer stock-to-use ratio for the trade year 2021 and 2022 to encapsulate the escalated wheat procurement by nations as a strategic response to the Russian incursion into Ukraine, and the ensuing apprehensions regarding domestic food security.

In the counterfactual scenarios, we consider four different categories of impacts: First, we model national production anomalies for the trade year 2022 by reducing the projected baseline world production \(\left({\delta }_{{\mathsf{trade}}}\right)\) by the affected countries’ shares of world production (as determined from the period 2019–2021) but keeping consumptions fixed to their projected baseline values. Second, we model export restrictions by assuming that when a country restricts exports by a certain share, this share of the national production is retained from the world market \(\left({\delta }_{{\mathsf{trade}}}\right)\) and available for domestic consumption. To this end, we reduce global demand \(\left({\delta }_{{\mathsf{demand}}}\right)\) by the minimum of the country’s multi-annual average consumption and the retained grain. Third, we model changes in wheat by reducing demand global demand \(\left({\delta }_{{\mathsf{demand}}}\right)\) by the assumed factor. Fourth, we model changes in the storage target level by changing the maximum size of consumer storage \(({I}_{{{max }} , {\mathsf{c}}})\). The maximum size of consumer storage is calibrated on political domestic food security decisions and to fit the global wheat price (Fig. 1a). Which impact channels are used to what extent in the factual and counterfactual scenarios is shown in Table 1.

Static grain supply network model – FSC model

We supplement the global supply-demand analysis by examining country-level supply balances for the export-restriction and production-decline scenarios using the Food Shock Cascades (FSC) model. We calculate each country \({\mathsf{c}}\)’s annual food balance in kilocalories as

where \({S}_{{\mathsf{c}}}\) is domestic supply, \({H}_{{\mathsf{c}}}\) is national wheat production, \({I}_{{\mathsf{c}}}\) is imports, \({E}_{{\mathsf{c}}}\) is exports, and \({R}_{{\mathsf{c}}}\) represents reserves of country \({\mathsf{c}}\). In case of production changes, supplies are directly impacted through the mass-balance Eq. (5). For a country imposing export restrictions by x%, we reduce all values in the corresponding row in the export matrix by x%, leading to losses of imports for partner countries. For scenarios with production declines and export restrictions, we estimate the relative ‘impaired supply’: \(\chi =\frac{S-{S}_{0}}{{S}_{0}}\), which is the resulting annual national supply \({S}\) relative to the baseline supply of 2018–2021 (\({S}_{0}\)).

The FSC model for wheat is designed to analyze scenarios for global trade and production. Utilizing data from 2018 to 2021, it establishes a baseline for trade networks, assessing deviations in national production for the trade year 2022. These deviations are pivotal in understanding supply anomalies driven by shifts in national production and the impact of export restrictions.

The model assumes immediate and direct impacts from export restrictions and production shocks, simplifying the complexities of global wheat supply dynamics. This approach enables the analysis of immediate effects on global supply chains without accounting for potential mitigating factors such as informal trading or delayed market responses.

‘Impaired supply’ within the model is directly correlated with these disruptions, not taking into account gradual market adjustments or compensatory mechanisms that may occur. Additionally, the model evaluates the capacity of countries to manage these disruptions with their domestic wheat reserves, assuming full accessibility and immediate mobilization. This does not consider potential logistical, legal, or economic barriers that could affect the use of reserves.

Compared to Falkendal et al.46, we update the trade network with the latest data from FAOSTAT and USDA-PSD (cf. Data section in Methods). For the scenarios, we i) reduce the national wheat production baseline (2018–2021) by the country’s production anomaly of 2022 or ii) reduce the national wheat export by the assumed restricted share of national exports (cf. Table 1).

Analysis setup

Both models, the TWIST and the FSC model, are complementary analytical tools within our scenario analyses, which do not (directly or indirectly) interact or exchange data. On the one hand, the FSC model is used to assess country-level supply balances, specifically identifying the ‘impaired supply’ – the quantity of supply lost that needs to be compensated for in the wake of disruptions. This analysis is crucial for understanding the extent and impact of supply shortages on a country-by-country basis. On the other hand, the TWIST model, which is not influenced by FSC’s results, computes the endogenous responses of international wheat prices to supply and demand shocks, e.g., arising from geopolitical events, and thus focusing on global market dynamics. By capturing the global interplay of supply, demand, and storage, the TWIST model offers broader insights on global food security and market stability, rather than specific country-level supply imbalances calculated by the FSC model. Using these independent applications within a coherent analytical framework provides a comprehensive understanding of both country-specific and global market impacts of agricultural commodity disruptions.

We use a set of transparent counterfactual scenarios to gain a deep understanding of the price responses to a large range of supply and demand shocks. At the same time, this scenario analysis serves as a sensitivity analysis ensuring the reliability and robustness of our findings.

Limitations

The TWIST model, while effective in calculating the dynamic development of price and storage on a global scale, has its own set of limitations. One of the main challenges is that it can be difficult to estimate national food security risk using a model that operates on a global scale. Furthermore, the TWIST model intentionally neglects certain mechanisms, such as interactions between the wheat market and other markets. It’s also worth noting that while speculation may not seem to play a major role in annual prices, it could have a larger effect on monthly or shorter timescales. For TWIST, we exclusively rely on input data from USDA-PSD and IFPRI (see Data section below) due to the unavailability of FAO data for the chosen study period.

The FSC model, while robust in its design, does have certain limitations that should be acknowledged. As a static network model, it does not account for dynamic trade flow adjustments and storage carry-over effects. This means that the model may not fully capture the complexities of real-world trade dynamics and the impact of storage on supply and demand. Additionally, the FSC model primarily focuses on the forward propagation of failures, without considering demand-side responses such as the redistribution of demand to unaffected suppliers in the event of supply failures. Despite these limitations, the FSC model provides a valuable tool for analyzing the potential impacts of disruptions in the global food supply chain.

Notably, these economic models are not designed to explore political dynamics or practical challenges of achieving international cooperation among nations with diverse interests, but rather focus on the food security impacts of international agreements and weather-induced crop failures.

Data

For TWIST, we use annual world wheat production, domestic consumption as well as ending stock data from the United States Department of Agriculture (USDA) Foreign Agricultural Service’s Production, Supply and Distribution (PSD) database25 over the time period 1975-2022. In order to obtain these values for the international wheat trade year (July – June), we rebalance the national market year data from PSD accordingly. The national weather-induced production anomalies of the trade year 2007 are computed as deviations from the 9-year moving average.

Additionally, we utilize national export restrictions data provided by IFPRI54 to calculate the national restricted exports and the consequent global supply and demand reductions for the trade years 2006–2011 and 2021–2022. We operate under the assumption that if a country imposes a wheat trade ban for x% of the days of a trade year, then the annual wheat supply to the world market (export) is reduced by x%. The global supply is then adjusted in accordance with the nation’s share of the global supply. Next to this, we also account for a reduction in global demand, because it is assumed that the withheld wheat is exclusively used for the domestic market, which does not require additional wheat once the national demand is met. Therefore, if 100% of the domestic wheat demand is satisfied by the non-exported wheat, then the global wheat demand is reduced by the nation’s share of the global demand. If less domestic demand is fulfilled, the reduction in global demand is proportionately less. It is important to note that when a nation imposes export restrictions, the reductions in global supply and global demand do not necessarily have to match. We compute annual world market wheat price by taken the annual nominal world market price for US hard red winter wheat from the Commodity Markets online database pink sheet of the World Bank24 and deflating it with the US All Urban Consumers price index (1982–1984 = 100) provided by the US Bureau of Labor Statistics101.

For the static network analysis, we use country-to-country trade data from the Food and Agricultural Organization of the United Nations (FAOSTAT)26 and country level production, consumption, and ending stocks (reserve) of the USDA-PSD database25. Based on the data of 2018–2021, we compute the average baseline trade network. The national production anomalies in trade year 2022 are computed as deviations from the average 2018–2021 average. Supply anomalies due to national production anomalies and export restrictions are calculated relative to these baseline values.

Scenario summary

See Table 1.

Data availability

The input data that support the findings of this study are publicly available from the USDA PSD database (https://apps.fas.usda.gov/psdonline/), the FAO FAOSTAT database (http://www.fao.org/faostat/), the World Bank commodity markets database (https://www.worldbank.org/en/research/commodity-markets) and the US Bureau of Labor Statistics (https://www.bls.gov). The input and output data that support the findings of this study are openly available under https://doi.org/10.5281/zenodo.10401277.

Code availability

The global supply–demand model TWIST used to compute the wheat prices is available as open source at https://gitlab.pik-potsdam.de/twist/twist-global-model/-/tree/ukraine. The grain network model FSC used to compute the national impaired supply is available as open source at https://github.com/mjpuma/FSC-WorldModelers/tree/ukraine.

References

Gaupp, F., Hall, J., Hochrainer-Stigler, S. & Dadson, S. Changing risks of simultaneous global breadbasket failure. Nat. Clim. Chang. 10, 54–57 (2020).

Distefano, T., Laio, F., Ridolfi, L. & Schiavo, S. Shock transmission in the International Food Trade Network. PLoS One 13, e0200639 (2018).

Paveliuc Olariu, C. Food scarcity as a trigger for civil unrest. Adv. Agric. Botanics 5, 174–178 (2013).

Tadasse, G., Algieri, B., Kalkuhl, M. & von Braun, J. Drivers and triggers of international food price spikes and volatility. in Food Price Volatility and Its Implications for Food Security and Policy 59–82 (Springer International Publishing, Cham, 2016). https://doi.org/10.1007/978-3-319-28201-5_3.

Kansiime, M. K. et al. COVID-19 implications on household income and food security in Kenya and Uganda: Findings from a rapid assessment. World Dev. 137, 105199 (2021).

Hamadani, J. D. et al. Immediate impact of stay-at-home orders to control COVID-19 transmission on socioeconomic conditions, food insecurity, mental health, and intimate partner violence in Bangladeshi women and their families: an interrupted time series. Lancet Glob. Health 8, e1380–e1389 (2020).

Laborde, D., Martin, W. & Vos, R. Impacts of COVID-19 on global poverty, food security, and diets: Insights from global model scenario analysis. Agric. Econ. 52, 375–390 (2021).

Béné, C. et al. Global assessment of the impacts of COVID-19 on food security. Glob. Food Sec. 31, 100575 (2021).

Laborde, D., Herforth, A., Headey, D. & de Pee, S. COVID-19 pandemic leads to greater depth of unaffordability of healthy and nutrient-adequate diets in low- and middle-income countries. Nat. Food 2, 473–475 (2021).

Al-Saidi, M., Saad, S. A. G. & Elagib, N. A. From scenario to mounting risks: COVID-19’s perils for development and supply security in the Sahel. Environ. Dev. Sustain. 25, 6295–6318 (2023).

Salih, A. A. M., Baraibar, M., Mwangi, K. K. & Artan, G. Climate change and locust outbreak in East Africa. Nat. Clim. Chang. 10, 584–585 (2020).

Durodola, O. S. The impact of climate change induced extreme events on agriculture and food security: A review on Nigeria. Agric. Sci. China 10, 487–498 (2019).

Bren d’Amour, C., Wenz, L., Kalkuhl, M., Christoph Steckel, J. & Creutzig, F. Teleconnected food supply shocks. Environ. Res. Lett. 11, 035007 (2016).

Headey, D. Rethinking the global food crisis: The role of trade shocks. Food Policy 36, 136–146 (2011).

Giordani, P. E., Rocha, N. & Ruta, M. Food prices and the multiplier effect of trade policy. J. Int. Econ. 101, 102–122 (2016).

Sun, T.-T., Su, C.-W., Mirza, N. & Umar, M. How does trade policy uncertainty affect agriculture commodity prices? Pac. -Basin Financ. J. 66, 101514 (2021).

Gaupp, F., Hall, J., Mitchell, D. & Dadson, S. Increasing risks of multiple breadbasket failure under 1.5 and 2 °C global warming. Agric. Syst. 175, 34–45 (2019).

Hasegawa, T. et al. Extreme climate events increase risk of global food insecurity and adaptation needs. Nat. Food 2, 587–595 (2021).

Ihle, R., Rubin, O. D., Bar-Nahum, Z. & Jongeneel, R. Imperfect food markets in times of crisis: economic consequences of supply chain disruptions and fragmentation for local market power and urban vulnerability. Food Secur. 12, 727–734 (2020).

Lin, J. Y. & Martin, W. The financial crisis and its impacts on global agriculture. Agric. Econ. 41, 133–144 (2010).

van der Ploeg, J. D. From biomedical to politico-economic crisis: the food system in times of Covid-19. J. Peasant Stud. 47, 944–972 (2020).

Molotoks, A., Smith, P. & Dawson, T. P. Impacts of land use, population, and climate change on global food security. Food Energy Secur. 10, e261 (2021).

Liu, Y. & Zhou, Y. Reflections on China’s food security and land use policy under rapid urbanization. Land use policy 109, 105699 (2021).

Commodity Markets. World Bank https://www.worldbank.org/en/research/commodity-markets.

PSD Online. US Department of Agriculture https://apps.fas.usda.gov/psdonline/app/index.html#/app/downloads.

FAOSTAT data. Food and Agriculture Organization of the United Nations https://www.fao.org/faostat/en/#data.

‘World Food Programme says supply chains falling apart’. Reuters https://www.reuters.com/world/world-food-programme-says-supply-chains-falling-apart-ukraine-2022-03-18/.

Lin, F. et al. The impact of Russia-Ukraine conflict on global food security. Glob. Food Security 36, 100661 (2023).

Tárik, M. The Russo-Ukrainian War Is A Threat To Food Security In The Arab World. Atlas Journal 8, 2748–2755 (2022).

Glauben, T. et al. The war in Ukraine, agricultural trade and risks to global food security. Inter Econ. 57, 157–163 (2022).

Mottaleb, K. A. et al. Potential impacts of Ukraine-Russia armed conflict on global wheat food security: A quantitative exploration. Glob. Food Security 35, 100659 (2022).

Glauber, J. W. & Laborde Debucquet, D. Do No Harm: Measured Policy Responses Are Key to Addressing Food Security Impacts of the Ukraine Crisis. https://ebrary.ifpri.org/digital/collection/p15738coll2/id/136752https://doi.org/10.2499/9780896294394_12 (2023).

‘More Food less Feed - Agriculture and the War on Ukraine’. Agricultural and Rural Convention https://www.arc2020.eu/more-food-less-feed-agriculture-and-the-war-on-ukraine/ (2022).

EUR-Lex − 52022DC0133 - EN - EUR-Lex. European Commission https://eur-lex.europa.eu/legal-content/EN/ALL/?uri=COM:2022:133:FIN.

Sun, Z., Scherer, L., Zhang, Q. & Behrens, P. Adoption of plant-based diets across Europe can improve food resilience against the Russia–Ukraine conflict. Nat. Food 3, 905–910 (2022).

Shams Esfandabadi, Z., Ranjbari, M. & Scagnelli, S. D. The imbalance of food and biofuel markets amid Ukraine-Russia crisis: A systems thinking perspective. Biofuel Res. J. 9, 1640–1647 (2022).

Ouko, K. O. & Odiwuor, M. O. Contributing factors to the looming food crisis in sub-Saharan Africa: Opportunities for policy insight. Cogent Soc. Sci. 9, 2173716 (2023).

Glauber, J. & Laborde, D. The Russia-Ukraine Conflict and Global Food Security. (International Food Policy Research Institute, 2023).

‘UN welcomes new centre to put Ukraine grain exports deal into motion’. UN News https://news.un.org/en/story/2022/07/1123532 (2022).

Sanger, D. E., Cohen, P. & Bilefsky, D. What Happened on Day 92 of the War in Ukraine. The New York Times (2022).

‘One year of the Black Sea Initiative: Key facts and figures’. UN News https://news.un.org/en/story/2023/07/1138532.

European Commission. EU-Ukraine Solidarity Lanes. EU Solidarity with Ukraine https://eu-solidarity-ukraine.ec.europa.eu/eu-assistance-ukraine/eu-ukraine-solidarity-lanes_en.

Carriquiry, M., Dumortier, J. & Elobeid, A. Trade scenarios compensating for halted wheat and maize exports from Russia and Ukraine increase carbon emissions without easing food insecurity. Nat. Food 3, 847–850 (2022).

Renn, O., Lucas, K., Haas, A. & Jaeger, C. Things are different today: the challenge of global systemic risks. J. Risk Res. 22, 401–415 (2019).

Thalheimer, L., Gaupp, F. & Webersik, C. Systemic risk and compound vulnerability impact pathways of food insecurity in Somalia. Clim. Risk Manag. 42, 100570 (2023).

Falkendal, T. et al. Grain export restrictions during COVID-19 risk food insecurity in many low- and middle-income countries. Nat. Food 2, 11–14 (2021).

Puma, M. J., Bose, S., Chon, S. Y. & Cook, B. I. Assessing the evolving fragility of the global food system. Environ. Res. Lett. 10, 024007 (2015).

Schewe, J., Otto, C. & Frieler, K. The role of storage dynamics in annual wheat prices. Environ. Res. Lett. 12, 054005 (2017).

Shepherd, T. G. et al. Storylines: an alternative approach to representing uncertainty in physical aspects of climate change. Clim. Change 151, 555–571 (2018).

J.J.M. van den Hurk, B. et al. Climate impact storylines for assessing socio-economic responses to remote events. Clim. Risk Manag 40, 100500 (2023).

Shepherd, T. G. & Lloyd, E. A. Meaningful climate science. Clim. Change 169, 17 (2021).

Zhu, B., Lin, R., Deng, Y., Chen, P. & Chevallier, J. Intersectoral systemic risk spillovers between energy and agriculture under the financial and COVID-19 crises. Econ. Model. 105, 105651 (2021).

Du, X., Yu, C. L. & Hayes, D. J. Speculation and volatility spillover in the crude oil and agricultural commodity markets: A Bayesian analysis. Energy Econ. 33, 497–503 (2011).

Food Export Restrictions Tracker. International Food Policy Research Institute https://public.tableau.com/app/profile/ifpri.food.security.portal/viz/FoodFertilizerExportRestrictionsTracker/FoodExportRestrictionsTracker.

Glauber, J. W. Ukraine One Year Later: Impacts on Global Food Security. https://ebrary.ifpri.org/digital/collection/p15738coll2/id/136745 (2023) https://doi.org/10.2499/9780896294394_11.

A., A. Pregnancy and Gestation Periods in Farm Animals. Livestocking https://www.livestocking.net/pregnancy-and-gestation-periods-of-various-farm-animals (2015).

Chicken. Encyclopedia Britannica https://www.britannica.com/animal/chicken (1998).

Alexander, P., Brown, C., Arneth, A., Finnigan, J. & Rounsevell, M. D. A. Human appropriation of land for food: The role of diet. Glob. Environ. Change 41, 88–98 (2016).

Anderson, K. Trade-related food policies in a more volatile climate and trade environment. Food Policy 109, 102253 (2022).

Bertassello, L., Winters, P. & Müller, M. F. Access to global wheat reserves determines country-level vulnerability to conflict-induced Ukrainian wheat supply disruption. Nat. Food 4, 673–676 (2023).

Zhang, Z., Abdullah, M. J., Xu, G., Matsubae, K. & Zeng, X. Countries’ vulnerability to food supply disruptions caused by the Russia-Ukraine war from a trade dependency perspective. Sci. Rep. 13, 16591 (2023).

Larson, D. F., Lampietti, J., Gouel, C., Cafiero, C. & Roberts, J. Food Security and Storage in the Middle East and North Africa. World Bank Econ. Rev. 28, 48–73 (2013).

Gouel, C., Gautam, M. & Martin, W. J. Managing food price volatility in a large open country: the case of wheat in India. Oxf. Econ. Pap. 68, 811–835 (2016).

d’Amour, C. B. & Anderson, W. International trade and the stability of food supplies in the Global South. Environ. Res. Lett. 15, 074005 (2020).

Laber, M., Klimek, P., Bruckner, M., Yang, L. & Thurner, S. Shock propagation from the Russia-Ukraine conflict on international multilayer food production network determines global food availability. Nat. Food 4, 508–517 (2023).

Wang, Y., Bouri, E., Fareed, Z. & Dai, Y. Geopolitical risk and the systemic risk in the commodity markets under the war in Ukraine. Finan. Res. Lett. 49, 103066 (2022).

Gong, X. & Xu, J. Geopolitical risk and dynamic connectedness between commodity markets. Energy Econ. 110, 106028 (2022).

Saghaian, S., Nemati, M., Walters, C. & Chen, B. Asymmetric Price Volatility Transmission between U.S. Biofuel, Corn, and Oil Markets. J. Agric. Resour. Econ. 43, 46–60 (2018).

Nazlioglu, S., Erdem, C. & Soytas, U. Volatility spillover between oil and agricultural commodity markets. Energy Econ. 36, 658–665 (2013).

Kang, S. H., McIver, R. & Yoon, S.-M. Dynamic spillover effects among crude oil, precious metal, and agricultural commodity futures markets. Energy Econ. 62, 19–32 (2017).

Commodities - Live Quote Price Trading Data. https://tradingeconomics.com/commodities.

Kuhla, K., Otto, C. & Kubiczek, P. Understanding agricultural market dynamics in times of crisis: the dynamic agent-based network model Agrimate. https://doi.org/10.2139/ssrn.4393720 (2024).

Willner, S. N., Otto, C. & Levermann, A. Global economic response to river floods. Nat. Clim. Chang. 8, 594–598 (2018).

Kuhla, K., Willner, S. N., Otto, C. & Levermann, A. Resilience of international trade to typhoon-related supply disruptions. J. Econ. Dyn. Control 151, 104663 (2023).

Clapp, J. & Moseley, W. G. This food crisis is different: COVID-19 and the fragility of the neoliberal food security order. J. Peasant Stud. 47, 1393–1417 (2020).

Manyise, T. & Dentoni, D. Value chain partnerships and farmer entrepreneurship as balancing ecosystem services: Implications for agri-food systems resilience. Ecosyst. Serv. 49, 101279 (2021).

Bruce, A., Jackson, C. & Lamprinopoulou, C. Social networks and farming resilience. Outlook Agric. 50, 196–205 (2021).

Bishwajit, G. et al. Self-sufficiency in rice and food security: a South Asian perspective. Agric. Food Secur 2, 10 (2013).

Baer-Nawrocka, A. & Sadowski, A. Food security and food self-sufficiency around the world: A typology of countries. PLoS One 14, e0213448 (2019).

Fader, M. et al. Past and present biophysical redundancy of countries as a buffer to changes in food supply. Environ. Res. Lett. 11, 055008 (2016).

Abay, K. A. et al. The Russia-Ukraine war: Implications for global and regional food security and potential policy responses. Glob. Food Sec. 36, 100675 (2023).

‘Secretary-General’s press encounter on the Black Sea Initiative’. UN Press https://www.un.org/sg/en/content/sg/press-encounter/2023-07-17/secretary-generals-press-encounter-the-black-sea-initiative.

‘Analysis: Russia’s Danube attacks tighten noose on Ukraine’s grain sector’. Reuters https://www.reuters.com/world/europe/russias-danube-attacks-tighten-noose-ukraines-grain-sector-2023-07-25.

‘Diplomatic spat after Poland calls Ukraine ungrateful’. Euronews https://www.euronews.com/2023/08/03/diplomatic-spat-after-poland-calls-ukraine-ungrateful (2023).

Vurro, M., Bonciani, B. & Vannacci, G. Emerging infectious diseases of crop plants in developing countries: impact on agriculture and socio-economic consequences. Food Secur 2, 113–132 (2010).

Fischer, G., Shah, M., Tubiello, F. N. & van Velhuizen, H. Socio-economic and climate change impacts on agriculture: an integrated assessment, 1990-2080. Philos. Trans. R. Soc. Lond. B Biol. Sci. 360, 2067–2083 (2005).

Olesen, J. E. Socio-economic impacts—agricultural systems. in North Sea Region Climate Change Assessment 397–407 (Springer International Publishing, Cham, 2016). https://doi.org/10.1007/978-3-319-39745-0_13.

Kremen, C. Reframing the land-sparing/land-sharing debate for biodiversity conservation. Ann. N. Y. Acad. Sci. 1355, 52–76 (2015).

Agomoh, I. V., Drury, C. F., Phillips, L. A., Reynolds, W. D. & Yang, X. Increasing crop diversity in wheat rotations increases yields but decreases soil health. Soil Sci. Soc. Am. J. 84, 170–181 (2020).

Yang, T., Siddique, K. & Liu, K. Cropping systems in agriculture and their impact on soil health-A review. Glob. Ecol. Conserv. 23, e01118 (2020).

Morison, J. I. L., Baker, N. R., Mullineaux, P. M. & Davies, W. J. Improving water use in crop production. Philos. Trans. R. Soc. Lond. B Biol. Sci. 363, 639–658 (2008).

Pfister, S., Bayer, P., Koehler, A. & Hellweg, S. Environmental impacts of water use in global crop production: hotspots and trade-offs with land use. Environ. Sci. Technol. 45, 5761–5768 (2011).

Bellemare, M. F. Rising food prices, food price volatility, and social unrest. Am. J. Agric. Econ. 97, 1–21 (2015).

Animal protein consumption. Our World in Data https://ourworldindata.org/grapher/animal-protein-consumption.

Daily per capita protein supply. Our World in Data https://ourworldindata.org/grapher/daily-per-capita-protein-supply.

FAOSTAT. https://www.fao.org/faostat/en/#data/TM.

Bentley, A. R. et al. Near- to long-term measures to stabilize global wheat supplies and food security. Nat. Food 3, 483–486 (2022).

Keeney, R. & Hertel, T. GTAP-AGR: A Framework for Assessing the Implications of Multilateral Changes in Agricultural Policies. http://docs.lib.purdue.edu/gtaptp/25 (2005).

Havlík, P. et al. Climate change mitigation through livestock system transitions. Proc. Natl Acad. Sci. Usa. 111, 3709–3714 (2014).

Dietrich, J. P. et al. MAgPIE - An Open Source Land-Use Modeling Framework. (Zenodo, 2023). https://doi.org/10.5281/ZENODO.1418752.

Website of Bureau of Labor Statistics. US Bureau of Labor Statistics https://www.bls.gov/.

Acknowledgements

This research has received funding from the German Federal Ministry of Education and Research (BMBF) under the research projects QUIDIC (grant agreement no. 01LP1907A), from the Deutsche Forschungsgemeinschaft (DFG, German Research Foundation – project number 536251506), and from the Horizon 2020 Framework Programme of the European Union under the projects RECEIPT (grant agreement no. 820712) and CASCADES (grant agreement no. 821010). Also, the research received funding from the Army Research Office/Army Research Laboratory under the Multidisciplinary University Research Initiative (grant agreement no. W911NF1810267) and the Defense Advanced Research Project Agency (DARPA) under the World Modelers program (grant agreement no. W911NF1910013).

Funding

Open Access funding enabled and organized by Projekt DEAL.

Author information

Authors and Affiliations

Contributions

K.K. and C.O. designed the research. K.K., M.J.P., and C.O. developed the counterfactual scenarios. K.K. conducted the analysis and visualized the results. All authors discussed the results, contributed to the interpretation, and wrote the manuscript.

Corresponding authors

Ethics declarations

Competing interests

The authors declare no competing interests.

Peer review

Peer review information

Communications Earth & Environment thanks Gideon Kruseman and the other, anonymous, reviewer(s) for their contribution to the peer review of this work. Primary Handling Editor: Martina Grecequet. A peer review file is available.

Additional information

Publisher’s note Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary information

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Kuhla, K., Puma, M.J. & Otto, C. International cooperation was key to stabilize wheat prices after the Russian Invasion of Ukraine. Commun Earth Environ 5, 481 (2024). https://doi.org/10.1038/s43247-024-01638-7

Received:

Accepted:

Published:

DOI: https://doi.org/10.1038/s43247-024-01638-7

- Springer Nature Limited